About 30 Questions with CRED

Introducing CRED iQ’s Fireside Chat & Q&A Blog Series, an engaging new platform designed to spark meaningful conversations and deliver actionable insights for commercial real estate professionals. Each installment features candid, interview-style discussions with industry leaders, innovators, and experts, diving deep into the trends, challenges, and opportunities shaping the CRE & Technology landscape. Moderated by seasoned professionals, our fireside chats offer a relaxed yet structured format, blending personal stories, expert analysis, and practical strategies to inform and inspire.

A fireside Q&A with legendary Ed Dittmer.

Quick Background on Ed:

Edward Dittmer, CFA, is a commercial real estate executive with over 25 years of experience in acquisitions, underwriting, portfolio management, CMBS credit ratings, and research.

He began his career at GMAC Commercial Mortgage on August 2, 1999, as an ARM Analyst (1999-2001), later advancing to Senior Risk Consultant (2001-2004). From there, he served as a CMBS Surveillance Analyst at Realpoint LLC (2004-2006), followed by a role as Assistant Vice President – Acquisitions Underwriter and Portfolio Manager at Capmark Investments’ Real Estate Equity Investment Group (2006-2009).

Dittmer then spent eight years at Morningstar Credit Ratings as Senior Vice President and Head of CMBS Credit Risk Services (2010-2018). In 2018, he joined DBRS Morningstar as Senior Vice President, North American CMBS, where he contributed to numerous CMBS ratings, property analysis criteria, and reports on CMBS & CRE CLO deals.

Since 2020, he has also been a Partner at Yonder MHP. Dittmer holds an MBA from The Ohio State University’s Max M. Fisher College of Business (1995-1998), a BA from American University (1991-1994), and attended Bradley University (1990-1991). His skills include CMBS, commercial real estate, real estate economics, valuation, investments, mortgage lending, asset management, portfolio management, project management, and disposition. He retired from DBRS Morningstar in mid-2024 and now lives in Portugal with his wife, Natalia, embracing a new phase of life after a fulfilling career.

1. What do you think of the trends in the office sector?

A lot of the damage in office has been done, but I would just be cautious about deciding that everything is in the past. We still aren’t through the renewal cycle so you have to keep a watch on what is coming up. Buyers who have cash are stepping up to acquire good quality properties at significant discounts and those are going to be the players that clean up. One other note. I know San Francisco has gotten its share of flack over the past couple of years. But the AI boom is real. And it’s not just data centers. A company with something viable in the AI space can get VC money and they are starting to become the new players in that market.

2. Has the current market caused you to think differently about any property types?

Multifamily was pretty badly overbuilt and the players in the space had some pretty lousy business plans. So it’s really been beaten up. But there is still housing demand and one thing has really moved which is the cost to own. One of my favorite measures is the housing affordability gap, the monthly cost of the monthly payment versus the average rent in various markets and submarket. Ongoing demand for for-sale housing combined with the higher interest rates have pushed a lot of markets in favor of renting over buying. I think the next wave of graduates is looking at renting as their only option because it just takes a lot to buy right now.

