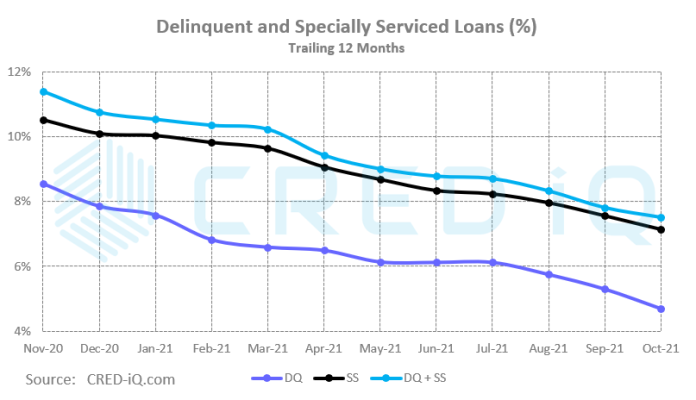

The CRED iQ overall delinquency rate declined for the 16th consecutive month since June 2020 and is now below 5%. The delinquency rate, equal to the percentage of all delinquent specially serviced loans and delinquent non-specially serviced loans, for CRED iQ’s sample universe of $500+ billion in CMBS conduit and single-asset single-borrower (SASB) loans was 4.70%. CRED iQ’s special servicing rate, equal to the percentage of CMBS loans that have transferred to special servicing, was equal to 7.15%. Aggregating these two indicators of distress – delinquency rate and special servicing rate – into an overall distressed rate (DQ + SS%) equals 7.51% of CMBS loans that are specially serviced, delinquent, or a combination of both. The overall distressed rate has declined in parallel with the delinquency rate over the past 16 months.

SS = All specially serviced CMBS loans in the conduit and SASB universe, including current, delinquent and REO

DQ + SS = All distressed CMBS loans in the conduit and SASB universe that are delinquent, specially serviced, or a combination of both

