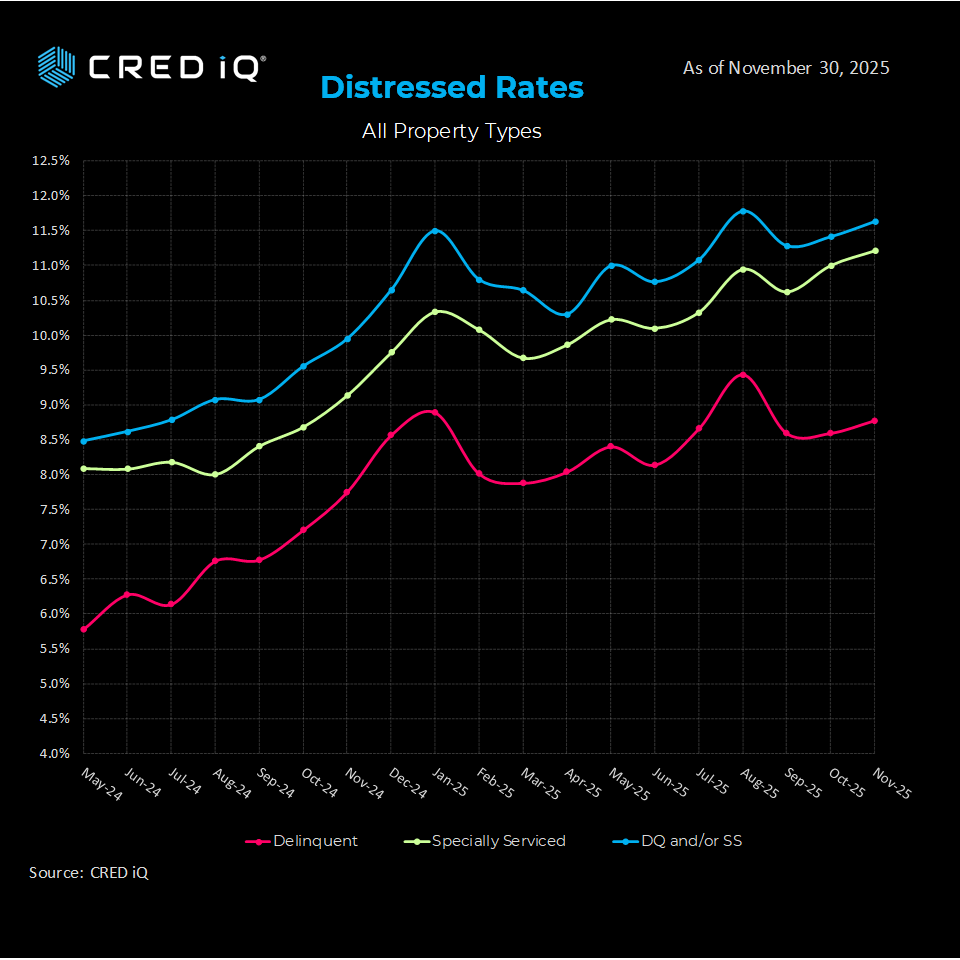

The commercial real estate (CRE) sector continues to face headwinds as the latest data from CRED iQ reveals a rise in distress metrics for November 2025. The CRED iQ Overall Distress Rate reached 11.63%, marking an increase from the previous month. This uptick underscores the persistent volatility in the market, driven largely by maturity defaults and sector-specific weakness.

The overall distress rate comprises loans that are either delinquent or specially serviced. For November, the Delinquency Rate stood at 8.78%, while the Specially Serviced Rate was notably higher at 11.21%. The gap between these two metrics suggests that a significant portion of loans are being transferred to special servicing for imminent default risks or modification discussions before they technically fall behind on monthly payments.

Office Sector Remains the Epicenter of Distress

Breaking down the data by property type, the Office sector continues to exhibit the highest level of stress, recording a distress rate of 17.55%. As remote work trends stabilize and lease rollovers occur in a high-interest-rate environment, office valuations face continued pressure.

Following Office, the Multifamily sector posted a distress rate of 10.80%, reflecting struggles with floating-rate debt and operating expense inflation. The Hotel sector also remains in double-digit distress territory at 10.33%, while Retail sits slightly lower at 9.08%. Conversely, niche asset classes continue to outperform; Industrial and Self Storage remain the most resilient sectors, with distress rates of just 1.90% and 0.15%, respectively.

The “Maturity Wall” in Focus

Perhaps the most telling statistic for investors and lenders lies in the payment status of distressed loans. The data highlights that the current distress cycle is overwhelmingly a story of refinancing risk rather than pure cash-flow insolvency.

Non-Performing Matured loans account for the largest share of the distressed universe, comprising 40.81% of all distressed loans. When combined with Performing Matured loans (17.91%), nearly 59% of all distressed CMBS loans are past their maturity date but have failed to pay off the balloon balance. This “maturity wall” indicates that while many properties may generate sufficient cash flow to cover debt service—evidenced by the 17.16% of distressed loans that are technically “Current” on payments—they are unable to secure refinancing in the current capital markets environment.

Outlook

For CRE investors and CMBS bondholders, the November data reinforces the need for careful credit monitoring, particularly in the Office and Multifamily heavy portfolios. With nearly 60% of distressed loans tied to maturity defaults, the market’s ability to clear this backlog will depend heavily on interest rate movements and the willingness of special servicers to extend or modify terms in the coming quarters.

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.

THE DATA, INFORMATION AND/OR RELATED MATERAL (“DELIVERABLES”) IS BEING OFFERED AS-IS/WHERE-AS CONDITION. CRED-IQ MAKES NO REPRESENTATION OR WARRANTY AS TO QUALITY OR ACCURACY OF SUCH DELIVERABLES BEING PURCHASED, WHETHER EXPRESS OR IMPLIED, EITHER IN FACT OR BY OPERATION OF LAW, STATUTE, OR OTHERWISE, AND CRED-IQ SPECIFICALLY DISCLAIMS ANY AND ALL IMPLIED OR STATUTORY WARRANTIES INCLUDING WARRANTIES OF MERCHANTABILITY AND OF FITNESS FOR A PARTICULAR PURPOSE, TECHNICAL PERFORMANCE, AND NON-INFRINGEMENT. WITHOUT LIMITING THE FOREGOING, YOU AS CUSTOMER ACKNOWLEDGE THAT YOU HAVE NOT AND ARE NOT RELYING UPON ANY IMPLIED WARRANTY OF MERCHANTABILITY OR OF FITNESS FOR A PARTICULAR PURPOSE OR OTHERWISE, OR UPON ANY REPRESENTATION OR WARRANTY WHATSOEVER AS TO THE DELIVERABLES IN ANY REGARDS WHATSOEVER, AND ACKNOWLEDGE THAT CRED-IQ MAKES NO, AND HEREBY DISCLAIMS ANY, REPRESENTATION, WARRANTY OR GUARANTEE THAT THE PURCHASE, USE OR COMMERCIALIZATION OF ANY DELIVERABLES WILL BE USEFUL TO YOU OR FREE FROM INTERFERENCE. BY ACCEPTANCE OF THE DELIVERABLES, YOU HEREBY RELEASE CRED-IQ AND ITS AFFILIATES AND AGENTS FROM ALL CLAIMS, DAMAGES AND LIABILITY ARISING HEREUNDER.