As 2024 winds down, we wanted to take a moment and reflect upon a year that was both challenging and transformational. This week, we are pleased to present our top ten research reports. Here they are!

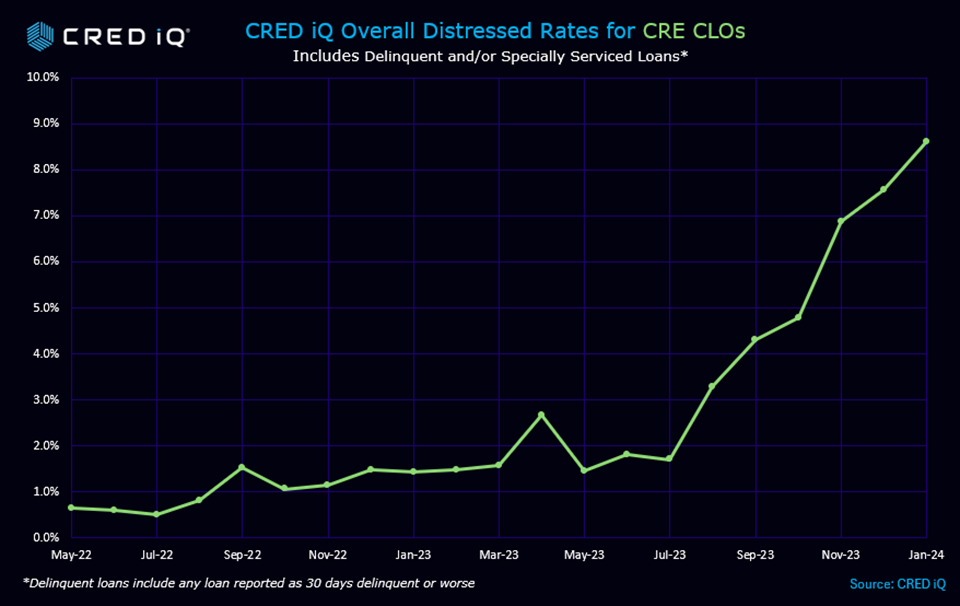

Number 1: CRE CLO Distress Rates Surge over 440% in 12 Months

“Arbor is not alone.” Immediately following the issues associated with Arbor, our team revealed that the distress exposure went well beyond Arbor. This became our most read research of 2024 and launched a thematic focus on the CRE CLO ecosystem.

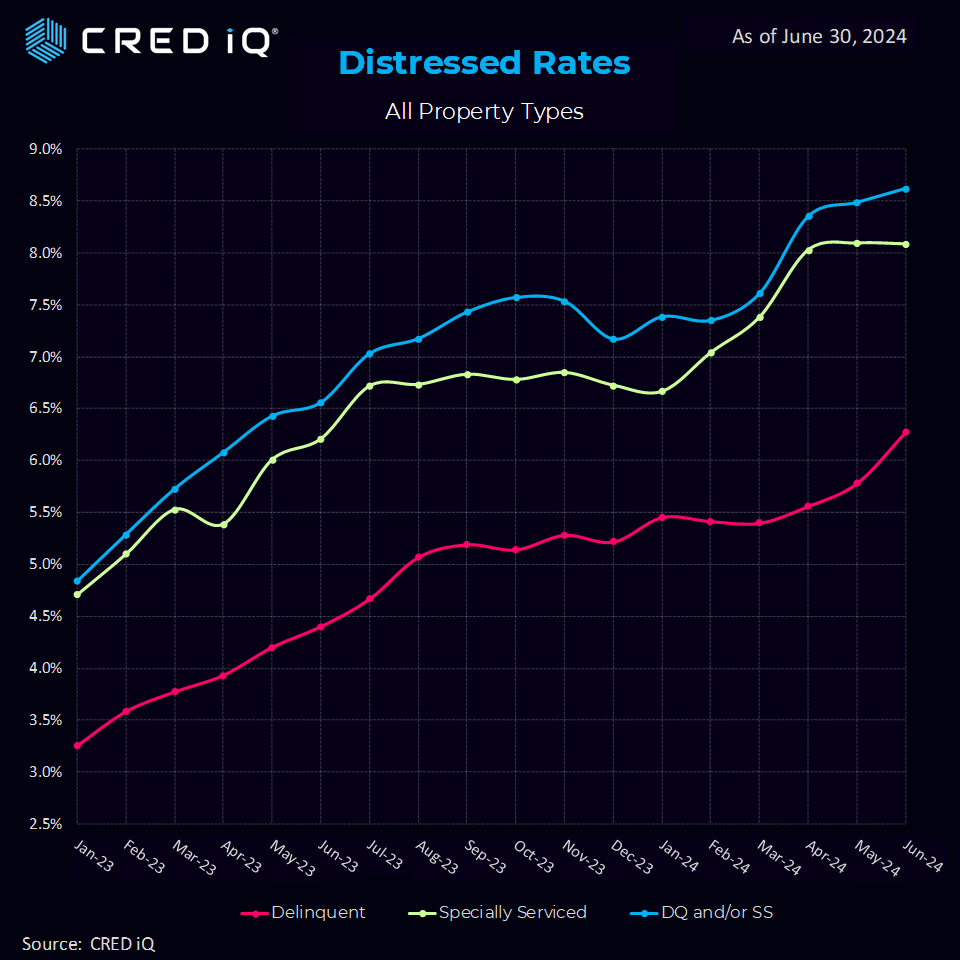

Number 2: CMBS Apartment Distress Rates up 185% in last 6 Months; Overall Rate Climbs to 8.62% for all CRE

Multifamily’ s escalating distress rates was a major story throughout 2024. This report revealed some of the earliest signs of this trend, which landed in the number 2 slot.

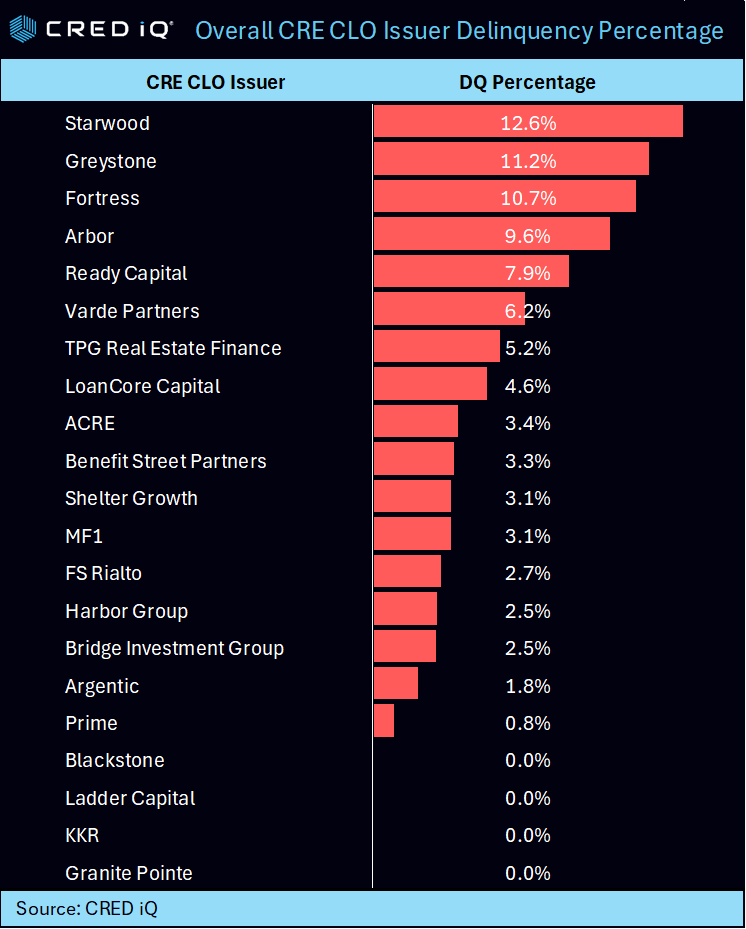

Number 3: CRED iQ’s CRE CLO Top Issuer Rankings

CRE CLO issuers were in focus in 2024. Our rankings report, number three most read in 2024, was of great interest to our readers.

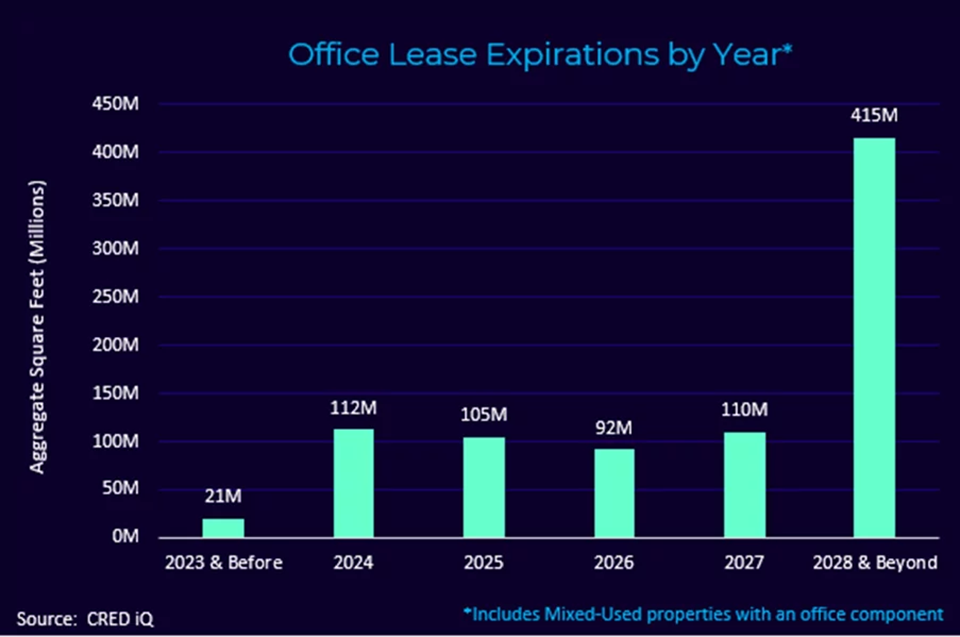

Number 4: Over 200 Million Square Feet of Office Leases set to Expire

The office sector unprecedented headwinds in 2024 and looming lease expirations were a major forecasting and risk management focus. This important report lands at number 4 in our rankings.

