As our final report of 2024, the CRED iQ research team focused upon CRE CLO distress. We wanted to explore how this marketplace has evolved since our previous report last month. After giving back 97 BP in our November report, The CRED iQ Distress reversed that progress by reaching a new record high of 13.23%.

The CRED iQ distress rate includes any loan reported 30 days delinquent or worse, past their maturity, specially serviced, or a combination of these. We also examined the most recent property-level net operating income figures and compared them to underwritten expectations.

Given the rapid surge in interest rates, these floating-rate loans have shown significant declines in debt-service-coverage-ratios (DSCR). CRED iQ’s analysis uncovers that 59.2% of CRE CLOs loans are operating below a 1.00 DSCR (NCF), down from 62.3% last month. Net Cash Flow (NCF) is a key variable in calculating a loan’s DSCR which determines the strength and creditworthiness of a given loan.

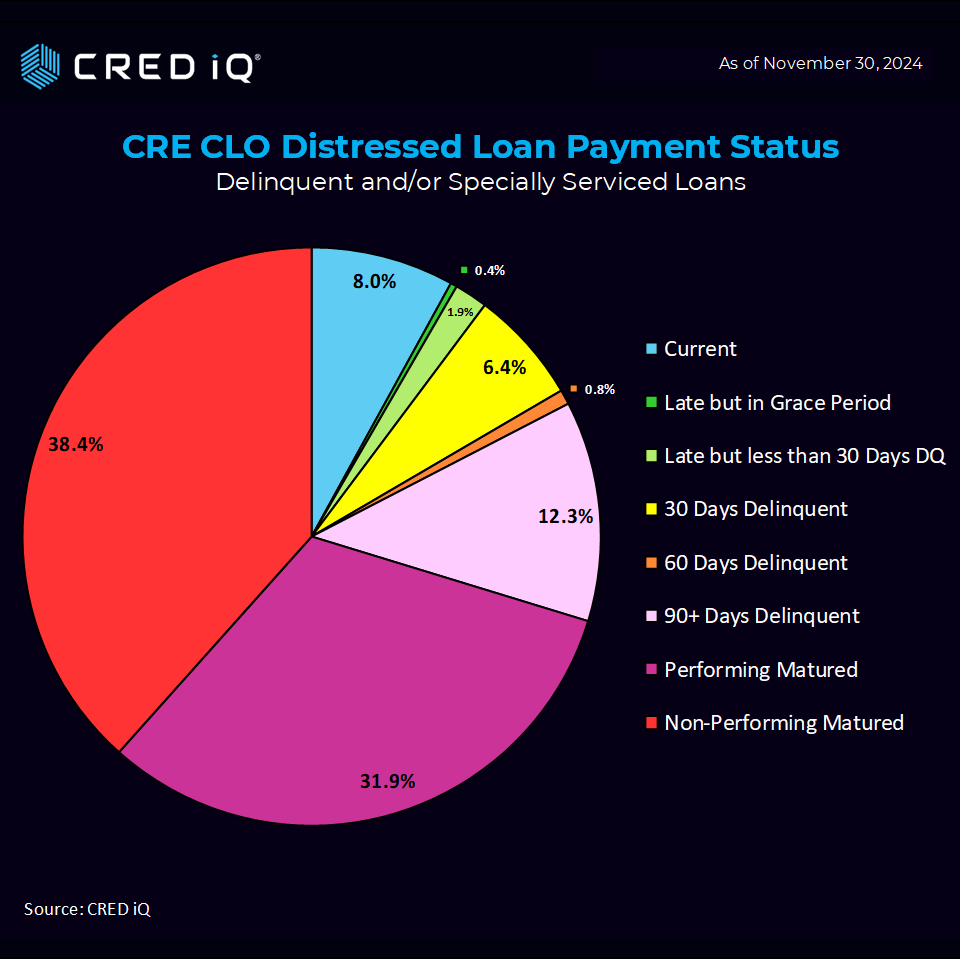

Payment Status

Looking across payment status, 31.9% of loans are performing matured (flat to last month’s print), with 38.4% non-performing matured (up from 32.4% last month), meaning 70.3% of the CRE CLO loans in our study are past their maturity dates up from 63.8% in last month’s report. Delinquent loans that have not past their maturity date accounted for 19.5% of the distressed loans, down from 23.3% in the previous month.

