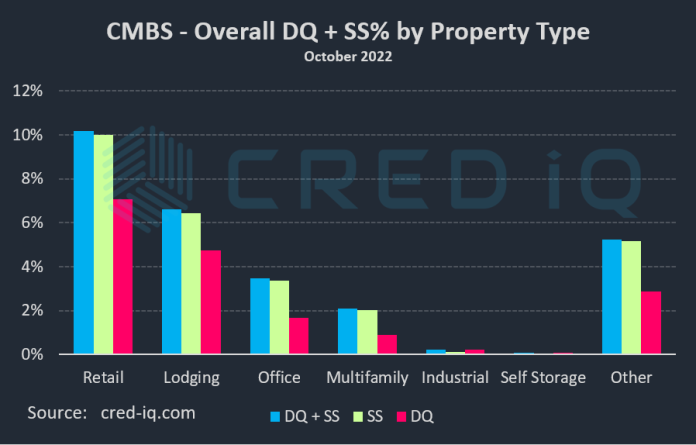

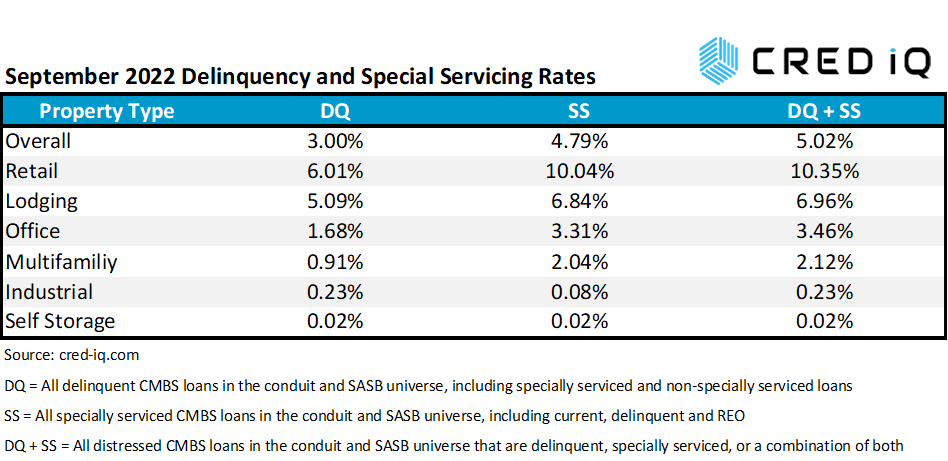

SS = All specially serviced CMBS loans in the conduit and SASB universe, including current, delinquent and REO

DQ + SS = All distressed CMBS loans in the conduit and SASB universe that are delinquent, specially serviced, or a combination of both

