| MSA – Property Type | DQ/SS

(millions) | DS/SS

(%) | Monthly

Change |

| Allentown-Bethlehem-Easton, PA-NJ MSA | $78.3 | 2.6% | 0.1% |

| Allentown – Hotel | $0.8 | 2.1% | 2.1% |

| Allentown – Industrial | $0.0 | 0.0% | 0.0% |

| Allentown – Multifamily | $0.0 | 0.0% | 0.0% |

| Allentown – Office | $58.5 | 19.1% | 0.0% |

| Allentown – Other | $0.0 | 0.0% | 0.0% |

| Allentown – Retail | $19.0 | 5.1% | 0.1% |

| Allentown – Self Storage | $0.0 | 0.0% | 0.0% |

| Atlanta – Atlanta-Sandy Springs-Marietta, GA MSA | $411.7 | 1.5% | -0.4% |

| Atlanta – Hotel | $131.9 | 5.4% | -1.5% |

| Atlanta – Industrial | $0.0 | 0.0% | 0.0% |

| Atlanta – Multifamily | $0.0 | 0.0% | 0.0% |

| Atlanta – Office | $69.4 | 3.4% | 0.1% |

| Atlanta – Other | $0.0 | 0.0% | 0.0% |

| Atlanta – Retail | $210.4 | 11.7% | -4.0% |

| Atlanta – Self Storage | $0.0 | 0.0% | 0.0% |

| Austin – Austin-Round Rock, TX MSA | $132.8 | 1.5% | -0.2% |

| Austin – Hotel | $33.4 | 4.5% | -1.9% |

| Austin – Industrial | $0.0 | 0.0% | 0.0% |

| Austin – Multifamily | $40.1 | 0.7% | 0.0% |

| Austin – Office | $0.0 | 0.0% | 0.0% |

| Austin – Other | $10.0 | 2.7% | 0.1% |

| Austin – Retail | $49.3 | 6.6% | 0.2% |

| Austin – Self Storage | $0.0 | 0.0% | 0.0% |

| Baltimore – Baltimore-Towson, MD MSA | $361.4 | 3.6% | -0.1% |

| Baltimore – Hotel | $44.0 | 10.0% | -0.7% |

| Baltimore – Industrial | $0.0 | 0.0% | 0.0% |

| Baltimore – Multifamily | $3.8 | 0.1% | 0.0% |

| Baltimore – Office | $40.9 | 2.3% | -0.9% |

| Baltimore – Other | $21.9 | 9.0% | 4.5% |

| Baltimore – Retail | $250.8 | 22.7% | 0.0% |

| Baltimore – Self Storage | $0.0 | 0.0% | 0.0% |

| Birmingham – Birmingham-Hoover, AL MSA | $282.4 | 9.7% | 0.0% |

| Birmingham – Hotel | $0.0 | 0.0% | 0.0% |

| Birmingham – Industrial | $0.0 | 0.0% | 0.0% |

| Birmingham – Multifamily | $2.1 | 0.2% | 0.0% |

| Birmingham – Office | $95.0 | 19.1% | 0.3% |

| Birmingham – Other | $0.0 | 0.0% | -4.7% |

| Birmingham – Retail | $184.4 | 27.1% | 0.8% |

| Birmingham – Self Storage | $0.9 | 2.6% | 2.6% |

