CRED iQ monitors distressed rates and market performance for nearly 400 MSAs across the United States, covering over $900 billion in outstanding commercial real estate (CRE) debt. Distressed rates include loans that are specially serviced, delinquent (30 days past due or worse), or a combination of both.

CRED iQ’s research team set out to examine the distress in today’s securitized CRE ecosystem. We wanted to explore geographic trends as well as the causes or triggers that earned the distressed designation. We focused upon the top 50 MSAs for this analysis.

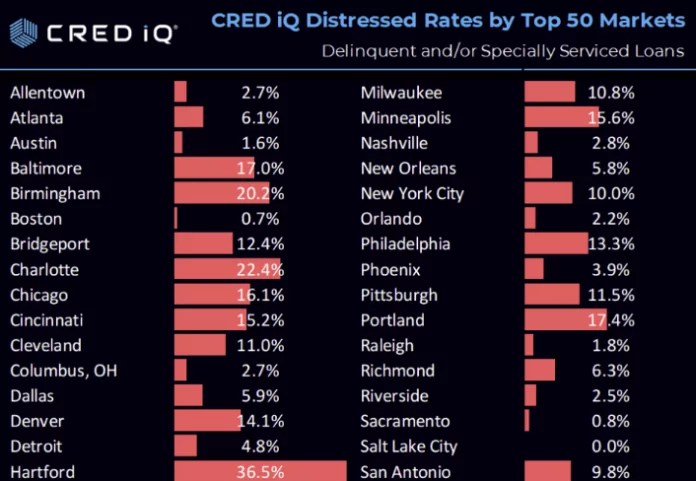

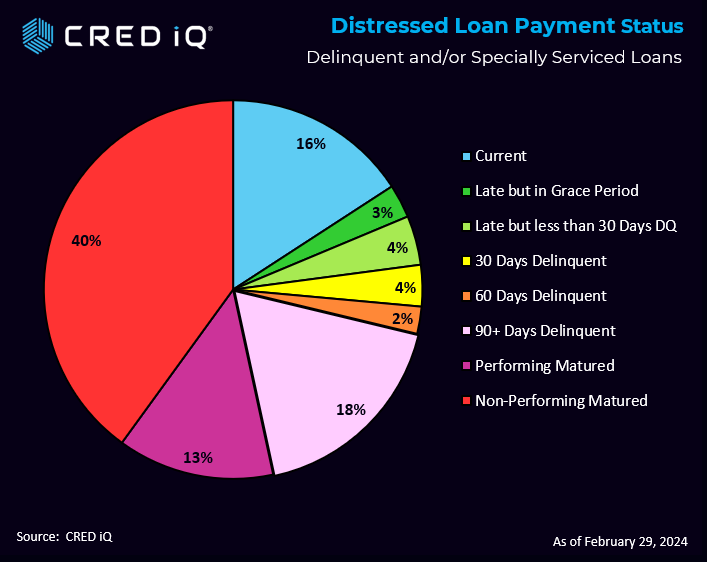

Across the top 50 MSAs, our team calculated CRED iQ Distress Rate for each market (which combines Delinquent and/or Specially Serviced loans). Hartford logged the highest level of distress at 36.5%, followed by Charlotte (22.4%), Birmingham (20.2%), San Francisco (19.2%) and Portland (17.4%) –rounding out the top 5 MSAs with the highest levels of distress. To provide perspective, the overall distress rate for all loans across every market was 7.35% as of February 2024.

Some of the strongest performing MSAs include Salt Lake City operating at 0% distress today, while San Diego, Sacramento, Seattle, and Boston have less than 1% of their loans in distress.

Among the scope of distressed loans in our analysis, one of the largest is the $384.0 million Nema San Francisco. The loan is backed by a 754-unit multifamily property in San Francisco. Cash flow at the high-rise property was unable to cover expenses, leading to imminent default. Consequently, the loan transferred to the special servicer in August 2023. The asset value decreased from $534.6 million ($720,955/unit) at underwriting to $328.8 million ($436,074/unit) in October 2023. Despite 91.9% occupancy, DSCR was reported below breakeven at 0.81.