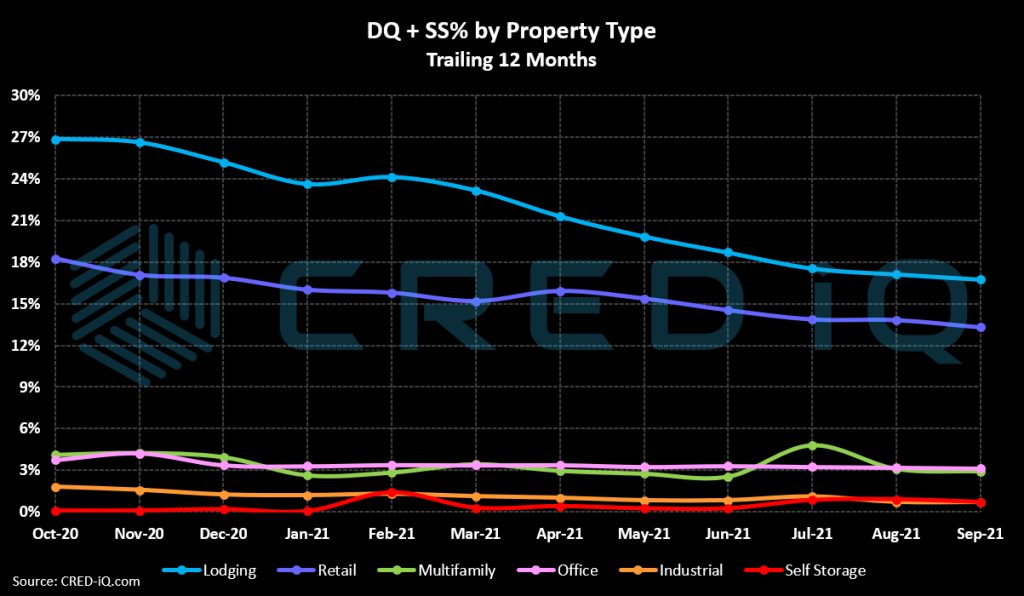

By property type, lodging and retail continue to have the highest individual delinquency rates. Delinquency for hotels declined month-over-month and has declined over 800 basis points compared to 12 months prior. Similarly, delinquency for retail has been reduced over the course of the trailing 12 months, declining approximately 500 basis points. Despite the month-over-month decline in retail delinquency, the special servicing rate for retail increased slightly, due partly to the transfer of Westgate Mall in October, which is a regional mall located in Spartanburg, SC that is owned by CBL Properties. Rounding out the remaining property types, the delinquency rate for office has been hovering just north of 2% while delinquency rates for industrial and office remain below 1%.

SS = All specially serviced CMBS loans in the conduit and SASB universe, including current, delinquent and REO

DQ + SS = All distressed CMBS loans in the conduit and SASB universe that are delinquent, specially serviced, or a combination of both

CRED iQ also monitors distressed rates (DQ + SS%) and market performance for nearly 400 MSAs across the United States, covering over $900 billion in outstanding CRE debt, including conduit, agency, SASB and CRE CLO. Among property sectors by market, lodging has been the most volatile. Of the Top 10 sector changes by market, hotels account for 7 out the top 10 decreases in rates of distressed collateral. Two sectors from the New Orleans MSA — lodging and multifamily — exhibited the highest increases in distressed rates. Additionally, the Washington, DC office sector exhibited one of the largest month-over-month increases in its distressed rate – caused by the delinquency of One Union Center, a 191,000-sf office property located in the Capitol Hill submarket of DC. The property is 5% occupied and failed to pay off at its initial maturity date in October 2021.

New Orleans maintains its position as one the 3 MSAs with the highest overall rates of distress, joining Minneapolis and Louisville. The Sacramento MSA has the lowest distressed rate among the Top 50 MSAs for the second month in a row.

For the full CRED DQ report, download here:

| MSA – Property Type | DQ/SS (millions) | DQ/SS (%) | Monthly Change |

| Allentown-Bethlehem-Easton, PA-NJ MSA | $19.4 | 0.6% | 0.0% |

| Hotel | $0.0 | 0.0% | 0.0% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $0.0 | 0.0% | 0.0% |

| Office | $0.0 | 0.0% | 0.0% |

| Other | $0.0 | 0.0% | 0.0% |

| Retail | $19.4 | 5.1% | 0.0% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| Atlanta-Sandy Springs-Marietta, GA MSA | $748.5 | 3.2% | 0.0% |

| Hotel | $247.0 | 13.0% | 0.1% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $4.7 | 0.0% | 0.0% |

| Office | $34.0 | 1.2% | -0.2% |

| Other | $0.0 | 0.0% | 0.0% |

| Retail | $462.9 | 17.7% | 0.7% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| Austin-Round Rock, TX MSA | $495.2 | 5.4% | -0.4% |

| Hotel | $406.1 | 44.1% | -1.0% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $0.0 | 0.0% | 0.0% |

| Office | $0.0 | 0.0% | 0.0% |

| Other | $0.0 | 0.0% | 0.0% |

| Retail | $86.5 | 12.7% | -3.0% |

| Self Storage | $2.6 | 2.2% | 0.0% |

| Baltimore-Towson, MD MSA | $413.5 | 4.2% | 0.0% |

| Hotel | $128.3 | 27.8% | -0.9% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $6.1 | 0.1% | 0.0% |

| Office | $22.9 | 3.6% | 0.0% |

| Other | $0.0 | 0.0% | 0.0% |

| Retail | $256.3 | 24.0% | -0.2% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| Birmingham-Hoover, AL MSA | $45.5 | 1.7% | 0.0% |

| Hotel | $22.6 | 21.4% | -1.0% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $0.0 | 0.0% | -0.1% |

