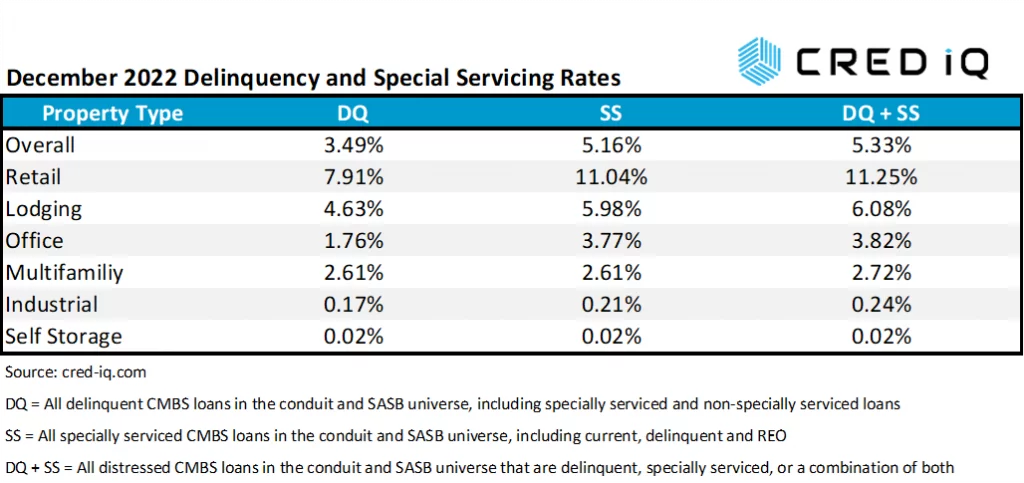

SS = All specially serviced CMBS loans in the conduit and SASB universe, including current, delinquent and REO

DQ + SS = All distressed CMBS loans in the conduit and SASB universe that are delinquent, specially serviced, or a combination of both

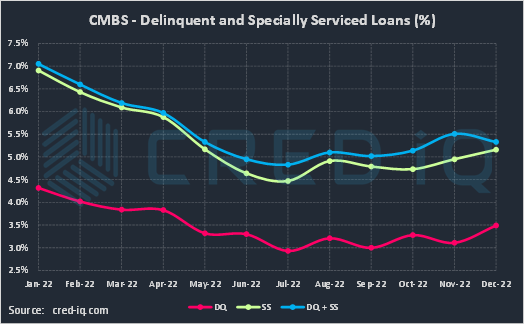

The CRED iQ delinquency rate for CMBS closed out year-end 2022 with a rate of 3.49% for the December 2022 reporting period. The delinquency rate marginally increased throughout Q4 2022 but was down overall compared to the start of the year. The delinquency rate (3.49%) is equal to the percentage of all delinquent specially serviced loans and delinquent non-specially serviced loans, for CRED iQ’s sample universe of $500+ billion in CMBS conduit and single asset single-borrower (SASB) loans. CRED iQ’s special servicing rate, equal to the percentage of CMBS loans that are with the special servicer (delinquent and non-delinquent), increased month-over-month to 5.16% from 4.95%. Aggregating the two indicators of distress – delinquency rate and special servicing rate – into an overall distressed rate (DQ + SS%) equals 5.33% of CMBS loans that are specially serviced, delinquent, or a combination of both. The overall distressed rate increased compared to the prior month’s distressed rate of 5.15%. These distressed rates typically track slightly higher than special servicing rates as most delinquent loans are also with the special servicer.

SS = All specially serviced CMBS loans in the conduit and SASB universe, including current, delinquent and REO

DQ + SS = All distressed CMBS loans in the conduit and SASB universe that are delinquent, specially serviced, or a combination of both