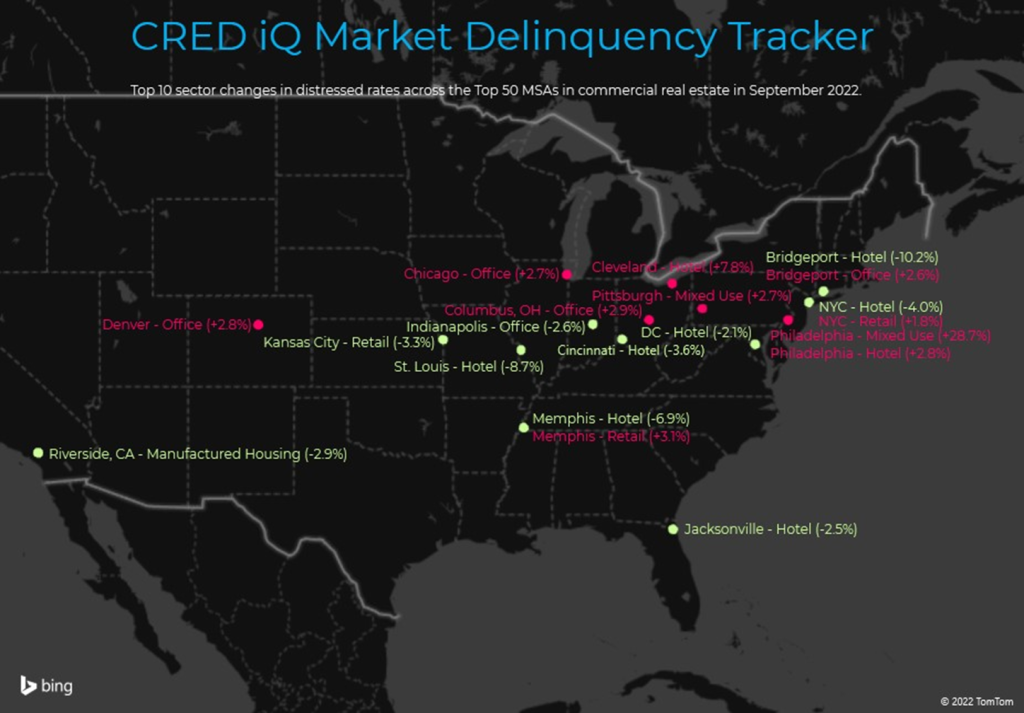

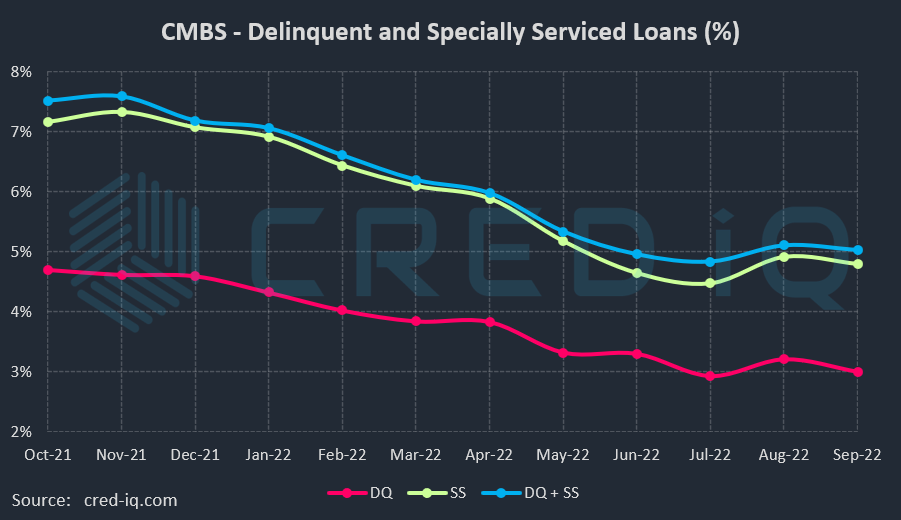

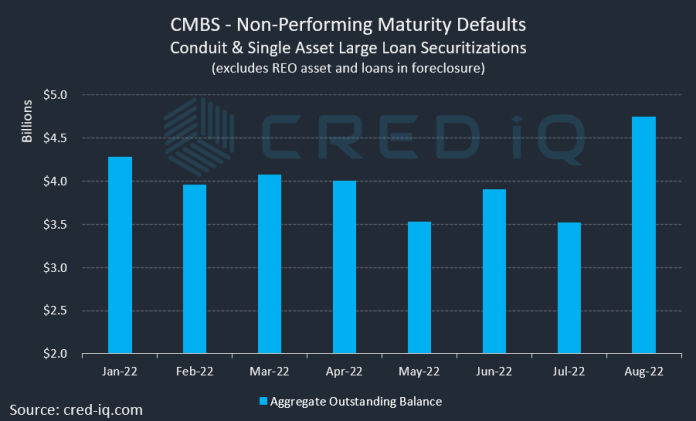

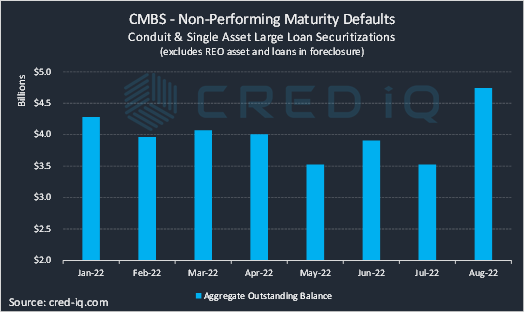

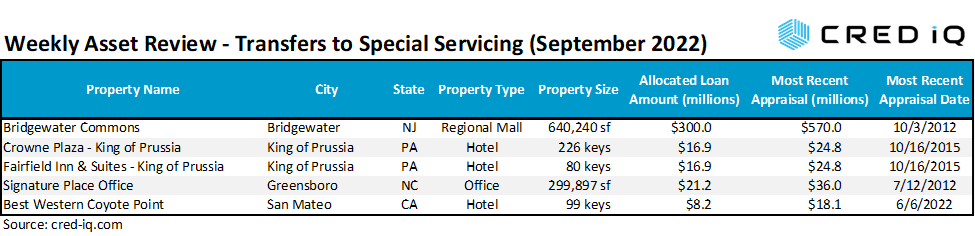

The CRED iQ delinquency rate for CMBS increased during the October 2022 reporting period, which was the second month-over-month increase over the past two years. This month, the delinquency rate, equal to the percentage of all delinquent specially serviced loans and delinquent non-specially serviced loans, for CRED iQ’s sample universe of $500+ billion in CMBS conduit and single asset single-borrower (SASB) loans was 3.28%, which was 28 bps higher than last month’s delinquency rate of 3.00%. CRED iQ’s special servicing rate, equal to the percentage of CMBS loans that are with the special servicer (delinquent and non-delinquent), declined slightly month-over-month to 4.73% from 4.79%. Aggregating the two indicators of distress – delinquency rate and special servicing rate – into an overall distressed rate (DQ + SS%) equals 5.14% of CMBS loans that are specially serviced, delinquent, or a combination of both. The overall distressed rate increased compared to the prior month’s distressed rate of 5.02%. These distressed rates typically track slightly higher than special servicing rates as most delinquent loans are also with the special servicer.

SS = All specially serviced CMBS loans in the conduit and SASB universe, including current, delinquent and REO

DQ + SS = All distressed CMBS loans in the conduit and SASB universe that are delinquent, specially serviced, or a combination of both