| Office | $0.0 | 0.0% | 0.0% |

| Other | $0.0 | 0.0% | 0.0% |

| Retail | $22.9 | 3.2% | 0.0% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| Boston-Cambridge-Quincy, MA-NH MSA | $356.1 | 2.1% | -0.2% |

| Hotel | $98.6 | 13.3% | -3.5% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $0.0 | 0.0% | 0.0% |

| Office | $0.0 | 0.0% | 0.0% |

| Other | $0.0 | 0.0% | 0.0% |

| Retail | $257.5 | 13.5% | 0.3% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| Bridgeport-Stamford-Norwalk, CT MSA | $169.2 | 4.4% | -0.4% |

| Hotel | $43.0 | 42.0% | -9.4% |

| Industrial | $17.8 | 14.0% | 0.4% |

| Multifamily | $0.0 | 0.0% | 0.0% |

| Office | $63.1 | 5.3% | 0.0% |

| Other | $23.6 | 5.8% | 0.0% |

| Retail | $21.7 | 6.9% | 0.0% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| Charlotte-Gastonia-Concord, NC-SC MSA | $303.6 | 3.8% | 0.7% |

| Hotel | $100.4 | 8.4% | -2.1% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $0.0 | 0.0% | 0.0% |

| Office | $21.3 | 2.5% | 0.0% |

| Other | $85.0 | 25.2% | 1.0% |

| Retail | $96.9 | 8.1% | 6.3% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| Chicago-Naperville-Joliet, IL-IN-WI MSA | $2,019.4 | 7.6% | 0.2% |

| Hotel | $1,119.6 | 52.8% | 7.8% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $119.9 | 1.2% | 0.0% |

| Office | $395.5 | 5.6% | 0.0% |

| Other | $99.2 | 5.1% | 0.0% |

| Retail | $285.2 | 8.6% | 0.9% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| Cincinnati-Middletown, OH-KY-IN MSA | $280.1 | 7.2% | -0.7% |

| Hotel | $116.9 | 39.4% | -6.8% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $0.0 | 0.0% | 0.0% |

| Office | $11.5 | 2.2% | 0.0% |

| Other | $15.7 | 5.1% | 0.1% |

| Retail | $135.1 | 19.5% | 0.0% |

| Self Storage | $1.0 | 1.8% | 0.1% |

| Cleveland-Elyria-Mentor, OH MSA | $469.3 | 11.8% | -0.6% |

| Hotel | $97.7 | 50.0% | -7.0% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $0.0 | 0.0% | -0.3% |

| Office | $105.0 | 12.9% | 0.0% |

| Other | $177.6 | 42.5% | 1.1% |

| Retail | $88.9 | 11.9% | 0.6% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| Columbus, OH MSA | $247.2 | 4.0% | -0.2% |

| Hotel | $84.3 | 26.8% | -0.1% |

| Industrial | $11.9 | 2.6% | -0.3% |

| Multifamily | $0.0 | 0.0% | -0.1% |

| Office | $12.4 | 2.8% | 0.0% |

| Other | $0.0 | 0.0% | 0.0% |

| Retail | $127.5 | 15.3% | 0.2% |

| Self Storage | $11.0 | 18.9% | 0.0% |

| Dallas-Fort Worth-Arlington, TX MSA | $836.9 | 2.5% | -0.2% |

| Hotel | $360.6 | 10.0% | -2.2% |

| Industrial | $1.7 | 0.1% | 0.0% |

| Multifamily | $47.7 | 0.2% | 0.0% |

| Office | $165.9 | 4.5% | -0.2% |

| Other | $23.8 | 1.3% | 0.2% |

| Retail | $225.3 | 9.9% | 0.4% |

| Self Storage | $11.9 | 2.3% | -0.1% |

| Denver-Aurora, CO MSA | $289.6 | 1.8% | -0.1% |

| Hotel | $30.7 | 3.8% | -1.4% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $0.0 | 0.0% | 0.0% |