Breaking Down the Distress Categories

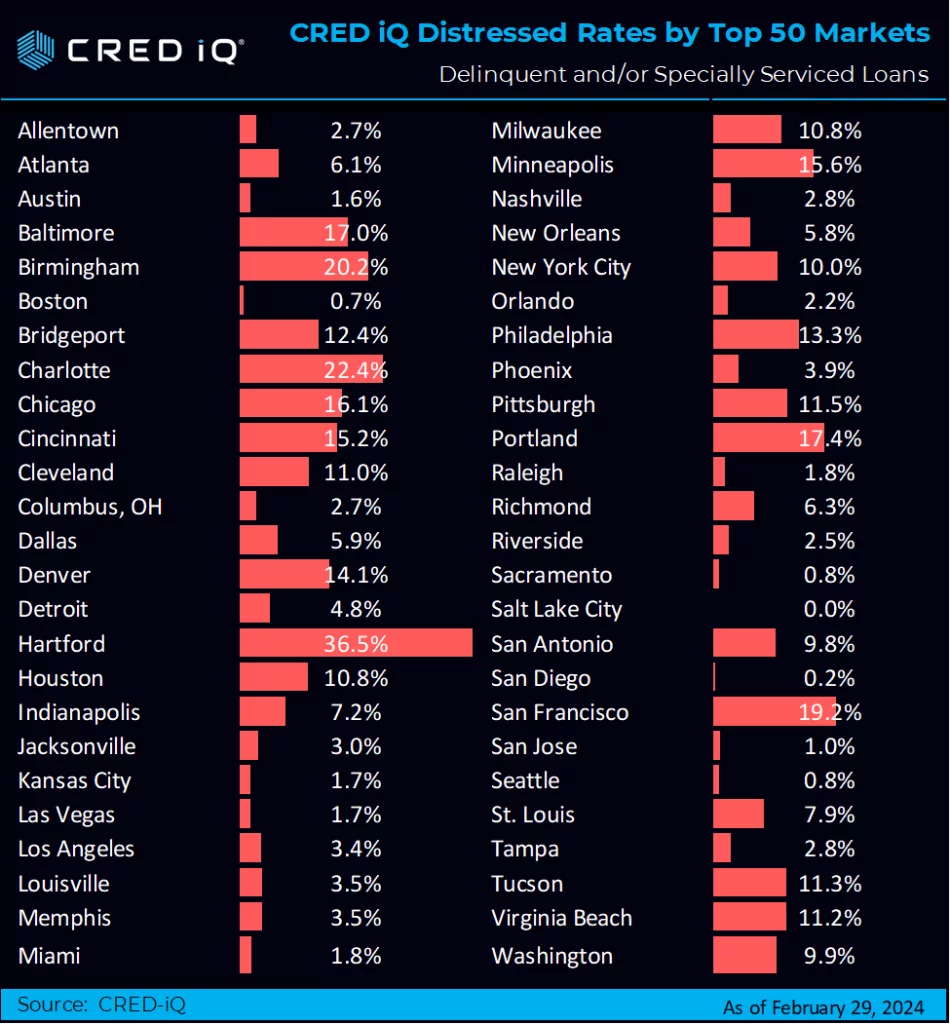

With the geographic concentrations in mind, our team took a step back and evaluated the triggers/causes that landed each loan in distress. 16% of all the loans are current with another 7% within the grace period or 30 days late. Meanwhile a whopping 40% are past their maturity dates and have stopped making monthly payments. On the other side, 13.4% are past their maturity dates, but still make their monthly mortgage payments on time. Measuring delinquency during loan terms prior to maturity dates, CRED iQ calculated 23.7% of the distressed loans are reporting between 30 days to 120+ days delinquent.

Early Warning Signals

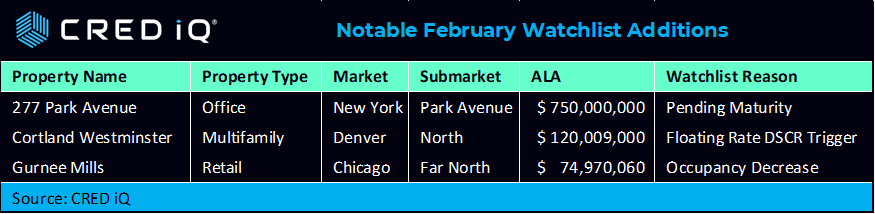

CRED iQ’s early signals of upcoming distress include loans that have been added to the servicer’s watchlist for credit-related issues. Issues include weak financial performance, low occupancy, high tenant rollover, upcoming maturity risk among other reasons to be flagged as possible troubles. Some notable loans that were added to the watchlist in February include:

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities.

The platform also offers a highly efficient valuation engine which can be leveraged across all property types and geographies. Our data platform is powered by over $2.0 trillion in transactions and data covering CRE, CMBS, CRE CLO, Single Asset Single Borrower (SASB), and all of GSE / Agency.