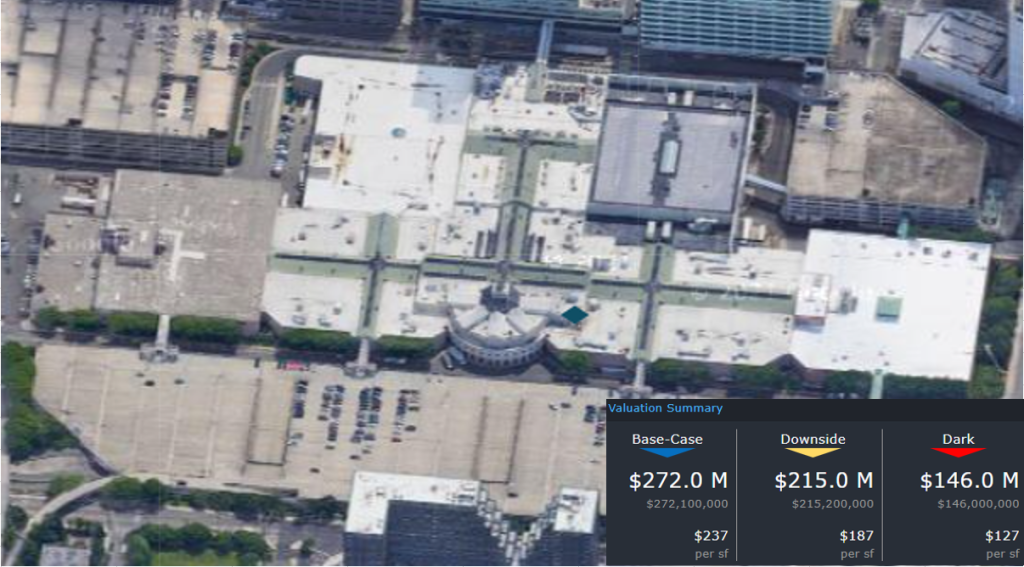

This week, CRED iQ calculated real-time valuations for 5 retail properties that have had title transfers and are now REO. Highlighted properties include the Montgomery Mall in North Wales, PA, which was featured in a Philadelphia Business Journal article that cited CRED iQ analysis. The CRED iQ valuations factor in a base-case (Most Likely), a downside (significant loss of tenants), and dark scenarios (100% vacant). For full access to the valuation reports as well as full CMBS loan reporting, including detailed financials, updated tenant information, and borrower contact information, sign up for a free trial here.

