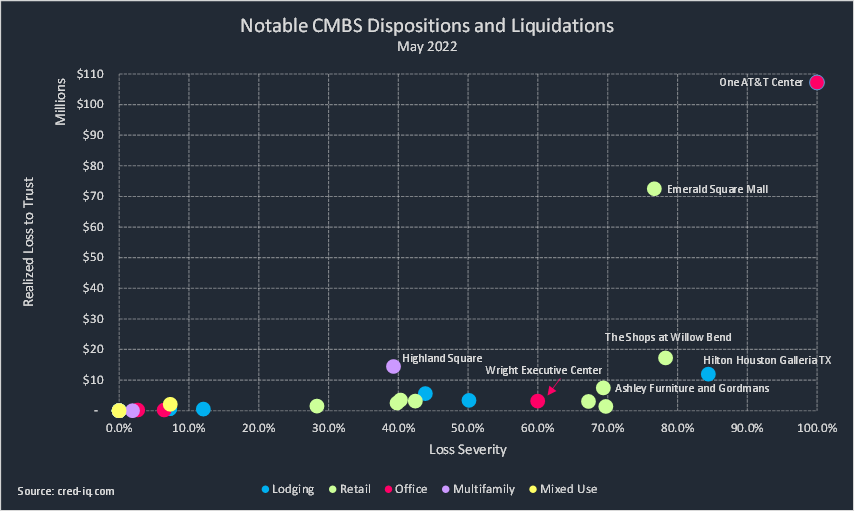

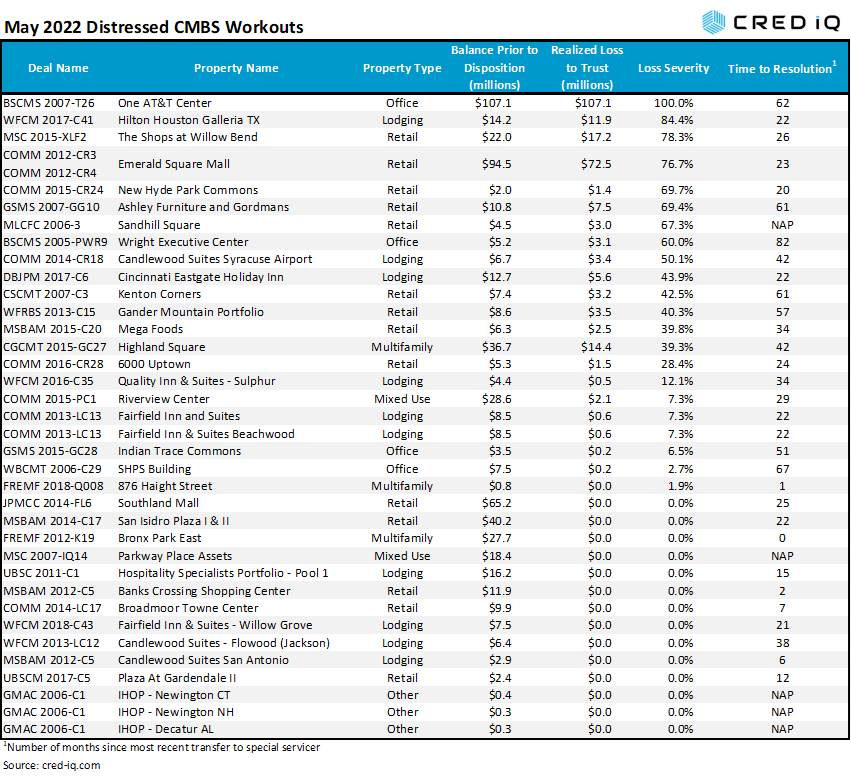

CMBS conduit and SBLL transactions incurred approximately $263 million in realized losses during May 2022 through the workout of distressed assets. CRED iQ identified 34 workouts classified as dispositions, liquidation, or discounted payoffs in May 2022. Additionally, there were two distressed loans securitized in Freddie K transactions that were in need of a workout, but only one of those loans incurred a nominal loss. Of those 36 total workouts, there were 14 distressed assets that were resolved without a loss. Loss severities for the month of April ranged from 2% to 100%, based on outstanding balances at disposition. Total realized losses in May represented more than a threefold increase compared to April’s realized loss totals of approximately $75 million.

Retail properties represented the highest number of distressed workouts this month with 14. There were 10 distressed workouts involving lodging properties. Together, these two property types account for 67% of the total number of distresses CMBS workouts.

One AT&T Center represents the largest loss, by total amount and severity, among all distressed workouts this month. The property was foreclosed on in 2017 after its sole tenant, AT&T, vacated at lease expiration. The 1.2 million-sf office tower sold for $4.1 million, equal to $3/sf, in May 2022 after spending approximately five years in special servicing. The REO asset was liquidated with a 100% loss severity on $107.1 million in outstanding debt prior to disposition.

Another notable distressed workout was the disposition of the $94.5 million Emerald Square Mall loan, which is secured by a 564,501-sf portion of a super-regional mall in North Attleboro, MA. The mall was formerly controlled by Simon Property Group but went into receivership shortly after the loan transferred to special servicing in September 2020. After a nearly two-year workout, the loan was resolved with a 77% loss severity, resulting in $72.5 million in principal losses to CMBS certificate holders. Emerald Square Mall represented the second-highest individual realized loss by total amount and the fourth highest by loss severity.

Excluding defeased loans, there was approximately $5.2 billion in securitized debt that was paid off or worked out in May, which was lower than $6.1 billion in April 2022. In May, 11% of the loan resolutions were categorized as dispositions, liquidations, or discounted payoffs, which was slightly higher than the prior month. An additional 15% of the loans paid off with prepayment penalties.

By property type, office had the highest total of outstanding debt paid off in May. The high volume of office payoffs was driven by the retirement of a $1.3 billion mortgage secured by Blackstone’s 27-property BioMed Realty portfolio. Lodging and multifamily loans also had a high volume of payoffs and dispositions.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform designed to unlock investment, financing, and leasing opportunities. CRED iQ provides real-time property, loan, tenant, ownership, and valuation data for over $2.0 trillion of commercial real estate.