| Office | $193.8 | 9.5% | 0.1% |

| Other | $6.9 | 1.4% | 0.0% |

| Retail | $54.9 | 3.7% | -0.5% |

| Self Storage | $3.3 | 1.9% | -0.1% |

| Detroit-Warren-Livonia, MI MSA | $522.0 | 6.0% | 0.1% |

| Hotel | $283.9 | 39.0% | -3.6% |

| Industrial | $18.6 | 3.7% | -4.8% |

| Multifamily | $25.2 | 0.8% | -0.4% |

| Office | $0.0 | 0.0% | 0.0% |

| Other | $22.8 | 3.7% | 0.2% |

| Retail | $171.6 | 10.2% | 3.7% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| Hartford-West Hartford-East Hartford, CT MSA | $208.0 | 8.3% | -0.3% |

| Hotel | $88.9 | 60.5% | -2.3% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $0.0 | 0.0% | -0.3% |

| Office | $87.6 | 22.3% | 0.0% |

| Other | $1.2 | 0.6% | 0.0% |

| Retail | $30.3 | 12.8% | 0.0% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| Houston-Sugar Land-Baytown, TX MSA | $1,425.1 | 5.9% | 0.7% |

| Hotel | $665.7 | 58.1% | -1.1% |

| Industrial | $4.2 | 0.8% | 0.1% |

| Multifamily | $66.6 | 0.5% | 0.0% |

| Office | $540.2 | 13.9% | 0.2% |

| Other | $0.0 | 0.0% | 0.0% |

| Retail | $103.9 | 2.8% | 0.4% |

| Self Storage | $44.4 | 9.5% | 3.1% |

| Indianapolis-Carmel, IN MSA | $385.4 | 8.0% | 0.2% |

| Hotel | $159.6 | 25.7% | -0.2% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $98.2 | 4.2% | 0.0% |

| Office | $75.8 | 13.6% | 0.9% |

| Other | $9.8 | 4.6% | 0.1% |

| Retail | $38.1 | 7.4% | 0.4% |

| Self Storage | $4.0 | 6.1% | 0.7% |

| Jacksonville, FL MSA | $71.7 | 1.4% | 0.1% |

| Hotel | $38.6 | 9.0% | -0.3% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $19.9 | 0.6% | 0.0% |

| Office | $4.2 | 1.1% | 1.1% |

| Other | $0.0 | 0.0% | 0.0% |

| Retail | $9.0 | 2.2% | 0.1% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| Kansas City, MO-KS MSA | $155.3 | 3.3% | 0.2% |

| Hotel | $89.9 | 30.4% | 3.4% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $7.6 | 0.3% | 0.0% |

| Office | $0.0 | 0.0% | 0.0% |

| Other | $2.8 | 1.5% | 0.5% |

| Retail | $53.3 | 8.3% | 0.0% |

| Self Storage | $1.7 | 0.8% | 0.0% |

| Las Vegas-Paradise, NV MSA | $396.0 | 2.0% | 0.0% |

| Hotel | $18.3 | 0.3% | 0.0% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $0.0 | 0.0% | 0.0% |

| Office | $13.5 | 2.1% | 0.4% |

| Other | $0.0 | 0.0% | 0.0% |

| Retail | $361.4 | 7.7% | 0.1% |

| Self Storage | $2.8 | 1.5% | 0.1% |

| Los Angeles-Long Beach-Santa Ana, CA MSA | $1,569.7 | 3.2% | -0.8% |

| Hotel | $647.0 | 16.3% | -0.2% |

| Industrial | $2.0 | 0.2% | 0.2% |

| Multifamily | $127.1 | 0.6% | 0.0% |

| Office | $89.2 | 0.8% | -2.5% |

| Other | $149.3 | 4.9% | -0.7% |

| Retail | $555.1 | 8.4% | -0.4% |

| Self Storage | $0.0 | 0.0% | -0.4% |

| Louisville/Jefferson County, KY-IN MSA | $630.9 | 21.0% | 0.7% |

| Hotel | $242.9 | 54.4% | -1.7% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $3.8 | 0.3% | 0.0% |