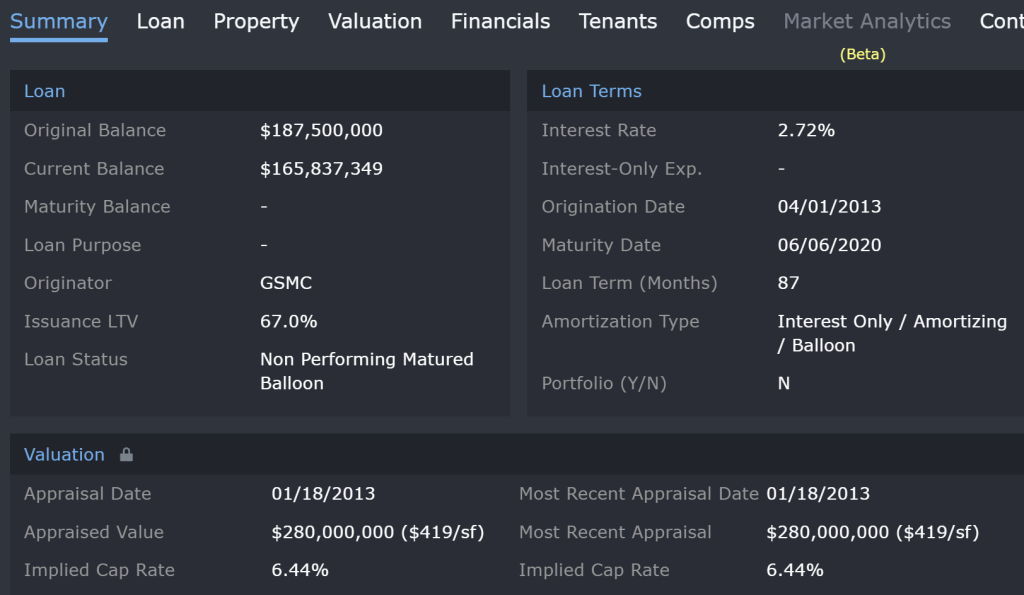

Montgomery Mall

1.1 million sf, Regional Mall, North Wales, PA 19454

This property, which has outstanding debt of $100.0 million, has been with the special servicer since June 16, 2020, and title to the mall transferred to LNR on July 12, 2021, according to the Philadelphia Business Journal. Prior to the mall becoming REO, the previous owner, Simon Property Group, had been discussing potential loan modification solutions, but foreclosure was filed. Two anchor pads at the mall are ground leased to Macy’s and a Wegmans supermarket while a third is leased to JCPenney. Another anchor pad was ground leased to Sears, but the location closed in 2020. Servicer-reported occupancy for the mall of 87% is a bit misleading considering the Sears closure and our estimation that in-line occupancy is trending sub-60%. Likewise, the most recent appraisal for the mall was $61.0 million; although CRED-iQ’s Base-Case Valuation calculates a lower figure. Next steps are for the property are stabilization or placement on the market to be sold. For the full valuation report and loan-level details, click here.