| Boston – Boston-Cambridge-Quincy, MA-NH MSA | $131.2 | 0.7% | 0.0% |

| Boston – Hotel | $26.7 | 1.6% | 0.0% |

| Boston – Industrial | $0.0 | 0.0% | 0.0% |

| Boston – Multifamily | $0.0 | 0.0% | 0.0% |

| Boston – Office | $14.5 | 0.2% | 0.0% |

| Boston – Other | $0.0 | 0.0% | 0.0% |

| Boston – Retail | $90.0 | 8.2% | -0.1% |

| Boston – Self Storage | $0.0 | 0.0% | 0.0% |

| Bridgeport – Bridgeport-Stamford-Norwalk, CT MSA | $145.3 | 3.8% | -0.9% |

| Bridgeport – Hotel | $1.0 | 1.2% | -32.9% |

| Bridgeport – Industrial | $0.0 | 0.0% | 0.0% |

| Bridgeport – Multifamily | $0.0 | 0.0% | 0.0% |

| Bridgeport – Office | $134.5 | 12.9% | 0.1% |

| Bridgeport – Other | $9.8 | 2.6% | 0.1% |

| Bridgeport – Retail | $0.0 | 0.0% | 0.0% |

| Bridgeport – Self Storage | $0.0 | 0.0% | 0.0% |

| Charlotte – Charlotte-Gastonia-Concord, NC-SC MSA | $248.0 | 3.4% | 0.0% |

| Charlotte – Hotel | $60.5 | 7.0% | -0.7% |

| Charlotte – Industrial | $0.0 | 0.0% | 0.0% |

| Charlotte – Multifamily | $0.0 | 0.0% | 0.0% |

| Charlotte – Office | $0.0 | 0.0% | 0.0% |

| Charlotte – Other | $100.5 | 40.3% | 0.3% |

| Charlotte – Retail | $87.0 | 9.7% | 1.6% |

| Charlotte – Self Storage | $0.0 | 0.0% | 0.0% |

| Chicago – Chicago-Naperville-Joliet, IL-IN-WI MSA | $2,247.4 | 7.7% | -0.2% |

| Chicago – Hotel | $814.9 | 31.6% | -1.3% |

| Chicago – Industrial | $0.0 | 0.0% | 0.0% |

| Chicago – Multifamily | $58.9 | 0.6% | 0.0% |

| Chicago – Office | $898.0 | 11.5% | 0.1% |

| Chicago – Other | $208.8 | 8.2% | -0.1% |

| Chicago – Retail | $266.9 | 9.2% | -0.1% |

| Chicago – Self Storage | $0.0 | 0.0% | 0.0% |

| Cincinnati – Cincinnati-Middletown, OH-KY-IN MSA | $108.6 | 2.9% | -0.3% |

| Cincinnati – Hotel | $87.4 | 29.5% | 0.0% |

| Cincinnati – Industrial | $0.0 | 0.0% | 0.0% |

| Cincinnati – Multifamily | $2.3 | 0.1% | 0.0% |

| Cincinnati – Office | $0.0 | 0.0% | 0.0% |

| Cincinnati – Other | $6.8 | 2.6% | 0.0% |

| Cincinnati – Retail | $12.1 | 2.4% | -1.7% |

| Cincinnati – Self Storage | $0.0 | 0.0% | 0.0% |

| Cleveland – Cleveland-Elyria-Mentor, OH MSA | $351.1 | 8.8% | -1.0% |

