The commercial real estate collateralized loan obligation (CRE CLO) market has been a critical financing vehicle for transitional assets, offering lenders flexibility and investors exposure to diversified real estate debt. However, as interest rates remain elevated and economic uncertainty lingers, the sector is experiencing notable shifts in loan performance. CRED iQ’s latest March 2025 report sheds light on delinquency and distress trends, providing valuable insights for commercial real estate professionals navigating this complex landscape.

A Decline in Distress, But Challenges Persist

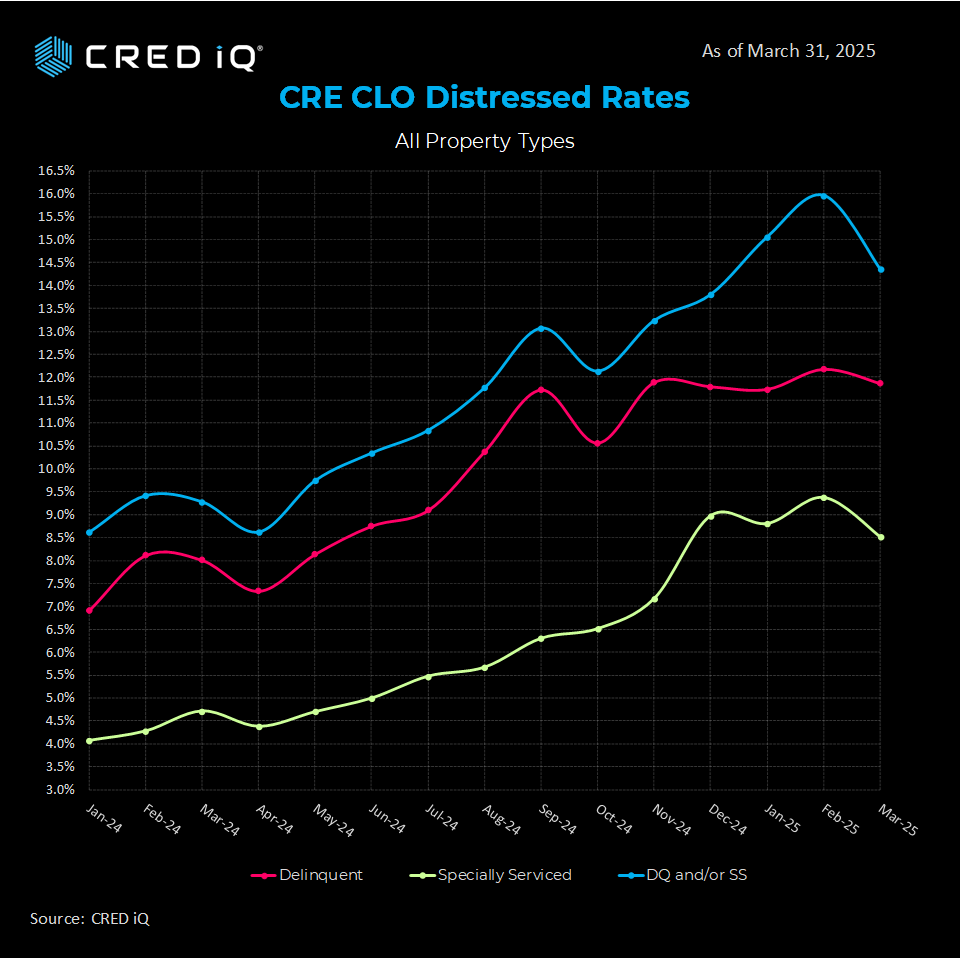

CRED iQ’s distress rate for CRE CLO loans saw a meaningful improvement in March 2025, dropping 160 basis points from 16.0% to 14.4%. This reduction reflects slight improvements across key metrics:

- Delinquency Rate: Fell 30 basis points to 11.9%, signaling fewer loans falling 30+ days behind on payments.