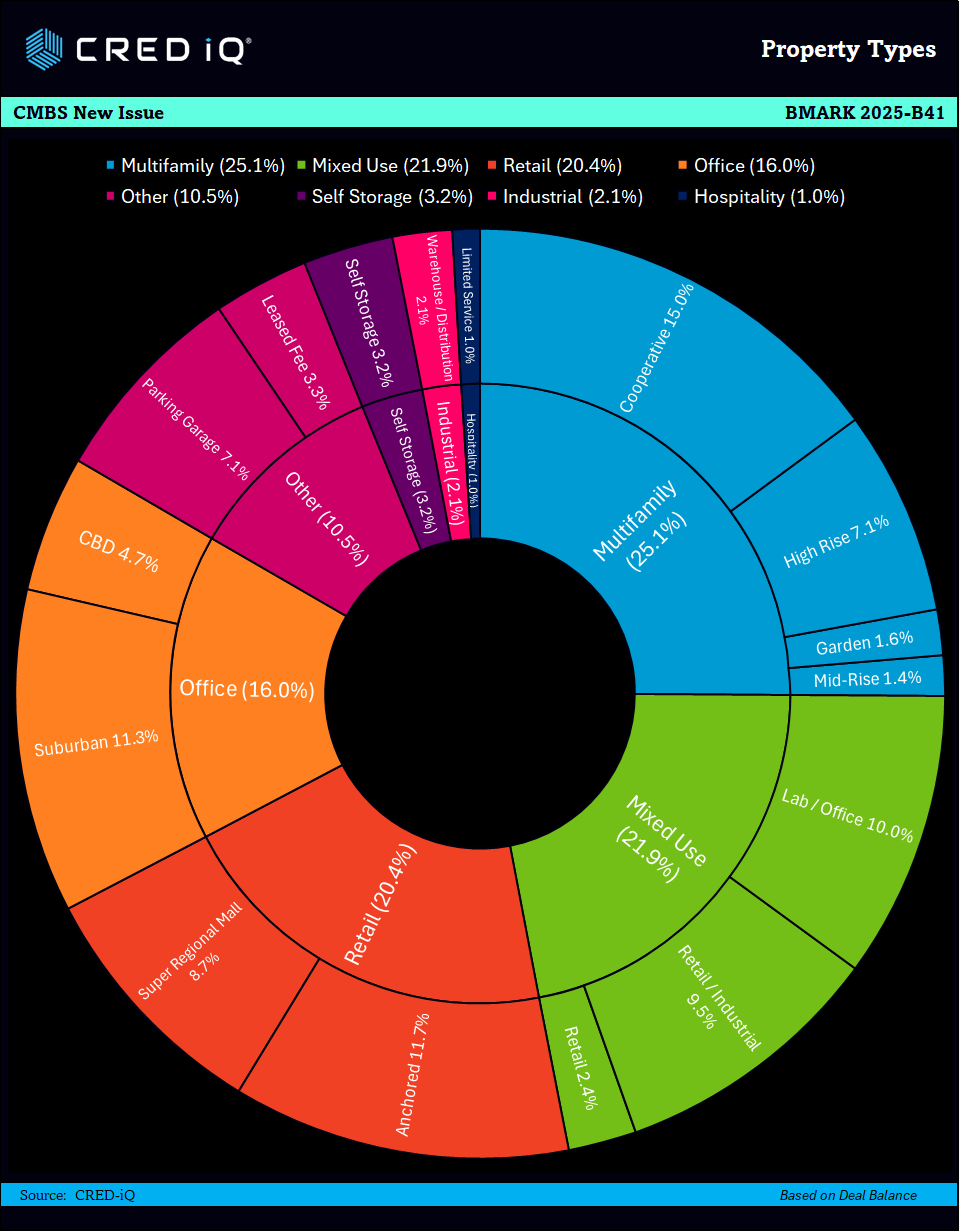

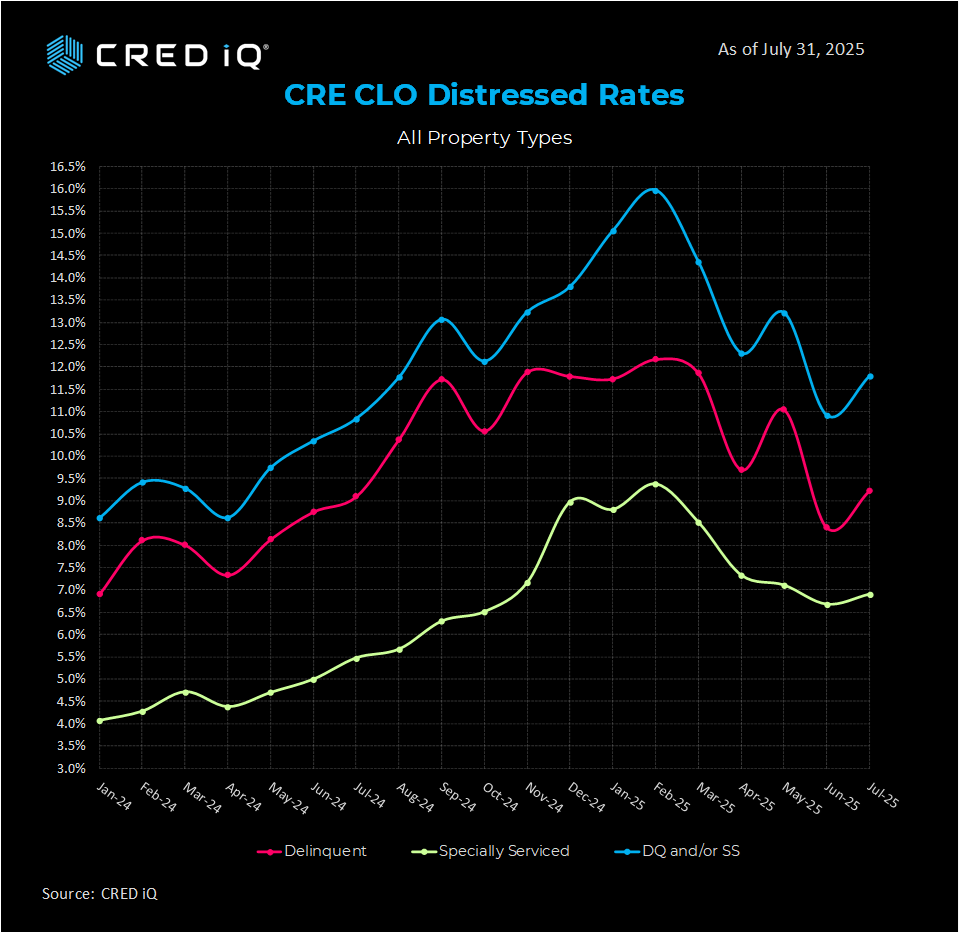

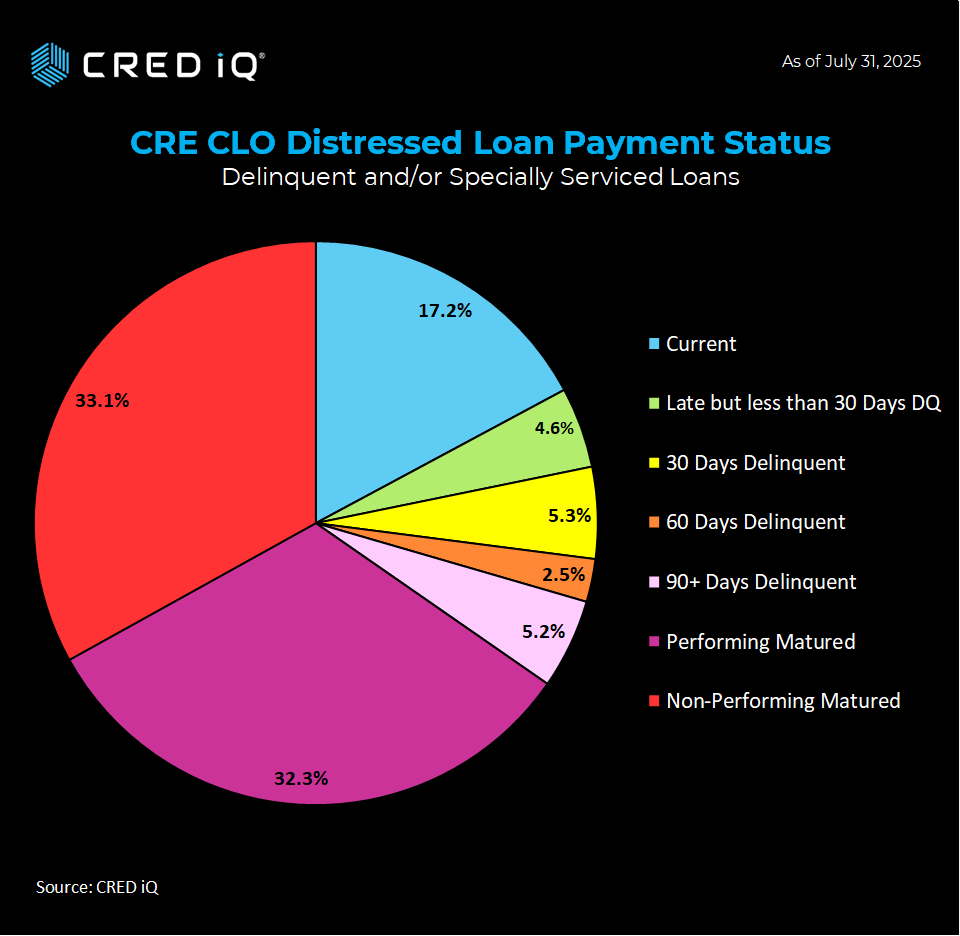

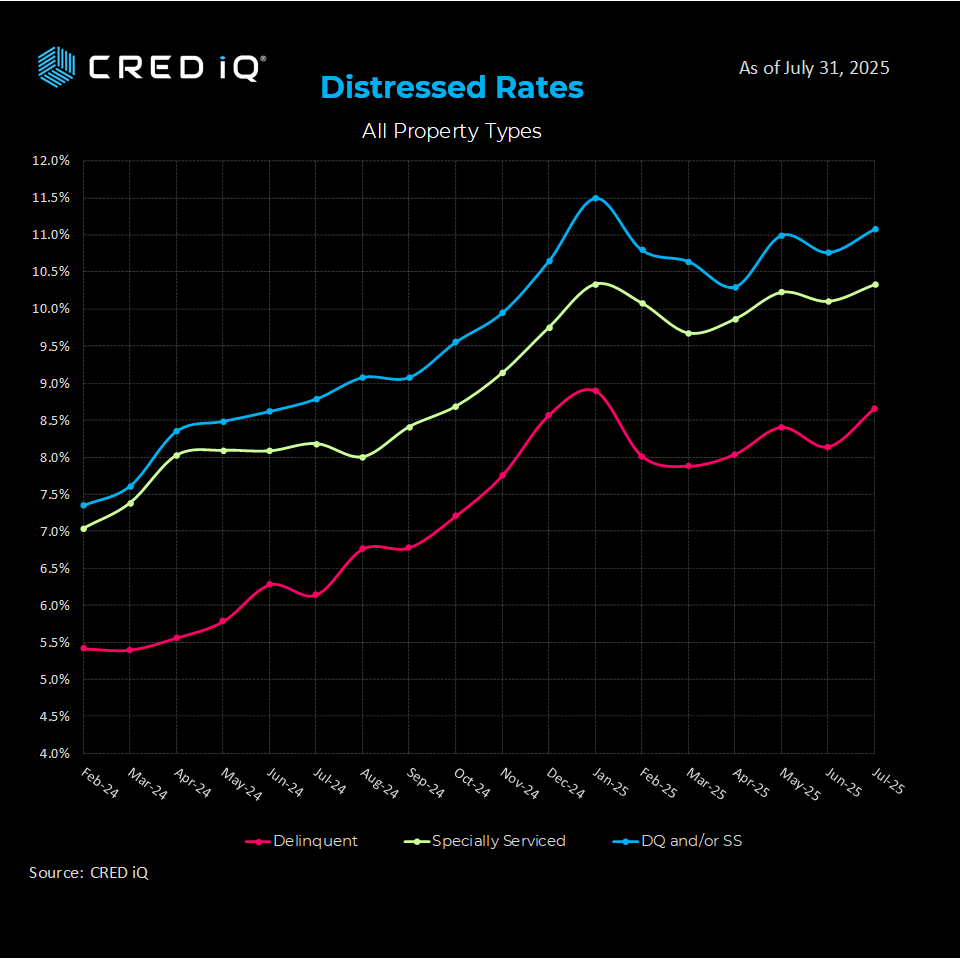

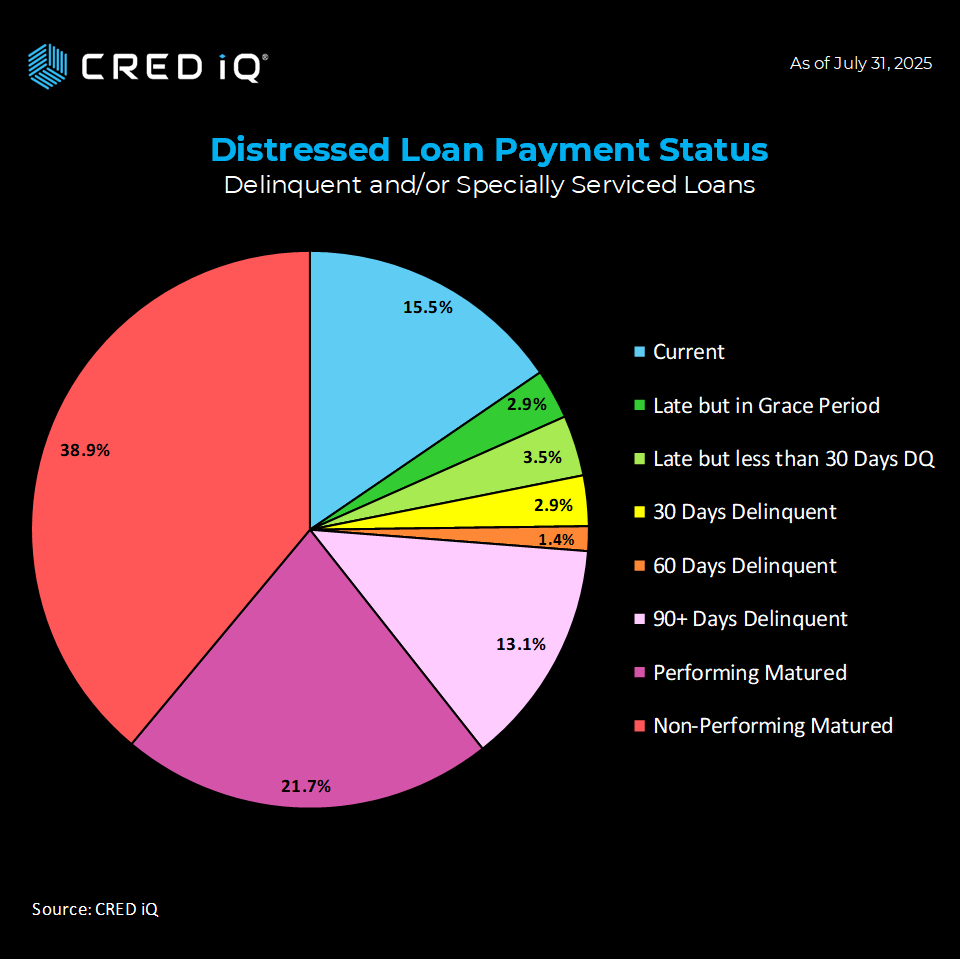

