The CRED iQ research team focused upon the underwriting of the latest market transactions. We wanted to understand they key loan metrics across this universe to get a real-time sense of the new issues marketplace.

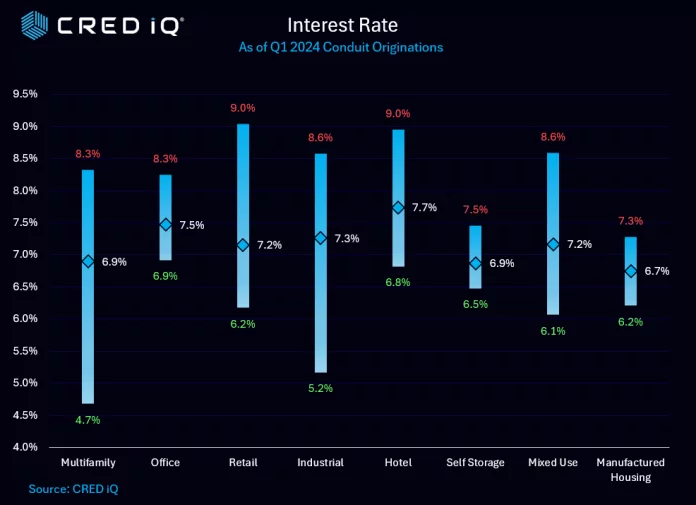

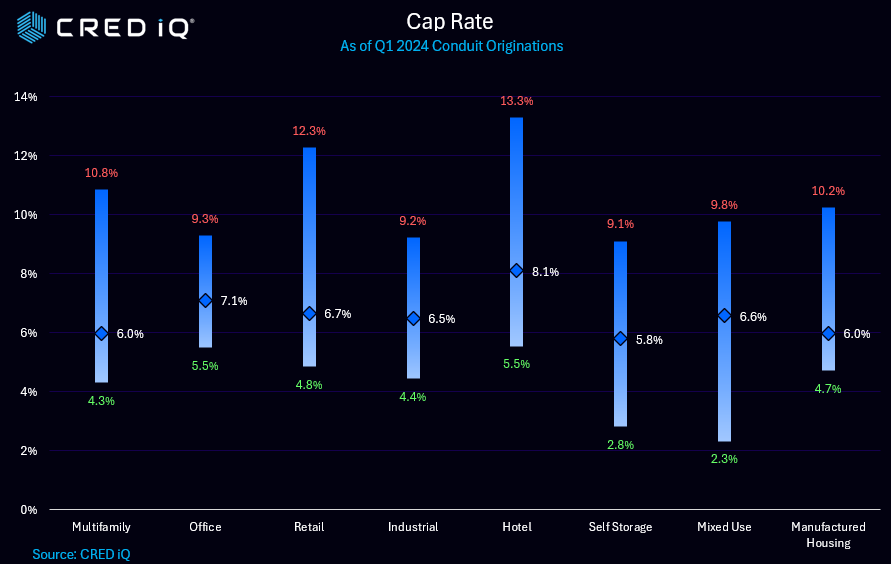

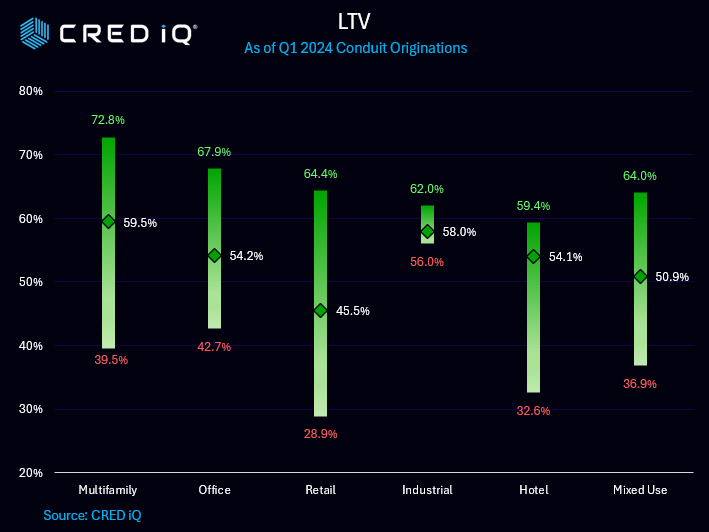

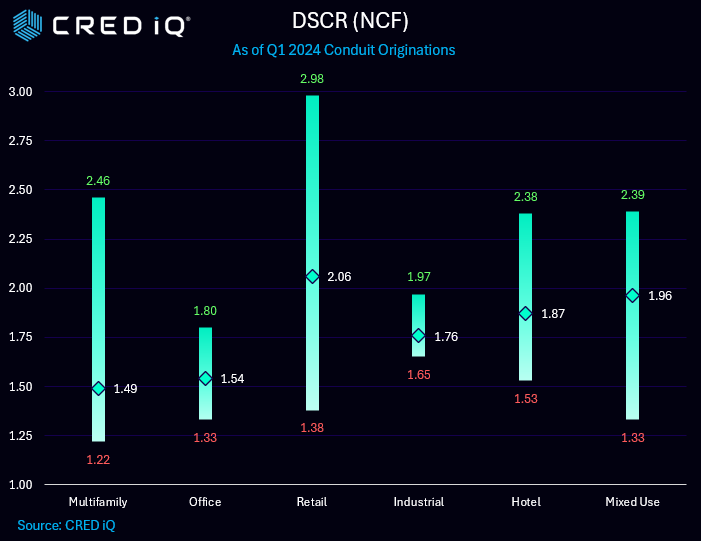

CRED iQ analyzed underwriting metrics for the latest 8 CMBS conduit transactions. We reviewed 500 properties associated with 302 new loans totaling $6.4 billion in loan value. All of the loans were originated within the past 4 months. Our analysis examined interest rates, loan-to-values (“LTV”), DSCR (NCF), debt yields, and cap rates. We further broke down these statistics to show a minimum, maximum and average for each metric and by property type.

Office

In total, 41 properties (of the 500 total in our analysis) were secured by office assets, comprising a total loan balance of $673.5 million. Average interest rates were 7.5% and ranged from 6.9% to 8.3. Cap rates ranged from 5.5% to 9.3% and had an average of 7.1% for the office sector. Debt yields and DSCRs averaged 13.3% and 1.54, respectively. Office LTVs were 54.2% on average.

Multifamily