- Special Servicing Rate: Decreased from 9.4% to 8.5%, indicating a modest decline in loans requiring intensive oversight.

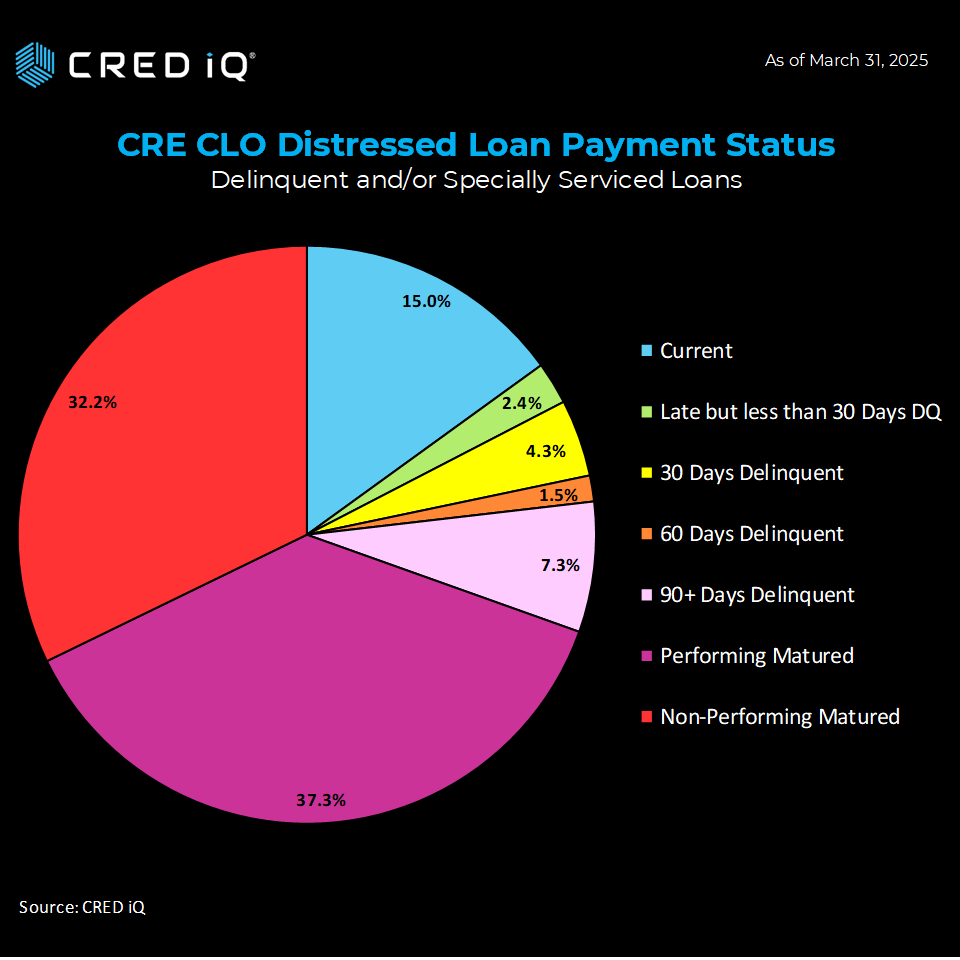

While these improvements are encouraging, the broader picture reveals ongoing challenges. A striking 69.5% of CRE CLO loans have surpassed their maturity dates, with 37.3% classified as “performing matured”—a 660-basis-point increase from the prior month. This surge suggests that many borrowers are exercising extension options or negotiating month-to-month arrangements to avoid default, particularly as rising interest rates and tighter capital markets complicate refinancing.

Payment Status: A Mixed Bag

The payment status of CRE CLO loans highlights the sector’s volatility:

- Current Loans: Only 15% of loans were current, down 530 basis points from the previous month. This sharp decline underscores the pressure on borrowers to maintain timely payments amid higher debt service costs.

