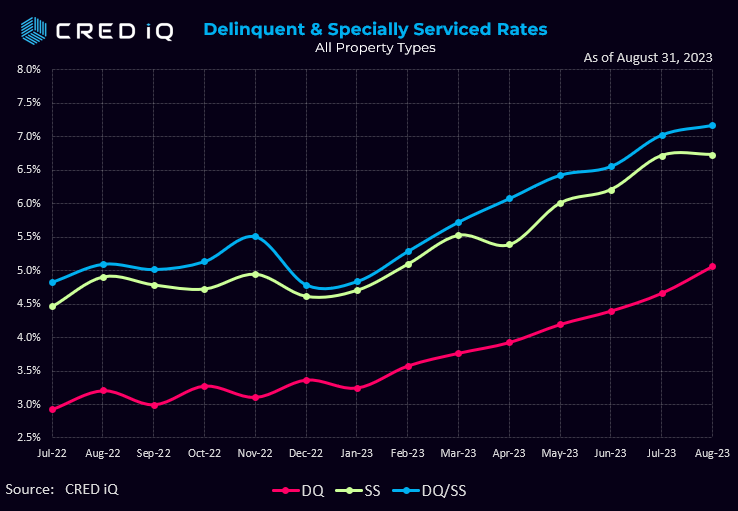

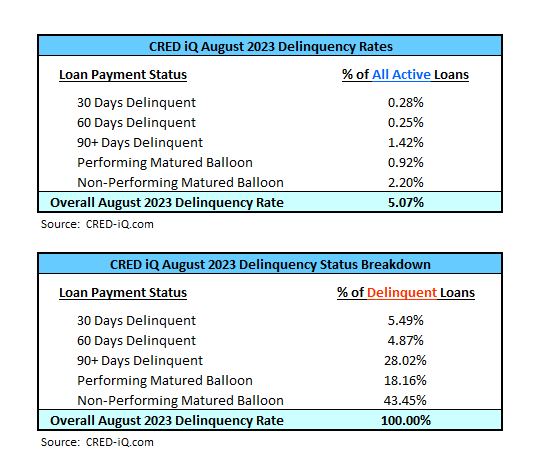

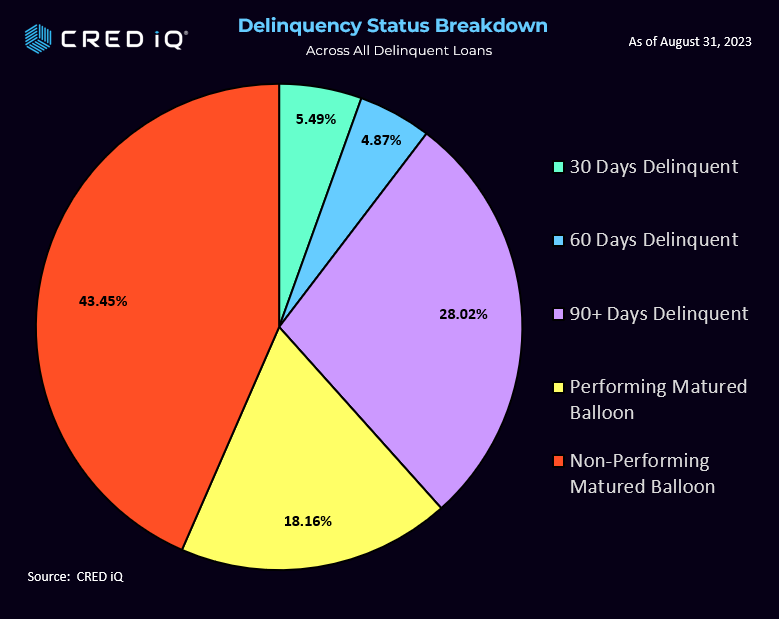

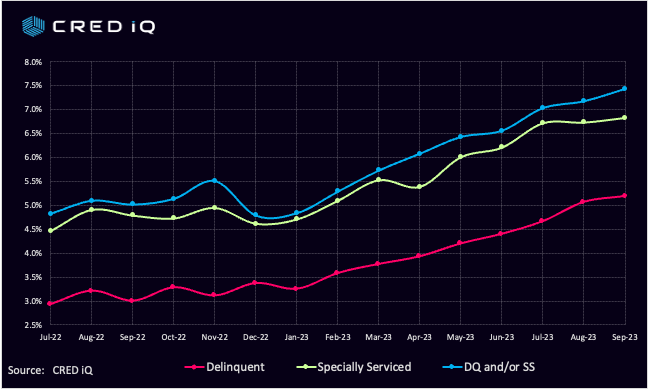

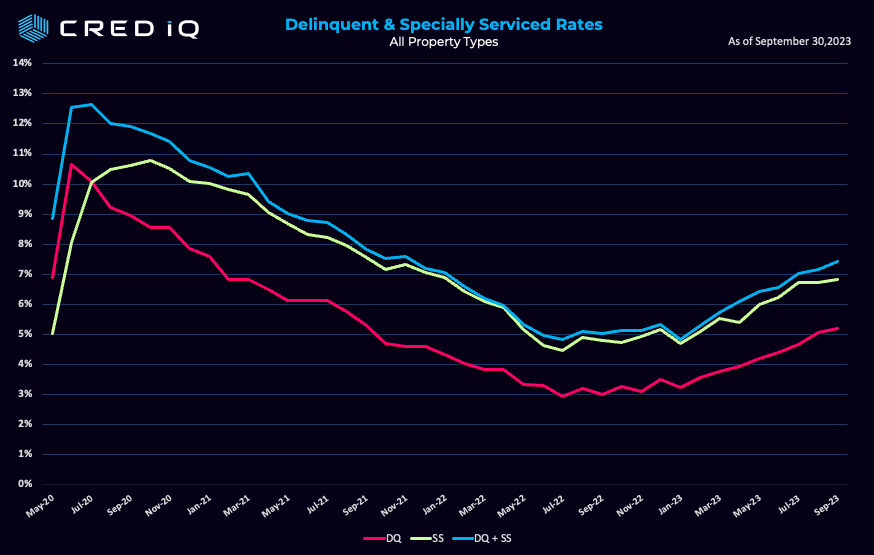

The Delinquency Rate is calculated as the percentage of all delinquent loans, whether specially serviced or non-specially serviced. CRED iQ’s Special Servicing Rate, equal to the percentage of CMBS loans that are with the special servicer (delinquent or non-delinquent), increased month-over-month to 6.83%, from 6.73%.

The Special Servicing Rate has continued to climb YTD 2023. Aggregating the two indicators of distress – delinquency rate and special servicing rate – into an overall distressed rate (DQ + SS%) of 7.43% of CMBS loans, an increase of 26 basis points from last month (August 7.17%), equal to a 3.6% increase.

The month-over-month increase in the overall distressed rate mirrors increases in the delinquency and special servicing rates. Distressed rates generally track slightly higher than special servicing rates as most delinquent loans are also with the special servicer.

