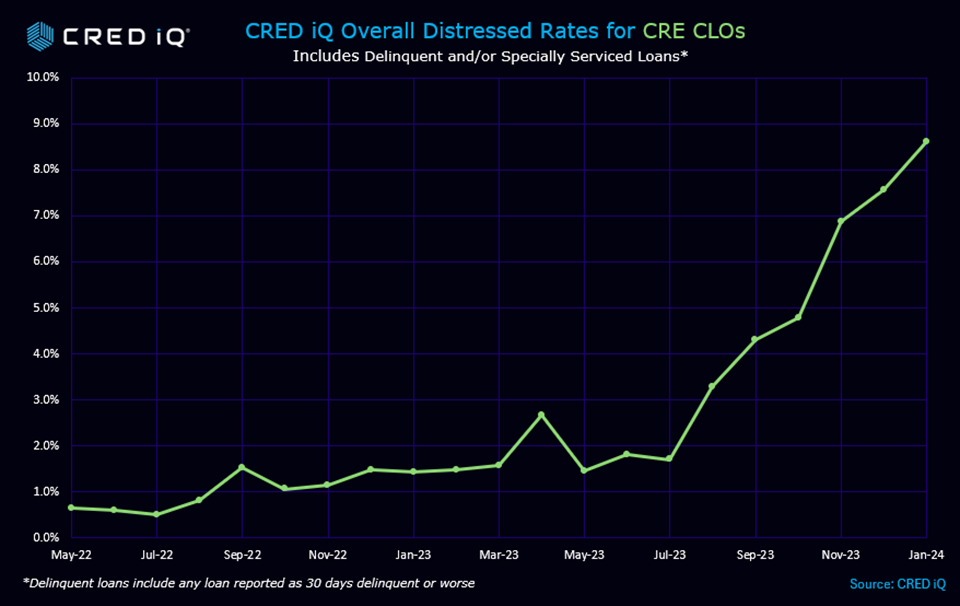

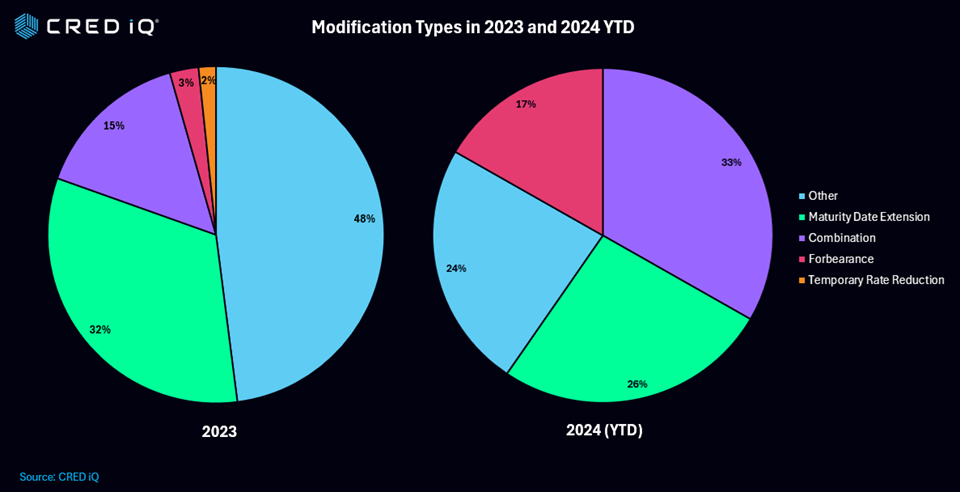

The CRED iQ research team zeroed in on loan modifications over the past three-years – exploring trends and resolutions for CRE securitized loans during this transformative period. This analysis included the loan modifications registered across CMBS, SBLL, CRE CLO and Freddie Mac loans.

Our research covered both actual monthly data and a cumulative analysis to ensure we expose as many patterns and trends as possible. We looked at both loan counts as well as loan balances in our study.

Trends

Our analysis reveals steep growth in modifications over the three-year range. 2,778 loans were modified during the period with a cumulative loan balance of $35.5 billion.

Over the past three years, loan modifications reported showed a lumpy pattern, but consistent overall growth. The modification filings varied from 52 properties in January 2022 ($584.1 billion in loan balances) down to just five properties ($157.5 million) in January of 2023. Meanwhile, December saw the highest number of modified loans in 2024 (347 loans –$1.1 billion in loan value) while April represented the largest loan value ($2.9 billion).

From a cumulative perspective, 2,778 loans worth $35.5 billion were modified since January 2022.

Notable Modification Example

Energy Centre, a 757,275 SF office property in the French Quarter District of New Orleans, is backed by a $53.3 million loan. The loan has an additional $8.7 million in mezzanine debt. Imminent monetary default resulted in the loan being transferred to the special servicer in September 2023. At origination, the loan was scheduled to mature in October 2023. Special servicer commentary indicates the extension of the loan closed in October 2024; however, an updated maturity is not listed.

The Energy Centre was appraised for $83.6 million ($114/SF) at origination in August 2013, which excluded the planned elevator and common area deferred maintenance renovation that was underway. The value of the asset increased to $92.6 million ($122/SF) in January 2024. The asset had a DSCR of 1.75 as of December 2023 and was 86% occupied as of year end 2024.

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.

THE DATA, INFORMATION AND/OR RELATED MATERAL (“DELIVERABLES”) IS BEING OFFERED AS-IS/WHERE-AS CONDITION. CRED-IQ MAKES NO REPRESENTATION OR WARRANTY AS TO QUALITY OR ACCURACY OF SUCH DELIVERABLES BEING PURCHASED, WHETHER EXPRESS OR IMPLIED, EITHER IN FACT OR BY OPERATION OF LAW, STATUTE, OR OTHERWISE, AND CRED-IQ SPECIFICALLY DISCLAIMS ANY AND ALL IMPLIED OR STATUTORY WARRANTIES INCLUDING WARRANTIES OF MERCHANTABILITY AND OF FITNESS FOR A PARTICULAR PURPOSE, TECHNICAL PERFORMANCE, AND NON-INFRINGEMENT. WITHOUT LIMITING THE FOREGOING, YOU AS CUSTOMER ACKNOWLEDGE THAT YOU HAVE NOT AND ARE NOT RELYING UPON ANY IMPLIED WARRANTY OF MERCHANTABILITY OR OF FITNESS FOR A PARTICULAR PURPOSE OR OTHERWISE, OR UPON ANY REPRESENTATION OR WARRANTY WHATSOEVER AS TO THE DELIVERABLES IN ANY REGARDS WHATSOEVER, AND ACKNOWLEDGE THAT CRED-IQ MAKES NO, AND HEREBY DISCLAIMS ANY, REPRESENTATION, WARRANTY OR GUARANTEE THAT THE PURCHASE, USE OR COMMERCIALIZATION OF ANY DELIVERABLES WILL BE USEFUL TO YOU OR FREE FROM INTERFERENCE. BY ACCEPTANCE OF THE DELIVERABLES, YOU HEREBY RELEASE CRED-IQ AND ITS AFFILIATES AND AGENTS FROM ALL CLAIMS, DAMAGES AND LIABILITY ARISING HEREUNDER.