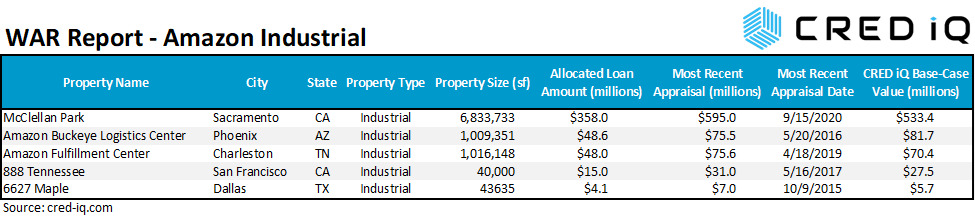

In this week’s WAR Report, CRED iQ calculated updated valuations for five industrial properties leased by Amazon. A Bloomberg article reported on May 21, 2022 that Amazon is seeking to reduce its industrial footprint by at least 10 million sf after overexpanding during the pandemic. Amazon will sublet excess space and exit leases where possible to accommodate the company’s initiative. According to the news article, regions of focus include New York, New Jersey, SoCal, and Atlanta, although any leases with near-term expirations in other markets are likely also under consideration. On a high level, the 10 million sf of planned reductions is a microscopic portion of Amazon’s leased industrial portfolio. However, from the perspective of individual landlords or investors, the loss of a high-profile tenant like Amazon could adversely impact returns and present credit risk on a one-off basis. Featured properties include larger warehouse-type facilities such as an industrial park in California, a logistics center in Phoenix, AZ, and a fulfillment center in rural Tennessee as well as last-mile distribution centers in San Francisco, CA and Dallas, TX.

CRED iQ valuations factor in base-case (most likely), downside (significant loss of tenants), and dark scenarios (100% vacant). For full access to the valuation reports as well as full CMBS loan reporting, including detailed financials, updated tenant information, and borrower contact information, sign up for a free trial here.

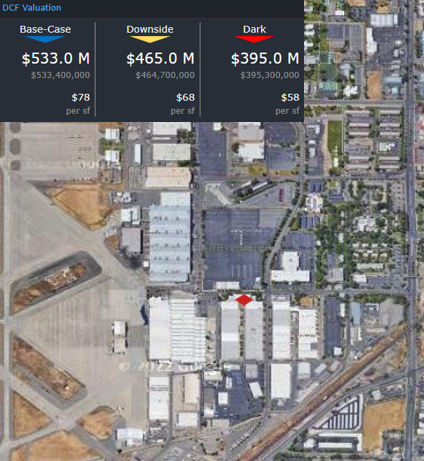

McClellan Business Park

6.8 million sf, Industrial/Mixed-Use, Sacramento, CA [View Details]

McClellan Business Park is one of the largest properties by size in CMBS and secures a $358 million mortgage that was originated in November 2020. Amazon is the largest tenant at McClellan Business Park by size and third largest by percentage of base rent. The firm leases a 417,637-sf last-mile distribution facility, one of several buildings in the business park, pursuant to a lease that expires in June 2030. Amazon has two, five-year extension options available at lease expiration, which is about six months prior to loan maturity.

McClellan Business Park is a former Air Force base that was redeveloped primarily for industrial use, but much of the park features other use types such as office, residential, retail, and airplane hangar space. The property was last featured in CRED iQ’s February 2022 report detailing the prevalence of mixed-used collateral in CMBS – Mixed Use Collateral in CMBS Conduits. The property’s former utility as an Air Force base presents some limitations for future redevelopment, caused by environmental factors, should the property need to be repositioned. A recent research report by Academy Securities highlighted some of the other nuances in credit risk facing industrial properties, including a location like McClellan Business Park.

Despite the property’s exposure to Amazon as its largest tenant, the vast size of the property and Amazon’s relatively small footprint (6% of NRA) are mitigating factors of the credit risk posed by potential sublet activity or non-renewal of its lease. Further, Southern California markets such as Los Angeles and San Diego were called out specifically as areas of focus as opposed to Sacramento. For the full valuation report and loan-level details, click here.

| Property Name | McClellan Park |

| Address | 3140 Peacekeeper Way McClellan, CA 95652 |

| Outstanding Balance | $358,000,000 |

| Interest Rate | 3.31% |

| Maturity Date | 12/11/2030 |

| Amazon Lease Size | 417,637 sf |

| Amazon Lease % of NRA | 6% |

| Amazon Lease Expiration | 6/30/2030 |

| Most Recent Appraisal | $595,000,000 ($86/sf) |

| Most Recent Appraisal Date | 9/15/2020 |

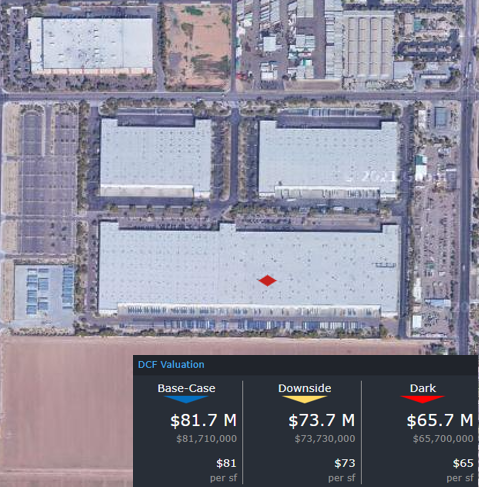

Amazon Buckeye Logistics Center

1.0 million sf, Industrial, Phoenix, AZ [View Details]

This 1.0 million sf warehouse in Phoenix, AZ secures a $48.6 million loan and is solely leased by Amazon. The tenant operates pursuant to a lease that expires in August 2028, which is two years after loan maturity in August 2026. The Phoenix MSA was not a market singled out by the company as a focus for scaling back warehouse space; however, the timing of the lease expiration relative to loan maturity could present complications when the mortgage debt needs to be refinanced.

The Buckeye Logistics Center was built to suit Amazon in 2007. The tenant still has four, five-year extension options remaining at the end of its lease term and has added space to the building in the past to accommodate growth. Even still, the loan was structured with a cash management provision to sweep cash in the event of any Sublease Events, which include Amazon or any subtenant going dark or Amazon failing to renew 12 months prior to lease expiration. Cash management structures, such as this one, are useful tools to mitigate binary risk and lease rollover concentration for single tenant properties like the Buckeye Logistics Center. For the full valuation report and loan-level details, click here.

| Property Name | Amazon Buckeye Logistics Center |

| Address | 6835 West Buckeye Road Phoenix, AZ 85043 |

| Outstanding Balance | $48,587,500 |

| Interest Rate | 4.50% |

| Maturity Date | 8/6/2026 |

| Amazon Lease Size | 1,009,351 sf |

| Amazon Lease % of NRA | 100% |

| Amazon Lease Expiration | 8/31/2028 |

| Most Recent Appraisal | $75,500,000 ($75/sf) |

| Most Recent Appraisal Date | 5/20/2016 |

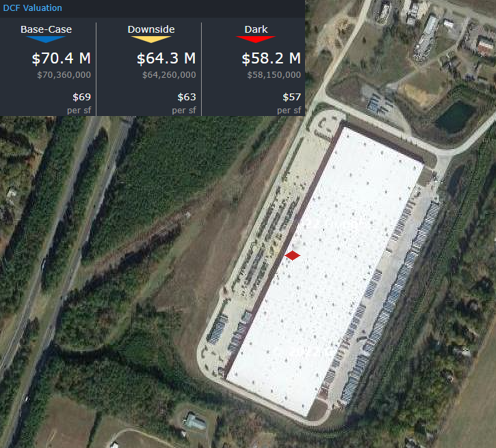

Amazon Fulfillment Center – Charleston

Diamondback Industrial Portfolio

1.0 million sf, Industrial, Charleston, TN [View Details]

This fulfillment center in rural Tennessee is part of a three-property portfolio that secures a $139 million loan. Approximately $48 million of the debt is allocated to this Charleston, TN warehouse. The loan is scheduled to mature in two years, June 2024. Amazon occupied the property pursuant to a lease that expires in September 2026, slightly more than two years post maturity. Amazon has four, five-year lease extension options and has a right of first offer to purchase the property. The right of first offer is an example of the methods at Amazon’s disposal for maintaining flexibility in the usage of its warehouse space. The tenant could just as easily expand as contract space as needed. The property participated in a payment-in-lieu-of-taxes (PILOT) program that expired in 2021; however, Amazon is responsible for paying all real estate taxes. For the full valuation report and loan-level details, click here.