| Office | $0.0 | 0.0% | 0.0% |

| Other | $0.0 | 0.0% | 0.0% |

| Retail | $384.2 | 59.4% | 0.2% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| Memphis, TN-AR-MS MSA | $141.2 | 6.5% | 0.0% |

| Hotel | $40.9 | 21.6% | -7.4% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $17.8 | 1.8% | 0.0% |

| Office | $0.0 | 0.0% | 0.0% |

| Other | $18.4 | 35.8% | 2.2% |

| Retail | $62.4 | 17.1% | 1.8% |

| Self Storage | $1.7 | 1.1% | 0.0% |

| Miami-Fort Lauderdale-Pompano Beach, FL MSA | $798.8 | 3.8% | 0.5% |

| Hotel | $360.9 | 8.1% | -0.3% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $5.8 | 0.1% | 0.0% |

| Office | $21.6 | 1.1% | 0.0% |

| Other | $8.7 | 0.6% | 0.0% |

| Retail | $401.9 | 8.4% | 2.7% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| Milwaukee-Waukesha-West Allis, WI MSA | $254.5 | 10.3% | -0.1% |

| Hotel | $35.6 | 23.1% | 0.0% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $0.0 | 0.0% | 0.0% |

| Office | $66.2 | 11.8% | 0.0% |

| Other | $0.0 | 0.0% | 0.0% |

| Retail | $152.7 | 30.5% | 0.0% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| Minneapolis-St. Paul-Bloomington, MN-WI MSA | $1,934.4 | 23.5% | 0.0% |

| Hotel | $332.1 | 53.3% | -0.6% |

| Industrial | $4.1 | 1.4% | -0.1% |

| Multifamily | $0.0 | 0.0% | 0.0% |

| Office | $154.8 | 7.7% | 0.0% |

| Other | $11.6 | 2.7% | -0.1% |

| Retail | $1,431.8 | 71.6% | 0.5% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| Nashville-Davidson-Murfreesboro-Franklin, TN MSA | $169.7 | 2.7% | -0.8% |

| Hotel | $160.2 | 11.8% | -3.9% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $0.0 | 0.0% | 0.0% |

| Office | $0.0 | 0.0% | 0.0% |

| Other | $0.0 | 0.0% | 0.0% |

| Retail | $9.5 | 1.2% | 0.0% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| New Orleans-Metairie-Kenner, LA MSA | $539.7 | 16.1% | 2.9% |

| Hotel | $465.0 | 41.4% | 4.0% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $34.5 | 4.4% | 2.7% |

| Office | $17.4 | 3.2% | 3.2% |

| Other | $0.0 | 0.0% | 0.0% |

| Retail | $22.8 | 3.2% | 0.1% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| New York-Northern New Jersey-Long Island, NY-NJ-PA MSA | $6,125.9 | 5.3% | -0.3% |

| Hotel | $1,615.6 | 44.8% | -1.6% |

| Industrial | $7.5 | 0.5% | 0.0% |

| Multifamily | $524.4 | 1.6% | -0.2% |

| Office | $717.3 | 1.7% | -0.2% |

| Other | $1,430.3 | 7.0% | -0.4% |

| Retail | $1,830.8 | 13.3% | -0.7% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| Orlando-Kissimmee, FL MSA | $435.3 | 3.8% | -0.1% |

| Hotel | $188.3 | 6.6% | 0.6% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $25.4 | 0.4% | 0.0% |

| Office | $47.1 | 9.6% | 0.0% |

| Other | $0.0 | 0.0% | 0.0% |

| Retail | $174.5 | 20.9% | -2.7% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| Philadelphia-Camden-Wilmington, PA-NJ-DE-MD MSA | $958.0 | 5.2% | 0.2% |