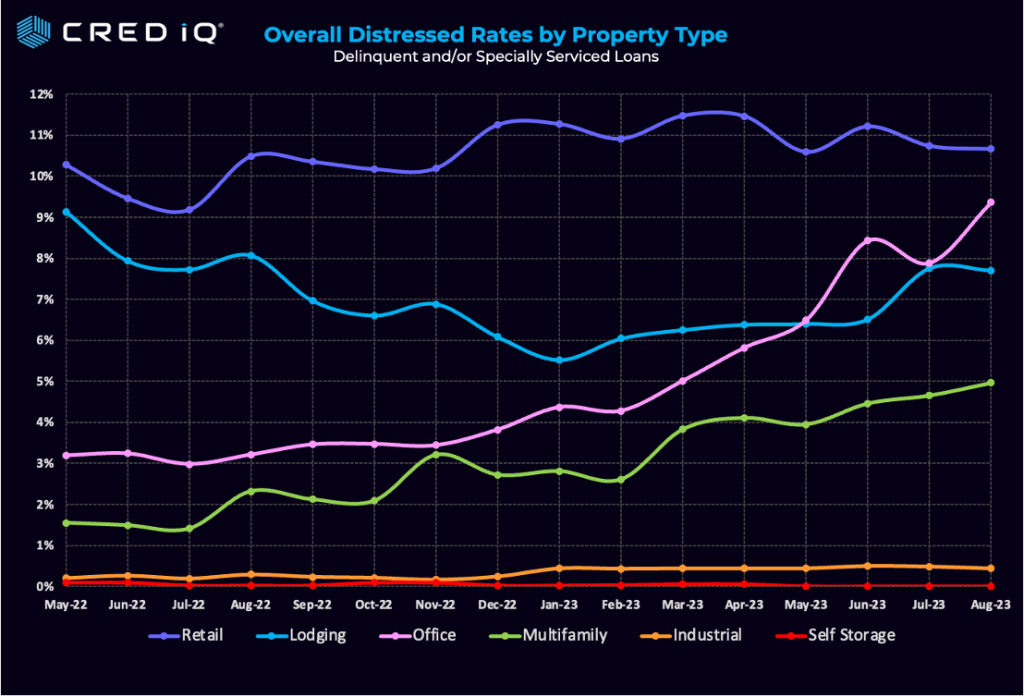

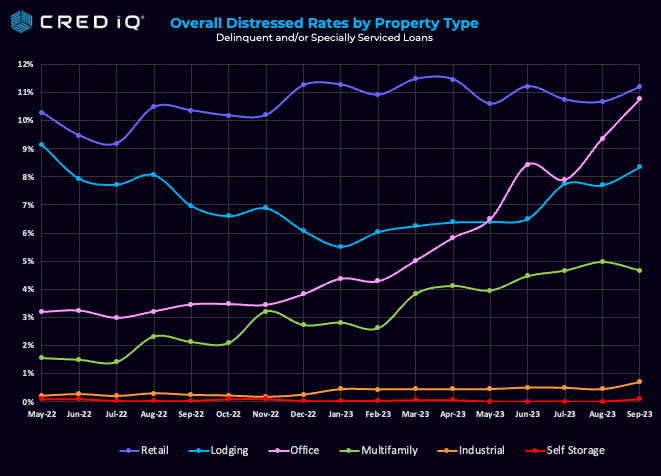

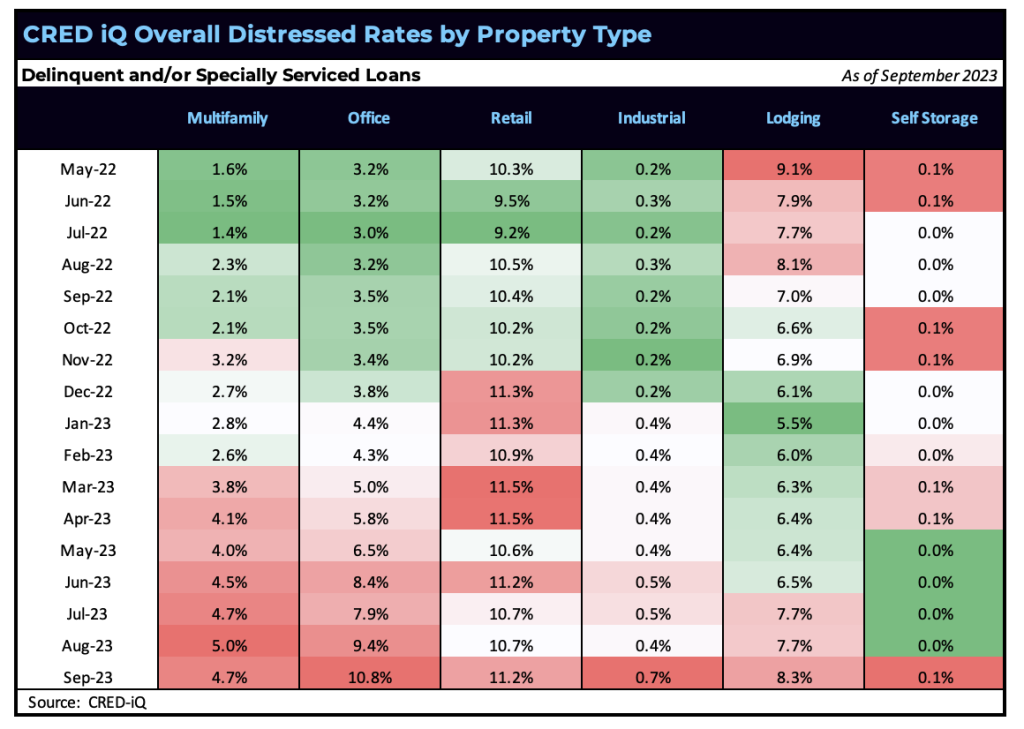

Distress in the office sector continued to build in September 2023. The Office Distressed Rate for August is 10.75%, which compared to 9.36% as of August 2023.

The month-over-month surge of 139 basis points in office delinquency was equal to a 15% increase. The natural progression of long to intermediate-term rolling leases coupled with ongoing refinancing difficulties at loan maturity have caused the velocity of new delinquencies to accelerate during 2023.

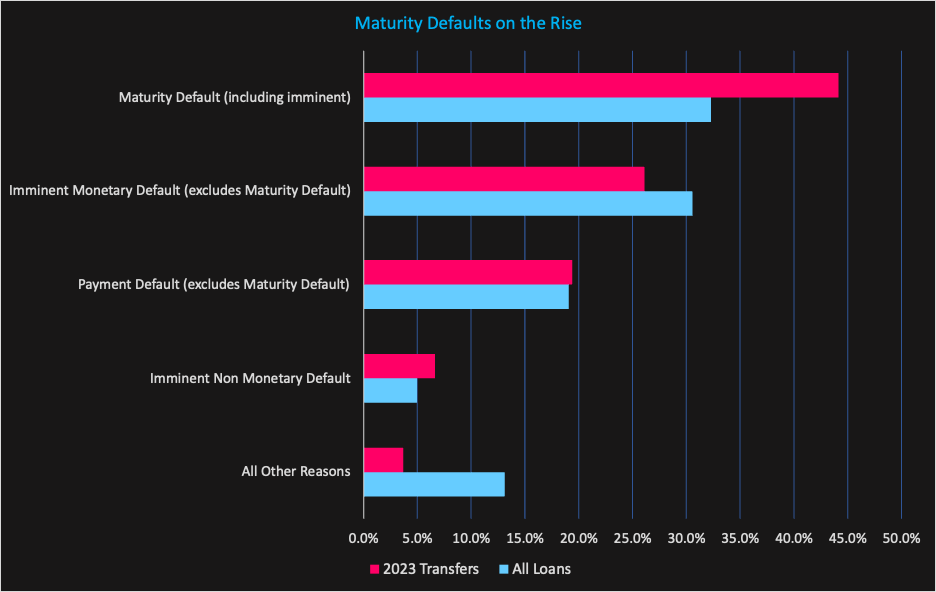

The CRED iQ Delinquency Rate has continued to rise, reaching 5.19% in September 2023. This represents a 12-basis point (0.12%) increase from August. Notably, 62% of the newly delinquent loans in September were a result of maturity defaults or refinancing challenges.

In September, Distressed rates for non-office properties showed the following changes:

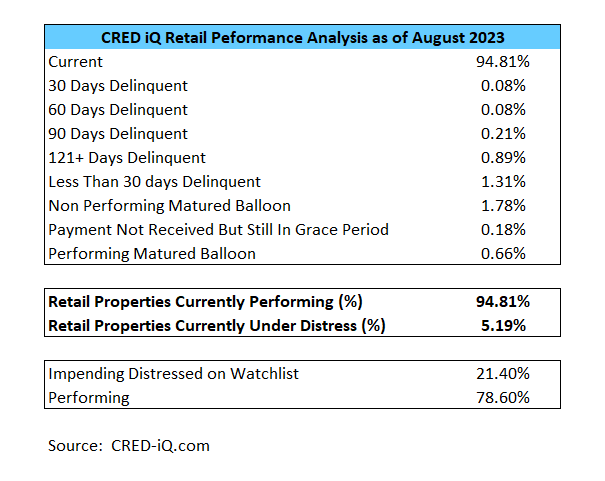

• Retail Distressed rates increased from 10.66% in August to 11.18% in September, a 52-basis point increase.

• Multifamily Distressed rate decreased slightly, falling by 30 basis points to reach 4.66% in September.

• Lodging Distressed rate increase in September, rising by 64 basis points to 8.34%.

CRED iQ’s overall distressed rate (DQ + SS%) by property type accounts for loans that qualify for either delinquent or special servicing subsets.

The 2023 YTD increase in the overall distressed rate has seen a rise of 54%. A severely limited refinancing market for office properties and a ‘higher for longer’ interest rate environment continues to contribute to sustained increases in commercial real estate distress.

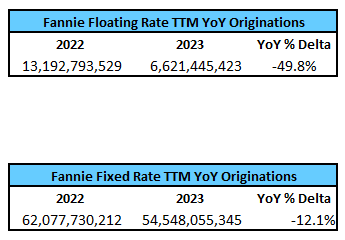

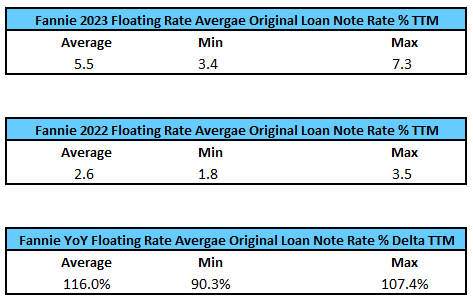

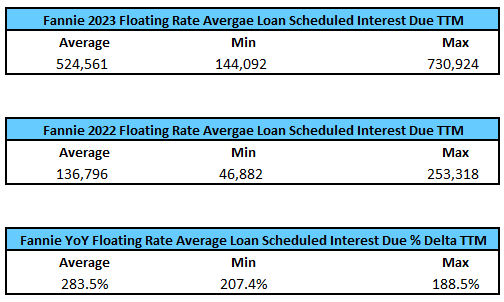

CRED iQ’s September Delinquency Rate (5.19%) has risen to levels we have not seen since Q3 2021.Market sentiment seems to be consistent whereby the CRE market will continue to see distress given the current interest rate environment and the wave of upcoming loan maturities, particularly in the floating rate loan market.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities.

The platform also offers a highly efficient valuation engine which can be leveraged across all property types and geographies. Our data platform is powered by over $2.0 trillion in transactions and data covering CRE, CMBS, CRE CLO, Single Asset Single Borrower (SASB), and all of GSE / Agency.