| Cleveland – Hotel | $85.1 | 47.4% | 0.0% |

| Cleveland – Industrial | $0.0 | 0.0% | 0.0% |

| Cleveland – Multifamily | $5.6 | 0.3% | 0.0% |

| Cleveland – Office | $83.0 | 10.1% | -4.4% |

| Cleveland – Other | $168.8 | 42.7% | -0.3% |

| Cleveland – Retail | $7.7 | 1.1% | 0.0% |

| Cleveland – Self Storage | $0.8 | 1.7% | 1.7% |

| Columbus, OH – Columbus, OH MSA | $197.7 | 2.9% | -0.4% |

| Columbus, OH – Hotel | $37.8 | 12.4% | -0.9% |

| Columbus, OH – Industrial | $11.7 | 2.8% | -0.2% |

| Columbus, OH – Multifamily | $9.4 | 0.2% | -0.3% |

| Columbus, OH – Office | $30.1 | 4.8% | 0.0% |

| Columbus, OH – Other | $0.0 | 0.0% | 0.0% |

| Columbus, OH – Retail | $108.6 | 15.1% | -0.6% |

| Columbus, OH – Self Storage | $0.0 | 0.0% | 0.0% |

| Dallas – Dallas-Fort Worth-Arlington, TX MSA | $241.2 | 0.7% | -0.1% |

| Dallas – Hotel | $78.0 | 2.3% | -0.3% |

| Dallas – Industrial | $1.7 | 0.1% | 0.0% |

| Dallas – Multifamily | $7.1 | 0.0% | -0.2% |

| Dallas – Office | $83.4 | 2.8% | 0.0% |

| Dallas – Other | $4.9 | 0.2% | 0.0% |

| Dallas – Retail | $66.1 | 3.4% | 0.8% |

| Dallas – Self Storage | $0.0 | 0.0% | 0.0% |

| Denver – Denver-Aurora, CO MSA | $283.0 | 1.8% | -0.2% |

| Denver – Hotel | $23.8 | 3.0% | 0.3% |

| Denver – Industrial | $0.0 | 0.0% | 0.0% |

| Denver – Multifamily | $0.0 | 0.0% | -0.1% |

| Denver – Office | $147.1 | 7.3% | -1.6% |

| Denver – Other | $94.3 | 10.0% | 0.2% |

| Denver – Retail | $17.8 | 1.4% | 0.1% |

| Denver – Self Storage | $0.0 | 0.0% | 0.0% |

| Detroit – Detroit-Warren-Livonia, MI MSA | $249.2 | 2.5% | -0.4% |

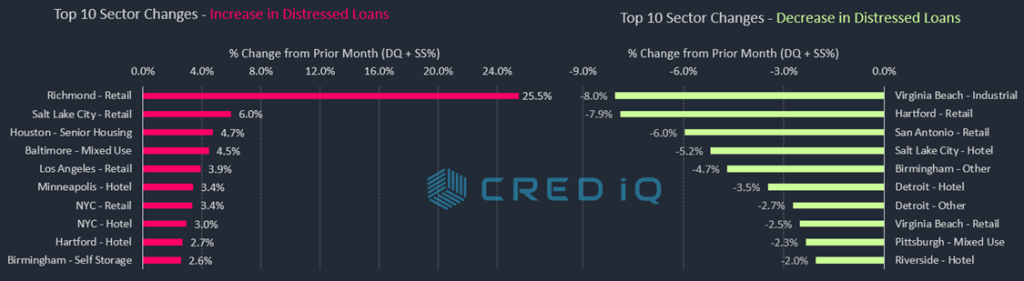

| Detroit – Hotel | $84.2 | 12.0% | -3.5% |

| Detroit – Industrial | $0.0 | 0.0% | 0.0% |

| Detroit – Multifamily | $0.0 | 0.0% | 0.0% |

| Detroit – Office | $14.6 | 0.7% | 0.0% |

| Detroit – Other | $0.0 | 0.0% | -2.7% |

| Detroit – Retail | $150.4 | 11.3% | 0.8% |

| Detroit – Self Storage | $0.0 | 0.0% | 0.0% |

| Hartford – Hartford-West Hartford-East Hartford, CT MSA | $202.1 | 8.3% | -0.3% |

| Hartford – Hotel | $19.7 | 21.5% | 2.7% |

| Hartford – Industrial | $0.0 | 0.0% | 0.0% |

| Hartford – Multifamily | $0.0 | 0.0% | 0.0% |

| Hartford – Office | $25.3 | 10.2% | 0.7% |

| Hartford – Other | $0.0 | 0.0% | 0.0% |

| Hartford – Retail | $157.2 | 46.7% | -7.9% |

| Hartford – Self Storage | $0.0 | 0.0% | 0.0% |

| Houston – Houston-Sugar Land-Baytown, TX MSA | $1,096.4 | 4.6% | 0.3% |

| Houston – Hotel | $383.3 | 40.0% | -1.0% |

| Houston – Industrial | $0.0 | 0.0% | 0.0% |

| Houston – Multifamily | $26.8 | 0.2% | 0.0% |

| Houston – Office | $502.7 | 15.9% | 1.9% |

| Houston – Other | $74.8 | 11.2% | 4.7% |

| Houston – Retail | $108.6 | 2.8% | 0.0% |

| Houston – Self Storage | $0.0 | 0.0% | 0.0% |

| Indianapolis – Indianapolis-Carmel, IN MSA | $209.5 | 3.4% | -0.6% |

| Indianapolis – Hotel | $96.9 | 15.1% | -1.8% |

| Indianapolis – Industrial | $0.0 | 0.0% | 0.0% |

| Indianapolis – Multifamily | $40.4 | 1.4% | 0.0% |

| Indianapolis – Office | $61.7 | 10.4% | 0.0% |

| Indianapolis – Other | $4.9 | 1.9% | 0.0% |

| Indianapolis – Retail | $5.6 | 2.0% | 0.1% |

| Indianapolis – Self Storage | $0.0 | 0.0% | 0.0% |

| Jacksonville – Jacksonville, FL MSA | $5.0 | 0.1% | 0.0% |

| Jacksonville – Hotel | $0.0 | 0.0% | 0.0% |

| Jacksonville – Industrial | $0.0 | 0.0% | 0.0% |

| Jacksonville – Multifamily | $3.1 | 0.1% | 0.0% |

| Jacksonville – Office | $0.0 | 0.0% | 0.0% |

| Jacksonville – Other | $0.0 | 0.0% | 0.0% |

| Jacksonville – Retail | $1.9 | 0.5% | 0.0% |

| Jacksonville – Self Storage | $0.0 | 0.0% | 0.0% |

| Kansas City – Kansas City, MO-KS MSA | $51.9 | 0.9% | -1.2% |

| Kansas City – Hotel | $29.7 | 13.2% | -14.3% |

| Kansas City – Industrial | $0.0 | 0.0% | 0.0% |

| Kansas City – Multifamily | $0.0 | 0.0% | -0.1% |

| Kansas City – Office | $0.0 | 0.0% | 0.0% |

| Kansas City – Other | $21.1 | 10.5% | 0.1% |

| Kansas City – Retail | $1.1 | 0.2% | -3.6% |

| Kansas City – Self Storage | $0.0 | 0.0% | 0.0% |

| Las Vegas – Las Vegas-Paradise, NV MSA | $229.3 | 1.1% | -0.2% |

| Las Vegas – Hotel | $0.0 | 0.0% | 0.0% |

| Las Vegas – Industrial | $0.0 | 0.0% | 0.0% |

| Las Vegas – Multifamily | $0.0 | 0.0% | -0.7% |

| Las Vegas – Office | $0.0 | 0.0% | 0.0% |

| Las Vegas – Other | $0.0 | 0.0% | 0.0% |

| Las Vegas – Retail | $229.3 | 5.7% | 0.6% |

| Las Vegas – Self Storage | $0.0 | 0.0% | 0.0% |

| Los Angeles – Los Angeles-Long Beach-Santa Ana, CA MSA | $868.1 | 1.7% | 0.6% |

| Los Angeles – Hotel | $99.9 | 1.5% | -0.3% |

| Los Angeles – Industrial | $0.0 | 0.0% | 0.0% |

| Los Angeles – Multifamily | $50.8 | 0.2% | 0.2% |

| Los Angeles – Office | $111.4 | 1.1% | 0.5% |

| Los Angeles – Other | $85.2 | 2.9% | 0.2% |

| Los Angeles – Retail | $520.7 | 8.9% | 3.9% |

| Los Angeles – Self Storage | $0.0 | 0.0% | 0.0% |

| Louisville – Louisville/Jefferson County, KY-IN MSA | $71.7 | 2.6% | 0.0% |

| Louisville – Hotel | $0.0 | 0.0% | 0.0% |

| Louisville – Industrial | $0.0 | 0.0% | 0.0% |

| Louisville – Multifamily | $0.0 | 0.0% | 0.0% |

| Louisville – Office | $0.0 | 0.0% | 0.0% |

| Louisville – Other | $0.0 | 0.0% | 0.0% |

| Louisville – Retail | $71.7 | 14.8% | -0.8% |

| Louisville – Self Storage | $0.0 | 0.0% | 0.0% |

| Memphis – Memphis, TN-AR-MS MSA | $86.2 | 3.6% | 0.1% |

| Memphis – Hotel | $13.0 | 5.8% | -0.2% |

| Memphis – Industrial | $0.0 | 0.0% | 0.0% |

| Memphis – Multifamily | $6.9 | 0.6% | 0.0% |

| Memphis – Office | $0.0 | 0.0% | 0.0% |

| Memphis – Other | $5.4 | 17.0% | -0.2% |

| Memphis – Retail | $60.9 | 17.2% | 0.8% |

| Memphis – Self Storage | $0.0 | 0.0% | 0.0% |

| Miami – Miami-Fort Lauderdale-Pompano Beach, FL MSA | $342.4 | 1.4% | 0.3% |

| Miami – Hotel | $11.0 | 0.2% | 0.0% |

| Miami – Industrial | $0.0 | 0.0% | 0.0% |

| Miami – Multifamily | $0.0 | 0.0% | 0.0% |

| Miami – Office | $4.0 | 0.2% | 0.0% |

| Miami – Other | $0.0 | 0.0% | -0.6% |

| Miami – Retail | $327.4 | 6.1% | 1.6% |

| Miami – Self Storage | $0.0 | 0.0% | 0.0% |

| Milwaukee – Milwaukee-Waukesha-West Allis, WI MSA | $208.6 | 8.8% | 0.5% |

| Milwaukee – Hotel | $16.7 | 10.7% | 6.7% |

| Milwaukee – Industrial | $0.0 | 0.0% | 0.0% |

| Milwaukee – Multifamily | $0.0 | 0.0% | 0.0% |

| Milwaukee – Office | $82.9 | 16.7% | -0.2% |

| Milwaukee – Other | $0.6 | 0.6% | 0.0% |

| Milwaukee – Retail | $108.4 | 27.1% | 1.8% |

| Milwaukee – Self Storage | $0.0 | 0.0% | 0.0% |

| Minneapolis – Minneapolis-St. Paul-Bloomington, MN-WI MSA | $1,739.3 | 20.9% | 0.3% |

| Minneapolis – Hotel | $243.0 | 43.4% | 3.4% |

| Minneapolis – Industrial | $0.0 | 0.0% | 0.0% |

| Minneapolis – Multifamily | $0.0 | 0.0% | 0.0% |

| Minneapolis – Office | $92.1 | 4.4% | 0.0% |

| Minneapolis – Other | $4.1 | 1.1% | 0.1% |

| Minneapolis – Retail | $1,400.0 | 77.8% | 0.4% |

| Minneapolis – Self Storage | $0.0 | 0.0% | 0.0% |

| Nashville – Nashville-Davidson-Murfreesboro-Franklin, TN MSA | $52.6 | 0.9% | -0.3% |

| Nashville – Hotel | $43.2 | 3.0% | -1.5% |

| Nashville – Industrial | $0.0 | 0.0% | 0.0% |

| Nashville – Multifamily | $0.0 | 0.0% | 0.0% |

| Nashville – Office | $0.0 | 0.0% | 0.0% |

| Nashville – Other | $0.0 | 0.0% | 0.0% |

| Nashville – Retail | $9.4 | 1.4% | 0.1% |

| Nashville – Self Storage | $0.0 | 0.0% | 0.0% |

| New Orleans – New Orleans-Metairie-Kenner, LA MSA | $124.1 | 3.7% | 0.0% |

| New Orleans – Hotel | $60.0 | 5.9% | 0.5% |

| New Orleans – Industrial | $0.0 | 0.0% | 0.0% |

| New Orleans – Multifamily | $0.0 | 0.0% | 0.0% |

| New Orleans – Office | $27.2 | 5.0% | 0.0% |

| New Orleans – Other | $14.8 | 9.5% | -0.5% |

| New Orleans – Retail | $22.1 | 3.5% | -0.2% |

| New Orleans – Self Storage | $0.0 | 0.0% | 0.0% |

| New York City – New York-Northern New Jersey-Long Island, NY-NJ-PA MSA | $5,985.3 | 4.7% | 0.6% |

| New York City – Hotel | $1,074.7 | 27.0% | 3.0% |

| New York City – Industrial | $64.6 | 1.6% | 0.0% |

| New York City – Multifamily | $182.0 | 0.5% | 0.0% |

| New York City – Office | $1,404.8 | 3.1% | 0.0% |

| New York City – Other | $1,637.6 | 7.5% | 1.4% |

| New York City – Retail | $1,621.7 | 13.3% | 3.4% |

| New York City – Self Storage | $0.0 | 0.0% | 0.0% |

| Orlando – Orlando-Kissimmee, FL MSA | $159.2 | 1.6% | -0.2% |

| Orlando – Hotel | $52.3 | 1.9% | -1.3% |

| Orlando – Industrial | $0.0 | 0.0% | 0.0% |

| Orlando – Multifamily | $0.0 | 0.0% | 0.0% |

| Orlando – Office | $57.8 | 12.7% | 2.1% |

| Orlando – Other | $0.0 | 0.0% | 0.0% |

| Orlando – Retail | $49.1 | 5.2% | 0.1% |

| Orlando – Self Storage | $0.0 | 0.0% | 0.0% |

| Philadelphia – Philadelphia-Camden-Wilmington, PA-NJ-DE-MD MSA | $730.3 | 3.7% | 0.4% |

| Philadelphia – Hotel | $102.1 | 11.1% | -0.9% |

| Philadelphia – Industrial | $0.0 | 0.0% | 0.0% |

| Philadelphia – Multifamily | $49.2 | 0.6% | 0.1% |

| Philadelphia – Office | $179.9 | 5.0% | 1.8% |

| Philadelphia – Other | $378.4 | 30.2% | 0.0% |

| Philadelphia – Retail | $20.8 | 1.0% | 0.1% |

| Philadelphia – Self Storage | $0.0 | 0.0% | 0.0% |

| Phoenix – Phoenix-Mesa-Scottsdale, AZ MSA | $195.0 | 1.0% | -0.4% |

| Phoenix – Hotel | $23.9 | 1.6% | 0.0% |

| Phoenix – Industrial | $0.0 | 0.0% | 0.0% |

| Phoenix – Multifamily | $0.0 | 0.0% | -0.5% |

| Phoenix – Office | $40.9 | 1.8% | 0.0% |

| Phoenix – Other | $8.6 | 1.0% | -0.3% |

| Phoenix – Retail | $121.6 | 7.4% | -0.9% |

| Phoenix – Self Storage | $0.0 | 0.0% | 0.0% |

| Pittsburgh – Pittsburgh, PA MSA | $54.2 | 1.2% | -0.3% |

| Pittsburgh – Hotel | $15.8 | 8.7% | 0.0% |

| Pittsburgh – Industrial | $0.0 | 0.0% | 0.0% |

| Pittsburgh – Multifamily | $0.0 | 0.0% | 0.0% |

| Pittsburgh – Office | $30.5 | 2.9% | -0.4% |

| Pittsburgh – Other | $7.9 | 2.3% | -2.3% |

| Pittsburgh – Retail | $0.0 | 0.0% | 0.0% |

| Pittsburgh – Self Storage | $0.0 | 0.0% | 0.0% |

| Portland – Portland-Vancouver-Beaverton, OR-WA MSA | $468.9 | 6.8% | -1.6% |

| Portland – Hotel | $240.0 | 30.5% | -8.9% |

| Portland – Industrial | $0.0 | 0.0% | 0.0% |

| Portland – Multifamily | $0.0 | 0.0% | 0.0% |

| Portland – Office | $12.9 | 3.3% | 0.3% |

| Portland – Other | $0.0 | 0.0% | 0.0% |

| Portland – Retail | $216.0 | 43.9% | 0.8% |

| Portland – Self Storage | $0.0 | 0.0% | 0.0% |

| Raleigh – Raleigh-Cary, NC MSA | $21.9 | 0.6% | 0.0% |

| Raleigh – Hotel | $15.3 | 7.3% | -0.1% |

| Raleigh – Industrial | $0.0 | 0.0% | 0.0% |

| Raleigh – Multifamily | $0.0 | 0.0% | 0.0% |

| Raleigh – Office | $0.0 | 0.0% | 0.0% |

| Raleigh – Other | $6.7 | 4.4% | -0.2% |

| Raleigh – Retail | $0.0 | 0.0% | 0.0% |

| Raleigh – Self Storage | $0.0 | 0.0% | 0.0% |

| Richmond – Richmond, VA MSA | $159.6 | 5.0% | 2.9% |

| Richmond – Hotel | $0.0 | 0.0% | 0.0% |

| Richmond – Industrial | $0.0 | 0.0% | 0.0% |

| Richmond – Multifamily | $0.0 | 0.0% | 0.0% |

| Richmond – Office | $0.0 | 0.0% | 0.0% |

| Richmond – Other | $12.9 | 8.9% | 0.0% |

| Richmond – Retail | $146.7 | 37.4% | 25.5% |

| Richmond – Self Storage | $0.0 | 0.0% | 0.0% |

| Riverside – Riverside-San Bernardino-Ontario, CA MSA | $277.3 | 2.8% | 0.0% |

| Riverside – Hotel | $39.2 | 8.5% | -2.0% |

| Riverside – Industrial | $0.0 | 0.0% | 0.0% |

| Riverside – Multifamily | $0.0 | 0.0% | 0.0% |

| Riverside – Office | $0.0 | 0.0% | 0.0% |

