Overall delinquency continued its decline for the eighth consecutive reporting period following its rapid ascent from April to June 2020. Although there has been a favorable trend, defaults on CRE mortgages remain at an elevated level across the United States, driven primarily by the retail and lodging sectors. We expect delinquency to remain elevated for 2021, however as COVID 19 vaccination efforts continue to ramp up, we anticipate more immediate and significant improvements to the hotel default rate throughout the year.

For the full delinquency report, download here:

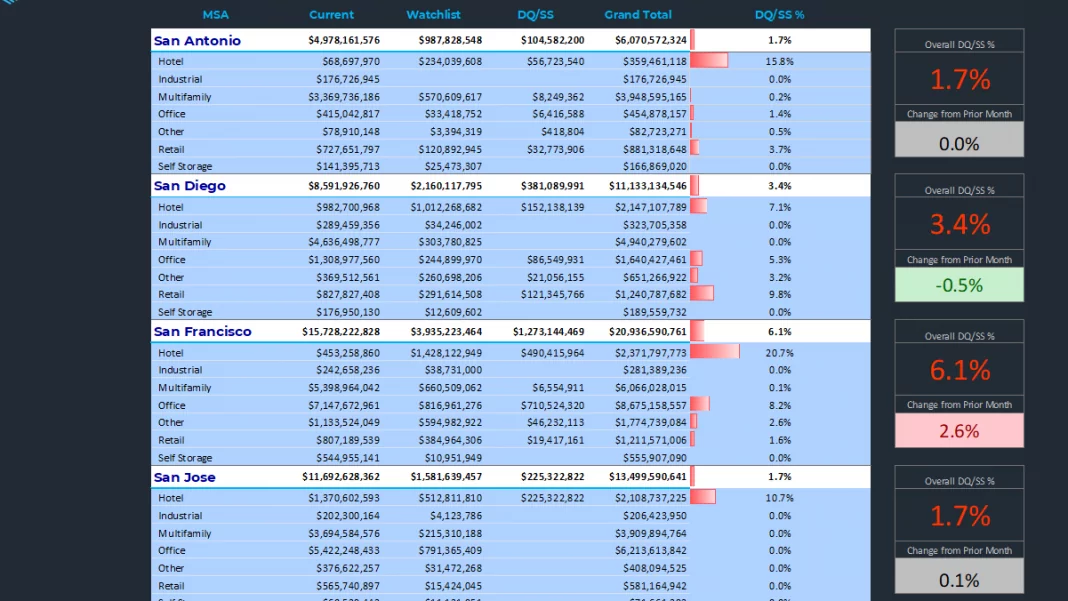

CRED iQ monitors market performance for nearly 400 MSAs across the United States. Below is a summary of the default rates for the 50 largest metros segmented by property type. Consistent with the months following the start of the pandemic, the hotel and retail sectors remain the largest contributors to the delinquency percentages for the majority of these statistical areas. Loans backed by self-storage, multifamily, and industrial facilities posted the lowest delinquency rates for most of these markets.

For full access to CRED iQ’s loan, property and valuation data, sign up here: