A data-driven analysis of bank-reported multifamily credit stress through Q3 2025

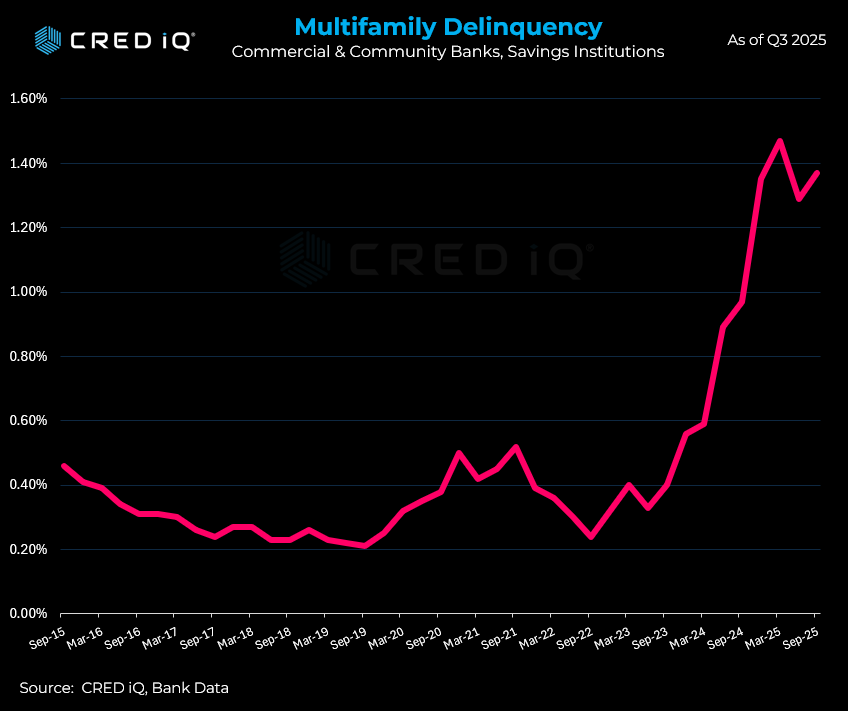

By the numbers, multifamily lending has entered a new phase of stress — one that deserves serious attention from investors, lenders, and brokers navigating today’s commercial real estate market. According to CRED iQ data reported by community, commercial, and savings banks, multifamily overall delinquency reached 1.37% as of Q3 2025, representing the highest level since the post-GFC recovery era and a dramatic escalation from the near-zero stress environment of 2021–2022.

Delinquency Trends: From Benign to Elevated in Three Years

To appreciate how quickly conditions have deteriorated, consider the baseline. From 2017 through mid-2022, multifamily overall delinquency rates held comfortably between 0.23% and 0.39% — a period defined by low interest rates, strong rent growth, and abundant capital. That era effectively ended in 2022 as the Federal Reserve began its most aggressive rate hiking cycle in decades.

By Q3 2023, overall delinquency had climbed to 0.40%. One year later, Q3 2024 showed 0.97%. And by Q3 2025, the rate hit 1.37% — a 3.4x increase in just two years. In dollar terms, the total delinquent multifamily loan balance grew from approximately $2.4 billion in Q3 2023 to nearly $8.9 billion in Q3 2025, an increase of more than $6.5 billion in 24 months.

The composition of that delinquency is equally telling. Serious delinquencies — loans 90 days or more past due — now represent the overwhelming majority of stressed exposure at 1.09%, or roughly $7.1 billion. Early-stage delinquencies (30–89 days) stand at 0.28%, suggesting that the pipeline of new stress, while active, is not yet overwhelming. The concern is the accumulation at the severe end of the spectrum, where borrowers have exhausted short-term remedies and lenders face resolution decisions.

Losses Are Accelerating

Perhaps more consequential than delinquency rates is the trajectory of realized losses. For much of the period from 2017 through 2021, bank-reported multifamily loss rates were effectively zero or nominal. By Q3 2024, losses had risen to 0.08%, or roughly $504 million. As of Q3 2025, the loss rate stands at 0.14% — translating to approximately $911 million in a single quarter.

To place that in historical context, cumulative quarterly losses during the Global Financial Crisis peaked around 1.24% in late 2010, with total delinquencies exceeding 5.7% at the cycle’s worst. Current levels remain well below those extremes. However, the velocity of the current loss cycle is noteworthy: it took roughly four years for GFC-era losses to fully materialize. Today’s losses are compressing on a faster timeline, driven by higher floating-rate exposure, rapid cap rate expansion, and value declines concentrated in specific markets and vintages.

