CRED iQ’s research team set out to explore CRE distress from a fresh perspective. We were interested in examining special servicer loan transfers over the past year. Our team wanted to understand trends by deal type and reason over time.

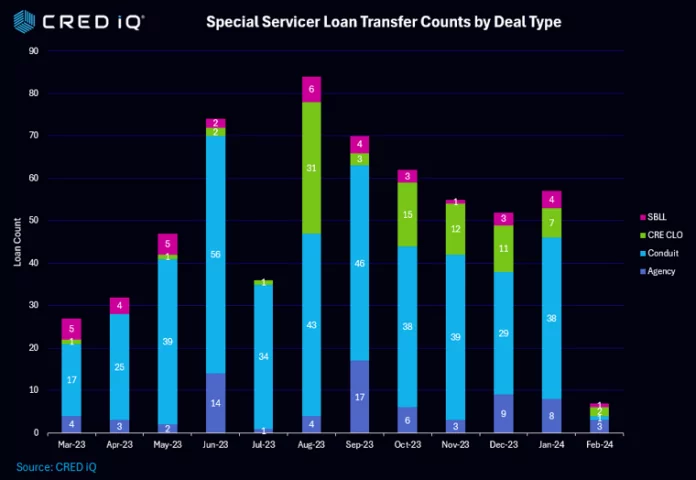

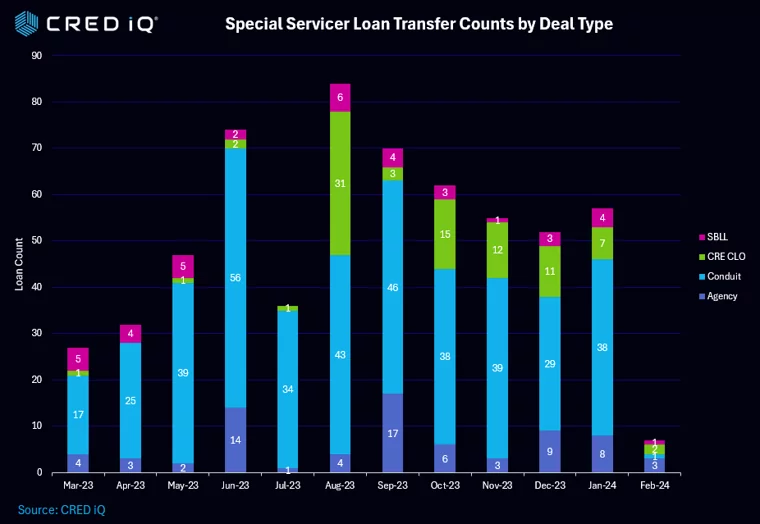

As a starting point we broke down each month’s transfers by deal type and plotted these along a timeline which seems to reveal some noteworthy trends.

February saw a spike in agency deal filings –with 36 loans transferring. Apart from February, Conduit loans dominated all other classes in loan filings –consistent with the proportional size of the conduit universe.

In August of 2023, the highest number of loans transferred to the special servicer. August marked the beginning of a trend of substantial distress in the CRE CLO arena. Following months of 1 or two loan transfers, August saw 31 CRE CLO loans sent to special service. 41 more CRE CLO loans would transfer for the balance of 2023 and that trend continues to be a major focus in 2024.

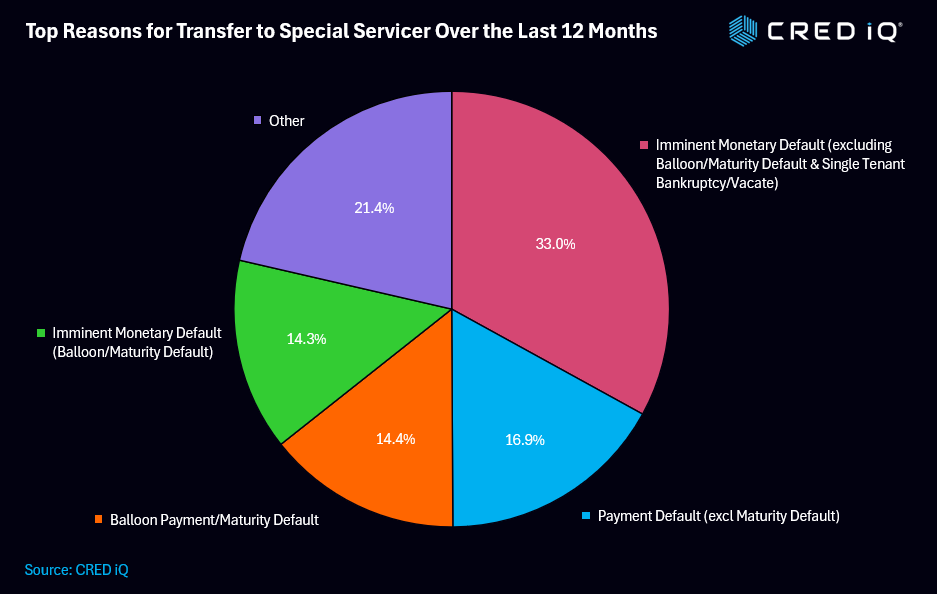

Over this past 12-month period, Imminent Monetary Default was the leading transfer reason. The data breaks down this category into two separate groupings. When combined, roughly half of the leans in our study were transferred for Imminent Monetary Default.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities.

The platform also offers a highly efficient valuation engine which can be leveraged across all property types and geographies. Our data platform is powered by over $2.0 trillion in transactions and data covering CRE, CMBS, CRE CLO, Single Asset Single Borrower (SASB), and all of GSE/Agency.