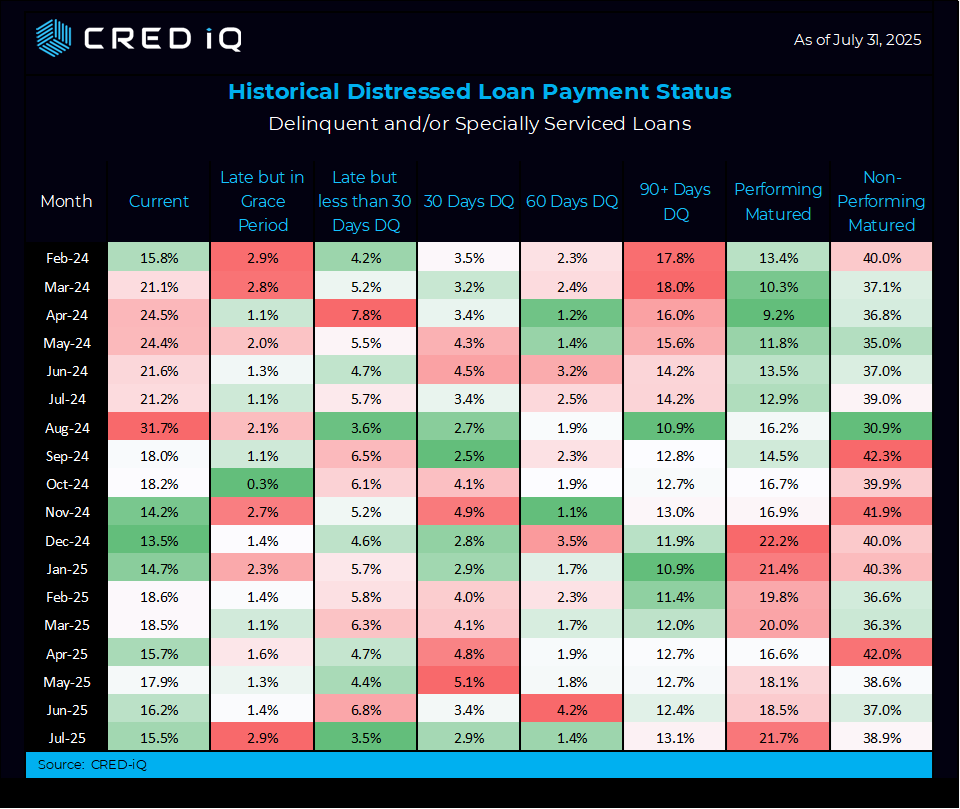

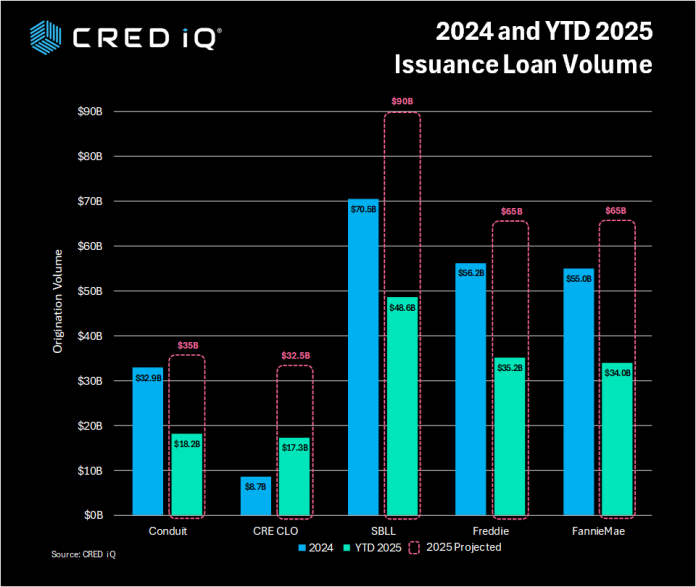

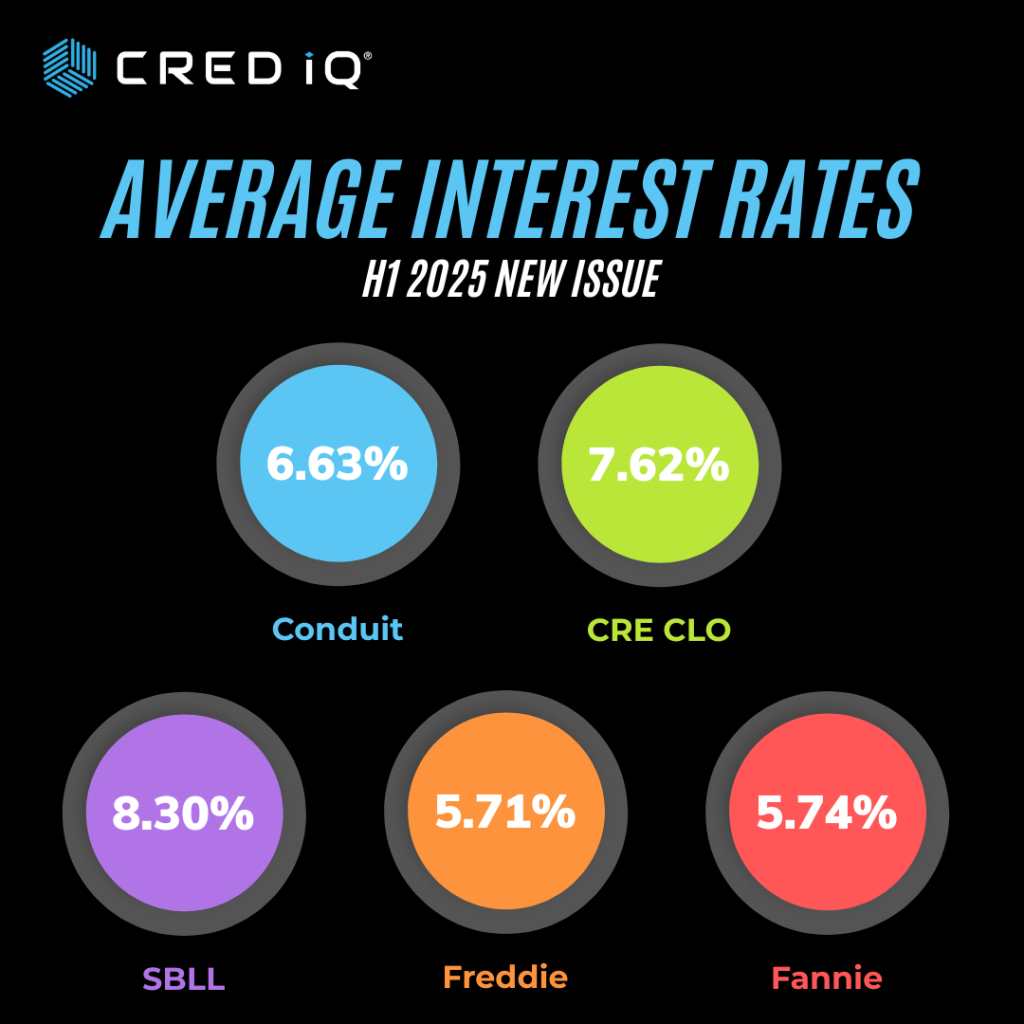

3. The CRE CLO ecosystem has shown some impressive growth with the demand of shorter-term loans being in heavy demand. How do you think about the CMBS market outlook over the next 12-24 months?

