This week, CRED iQ reviewed real-time valuations for several assets that secure non-performing matured loans. Maturity defaults often can be a result of distress but may also be a mismatch in the timing of a refinancing effort or a sale closing. Many of this week’s assets had high concentrations of lease rollover over the next 12 to 36 months. Prospective lenders generally view lease rollover risk unfavorably given the possibility of tenants vacating with subsequent impairment of net cash flow at the collateral. However, non-performing matured loans are opportunities for distressed investors to step in and infuse capital in situations where traditional solutions may not be an option. This week’s highlights include 4 retail properties and a suburban office property in Fairfax, VA.

CRED iQ valuations factor in a base-case (most likely), a downside (significant loss of tenants), and dark scenarios (100% vacant). For full access to the valuation reports as well as full CMBS loan reporting, with detailed financials, updated tenant information, and borrower contact information, sign up for a free trial here.

Siegen Plaza

156,418 sf, Retail, Baton Rouge, LA [View Details]

This $16.6 million interest-only loan failed to pay off at its January 6, 2022 maturity date after the borrower asked for an extension, which was not granted. Prior to the maturity default, the borrower had indicated plans to pay off the loan at maturity. The mortgage is secured by a 156,418-sf retail center comprising two freestanding retail strips as well as an outparcel leased to Olive Garden. The larger of the two primary buildings is attached to a Target, which does not serve as collateral for the loan. The property’s 3 largest tenants — Ross Dress for Less, HomeGoods, and Petco — account for a combined 44% of the property’s NRA and all have leases that are scheduled to expire in 2024. The elevated concentration of near-term lease rollover may be the source of complications related to the loan’s maturity default. The borrower ideally would benefit from more favorable refinancing terms with long-term extensions with primary tenants in place, whereas prospective lenders may view the near-term lease expirations as a credit risk. Ross Dress for Less and Petco previously signed 10-year extensions in 2014. With all 3 primary tenants in place, the property has generated net cash flow in excess of $2 million for the previous 3 years. For the full valuation report and loan-level details, click here.

| Property Name | Siegen Plaza |

| Address | 6725 Siegen Lane Baton Rouge, LA 70809 |

| Outstanding Balance | $16,600,000 |

| Interest Rate | 5.49% |

| Maturity Date | 1/6/2022 |

| Most Recent Appraisal | $30,800,000 ($197/sf) |

| Most Recent Appraisal Date | 10/31/2011 |

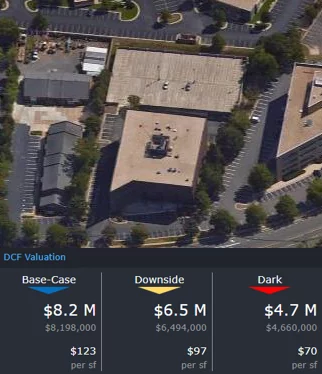

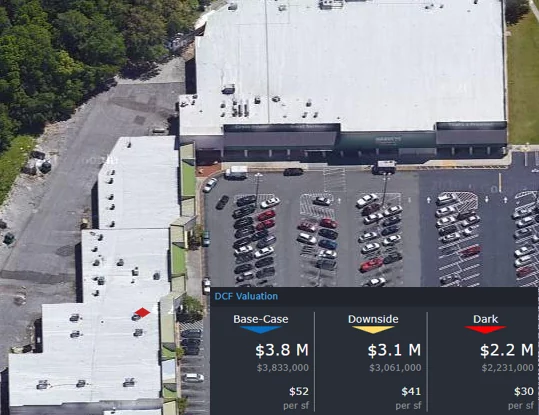

Fairfax Ridge

66,812 sf, Suburban Office, Fairfax, VA [View Details]

This $9 million loan had a maturity default on December 11, 2021. Prior to the maturity default, the borrower had asked for a maturity extension through March 2022, which was not yet granted. Difficulty in securing refinancing is likely related to near-term lease rollover risk stemming from the collateral property’s largest tenant, the General Services Administration (GSA). The GSA had a 37,819-sf lease, accounting for 57% of the NRA, that was scheduled to expire on January 31, 2022; however, updated commentary from the servicer stated that the GSA signed a one-year extension. The short-term agreement may be problematic for the borrower in its attempts to secure long-term financing given the work-from-home trends within the office sector and the GSA’s recent rethinking on federal office space. The remainder of the collateral property’s space, 43% of the property’s NRA, is leased to AVIXA – Audio Visual and Integrated Experience Association pursuant to a lease that expires in October 2026. For the full valuation report and loan-level details, click here.

| Property Name | Fairfax Ridge |

| Address | 11242 Waples Mill Road Fairfax, VA 22030 |

| Outstanding Balance | $8,963,613 |

| Interest Rate | 6.28% |

| Maturity Date | 12/11/2021 |

| Most Recent Appraisal | $15,400,000 (231/sf) |

| Most Recent Appraisal Date | 11/3/2011 |

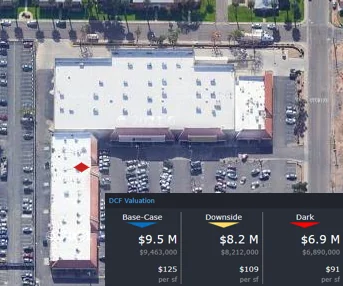

Park Lee Shopping Center

75,559 sf, Retail, Phoenix, AZ [View Details]