| Hotel | $360.8 | 41.2% | 4.6% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $110.4 | 1.3% | -0.1% |

| Office | $102.5 | 2.5% | 1.0% |

| Other | $47.9 | 3.7% | -0.5% |

| Retail | $336.3 | 13.7% | -0.5% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| Phoenix-Mesa-Scottsdale, AZ MSA | $409.6 | 2.4% | -0.1% |

| Hotel | $39.0 | 2.4% | -1.2% |

| Industrial | $10.2 | 2.2% | 0.3% |

| Multifamily | $0.0 | 0.0% | 0.0% |

| Office | $23.7 | 1.1% | 0.0% |

| Other | $180.5 | 24.1% | 0.0% |

| Retail | $156.3 | 7.3% | 0.1% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| Pittsburgh, PA MSA | $149.3 | 3.2% | -1.0% |

| Hotel | $118.0 | 41.6% | -4.3% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $0.0 | 0.0% | 0.0% |

| Office | $15.4 | 1.7% | 0.0% |

| Other | $8.1 | 2.1% | 0.0% |

| Retail | $7.8 | 1.2% | -5.9% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| Portland-Vancouver-Beaverton, OR-WA MSA | $514.2 | 7.8% | 0.0% |

| Hotel | $502.5 | 58.1% | -4.6% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $10.2 | 0.2% | 0.0% |

| Office | $1.6 | 0.6% | 0.1% |

| Other | $0.0 | 0.0% | 0.0% |

| Retail | $0.0 | 0.0% | 0.0% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| Raleigh-Cary, NC MSA | $122.4 | 3.0% | -0.3% |

| Hotel | $86.6 | 21.1% | 0.0% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $0.0 | 0.0% | 0.0% |

| Office | $0.0 | 0.0% | -4.0% |

| Other | $0.0 | 0.0% | 0.0% |

| Retail | $35.8 | 9.1% | 0.0% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| Richmond, VA MSA | $141.5 | 4.1% | 0.1% |

| Hotel | $50.5 | 17.8% | 0.0% |

| Industrial | $6.9 | 4.9% | 0.0% |

| Multifamily | $0.0 | 0.0% | 0.0% |

| Office | $0.0 | 0.0% | 0.0% |

| Other | $0.0 | 0.0% | 0.0% |

| Retail | $84.2 | 15.3% | 0.0% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| Riverside-San Bernardino-Ontario, CA MSA | $359.7 | 4.0% | 0.5% |

| Hotel | $73.3 | 16.4% | -2.1% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $2.4 | 0.1% | 0.0% |

| Office | $0.0 | 0.0% | 0.0% |

| Other | $0.0 | 0.0% | 0.0% |

| Retail | $283.9 | 13.3% | 2.2% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| Sacramento-Arden-Arcade-Roseville, CA MSA | $30.9 | 0.6% | 0.0% |

| Hotel | $6.3 | 1.7% | 0.0% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $0.0 | 0.0% | 0.0% |

| Office | $10.9 | 1.9% | 0.0% |

| Other | $0.0 | 0.0% | 0.0% |

| Retail | $13.7 | 1.9% | 0.1% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| Salt Lake City, UT MSA | $57.6 | 1.6% | 0.7% |

| Hotel | $57.6 | 19.1% | 8.4% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $0.0 | 0.0% | 0.0% |

| Office | $0.0 | 0.0% | 0.0% |

| Other | $0.0 | 0.0% | 0.0% |

| Retail | $0.0 | 0.0% | 0.0% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| San Antonio, TX MSA | $176.5 | 2.8% | -0.2% |

| Hotel | $26.1 | 7.4% | -0.4% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $4.9 | 0.1% | -0.2% |