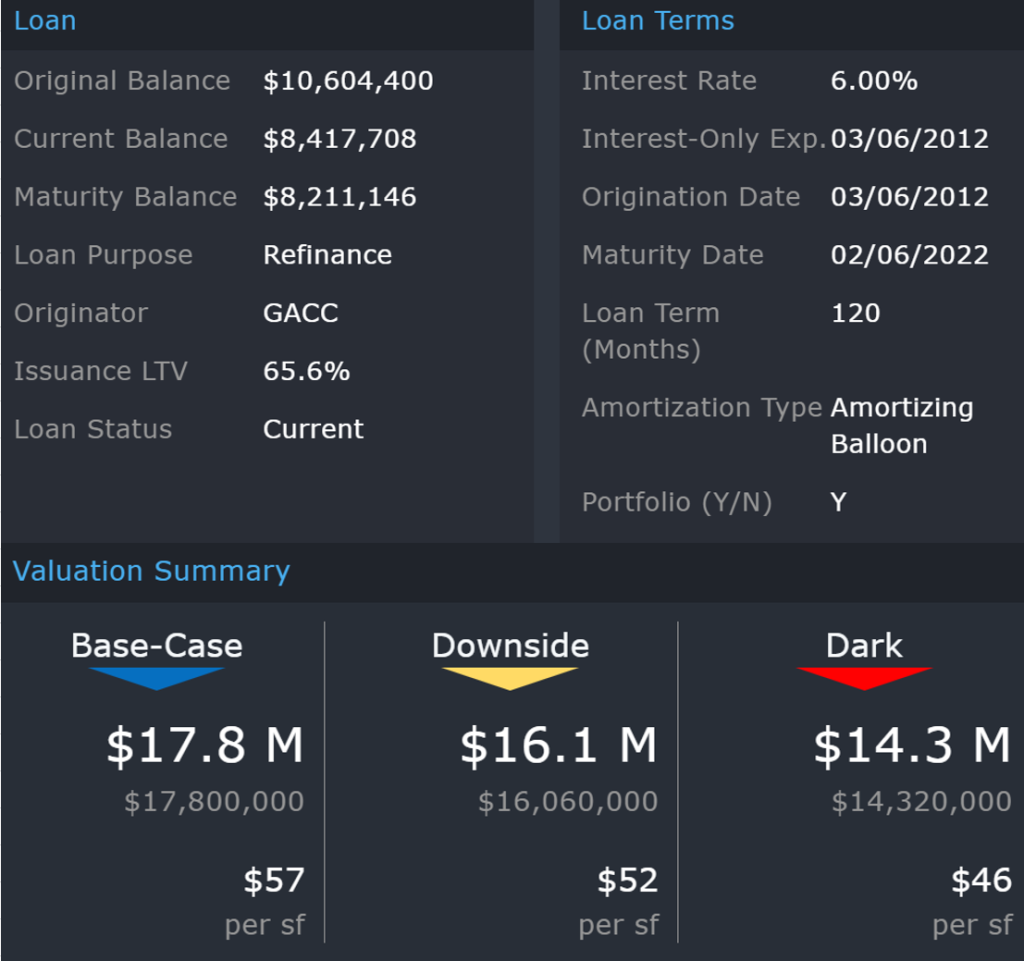

North Oaks

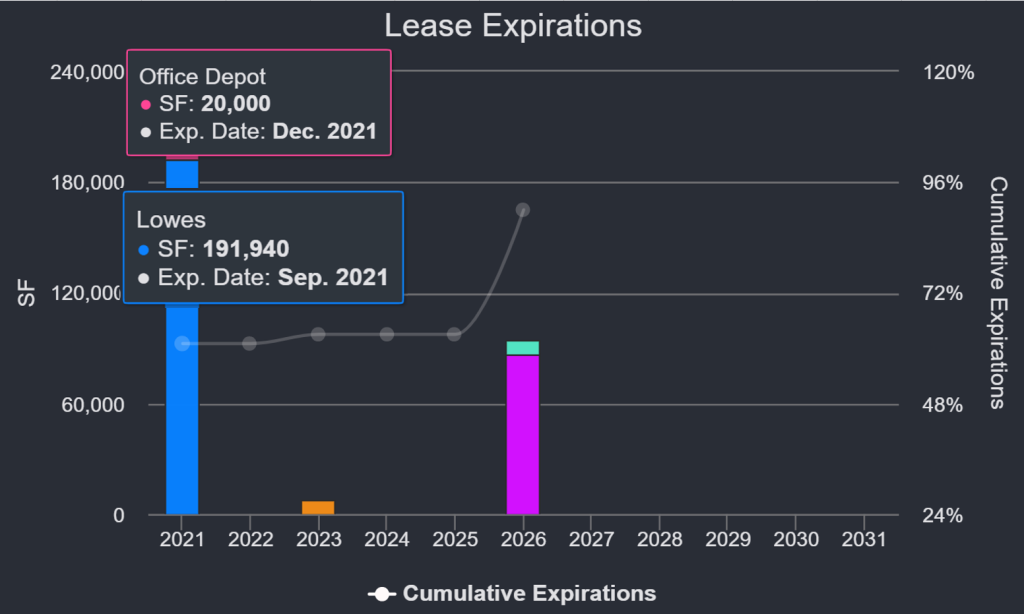

448,740 sf, Power Center, Houston, TX 77069

This property, which has outstanding debt of $23.7 million, has been with the special servicer since June 18, 2020, and title to the property transferred to LNR on June 1, 2021. The retail center is located in northwest Houston and is anchored by a Hobby Lobby with a lease, accounting for 12.5% of the GLA, that is scheduled to expire on August 31, 2021. The owner of the former loan sponsor, Nate Paul of World Class Capital Group, has been embattled in bankruptcies and legal proceedings; however, the North Oaks center has also struggled with occupancy, which was last reported to be 72% at the end of 2019. Notably, TJ Maxx vacated in 2019 in favor of a new location at a neighboring shopping center. Special servicer commentary stated the property is not yet listed for sale. For the full valuation report and loan-level details, click here.