| Riverside – Other | $9.7 | 2.6% | 2.6% |

| Riverside – Retail | $228.4 | 12.5% | 1.2% |

| Riverside – Self Storage | $0.0 | 0.0% | 0.0% |

| Sacramento – Sacramento-Arden-Arcade-Roseville, CA MSA | $29.1 | 0.5% | 0.2% |

| Sacramento – Hotel | $9.8 | 2.8% | 1.4% |

| Sacramento – Industrial | $0.0 | 0.0% | 0.0% |

| Sacramento – Multifamily | $0.0 | 0.0% | 0.0% |

| Sacramento – Office | $0.0 | 0.0% | 0.0% |

| Sacramento – Other | $11.0 | 2.9% | 0.0% |

| Sacramento – Retail | $8.3 | 1.5% | 1.5% |

| Sacramento – Self Storage | $0.0 | 0.0% | 0.0% |

| Salt Lake City – Salt Lake City, UT MSA | $42.7 | 1.0% | 0.5% |

| Salt Lake City – Hotel | $6.1 | 2.2% | -5.2% |

| Salt Lake City – Industrial | $0.0 | 0.0% | 0.0% |

| Salt Lake City – Multifamily | $0.0 | 0.0% | 0.0% |

| Salt Lake City – Office | $0.0 | 0.0% | 0.0% |

| Salt Lake City – Other | $0.0 | 0.0% | 0.0% |

| Salt Lake City – Retail | $36.5 | 6.0% | 6.0% |

| Salt Lake City – Self Storage | $0.0 | 0.0% | 0.0% |

| San Antonio – San Antonio, TX MSA | $133.4 | 2.0% | -0.3% |

| San Antonio – Hotel | $17.1 | 3.2% | -3.4% |

| San Antonio – Industrial | $0.0 | 0.0% | 0.0% |

| San Antonio – Multifamily | $0.0 | 0.0% | -0.2% |

| San Antonio – Office | $0.0 | 0.0% | 0.0% |

| San Antonio – Other | $0.0 | 0.0% | 0.0% |

| San Antonio – Retail | $116.3 | 14.2% | -6.0% |

| San Antonio – Self Storage | $0.0 | 0.0% | 0.0% |

| San Diego – San Diego-Carlsbad-San Marcos, CA MSA | $55.7 | 0.5% | 0.0% |

| San Diego – Hotel | $39.4 | 2.1% | 0.1% |

| San Diego – Industrial | $0.0 | 0.0% | 0.0% |

| San Diego – Multifamily | $4.2 | 0.1% | 0.0% |

| San Diego – Office | $0.0 | 0.0% | 0.0% |

| San Diego – Other | $9.2 | 1.3% | 0.0% |

| San Diego – Retail | $2.9 | 0.3% | 0.0% |

| San Diego – Self Storage | $0.0 | 0.0% | 0.0% |

| San Francisco – San Francisco-Oakland-Fremont, CA MSA | $245.3 | 1.0% | 0.2% |

| San Francisco – Hotel | $109.0 | 4.2% | -0.3% |

| San Francisco – Industrial | $0.0 | 0.0% | 0.0% |

| San Francisco – Multifamily | $18.1 | 0.2% | 0.2% |

| San Francisco – Office | $32.2 | 0.3% | 0.3% |

| San Francisco – Other | $38.6 | 1.4% | 0.0% |

| San Francisco – Retail | $47.5 | 4.3% | -0.2% |

| San Francisco – Self Storage | $0.0 | 0.0% | 0.0% |

| San Jose – San Jose-Sunnyvale-Santa Clara, CA MSA | $23.8 | 0.1% | 0.0% |

| San Jose – Hotel | $0.0 | 0.0% | -0.5% |

| San Jose – Industrial | $0.0 | 0.0% | 0.0% |

| San Jose – Multifamily | $0.0 | 0.0% | 0.0% |

| San Jose – Office | $23.8 | 0.3% | 0.3% |

| San Jose – Other | $0.0 | 0.0% | 0.0% |