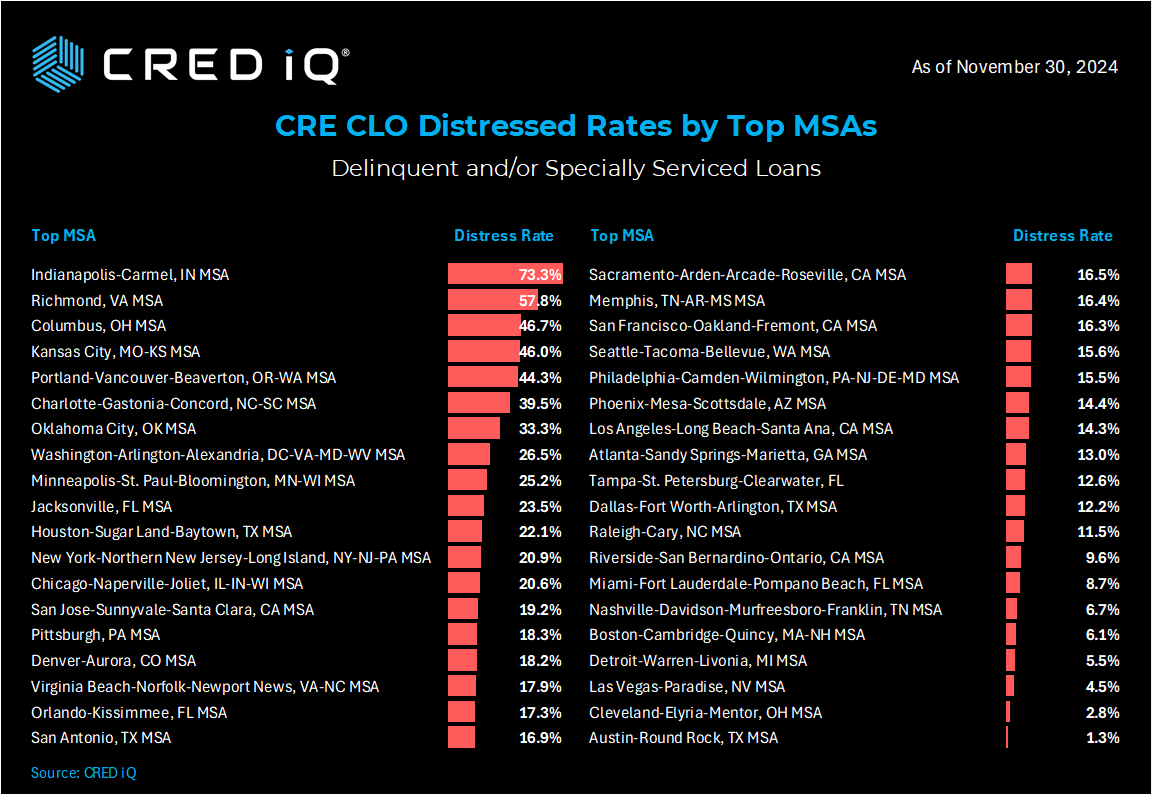

Regional Analysis

Our readers have asked us to examine CRE CLO distress on a regional-level and we are pleased to add that dimension to this report. Our analysis broke out CRE CLO assets to their respective MSAs to understand how the distress has manifested at the MSA level.

Indianapolis-Carmel landed solidly in first place with 73.3% of their CRE CLO loans in some form of distress.

The Indiana MSA was followed by Richmond, VA with 57.8% of their loans in distress. Columbus Ohio rounds out the top three with a CRE CLO distress rate of 46.7%.

Elsewhere in Ohio, the Cleveland-Elyria-Mentor MSA Ohio had one of the lowest CRE CLO distress rates at 2.8%, followed by Austin-Round Rock Texas at 1.3%.

Analysis Scope & Methodology

CRED iQ consolidated all of the loan-level performance data for every outstanding CRE CLO loan to measure the underlying risks associated with these transitional assets. Our team examined $64.3 billion in active CRE CLO loans. Many of these loans were originated in 2021 at times where cap rates were low, valuations high, low interest rates, and are starting to run into maturity issues given the spike in rates.

Some of the largest issuers of CRE CLO debt over the past five years include MF1, Arbor, LoanCore, Benefit Street Partners, Bridge Investment Group, FS Rialto, and TPG. The vast majority of the $79.1 billion in CRE CLO loans are structured with floating rates with 3-year loan terms equipped with loan extension options if certain financial hurdles are met.

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.

THE DATA, INFORMATION AND/OR RELATED MATERAL (“DELIVERABLES”) IS BEING OFFERED AS-IS/WHERE-AS CONDITION. CRED-IQ MAKES NO REPRESENTATION OR WARRANTY AS TO QUALITY OR ACCURACY OF SUCH DELIVERABLES BEING PURCHASED, WHETHER EXPRESS OR IMPLIED, EITHER IN FACT OR BY OPERATION OF LAW, STATUTE, OR OTHERWISE, AND CRED-IQ SPECIFICALLY DISCLAIMS ANY AND ALL IMPLIED OR STATUTORY WARRANTIES INCLUDING WARRANTIES OF MERCHANTABILITY AND OF FITNESS FOR A PARTICULAR PURPOSE, TECHNICAL PERFORMANCE, AND NON-INFRINGEMENT. WITHOUT LIMITING THE FOREGOING, YOU AS CUSTOMER ACKNOWLEDGE THAT YOU HAVE NOT AND ARE NOT RELYING UPON ANY IMPLIED WARRANTY OF MERCHANTABILITY OR OF FITNESS FOR A PARTICULAR PURPOSE OR OTHERWISE, OR UPON ANY REPRESENTATION OR WARRANTY WHATSOEVER AS TO THE DELIVERABLES IN ANY REGARDS WHATSOEVER, AND ACKNOWLEDGE THAT CRED-IQ MAKES NO, AND HEREBY DISCLAIMS ANY, REPRESENTATION, WARRANTY OR GUARANTEE THAT THE PURCHASE, USE OR COMMERCIALIZATION OF ANY DELIVERABLES WILL BE USEFUL TO YOU OR FREE FROM INTERFERENCE. BY ACCEPTANCE OF THE DELIVERABLES, YOU HEREBY RELEASE CRED-IQ AND ITS AFFILIATES AND AGENTS FROM ALL CLAIMS, DAMAGES AND LIABILITY ARISING HEREUNDER.