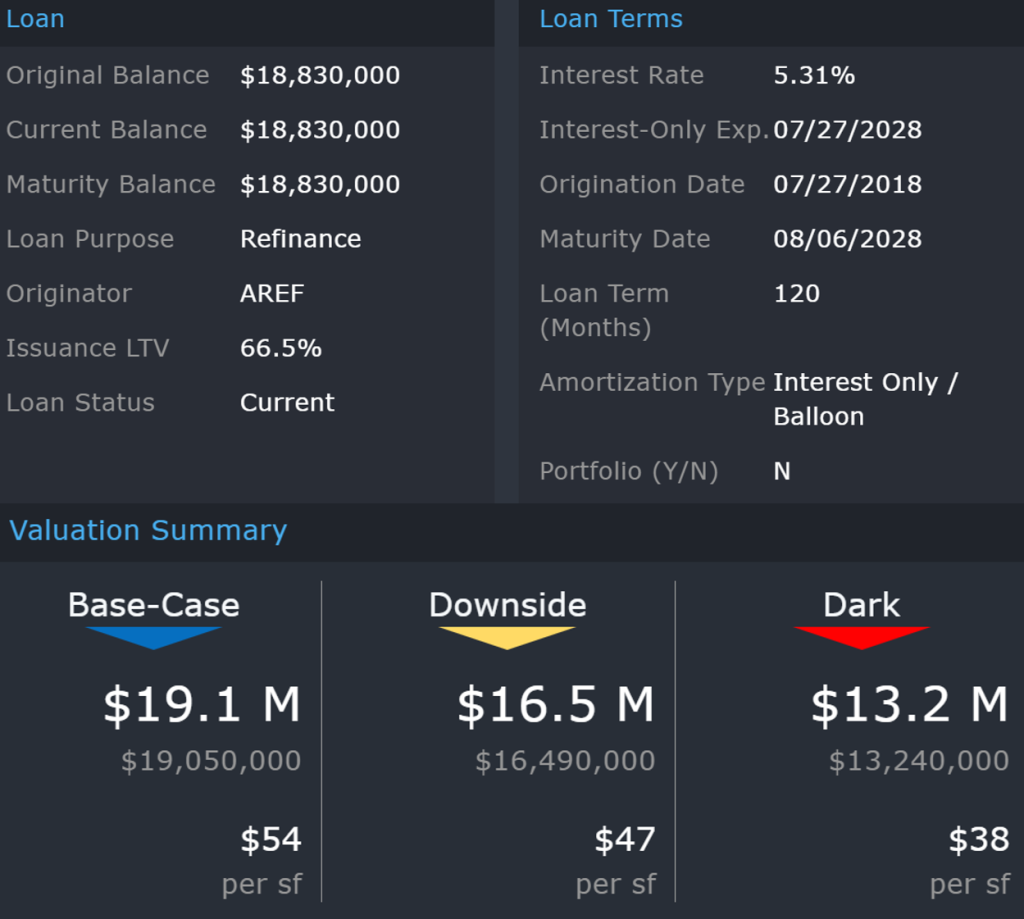

Portsmouth Station Shopping Center

147,104 sf, Strip Center, Manassas, VA 20110

This property, which has outstanding debt of $18.5 million, has been with the special servicer since June 18, 2020, and became REO just over a year later on June 25, 2021. The retail center is located in northern Virginia, approximately 50 miles west of Washington, DC and is anchored by a Regency Furniture store with a lease, accounting for 31% of the GLA, that is scheduled to expire in 2030. Regency Furniture backfilled a former Toys “R” Us location, which closed following the company’s bankruptcy and liquidation. The property is 78% occupied and special servicer commentary stated the property is not yet listed for sale. For the full valuation report and loan-level details, click here.