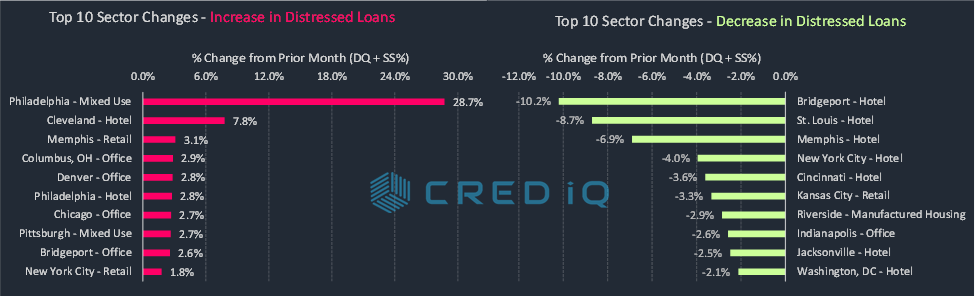

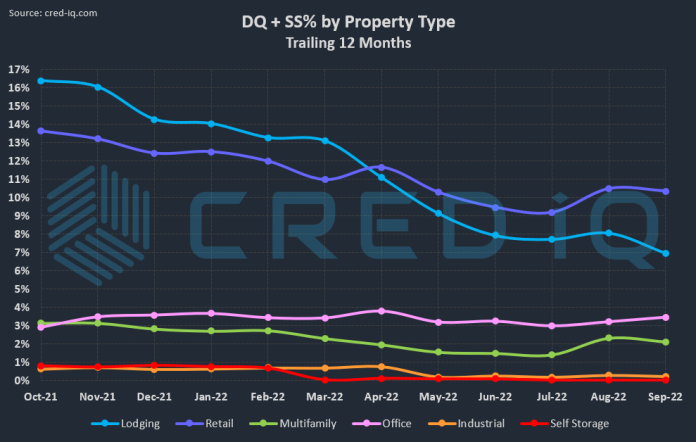

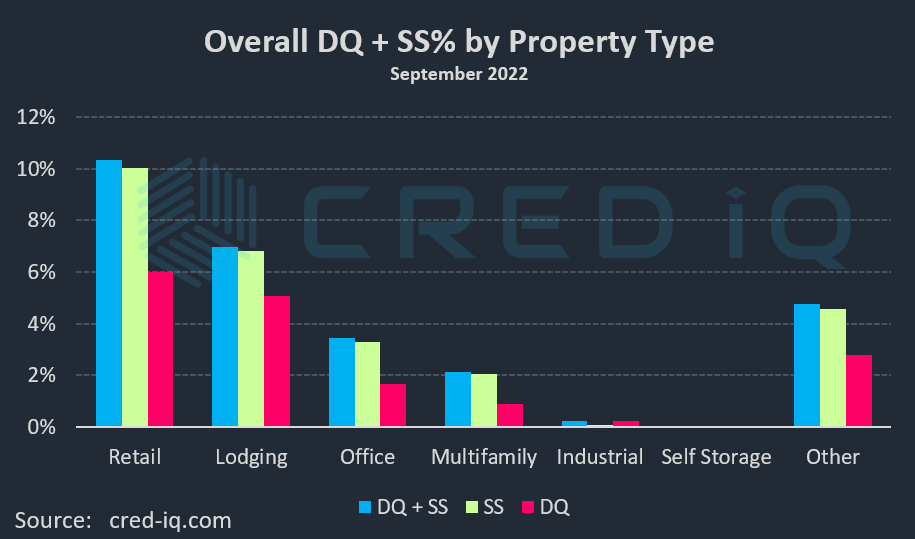

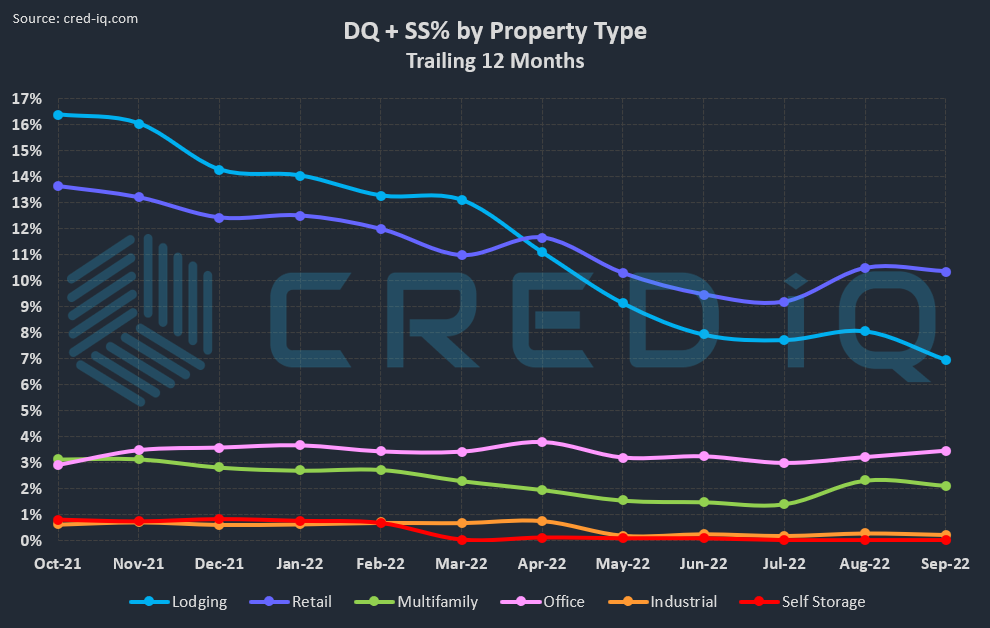

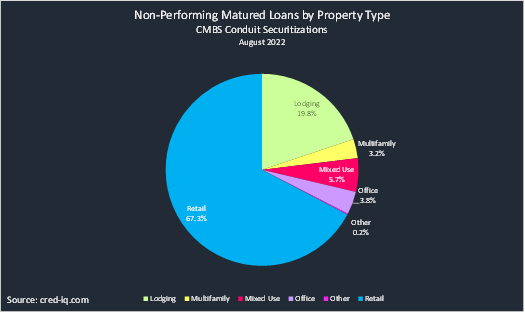

By property type, retail was the driver behind the overall increase in delinquency. The delinquency rate for retail increased 17% from 6.01% as of September 2022 to 7.06% as of October. This is the third consecutive month that the retail delinquency rate has increased. The last reporting period when retail delinquency was higher than 7% was six months ago in April 2022 when the rate was 7.37%. The retail sector has had the highest delinquency rate among all property types since May 2022.

One of the largest newly delinquent retail loans this month is secured by a regional mall. The $216 million Clackamas Town Center loan failed to pay off at its October 2022 maturity date. Prior to the maturity default, the loan had been current in payment throughout its term. The loan transferred to special servicing in July 2022 in anticipation of the maturity default. The loan collateral is a 1.4 million-sf regional mall located 10 miles outside of Portland, OR.

Aside from retail, delinquency rates for lodging (4.47%), multifamily (0.89%), and industrial (0.21%) exhibited month-over-month decreases during the October 2022 reporting period. The delinquency rate for loans secured by office properties (1.68%) was flat compared to the prior month.

