CRED iQ’s research team continues to examine the CRE CLO ecosystem from multiple perspectives and CRED iQ’s latest loan information from the March 2024 reporting period. In this report we explore and breakdown the distress levels for CRE CLO during the first quarter of this year. CRED iQ excludes CRE CLO deals from our monthly delinquency reports and so we continue our examination of this important sector on a stand-alone basis.

Some of the largest issuers of CRE CLO debt over the past five years include MF1, Arbor, LoanCore, Benefit Street Partners, Bridge Investment Group, FS Rialto, and TPG. CRED iQ consolidated all of the loan-level performance data for every outstanding CRE CLO loan to measure the underlying risks associated with these transitional assets. Many of these loans were originated in 2021 at times where cap rates were low, valuations high, low interest rates, and are starting to run into maturity issues given the spike in rates.

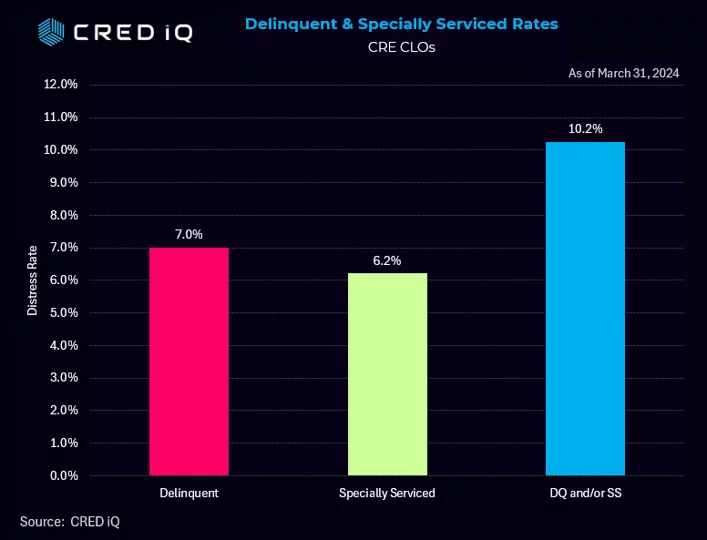

CRED iQ’s research finds the distress rate for CRE CLO climbed from 7.4% as published in our 2023 summary report to 10.2% at the close of Q1continuing the upward trend that commenced last summer – leading to a 440% increase in 2023. This metric includes any loan that reported 30 days delinquent or worse as well as any loan that is with the special servicer.

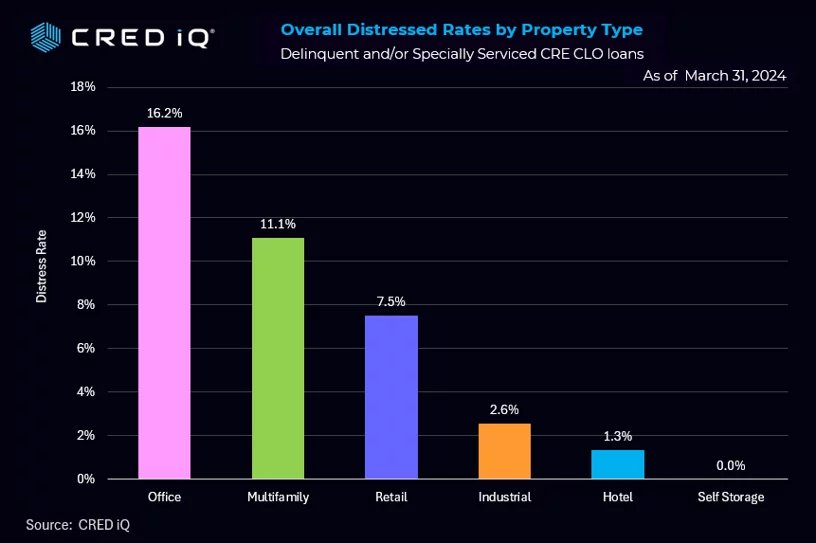

Breaking down CRE CLO distress rates by property type, the office sector lead all other categories at 16.2%. Multifamily and retail round out the top three at 11.1% and 7.5% respectively. Industrial, hotel and self-storage all operating below 3% – with self-storage at 0% in this print.

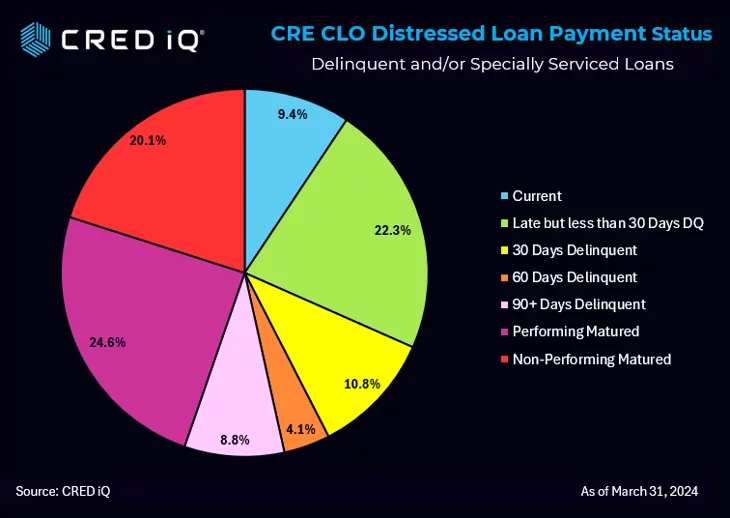

When examining distressed rates by loan payment status, it is interesting to note that 44.6% of the distressed loans have passed their maturity and have not paid off, in breach of their loan terms (combining performing and noon-performing loans). Clear indications here that the momentum in CRE loan modifications is likely to continue.

Outstanding CRE CLO loans amount to approximately $75 billion in loans. The vast majority of these CRE CLO loans are structured with floating rate loans with 3-year loan terms equipped with loan extension options if certain financial hurdles are met.

The sudden spike in CRE CLO commenced in in July and August 2023 when distressed rates were around 1.7%, increasing by an average of 1.2% each month. That continued into 2024. The latest distressed levels total 10.2% for all of CRE CLO loans at the close of Q1.

Office Loan

Pacific Building, a 138,252 SF office property in the Pioneer Sq / Waterfront submarket of Seattle is backed by a $36.5 million loan that is over 120 days delinquent. The loan transferred to the special servicer in July 2023 due to delinquency. The current interest rate of the loan (9.618%) more than doubled the 4.809% rate at issuance. The loan is scheduled to mature in January 2025 with a potential fully extended maturity date in January 2027. The property value drastically declined from $69.0 million at underwriting in November 2021 to $36.2 million in September 2023. The asset was most recently performing with 41.9% occupancy and a 0.29 DSCR.

Multifamily Loan

A $39.9 million loan backed by the Tribeca Apartments in Washington, DC, fell 60 days delinquent in March. The loan has a current interest rate of 9.268% and is scheduled to mature in July 2024 with three, one-year extension options. The high-rise apartment building consists of 90-units and is in the Capitol Hill submarket. Constructed in 2021, the asset was valued at $63.6 million at underwriting in May 2022. The asset was performing with a 0.24 DSCR at 88.9% occupancy as of year-end 2023.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities.

The platform also offers a highly efficient valuation engine which can be leveraged across all property types and geographies. Our data platform is powered by over $2.0 trillion in transactions and data covering CRE, CMBS, CRE CLO, Single Asset Single Borrower (SASB), and all of GSE / Agency.