Troubled Loan Workout Strategies: Continuing our Series

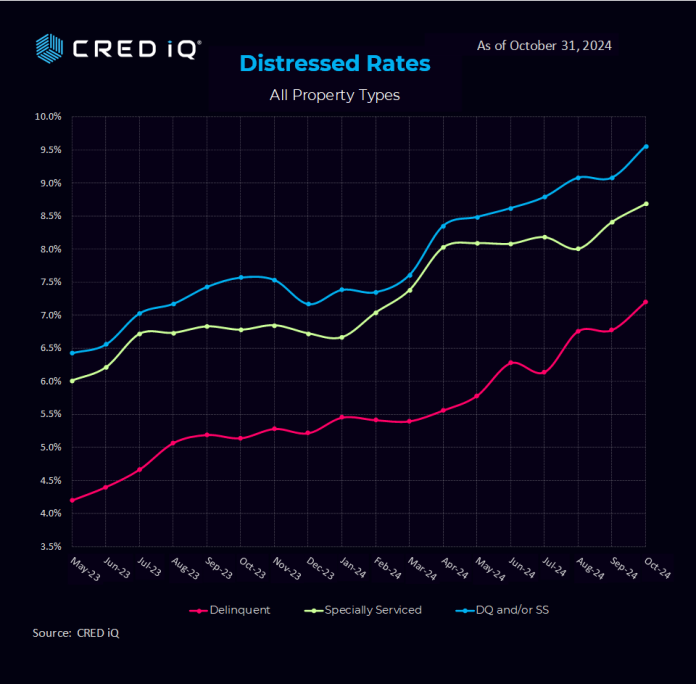

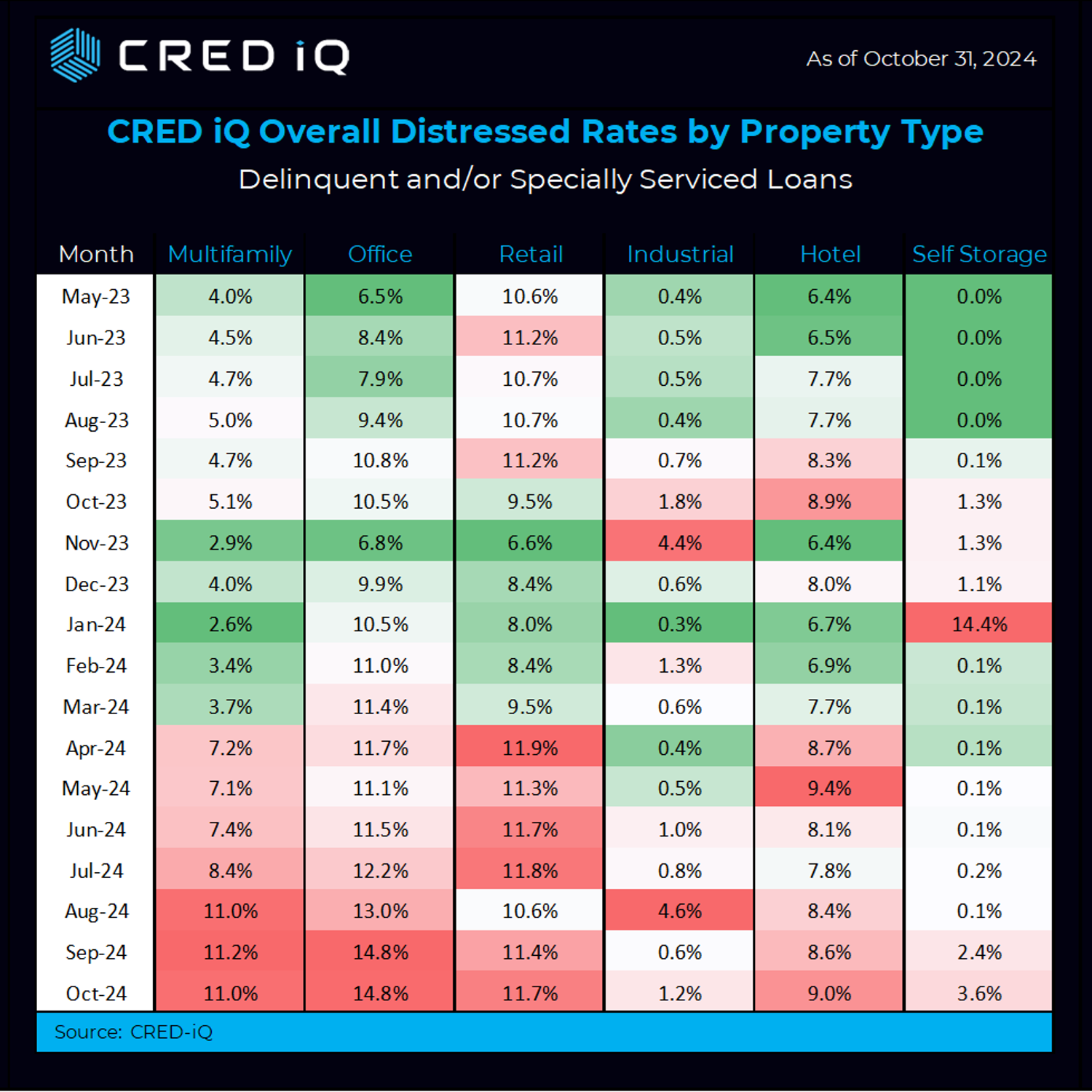

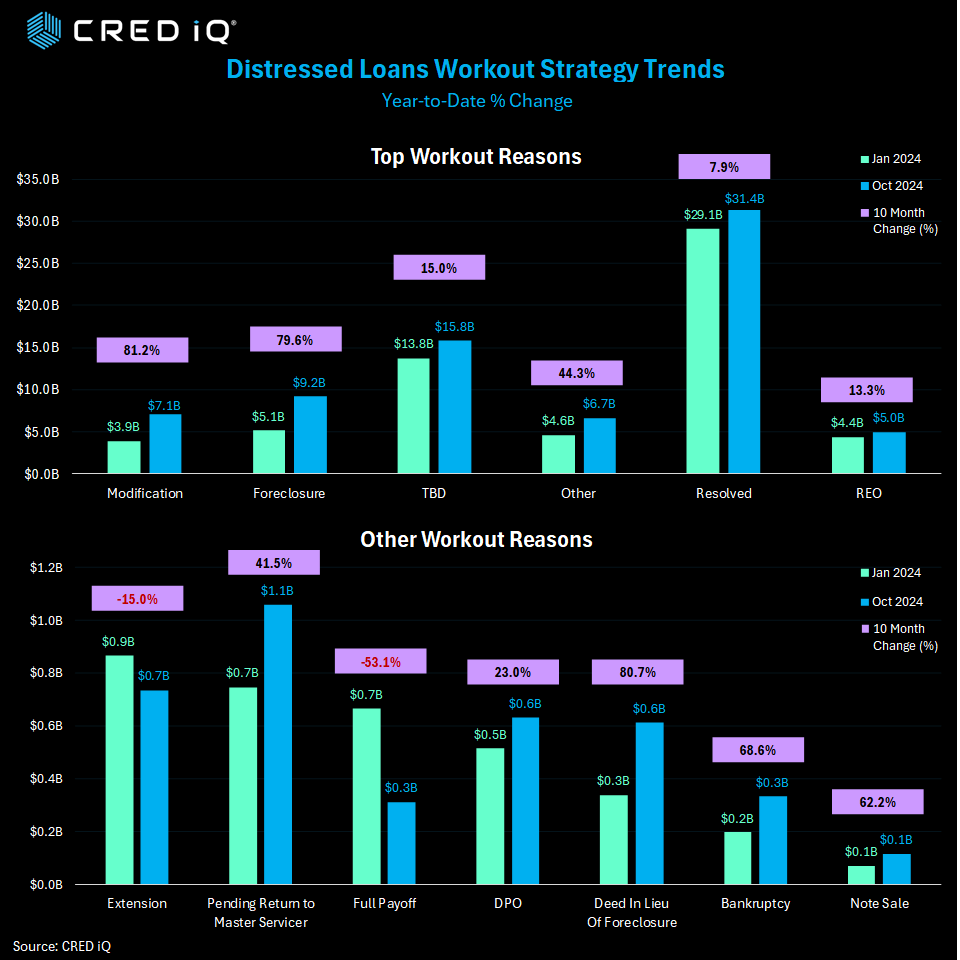

The CRED iQ research team zeroed in on workout strategies –exploring trends and resolutions for CRE securitized loans so far in 2024. This analysis included the workout strategies across CMBS, SBLL, CRE CLO and Freddie loans. Building upon our September report, our analysis compared the special servicer’s workout strategies from January 2024 with October 2024. Our previous report explored the period of January 2024 to August 2024. Our analysis compared workout strategies across $64.3 billion in loan balances (5,488 loans) in January of 2024 with $79.1 billion (6,169 loans) in October of 2024.

Top Workout Categories

The top 4 workout strategies used by special servicers from this dataset includes: 1) Successful Resolution 2) Foreclosure and 3) Modification or 4) REO.