Despite zero month-over-month change in delinquency for office loans, the special servicing rate for office increased modestly to 3.36%, compared to 3.31% from the prior month. Notable loan transfers to special servicing this month included a $47 million mortgage secured by One Westchase Center in Houston, TX and a $38.4 million mortgage secured by 1 South Broad Street in Philadelphia, PA. Both office buildings, which each have over 400,000 sf in NRA, are experiencing issues with low occupancy that is likely impacting the respective borrowers’ refinancing efforts. One Westchase Center was approximately 71% occupied as of June 2022 and occupancy declined to 51% at 1 South Broad Street after its primary tenant, Wells Fargo, vacated at year-end 2020.

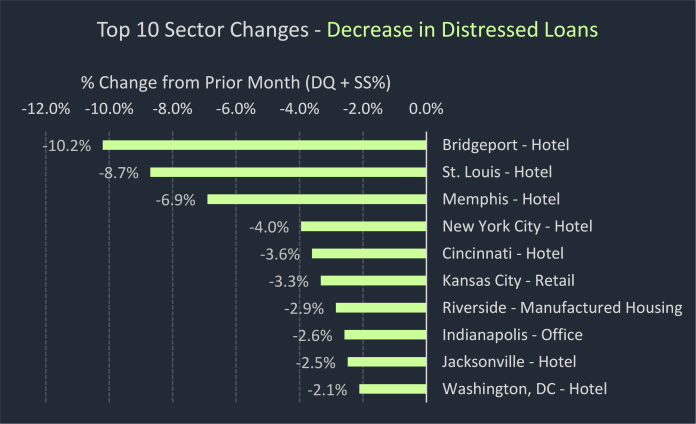

The lodging sector exhibited the sharpest decline in its special servicing rate compared to September 2022, decreasing to 6.43% during October 2022 — equal to a 6% decline. Declines in special servicing rates for retail and multifamily were nominal.

CRED iQ’s CMBS distressed rate (DQ + SS%) by property type accounts for loans that qualify for either delinquent or special servicing subsets. This month, the overall distressed rate for CMBS increased to 5.14%, which followed a relatively sharp increase in the overall delinquency rate. The increase in the overall CMBS distressed rate was primarily caused by maturity defaults of loans secured by retail properties, including a concentration of regional malls. Two such examples are a $418.5 million mortgage secured by the 1.9 million-sf Palisades Center Mall in West Nyack, NY and a $195 million mortgage secured by the 1.1 million-sf Valencia Town Center in Santa Clarita, CA. Both loans transferred to special servicing in late-September 2022 due to issues related to maturity default risk. For additional information about these two loans, click View Details below:

| [View Details] | [View Details] | |

| Loan | Palisades Center Mall | Valencia Town Center |

| Balance | $418,500,000 | $195,000,000 |

| Special Servicer Transfer Date | 9/27/2022 | 9/26/2022 |

About CRED iQ

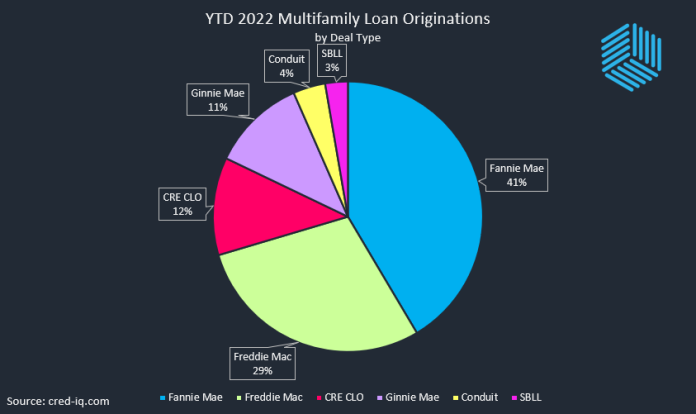

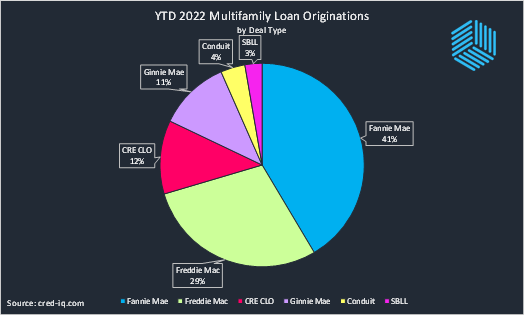

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. Our data platform is powered by over $2.0 trillion of CMBS, CRE CLO, SBLL, and GSE Agency loan and property data.