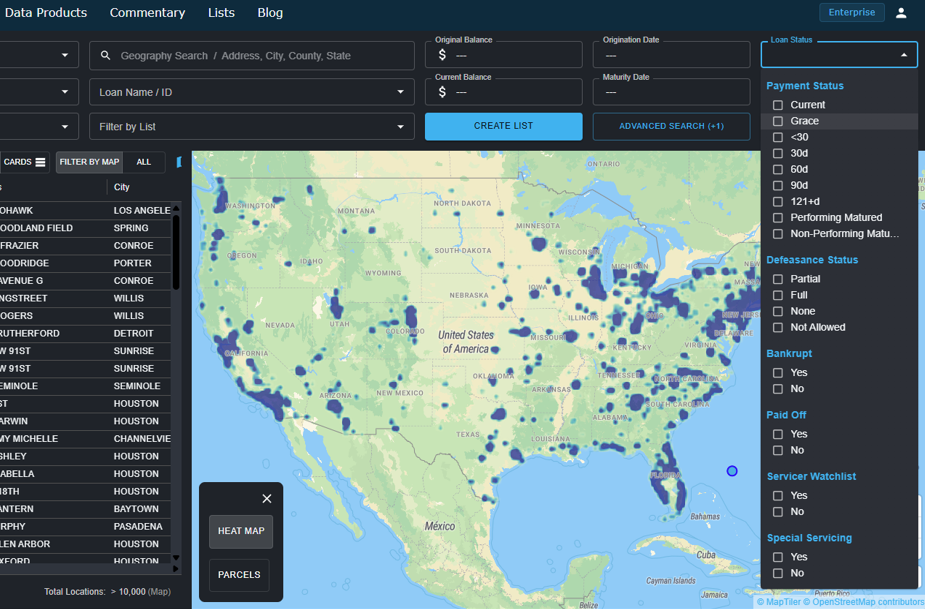

Explore Distress on CRED iQ

What the Data Signals for CRE Stakeholders

For lenders, the data reinforces the need for proactive asset management. With $7.1 billion in 90+ day delinquencies sitting on bank balance sheets, resolution strategies — workouts, modifications, note sales — will define credit outcomes over the next 12–24 months.

For investors, the rise in distressed inventory creates opportunity, but underwriting discipline remains essential. Assets with overleveraged 2021–2022 vintage debt remain the highest-risk segment.

For brokers, understanding where distress is concentrated — by geography, loan vintage, and lender type — will be critical to sourcing off-market deal flow as banks seek resolution.

The multifamily sector’s fundamental demand drivers remain intact. But the credit cycle has clearly turned. CRED iQ data through Q3 2025 makes one thing clear: stress is no longer emerging — it has arrived.

Data sourced from CRED iQ, based on multifamily loan performance reported by community, commercial, and savings banks as of Q3 2025.

About CRED iQ

CRED iQ is a leading commercial real estate (CRE) data and analytics platform designed to bring transparency, structure, and actionable intelligence to complex CRE debt markets. The platform aggregates and normalizes loan- and property-level data across CMBS, CRE CLO, Agency, and private debt, enabling investors, lenders, servicers, and advisors to analyze risk, performance, and opportunities within a single, unified environment.

CRED iQ specializes in advanced analytics for loan surveillance, distress tracking, special servicing activity, and workout strategies, with a particular focus on identifying early warning signals and resolution outcomes across the CRE lifecycle. By combining institutional-grade data infrastructure with AI-driven insights, CRED iQ helps market participants move beyond static reporting toward dynamic, forward-looking decision-making.

Users leverage CRED iQ to monitor delinquency trends, track foreclosures and REO pipelines, evaluate modification and extension activity, and assess portfolio exposure at the property, sponsor, and market level. The platform is built for speed, scalability, and precision—reducing manual research while increasing confidence in investment, underwriting, and asset management decisions.

Trusted by leading institutional investors, lenders, and advisory firms, CRED iQ delivers the data foundation required to navigate today’s evolving CRE market. For professionals seeking a comprehensive commercial real estate analytics platform with deep coverage of distressed debt, special servicing, and AI-powered insights, CRED iQ provides a differentiated, execution-ready solution.