CMBS will be a stable outlet for borrowers to get the cash they need whether they need short-term floating rates or longer-term fixed rates. It makes sense that CLO issuance is back because a lot of players need to get financing and they are willing to make a bet on short-term rates coming down over the next year. I guess I would be concerned if borrowers need to win that bet for their business plan to pan out. If you like the deal at today’s rates, you’ll be thrilled if they come down over the next couple of years. But if a deal doesn’t work without rates coming down, then it doesn’t work.

4. What is keeping you up at night?

Same thing as it always is. When everything seems to be clicking and the money starts to flow easily, everyone thinks they are the smartest person in the room. And when you think you can’t screw up, that’s when you start to make mistakes. And to add a bit to the last question where I talk about betting on interest rates, an old boss of mine used to say “I make investments, I don’t make bets”. There may be people who are still making bets on one thing or another.

5. Any thoughts with respect to how AI will impact CRE and CRE Finance?

A lot of CMBS could probably use an AI intervention. But it won’t get one because everyone wants to think they add so much value. So when a human makes a typo, it’s not a big deal. If AI makes a mistake, people are screaming “See its not perfect!” So we will trudge along with voluminous spreadsheets for a while longer. In the near future, there will be companies that are using AI for client screening and monitoring. And they’ll probably do a really good job. They just have to compete with someone who says “My dad built half of this city lending money over an empty apple barrel.”

6. How are you feeling about private credit financing vs. traditional lending.

Traditional CMBS or bank lending? I think borrowers still chafe at having to produce all of their proprietary information to the markets for CMBS lending. That whole notion of “the borrower experience” is something that has always been a bit of the thorn in people’s side. And banks and life companies are often constrained by their own internal credit metrics. If private credit can fill the gap, that’s a good thing. They can be flexible, they can work with borrowers to create the right product and be creative.

7. Can you give us something on the property type that a lot of people are talking about these days, data centers?

I posted not too long ago on my LinkedIn about data centers. They are here and they are here to stay. But I do think that we, as an industry, has to become educated on what they are and how they make money. Last week someone in the UK suggested that people should delete e-mails as a way of conserving water and energy and, of course, that’s not how these things work.

In the way I talked about VC’s throwing money at anything AI and not long ago it was anything with crypto, I think a lot of people will call something a “data center” and hope that people throw money at it. We also have to come to terms with the costs. Are consumers going to get saddled with the costs of building out grids to accommodate the power or dealing with outsized water needs? Will communities be ok with that? Because data centers produce good income and good property tax, but jobs are a lower-level output once they are up and running.

8. Where do you think interest rates will be at year-end?

Short term rates will be marginally lower. I really think the Fed wants to sit on this because they haven’t seen a big slowdown and the impact of tariffs on prices is yet to be seen. I personally find it hard to believe there will be no increase in prices and, if that’s the case, I expect longer term yields to remain in the same range.

9. How do we solve the housing crisis? Does the federal government need to play a key role?

How much more of a role should the Federal government play? It’s got the Federal Home Loan Banks and the agencies which keep lending flowing. It has low down payments through FHA loans and a lot of first-time homebuyer benefits. If you want the cost of housing to come down, you’re going to have to build housing. And you can either get over the angst about sprawl and build homes in the burbs or you can get over the angst about density and build more homes per acre.

10. Any sense of AI’s impact upon office demand?

Automation didn’t reduce the need for offices over the long term. It just changed the people in them. You got rid of typists and put IT techs in their instead. Some really old buildings couldn’t adapt and being used for low-rent Class C alternatives, being converted to housing, or frankly sitting in foreclosure somewhere. You’ll probably see something similar where older buildings that are less flexible and scalable physically might not adapt to the types of jobs we will need in 10 years. They will be the losers.

11. On a scale of 1-10 what will be the impact of tariffs upon the warehousing segments?

I think for a lot of players it’s been pretty good. Bonded warehouses near the ports have been sitting on billions of dollars in goods that were imported with the hopes that tariffs will come down so they can release them. Over the long-term I think you have to believe that consumers will stop buying stuff for distribution centers to go away. Whether the buy something made in China or Mexico or Wisconsin, modern logistics practices will still require warehouses to get product and supplies from Point A to Point B. Now if tariffs really take a bite on imports, maybe there will be a bit of a reduction in demand for space near the ports.