| San Jose – Retail | $0.0 | 0.0% | 0.0% |

| San Jose – Self Storage | $0.0 | 0.0% | 0.0% |

| Seattle – Seattle-Tacoma-Bellevue, WA MSA | $73.4 | 0.3% | 0.0% |

| Seattle – Hotel | $73.4 | 5.2% | -0.1% |

| Seattle – Industrial | $0.0 | 0.0% | 0.0% |

| Seattle – Multifamily | $0.0 | 0.0% | 0.0% |

| Seattle – Office | $0.0 | 0.0% | 0.0% |

| Seattle – Other | $0.0 | 0.0% | 0.0% |

| Seattle – Retail | $0.0 | 0.0% | 0.0% |

| Seattle – Self Storage | $0.0 | 0.0% | 0.0% |

| St. Louis – St. Louis, MO-IL MSA | $216.5 | 5.4% | 0.4% |

| St. Louis – Hotel | $1.7 | 0.7% | 0.1% |

| St. Louis – Industrial | $0.0 | 0.0% | 0.0% |

| St. Louis – Multifamily | $3.2 | 0.2% | 0.2% |

| St. Louis – Office | $0.0 | 0.0% | 0.0% |

| St. Louis – Other | $19.6 | 4.0% | 0.0% |

| St. Louis – Retail | $192.0 | 21.7% | 2.3% |

| St. Louis – Self Storage | $0.0 | 0.0% | 0.0% |

| Tampa – Tampa-St. Petersburg-Clearwater, FL | $129.3 | 1.4% | -0.1% |

| Tampa – Hotel | $54.9 | 7.7% | -0.9% |

| Tampa – Industrial | $0.0 | 0.0% | 0.0% |

| Tampa – Multifamily | $0.0 | 0.0% | 0.0% |

| Tampa – Office | $23.4 | 3.7% | 0.2% |

| Tampa – Other | $0.0 | 0.0% | 0.0% |

| Tampa – Retail | $51.0 | 7.1% | 0.2% |

| Tampa – Self Storage | $0.0 | 0.0% | 0.0% |

| Tucson – Tucson, AZ MSA | $158.9 | 4.9% | 0.1% |

| Tucson – Hotel | $0.0 | 0.0% | 0.0% |

| Tucson – Industrial | $0.0 | 0.0% | 0.0% |

| Tucson – Multifamily | $0.0 | 0.0% | 0.0% |

| Tucson – Office | $0.0 | 0.0% | 0.0% |

| Tucson – Other | $0.0 | 0.0% | 0.0% |

| Tucson – Retail | $158.9 | 22.7% | 2.8% |

| Tucson – Self Storage | $0.0 | 0.0% | 0.0% |

| Virginia Beach – Virginia Beach-Norfolk-Newport News, VA-NC MSA | $155.4 | 3.3% | -0.7% |

| Virginia Beach – Hotel | $0.0 | 0.0% | 0.0% |

| Virginia Beach – Industrial | $0.0 | 0.0% | -8.0% |

| Virginia Beach – Multifamily | $0.0 | 0.0% | 0.0% |

| Virginia Beach – Office | $0.0 | 0.0% | 0.0% |

| Virginia Beach – Other | $0.0 | 0.0% | 0.0% |

| Virginia Beach – Retail | $155.4 | 20.4% | -2.5% |

| Virginia Beach – Self Storage | $0.0 | 0.0% | 0.0% |

| Washington, DC – Washington-Arlington-Alexandria, DC-VA-MD-WV MSA | $534.9 | 1.7% | -0.1% |

| Washington, DC – Hotel | $49.9 | 4.5% | 0.1% |

| Washington, DC – Industrial | $0.0 | 0.0% | 0.0% |

| Washington, DC – Multifamily | $0.0 | 0.0% | 0.0% |

| Washington, DC – Office | $377.5 | 5.0% | 0.1% |

| Washington, DC – Other | $32.9 | 2.3% | 0.2% |

| Washington, DC – Retail | $74.7 | 2.3% | 0.1% |

| Washington, DC – Self Storage | $0.0 | 0.0% | 0.0% |

| Grand Total | $20,606.7 | 3.0% | 0.1% |