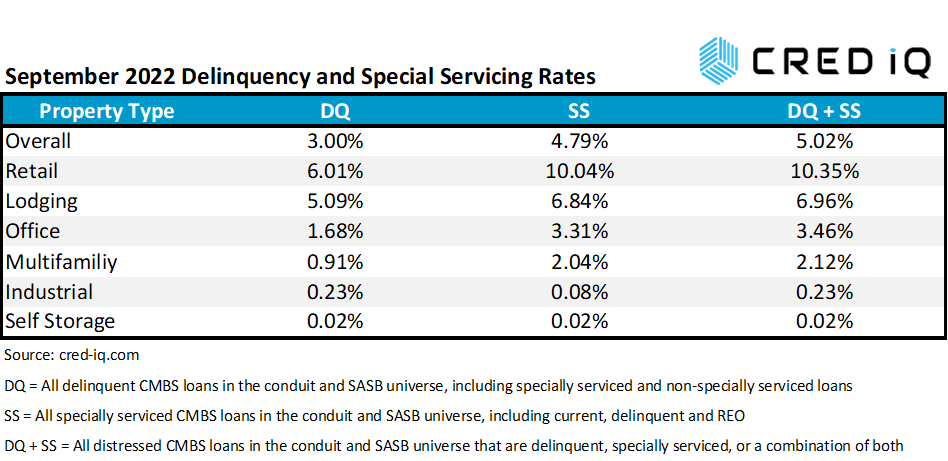

SS = All specially serviced CMBS loans in the conduit and SASB universe, including current, delinquent and REO

DQ + SS = All distressed CMBS loans in the conduit and SASB universe that are delinquent, specially serviced, or a combination of both

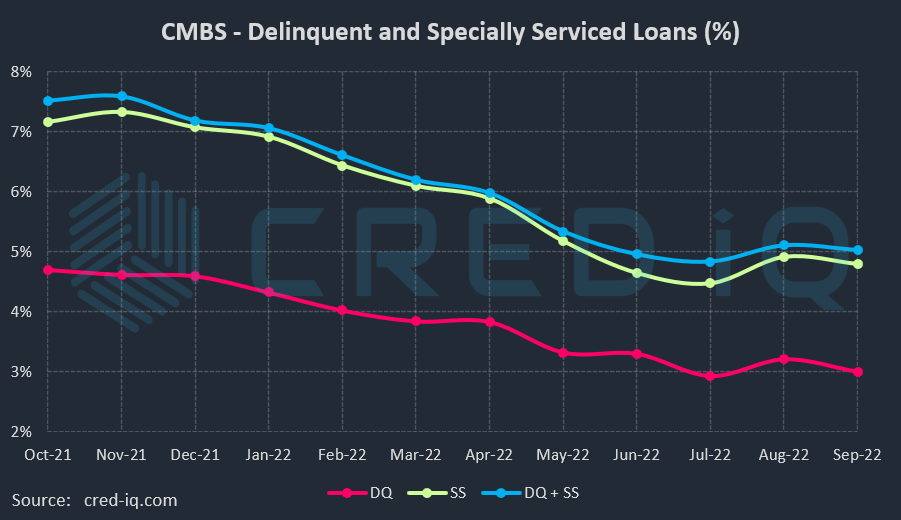

The CRED iQ delinquency rate for CMBS declined during the September 2022 reporting period, one month after its first month-over-month increase in over two years. This month, the delinquency rate, equal to the percentage of all delinquent specially serviced loans and delinquent non-specially serviced loans, for CRED iQ’s sample universe of $500+ billion in CMBS conduit and single asset single-borrower (SASB) loans was 3.00%, which was 21 bps lower than last month’s delinquency rate of 3.21%. CRED iQ’s special servicing rate, equal to the percentage of CMBS loans that are with the special servicer (delinquent and non-delinquent), declined month-over-month to 4.79% from 4.91%. The special servicing rate is still at its highest level since May 2022 despite this month’s decline. Aggregating the two indicators of distress – delinquency rate and special servicing rate – into an overall distressed rate (DQ + SS%) equals 5.02% of CMBS loans that are specially serviced, delinquent, or a combination of both. The overall distressed rate decreased compared to the prior month’s distressed rate of 5.10%. These distressed rates typically track slightly higher than special servicing rates as most delinquent loans are also with the special servicer.

SS = All specially serviced CMBS loans in the conduit and SASB universe, including current, delinquent and REO

DQ + SS = All distressed CMBS loans in the conduit and SASB universe that are delinquent, specially serviced, or a combination of both

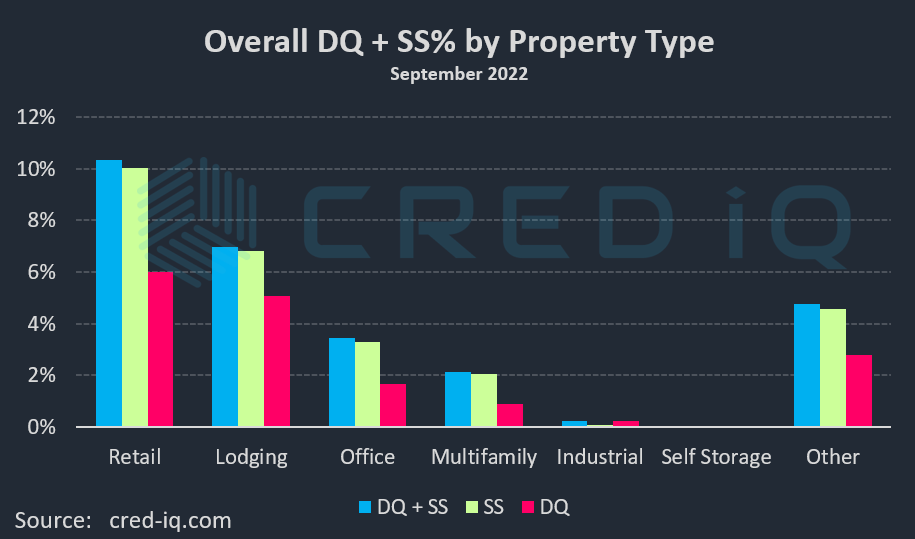

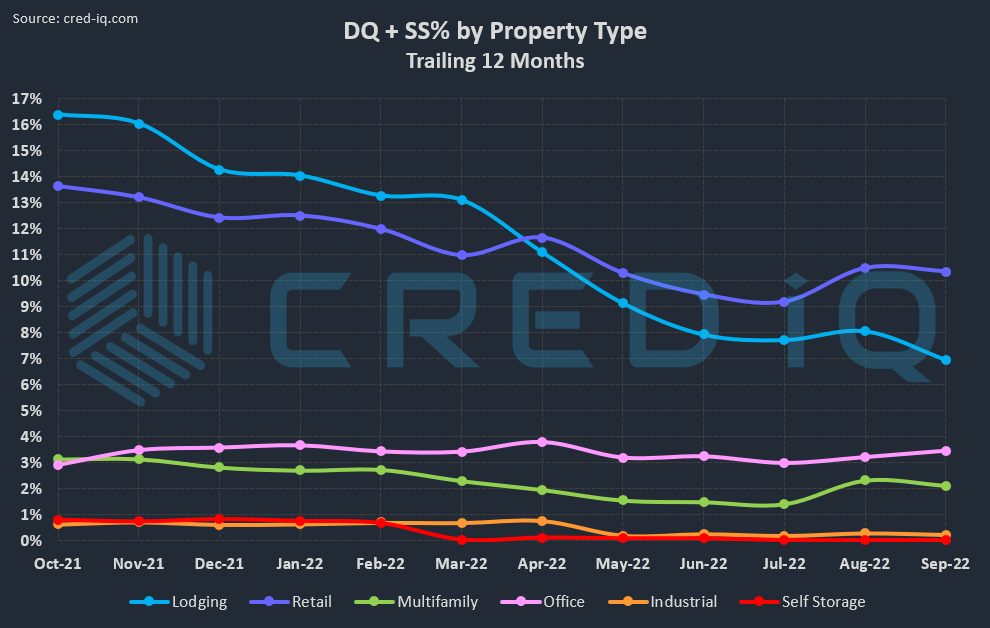

By property type, there were variations in trends among delinquency rates this month. The office and retail sectors exhibited month-over-month increases in delinquency while the lodging (5.09%), multifamily (0.91%), and industrial (0.23%) sectors exhibited delinquency rate declines. The office delinquency rate increased to 1.68% in September, which was 11% higher than August. One of the more notable loans to become delinquent this month was a $51 million mortgage secured by 700 Broadway, a 424,453-sf office tower located in Denver, CO. The loan was reported as 30 days delinquent as of September 2022. Overall, the office delinquency rate is still lower than it was a year ago when it equaled 2.19%.

The delinquency rate for retail increased modestly to 6.01%, compared to 5.91% a month prior. This is the second consecutive month that the retail delinquency rate has increased. The retail sector has had the highest delinquency rate among all property types since May 2022. A $125 million mortgage secured by 1880 Broadway, an 84,240-sf retail condo located in the Upper West Side of Manhattan, defaulted at maturity on September 6, 2022 and contributed to the increase in retail delinquency.

Special servicing rates across property types were either down or flat in September 2022 compared to the prior month with the exception of the office sector. The special servicing rate for loans secured by office collateral increased to 3.31%. This is the second consecutive month that the office special servicing rate has increased. Additionally, the special servicing rate for office is higher than it was 12 months ago when it equaled 2.89%. The retail sector had the highest special servicing rate among all property types, equaling 10.04%.

The most dramatic improvement in special servicing rates across property types was for the lodging sector. The lodging special servicing rate declined to 6.84%, which was a 14% decrease compared to August. Several notable lodging loans were worked out and returned to the master servicer over the past two months, including a $72.6 million mortgage secured by the Holiday Inn – 6th Avenue, a 226-key hotel located in the Chelsea submarket of Manhattan, NY. The collateral property was sold in June 2022 for $80.3 million and the mortgage was assumed and brought current.

CRED iQ’s CMBS distressed rate (DQ + SS%) by property type accounts for loans that qualify for either delinquent or special servicing subsets. This month, the overall distressed rate for CMBS decreased to 5.02% in tandem with declines in the overall delinquency and special servicing rates. The decline in the overall CMBS distressed rate was driven primarily by cures of loans secured by lodging properties this month. Conversely, two of the largest loans to became delinquent in September were a $126.8 million mortgage secured by 750 Lexington Avenue, a 382,256-sf mixed-use property (office and retail) located in Midtown Manhattan, and the aforementioned $125 million 1880 Broadway loan. For additional information about these two loans, click View Details below:

| [View Details] | [View Details] | |

| Loan | 750 Lexington Avenue | 1880 Broadway |

| Balance | $126,826,217 | $125,000,000 |

| Loan Status | 30 Days Delinquent | Non-Performing Matured |

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. Our data platform is powered by over $2.0 trillion of CMBS, CRE CLO, SBLL, and GSE Agency loan and property data.