There were 105 properties secured by multifamily properties totaling $1.3 billion in new loan originations. Interest rates ranged from 4.7% to 8.3% with an average of 6.9%. Cap rates ranged from 4.3% to 10.8% and had an average of 6.0% for the multifamily sector. Average debt yields and DSCRs were the lowest across all property types at 9.6% and 1.49 respectively. Meanwhile, the multifamily LTV average was the highest value across property types at 59.5%.

Retail

By loan value, retail was the most popular asset type with $2.3 billion. In total, 128 properties were secured by retail properties. Interest rates ranged from 6.2% to 9.0% with an average of 7.2%. Cap rates ranged from 4.8% to 12.3% with an average of 6.7% for the retail sector. The average debt yield was 15.2%. The average DSCR of 2.06 was the highest of any sector, while the LTV of 45.5% was the lowest.

Other Notable Findings

Hotels had the highest average interest rate (7.7%), cap rate (8.1%), and debt yield (17.1%) across the sectors.

Manufactured housing represented the smallest property type with only 12 properties backing $59.9 million. Self storage properties had the lowest average cap rate at 5.8%.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities.

The platform also offers a highly efficient valuation engine which can be leveraged across all property types and geographies. Our data platform is powered by over $2.0 trillion in transactions and data covering CRE, CMBS, CRE CLO, Single Asset Single Borrower (SASB), and all of GSE / Agency.