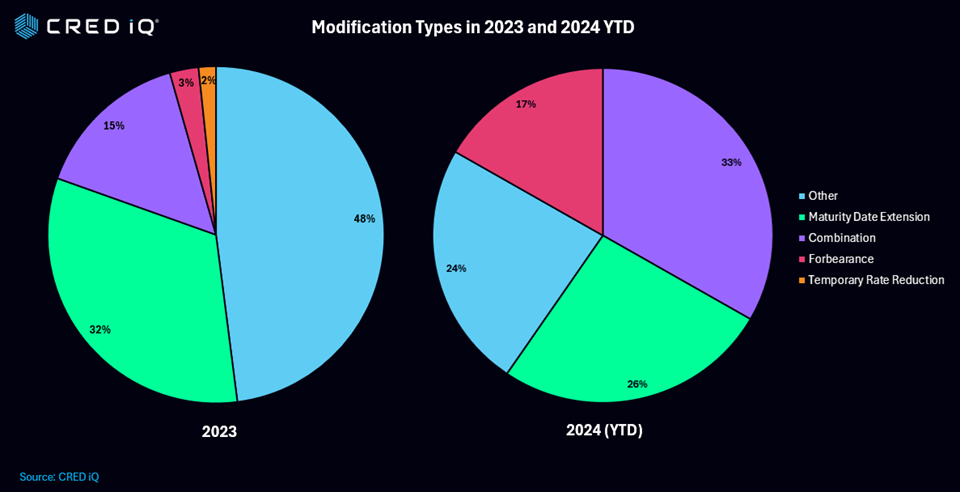

Number 5: The Wall of Maturities Morphs into the Wave of Modifications

“Extend and Pretend” was the story for maturing loans in 2024. Our editors’ choice research came in at number 5.

The Best of the Rest

6: Loan Modifications Swell 195% in 12 Months: CRED iQ

7: Multifamily logged its Largest Monthly Increase in Distress in over 18 Months

8: CRED iQ’s Distress Rate Sets a New Record, Led by Multifamily

9: CRE Valuation Trends in 2023

10: CRE CLO Distress Rates By Issuer – August 2024 Update

Looking Forward

Next week, CRED iQ will release our 2025 Almanac which includes our anticipated Maturities Outlook. An invaluable resource for all CRE professionals. Navigate risk while harvesting opportunities in the year ahead! Stay tuned!

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.

THE DATA, INFORMATION AND/OR RELATED MATERAL (“DELIVERABLES”) IS BEING OFFERED AS-IS/WHERE-AS CONDITION. CRED-IQ MAKES NO REPRESENTATION OR WARRANTY AS TO QUALITY OR ACCURACY OF SUCH DELIVERABLES BEING PURCHASED, WHETHER EXPRESS OR IMPLIED, EITHER IN FACT OR BY OPERATION OF LAW, STATUTE, OR OTHERWISE, AND CRED-IQ SPECIFICALLY DISCLAIMS ANY AND ALL IMPLIED OR STATUTORY WARRANTIES INCLUDING WARRANTIES OF MERCHANTABILITY AND OF FITNESS FOR A PARTICULAR PURPOSE, TECHNICAL PERFORMANCE, AND NON-INFRINGEMENT. WITHOUT LIMITING THE FOREGOING, YOU AS CUSTOMER ACKNOWLEDGE THAT YOU HAVE NOT AND ARE NOT RELYING UPON ANY IMPLIED WARRANTY OF MERCHANTABILITY OR OF FITNESS FOR A PARTICULAR PURPOSE OR OTHERWISE, OR UPON ANY REPRESENTATION OR WARRANTY WHATSOEVER AS TO THE DELIVERABLES IN ANY REGARDS WHATSOEVER, AND ACKNOWLEDGE THAT CRED-IQ MAKES NO, AND HEREBY DISCLAIMS ANY, REPRESENTATION, WARRANTY OR GUARANTEE THAT THE PURCHASE, USE OR COMMERCIALIZATION OF ANY DELIVERABLES WILL BE USEFUL TO YOU OR FREE FROM INTERFERENCE. BY ACCEPTANCE OF THE DELIVERABLES, YOU HEREBY RELEASE CRED-IQ AND ITS AFFILIATES AND AGENTS FROM ALL CLAIMS, DAMAGES AND LIABILITY ARISING HEREUNDER.