| Property Name | Amazon Fulfillment Center – Charleston |

| Address | 225 Infinity Drive NW Charleston, TN 37310 |

| Allocated Loan Amount | $48,000,000 |

| Interest Rate | 3.57% |

| Maturity Date | 6/6/2026 |

| Amazon Lease Size | 1,016,148 sf |

| Amazon Lease % of NRA | 100% |

| Amazon Lease Expiration | 9/30/2026 |

| Most Recent Appraisal | $75,600,000 ($74/sf) |

| Most Recent Appraisal Date | 4/18/2019 |

888 Tennessee

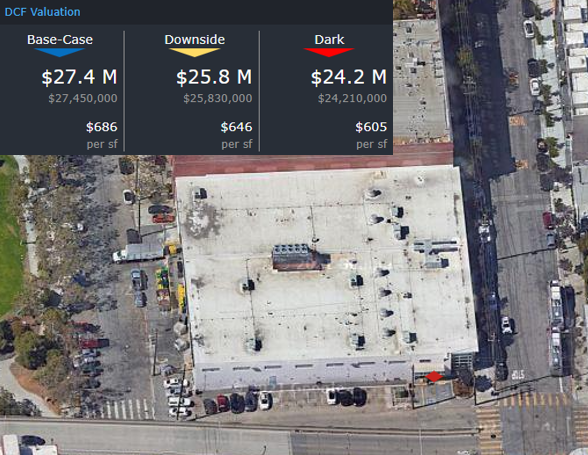

40,000 sf, Industrial, San Francisco, CA [View Details]

This 40,000-sf warehouse located on the bayside of San Francisco, CA secures a $15 million loan. Amazon leases the property pursuant to a lease that expires in April 2027, which is two months prior to loan maturity in July 2027. Amazon has a lease termination option during the last two years of the lease term, which equates to a potential departure as early as July 2025. Amazon pays triple-net (NNN) rent of $40 per square foot for the space, which is opportunistically positioned as a last-mile grocery distribution center in a major metropolitan market. Despite the headwinds facing San Francisco in terms of physical occupancy across multiple commercial real estate sectors, the competitive location of the property is an advantage for the borrower. However, Amazon’s termination option allows flexibility for the tenant to reduce its footprint in the market while presenting potential lease rollover risk for the loan within its maturity window. Further, industrial may not be the highest and best use for the underlying land parcel, adding additional questions for Amazon’s long-term presence at the location. At loan maturity, opportunities may exist for bridge financing or construction financing for a repositioning of the property. For the full valuation report and loan-level details, click here.

| Property Name | 888 Tennessee |

| Address | 888 Tennessee Street San Francisco, CA 94107 |

| Outstanding Balance | $15,000,000 |

| Interest Rate | 3.93% |

| Maturity Date | 7/1/2027 |

| Amazon Lease Size | 40,000 sf |

| Amazon Lease % of NRA | 100% |

| Amazon Lease Expiration | 4/30/2027 |

| Most Recent Appraisal | $31,000,000 ($775/sf) |

| Most Recent Appraisal Date | 5/16/2017 |

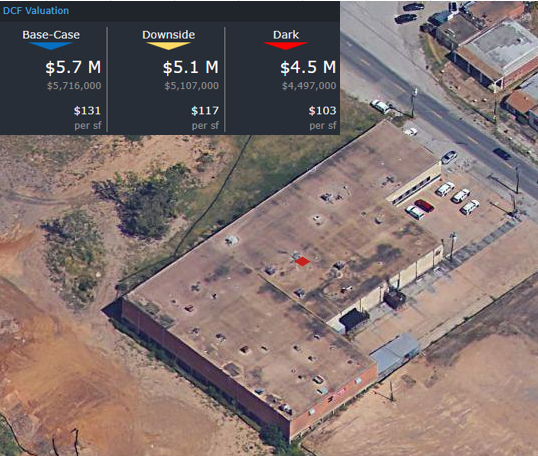

6627 Maple

43,635 sf, Industrial, Dallas, TX [View Details]

This 43,635-sf fulfillment center in Dallas, TX secures a $4.1 million loan that matures in May 2026. Amazon occupies the building pursuant to a lease that expires in December 2025, four months prior to loan maturity. Amazon previously signed a five-year extension in December 2020. Similar to previously highlighted properties, the proximity between lease expiration and loan maturity presents potential complications for refinancing at the end of the loan term. The collateral is positioned as a last-mile distribution center, but is an older vintage property, originally constructed in 1956. However, the property was renovated in 2015 prior to loan origination in June 2016. Prior to Amazon’s lease expiration in 2020, the tenant was paying approximately $11.40 per square foot on a triple-net basis. For the full valuation report and loan-level details, click here.

| Property Name | 6627 Maple |

| Address | 6627 Maple Avenue Dallas, TX 75235 |

| Outstanding Balance | $4,114,675 |

| Interest Rate | 4.45% |

| Maturity Date | 5/6/2026 |

| Amazon Lease Size | 43,635 sf |

| Amazon Lease % of NRA | 100% |

| Amazon Lease Expiration | 12/31/2025 |

| Most Recent Appraisal | $7,000,000 ($160/sf) |

| Most Recent Appraisal Date | 10/9/2015 |

For full access to our loan database and valuation platform, sign up for a free trial below:

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. Our data platform is powered by over $2.0 trillion of CMBS, CRE CLO, SBLL, Ginnie Mae, FHA/HUD, and Freddie Mac loan and property data.