| Office | $0.0 | 0.0% | 0.0% |

| Other | $0.0 | 0.0% | 0.0% |

| Retail | $143.9 | 16.4% | -0.9% |

| Self Storage | $1.5 | 1.0% | 0.0% |

| San Diego-Carlsbad-San Marcos, CA MSA | $217.7 | 2.0% | 0.0% |

| Hotel | $79.4 | 3.8% | -0.1% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $0.0 | 0.0% | 0.0% |

| Office | $0.0 | 0.0% | 0.0% |

| Other | $20.7 | 3.4% | 0.0% |

| Retail | $117.6 | 9.9% | -0.1% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| San Francisco-Oakland-Fremont, CA MSA | $324.4 | 1.4% | -0.1% |

| Hotel | $203.4 | 8.8% | -0.4% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $23.8 | 0.3% | 0.0% |

| Office | $18.8 | 0.2% | 0.0% |

| Other | $30.6 | 1.8% | 0.0% |

| Retail | $47.7 | 3.5% | -0.1% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| San Jose-Sunnyvale-Santa Clara, CA MSA | $136.9 | 1.0% | 0.0% |

| Hotel | $122.1 | 6.2% | 0.1% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $0.0 | 0.0% | 0.0% |

| Office | $14.7 | 0.2% | 0.0% |

| Other | $0.0 | 0.0% | 0.0% |

| Retail | $0.0 | 0.0% | 0.0% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| Seattle-Tacoma-Bellevue, WA MSA | $217.5 | 1.3% | 0.1% |

| Hotel | $210.8 | 16.8% | 1.2% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $0.0 | 0.0% | 0.0% |

| Office | $0.0 | 0.0% | 0.0% |

| Other | $0.0 | 0.0% | 0.0% |

| Retail | $6.7 | 0.4% | 0.0% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| St. Louis, MO-IL MSA | $406.7 | 9.4% | -0.3% |

| Hotel | $58.5 | 21.9% | 1.3% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $20.0 | 1.1% | -0.2% |

| Office | $107.6 | 19.2% | 0.2% |

| Other | $24.7 | 5.3% | 0.4% |

| Retail | $196.0 | 19.3% | -1.2% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| Tampa-St. Petersburg-Clearwater, FL | $381.6 | 4.0% | -0.1% |

| Hotel | $74.8 | 6.4% | -0.1% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $34.6 | 0.6% | 0.0% |

| Office | $20.3 | 3.5% | 0.1% |

| Other | $0.0 | 0.0% | 0.0% |

| Retail | $251.9 | 27.3% | -0.2% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| Tucson, AZ MSA | $264.7 | 9.2% | 0.0% |

| Hotel | $1.4 | 0.5% | 0.0% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $0.0 | 0.0% | 0.0% |

| Office | $0.0 | 0.0% | 0.0% |

| Other | $0.0 | 0.0% | 0.0% |

| Retail | $263.4 | 41.7% | 2.2% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| Virginia Beach-Norfolk-Newport News, VA-NC MSA | $242.8 | 5.5% | 1.9% |

| Hotel | $24.6 | 6.0% | 0.7% |

| Industrial | $21.2 | 13.1% | 0.0% |

| Multifamily | $0.0 | 0.0% | 0.0% |

| Office | $12.4 | 3.1% | 0.0% |

| Other | $0.0 | 0.0% | 0.0% |

| Retail | $184.5 | 20.5% | 8.5% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| Washington-Arlington-Alexandria, DC-VA-MD-WV MSA | $847.7 | 3.1% | 0.3% |

| Hotel | $66.3 | 6.1% | 0.9% |

| Industrial | $0.0 | 0.0% | 0.0% |

| Multifamily | $1.3 | 0.0% | 0.0% |

| Office | $362.8 | 5.7% | 1.1% |

| Other | $249.7 | 12.9% | 0.6% |

| Retail | $167.7 | 6.2% | 0.7% |

| Self Storage | $0.0 | 0.0% | 0.0% |

| Grand Total | $28,417.1 | 4.4% | -0.1% |