Brettwood Village Shopping Center

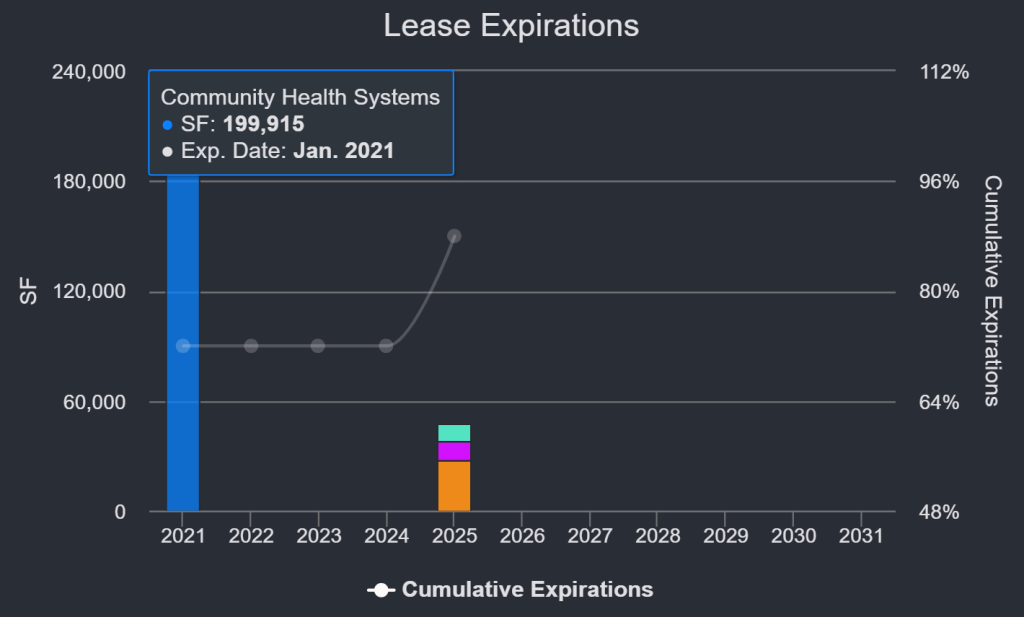

205,180 sf, Retail Center, Decatur, IL 62526

This property, which has outstanding debt of $9.2 million, has been with the special servicer since May 21, 2020, and a deed-in-lieu of foreclosure agreement was finalized on June 2, 2021. The retail property is located in central Illinois and is anchored by a Kroger supermarket, accounting for 28% of the GLA, with a lease that is scheduled to expire in April 2026. The property is 64% occupied following the departure of several tenants over the past few years, including TJ Maxx, American Furniture Group, Dollar General, and Payless ShoeSource. Special servicer commentary stated the property may be ready for sale by May 2022. For the full valuation report and loan-level details, click here.

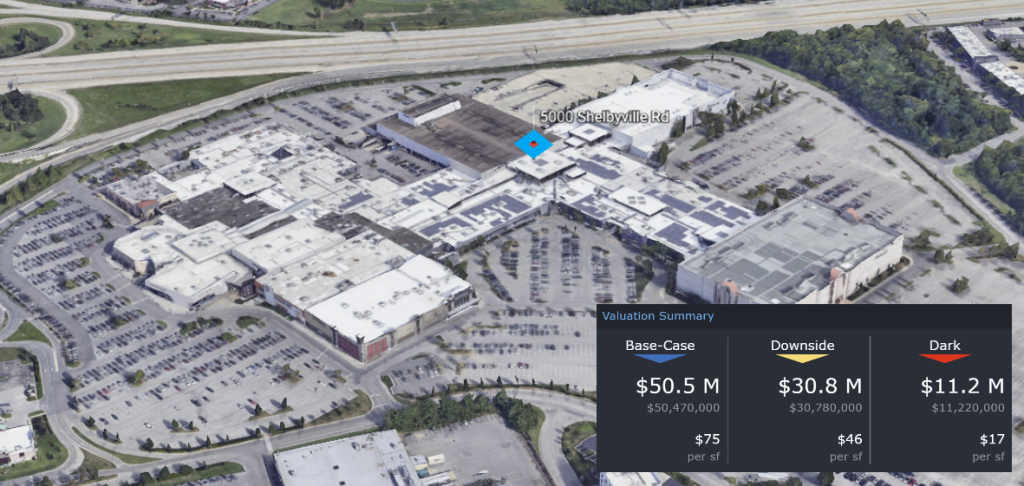

Market Square at Montrose

166,373 sf, Big Box Retail, Fairlawn, OH 44333

This property, which has outstanding debt of $5.4 million, has been with the special servicer since June 9, 2020, and title of the property transferred to LNR on June 30, 2021. The property consists of a leasehold interest in a big-box retail building located outside of Akron, OH. Ground rent for the property costs about $500,000 per year. A 42% portion of the building was occupied by Levin Furniture through December 2020 when the tenant vacated after bankruptcy issues related to affiliate Art Van Furniture. The other 58% portion of the building is leased to JCPenney through October 2027, which is coincidentally coterminous with the property’s ground lease. CRED-iQ’s Base-Case Valuation assumes the departure of JCPenney at lease expiration and the reversion of the improvements to the ground lessor, resulting in little to no residual value for the property, unless the ground lease can be re-negotiated. For the full valuation report and loan-level details, click here.

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. For full access to our loan database and valuation platform, sign up for a free trial below: