Each month the CRED iQ research team aggregates the entirety of payment statuses reported for each loan, along with special servicing status to arrive at the Distress Rate.

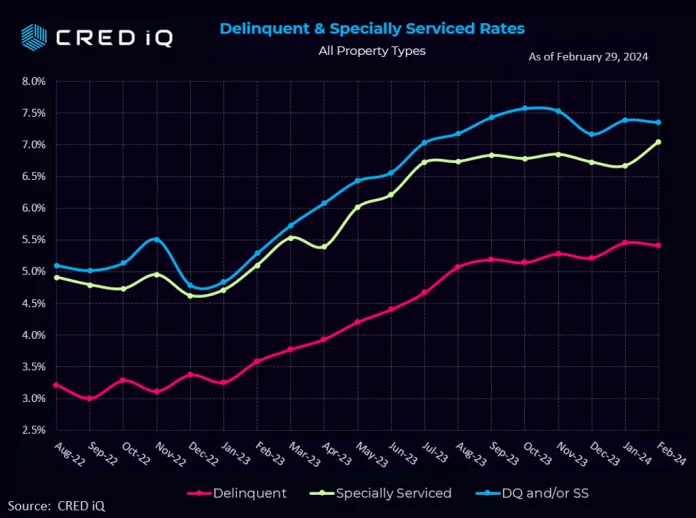

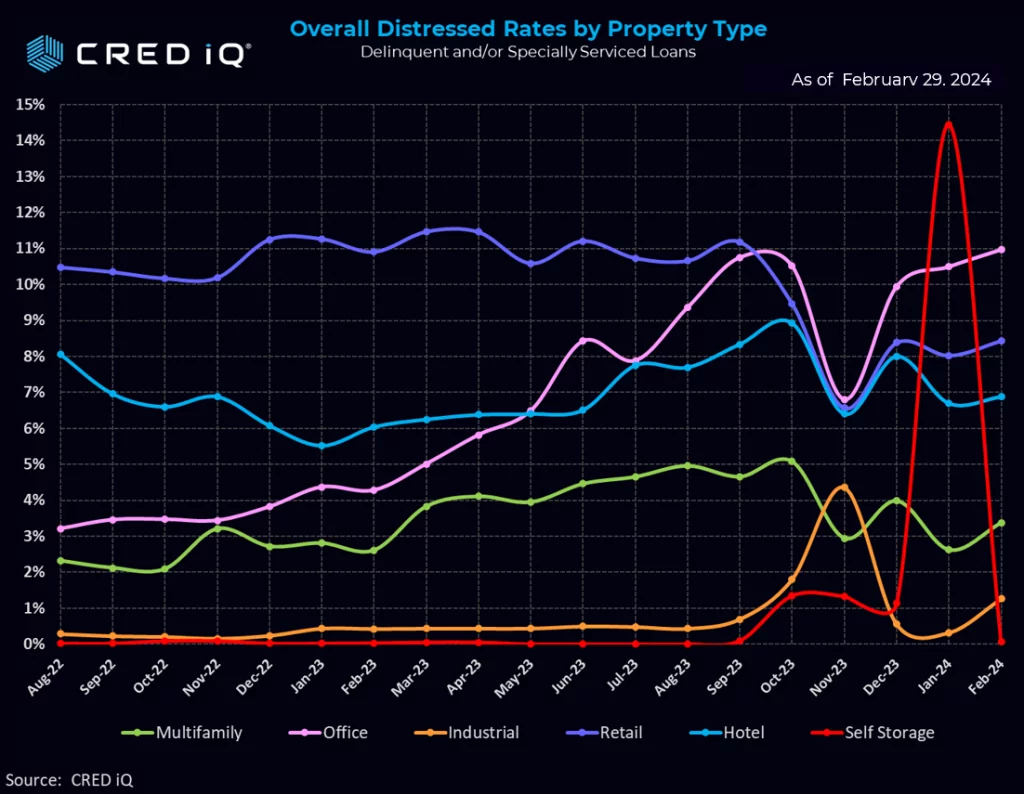

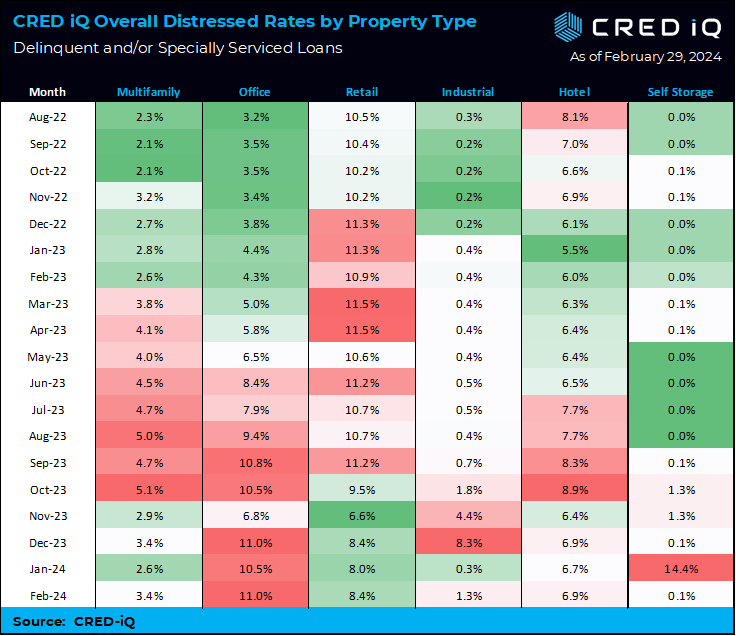

CRED iQ’s Distress Rate for all property types trimmed 4 basis points in February to 7.35% from 7.39%. Our distress rate has logged modest decreases in 3 of the last 4 months (net reduction of 18 basis points during that period). The overall distress rate declined primarily due to a large self storage portfolio ($2.1B) loan’s payment status became current this month after being delinquent last month. Despite the overall distress rate being slightly down, it is notable that 5 of the largest property types each increased this month.

Multifamily’s distress rate earned the largest monthly increase with 80 basis points—the largest monthly increase in that sector in well over 18 months. Our team is wondering if the see-saw trending will continue—albeit with wider swings. Something to watch for in March results.

Underlying CRED iQ’s Distress Rate, the CRED iQ Specially Serviced rate rose 37 basis points to 7.04% while the Delinquent print matched the distress rate with a 4-basis point reduction in February.

Once again, the office sector claimed the largest Overall Distress Rate of 11.0%, an increase of 47 basis points from the previous month.

An example of issues we are tracking within the multifamily scene is one loan, The Reserve at Brandon, a 982-unit multifamily property in East Tampa, that is backed by a $94.1 million loan that fell 30 days delinquent in February. The loan’s rate cap expiration date was in April 2024, along with its initial maturity date. There were three, 12-month extension options at securitization. The loan was added to the watchlist in May 2023 due to low occupancy and DSCR – mostly recently reported in September at 82.3% and 0.41, respectively. At underwriting, the as-is appraisal for the multifamily community was $232.5M ($263,762/unit) with an as-stabilized value of $312.6 million, with stabilization anticipated for March 2025. Servicer commentary indicates there are discussions of extending the April 2024 maturity date.

The hotel segment’s distress rate saw a modest increase of 20 basis points and industrial and self-storage continued to enjoy near zero distress levels.

CRED iQ’s Distress Rate aggregates the two indicators of distress – Delinquency Rate and Specially Serviced Rate – yielding the Distress Rate. This includes any loan with a payment status of 30+ days or worse, any loan actively with the special servicer, and includes non-performing and performing loans that have failed to pay off at maturity.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities.

The platform also offers a highly efficient valuation engine which can be leveraged across all property types and geographies. Our data platform is powered by over $2.0 trillion in transactions and data covering CRE, CMBS, CRE CLO, Single Asset Single Borrower (SASB), and all of GSE / Agency.