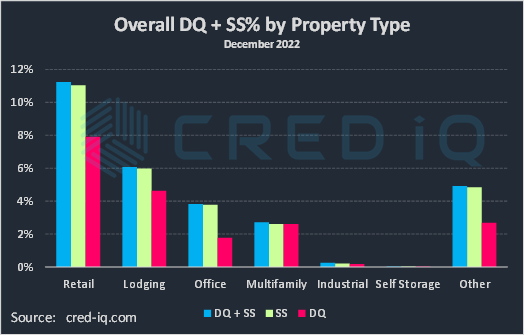

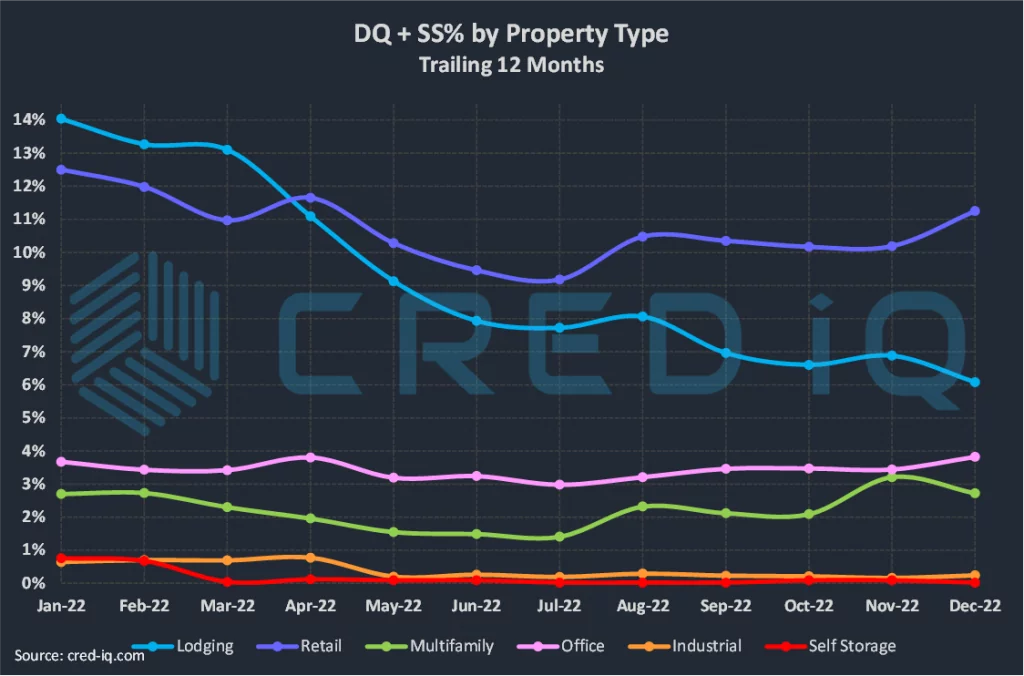

By property type, retail ended the year with the highest delinquency rate. The delinquency rate for retail increased 13% to 7.91%, compared to 7.00% as of November 2022. Retail started 2022 with the second-highest delinquency rate behind lodging; however, a lack of meaningful and sustained delinquency cures caused retail to be a laggard among property types for most of the year.

December’s delinquency retail rate was pushed higher in December by several maturity defaults. As one example, a $162.9 million loan secured by West County Center in Des Peres, MO defaulted on its December 1, 2022 maturity date. The collateral is a 743,945-sf portion of a regional mall owned by CBL Properties. The loan had been in special servicing since the onset of the pandemic in April 2020 but remained current in payment until its maturity default.

In addition to retail, delinquency rates for multifamily (2.61%), office (1.76%), and industrial (0.17%) also exhibited month-over-month increases during December 2022. Conversely, the delinquency rate for loans secured by lodging properties (4.63%) was lower compared to the prior month. Over the course of 2022, the delinquency rate for lodging has declined by more than 50% as part of a significant sector recovery from pandemic-related distress.

Switching focus to special servicing rates by property type, loans secured by office properties have exhibited the largest month-over-month increase among all property types. The office special servicing rate for December 2022 was 3.77%, compared to 3.31% as of the prior month. One of the largest office loans to transfer to special servicing was the $243.6 million Republic Plaza loan, which is secured by a 1.3 million-sf tower located in the CBD of Denver, CO. The loan defaulted on its December 1, 2022 maturity date.

Maturity defaults also stressed the special servicing rate for retail. The retail special servicing rate increased to 11.04% as of December 2022. One of the larger retail maturity defaults was a $75.4 million mortgage secured by Avenue Forsyth, a 523,535-sf retail center located in Cumming, GA. The special servicing rates for lodging, multifamily, and industrial commercial real estate loans declined compared to the prior month.

CRED iQ’s CMBS distressed rate (DQ + SS%) by property type accounts for loans that qualify for either delinquent or special servicing subsets. This month, the overall distressed rate for CMBS increased to 5.33%, which followed a relatively sharp increase in the overall delinquency rate. The increase in the overall CMBS distressed rate was primarily caused by loans entering maturity default such as the aforementioned West County Center and Republic Plaza loans. For additional information about these two loans, click View Details below:

| [View Details] | [View Details] | |

| Loan | Republic Plaza | West County Center |

| Balance | $243,621,128 | $161,887,620 |

| Special Servicer Transfer Date | 11/22/2022 | 4/6/2020 |

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform designed to unlock investment, financing, and leasing opportunities. CRED iQ provides real-time property, loan, tenant, ownership, and valuation data for over $2.0 trillion of commercial real estate.