2024 YTD October, the so-called “extend and pretend” strategy reigns supreme, notching the fastest growth rate of all workout strategies. Not surprisingly, loan modifications grew by 81.2% since January of this year.

Foreclosures are not far behind, with growth in that category reaching 79.6% this year, for the second most common workout strategy.

Full resolution (“Resolved”) was by far, the largest category by multiples, reaching $31.4B in October and seeing a 2024 category growth rate of 7.9%.

Finally, REO, the fourth largest category crested over $5.0 billion in October, with a 13.3% growth rate vs. January (ranking third in growth rates across the major workout reasons).

Other Workout Reasons

Perhaps most notable across all categories was the 53.1% drop in full payoffs in October, compared to January. Just $312.1 million in loans saw full payoffs in October, versus $700 million in January.

Extensions also saw a decrease since January, albeit more modest at 15%.

The fastest growing strategies in this secondary category of Other Workout Reasons, were Deed in Lieu of Foreclosure (80.7% increase), Bankruptcy (68.6% increase) and Note Sale (62.2% increase).

Notable Workout Example

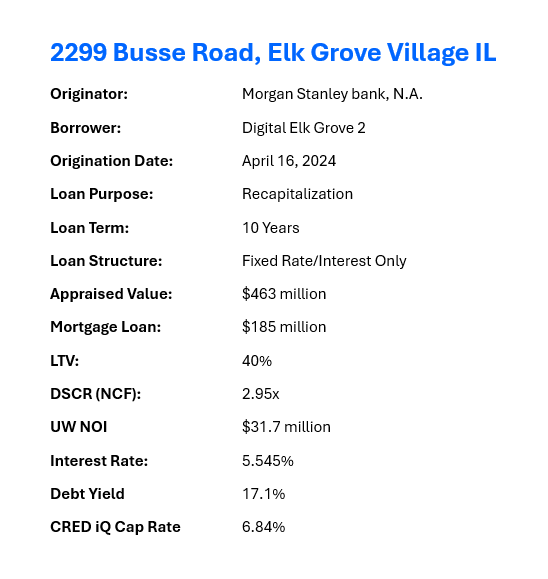

Chelsea Gardens, a 474-unit multifamily property in the Atlanta market, is backed by a $37.1 million CRE CLO loan. The loan transferred to the special servicer in October 2024 due to non-monetary default and is expected to undergo foreclosure as the workout strategy. The loan fell 90 days delinquent in November 2024. The loan is scheduled to mature in February 2025 with an extended maturity date of February 2026.

The Chelsea Garden was appraised for $44.2 million ($93,249/unit) at origination in December 2021. The value of the asset has increased to $55.1 million ($116,245/unit) in February 2024. The asset had a below breakeven DSCR of 0.65 and was 82.7% occupied as of August 2024.

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.