SS = All specially serviced CMBS loans in the conduit and SASB universe, including current, delinquent and REO

DQ + SS = All distressed CMBS loans in the conduit and SASB universe that are delinquent, specially serviced, or a combination of both

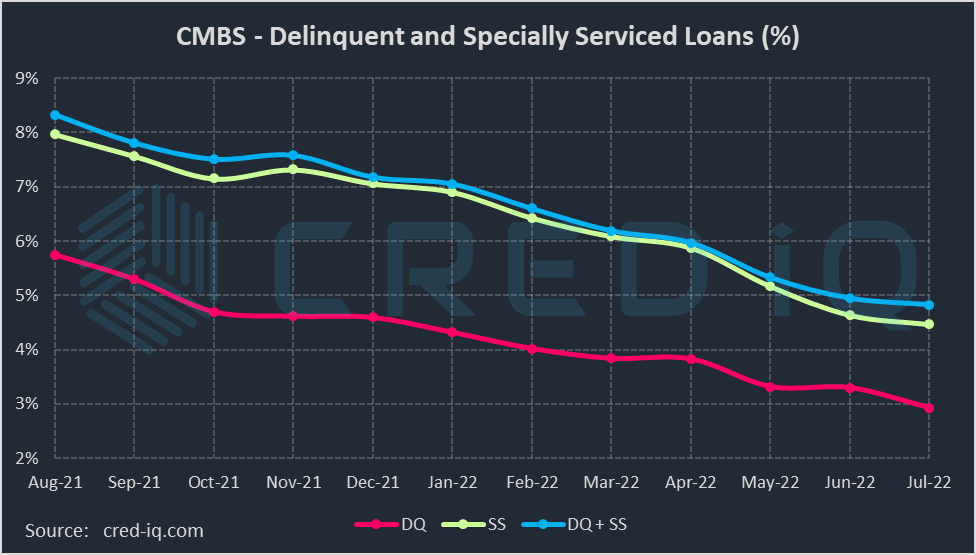

The CRED iQ delinquency rate for CMBS declined by 37 bps during the July 2022 remittance period. Overall delinquency has continuously declined since June 2020 when the rate was at its COVID-induced high of 10.66%. This month, the delinquency rate, equal to the percentage of all delinquent specially serviced loans and delinquent non-specially serviced loans, for CRED iQ’s sample universe of $500+ billion in CMBS conduit and single asset single-borrower (SASB) loans was 2.93%, which compares to last month’s rate of 3.30%. CRED iQ’s special servicing rate, equal to the percentage of CMBS loans that are with the special servicer (delinquent and non-delinquent), declined month-over month to 4.47% from 4.64%. The CMBS special servicing rate has declined for eight consecutive months. Aggregating the two indicators of distress – delinquency rate and special servicing rate – into an overall distressed rate (DQ + SS%) equals 4.83% of CMBS loans that are specially serviced, delinquent, or a combination of both. The overall distressed rate declined compared to the prior month rate of 4.95%. These distressed rates typically track slightly higher than special servicing rates as most delinquent loans are also with the special servicer.

SS = All specially serviced CMBS loans in the conduit and SASB universe, including current, delinquent and REO

DQ + SS = All distressed CMBS loans in the conduit and SASB universe that are delinquent, specially serviced, or a combination of both

By property type, the delinquency rate declined in July across all sectors with delinquency cures totaling over $2 billion by outstanding balance. Delinquency cures were led by loans secured by lodging properties. The lodging sector exhibited the sharpest month-over-month decline in delinquency with a rate of 4.34%, which was 58% lower than the prior month. More than half of the loans with delinquency cures in July, based on outstanding balance, were secured by hotels. One of the largest lodging delinquency cures was the $134.5 million Marriott LAX loan, which is secured by a 1,004-room hotel adjacent to the Los Angeles International Airport. The loan has had issues staying current after a February 2022 modification agreement but returned to the master servicer in June 2022 after nearly a year and a half in special servicing.

A pair of maturity defaults were highlights among newly delinquent loans in July. First, a $57.5 million loan secured by a 575,359-sf portion of the Greenwood Mall in Bowling Green, KY failed to pay off on its July 5, 2022 maturity date. Updated servicer commentary indicated loan sponsor Brookfield Property Partners was in the process of a sale of the loan collateral. Second, a $25.4 million loan secured by 989 Sixth Avenue — a 105,555-sf office building in Midtown Manhattan, NY — failed to pay off at maturity on July 10, 2022. The property’s performance has been hampered by low occupancy, which was most recently reported as 40% as of December 2021.

Special servicing rates also declined across all major property types this month, although the velocities of the declines were more subdued than delinquency improvements. The majority of special servicing cures were loans secured by lodging properties. The lodging special servicing rate declined to 7.49%, compared to 7.72% in the previous month. One of the largest special serving cures during the July remittance period was the $155 million Hilton Garden Inn W 54th Street loan, secured by a 401-key hotel in Manhattan, NY that was temporarily closed for a short time due to COVID. The loan transferred to special servicing in May 2020 but returned to the master servicer in June 2022.

CRED iQ’s CMBS distressed rate (DQ + SS%) by property type accounts for loans that qualify for either delinquent or special servicing subsets. This month, overall distressed rates for all property types declined. The distressed rate for retail was the highest by property type for the fourth consecutive month with a rate of 9.18%. Two of the more notable loans added to the distressed category this month, both via transfers to special servicing, were West Covina Village — a $36 million loan secured by a 220,00-sf mixed-use (retail/office) property in West Covina, CA — and 4141 N Scottsdale — a $24.9 million loan secured by a 147,864-sf office building in Scottsdale, AZ. For additional information about these two loans, click View Details below:

| [View Details] | [View Details] | |

| Loan | West Covina Village | 4141 N Scottsdale |

| Balance | $36,000,000 | $24,903,900 |

| Special Servicer Transfer Date | 7/8/2022 | 6/21/2022 |

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. Our data platform is powered by over $2.0 trillion of CMBS, CRE CLO, SBLL, and GSE Agency loan and property data.