- Non-Performing Matured Loans: Represent 32.2% of the portfolio, relatively stable with a slight 50-basis-point drop.

- Delinquent Loans (Pre-Maturity): Account for 15.4% of loans, a marginal improvement from 16.3% last month.

These figures reflect a market grappling with the aftermath of loans originated in 2021, when cap rates were compressed, valuations were elevated, and interest rates were historically low. Many of these loans, structured with floating rates and three-year terms, are now hitting maturity walls in a dramatically different economic environment.

Case Study: 1213 Walnut Loan

A real-world example illustrates the pressures facing CRE CLO borrowers. The $125 million 1213 Walnut loan, backed by a 322-unit multifamily property in Philadelphia, highlights maturity-related challenges. Built in 2018 and valued at $151.4 million at underwriting, the property was 90.4% occupied as of March 2025. However, its debt service coverage ratio (DSCR) of 0.64 signals financial strain, well below breakeven.

Originally set to mature in January 2023, the interest-only loan included two one-year extension options. Despite month-to-month extensions, it was flagged on the servicer’s watchlist and transitioned to non-performing matured status in March 2025. This case underscores a broader trend: even well-occupied properties can face distress when cash flows fail to cover rising debt service costs or when refinancing options remain scarce.

What’s Driving These Trends?

Several factors contribute to the delinquency and maturity challenges in the CRE CLO sector:

- Rising Interest Rates: Most CRE CLO loans carry floating rates, making borrowers vulnerable to the steep rate hikes since 2022. Higher debt service costs are squeezing cash flows, particularly for properties with underwritten DSCRs based on low-rate environments.

- Maturity Wall: Loans originated in 2021 with three-year terms are now maturing, and many borrowers struggle to refinance in a market with higher rates and stricter underwriting standards.

- Economic Uncertainty: While multifamily and industrial assets have shown resilience, sectors like office and retail face headwinds from hybrid work trends and shifting consumer behavior, impacting property-level performance.

- Extension Dependency: The prevalence of “performing matured” loans reflects borrowers leaning heavily on extension options. However, these extensions often come with stricter covenants or higher costs, adding pressure to already strained assets.

Implications for CRE Professionals

For lenders, investors, and asset managers, these trends highlight the importance of proactive portfolio management:

- Enhanced Due Diligence: Scrutinize property-level performance metrics, such as occupancy, net operating income (NOI), and DSCR, to identify at-risk loans early. CRED iQ’s data shows that many distressed loans exhibit below-breakeven DSCRs, as seen in the 1213 Walnut case.

- Maturity Monitoring: With 69.5% of loans past maturity, prioritize loans approaching or exceeding their terms. Engage borrowers early to explore extension feasibility or restructuring options.

- Sector-Specific Strategies: Focus on resilient asset classes like multifamily, which continue to benefit from strong rental demand, while exercising caution with office or retail-heavy portfolios.

- Capital Markets Awareness: Stay attuned to refinancing conditions. Tighter lending standards and higher rates may necessitate creative solutions, such as bridge financing or equity partnerships.

Looking Ahead

While the 160-basis-point drop in the distress rate is a positive signal, the CRE CLO sector remains under pressure. The high percentage of matured loans and low share of current loans suggest that challenges will persist, particularly for assets underwritten in the pre-2022 low-rate environment. Issuers like MF1, Arbor, LoanCore, and Benefit Street Partners, which dominate the CRE CLO market, will need to navigate these headwinds carefully.

For commercial real estate professionals, leveraging data-driven insights like those from CRED iQ is critical. By closely monitoring delinquency trends, maturity statuses, and property-level performance, stakeholders can make informed decisions to mitigate risk and capitalize on opportunities in this evolving market.

Disclaimer: The data and insights in this blog are based on CRED iQ’s March 2025 report, analyzing $53.5 billion in active CRE CLO loans. Market conditions are subject to change, and professionals should consult primary sources and advisors for specific investment or lending decisions.