This $7.4 million loan defaulted at maturity on January 6, 2022 but had not yet transferred to special servicing as of writing. Servicer commentary for the loan indicated that the borrower had previously applied for COVID-related relief but an agreement was never finalized. The loan is secured by a 75,559-sf retail center in Phoenix, AZ, located approximately 5 miles north of the CBD. The property is anchored by a Goodwill Store and Donation Center pursuant to a 29,919-sf lease, accounting for 40% of the NRA, that is scheduled to expire in August 2025. The retail center also features a Planet Fitness that occupies 20,750 sf, accounting for 28% of the NRA, with a lease that expires in 2027. Lease rollover risk does not appear to be an immediate concern until 2025 based on the status of the property’s rent roll. However, the borrower’s prior request for relief may indicate underlying cash flow issues while also considering heavy reliance on a fitness tenant that was likely impacted during the height of the pandemic. For the full valuation report and loan-level details, click here.

| Property Name | Park Lee Shopping Center |

| Address | 1615 West Camelback Road Phoenix, AZ 85015 |

| Outstanding Balance | $7,346,399 |

| Interest Rate | 5.32% |

| Maturity Date | 1/6/2022 |

| Most Recent Appraisal | $10,700,000 ($142/sf) |

| Most Recent Appraisal Date | 8/31/2015 |

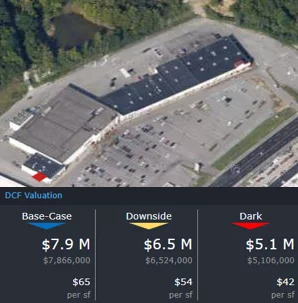

Russell Center

120,378-sf, Grocery-Anchored Retail, Ashland, KY [View Details]

This $5.8 million loan failed to pay off at its maturity on January 6, 2022 despite no immediately apparent credit issues. The loan is secured by a 120,378-sf retail center in Ashland, KY that is anchored by a Kroger. Kroger’s lease accounts for 48% of the property NRA and expires in April 2025. The nearest second location for Kroger is approximately 3 miles away. The property’s second-largest tenant, Dollar Tree, accounts for 8% of the property’s NRA but faces a high-level of competition with a total of 4 Dollar General stores within a 4-mile radius. The latest servicer commentary for the loan indicates the borrower was in the process of securing refinancing. Based on the positive sentiment of the commentary, a favorably and timely resolution may be on the horizon. For the full valuation report and loan-level details, click here.

| Property Name | Russell Center |

| Address | 370 Diederich Boulevard Ashland, KY 41101 |

| Outstanding Balance | $5,783,966 |

| Interest Rate | 6.15% |

| Maturity Date | 1/6/2022 |

| Most Recent Appraisal | $9,700,000 ($81/sf) |

| Most Recent Appraisal Date | 11/7/2021 |

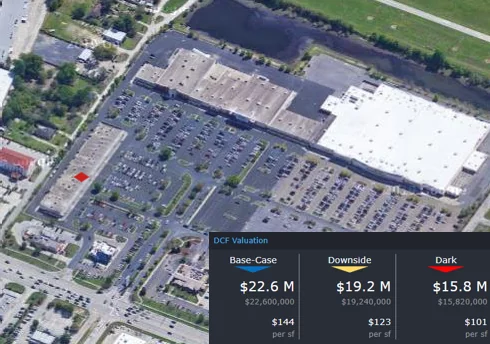

Edgewood Square Shopping Center

74,304 sf, Grocery-Anchored Retail, Jacksonville, FL [View Details]

This $2.5 million loan failed to pay off at its January 6, 2022 maturity date following an extension request by the borrower. The borrower may need an extension to resolve lease rollover issues at the collateral property, a 74,034-sf grocery-anchored retail center in Jacksonville, FL. The property’s two largest tenants have lease expirations in 2022. Harveys Supermarket is the grocery anchor at the property and accounts for 59% of the building’s NRA pursuant to a lease that expires on August 31, 2022. A freestanding Harveys Supermarket is located 2.5 miles away from the Edgewood Square location. Additionally, Family Dollar is the second-largest tenant with an 8,450-sf lease, accounting for 11% of the NRA, that expires on December 31, 2022. Finding financing to pay off the loan could prove to be difficult with aggregate rollover of 71% of the NRA at the property taking place in 2022. For the full valuation report and loan-level details, click here.

| Property Name | Edgewood Shopping Center |

| Address | 2261 Edgewood Ave W Jacksonville, FL 32209 |

| Outstanding Balance | $2,539,298 |

| Interest Rate | 5.93% |

| Maturity Date | 1/6/2022 |

| Most Recent Appraisal | $4,600,000 ($62/sf) |

| Most Recent Appraisal Date | 10/10/2011 |

For full access to our loan database and valuation platform, sign up for a free trial below:

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. Our data platform is powered by over $2.0 trillion of CMBS, CRE CLO, SBLL, and GSE Agency loan and property data.