12. How will we be thinking about co-working in two year? From a aggregate perspective will this segment see growth in overall square footage?

I have a confession to make. Five years ago, there was no one on earth who disliked coworking as much as I did. The players in the space were overhyped, they were amazingly expensive in my mind and I just didn’t see the need for that much. The Covid hit, and instead of sitting in my house, I rented a co-working space in Philly. And I really enjoyed it.

Now that the space has been pared down, a lot of the companies that are doing it are often connected to leasing brokers instead of competing against them, I kind of like it. I think there is room for it in the ecosystem. I think that, priced well, it can really give people that feel of being “at work”. And the way they work with businesses today is a setup for growth into real leased space, rather than managed space.

13. What is your outlook on traditional malls as a potential investment?

I don’t think about them. Look, I know Macerich just bought a mall. That’s a decent property that’s in a good corridor and has been re-tenanted to a large extent. Good on them. CBL just bough four malls from Washington Prime which, frankly, is picking a corpse clean. But realistically, there are going to be a handful of destination centers that already have owners. There are going to be hybrid high-end mall/lifestyle centers in the market. But traditional malls are hard to see as a financeable or investible asset class outside of a handful of exceptions.

14. With Apartment construction at a decade low, how do you feel about multifamily unit pricing trends over the coming 18 months?

Every forecast I see is for some improvement and it’s hard to disagree. I think for the most part, absorption is going to start improving in a lot of markets where development activity has cratered. How fast the pricing will come around will probably depend a ton on long-term interest rates. But I think 2026 will start to bring some measurable improvement for multifamily.

Fun Facts About Ed Dittmer

- Favorite food? Grilled ribs, normally I’d say pizza, but it’s been a while since I had a decent pie.

- Best Sports movie of all time? Eight men out, I love history and it’s a good historical film.

- Name the last three books you read? Ones you didn’t finish don’t count. I’ve been doing a lot of audiobooks in foreign languages just to not lose it. So last three were 1984, Man in The High Castle, and another Philip K. Dick work called The Three Stigmata of Palmer Eldritch

- What is your favorite quote from the movie Airplane? When Kareem breaks the fourth wall and yells at Joey “Listen, kid! I’ve been hearing that crap ever since I was at UCLA. I’m out there busting my buns every night! Tell your old man to drag Walton and Lanier up and down the court for 48 minutes” Its just this wildly unexpected movie moment.

- New TV shows have been pretty bad lately. What are your thoughts there? I literally do not have cable TV. I watch some movies. My wife, who really had no exposure to it, had me watching a 25 hour documentary of the OJ Simpson trial so she could really understand what it was about.

- What was your first aol screen name or email? dittmer4. That was my login at Ohio State for my email and I just rolled it over.

- Who’s the best person to follow on Twitter / X? I’m more of a Reddit guy, personally. But if logging into Twitter RadioFreeTom, Tom Nichols, he’s a Russia expert and former professor of military strategy, Noahpinion, Noah Smith, he’s often got some interesting stuff. Other than that, I might search for cat videos to show my wife.

- Best Golf Course ever played? I have only played golf once, in Sicklerville, NJ.

- Name the person (present, historical or even fiction) you’d love to have dinner with? Julius Caesar, he seemed like a pretty bright guy

- What’s the best city in the USA? Chicago is really awesome

- What is a really solid life lesson that you’d teach others? Don’t get outworked. It’s the one thing you can control. You may be outsmarted, but don’t be outworked.

- Insta, LinkedIn, twitter, facebook or old school texts or phone calls? Texts. I don’t have Instagram, I don’t think I’ve sent a tweet in two years, and I may post on Facebook once every three months.

- What’s your go-to happy hour drink at a networking event? I’ve only had it once since I stepped away last year, but Sapphire, Club Soda, tall glass, single-shot, lime

- What’s your favorite professional sports team? And then college team? With college, there’s no question, I’m all Ohio State. Pros I’ve got a few loyalties.

- Name something you’re secretly proud of that not a lot of people know? My career started as a temp worker at GMAC Commercial Mortgage, doing filing because I couldn’t land a job. I did ok for a guy that no one thought was worth hiring.

- Are you a Swiftie? Like Taylor Swift? I really know very little about her.

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.