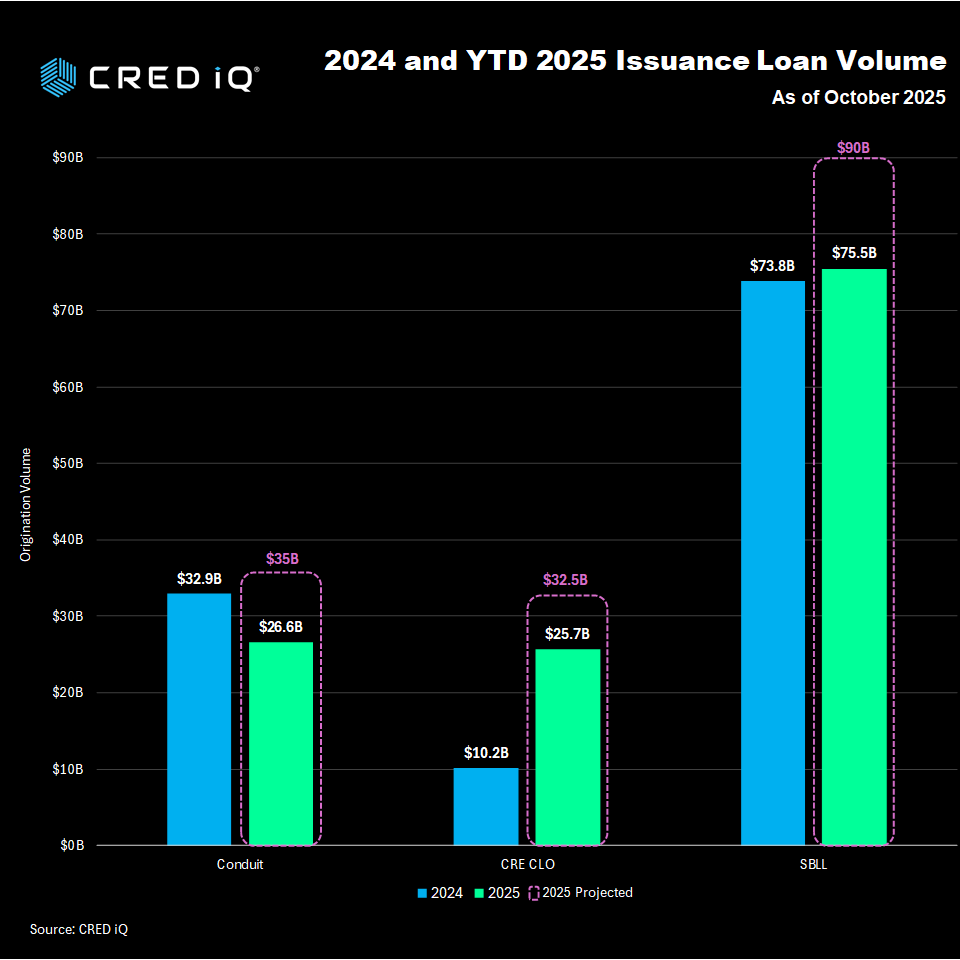

With less than two months left in 2025, commercial real estate securitization has already eclipsed the entire 2024 total. Year-to-date issuance through October across Conduit, Single-Borrower Large Loan (SBLL), and CRE CLO reached $127.72 billion — up 9% from the full-year 2024 volume of $116.95 billion.

Volume Breakdown

| Segment | 2024 Full Year | YTD Oct 2025 | YoY Change |

| Conduit | $32.9B | $26.6B | –19% |

| SBLL | $73.8B | $75.5B | +2% |

| CRE CLO | $10.2B | $25.7B | +152% |

| Total | $116.95B | $127.72B | +9% |

Segment Highlights

Single-Borrower Large Loan (SBLL)

SBLL continues to dominate, representing 63% of 2024 issuance and 59% so far in 2025. Trophy assets, portfolio refinancings, and large transitional properties keep driving mega-deals in the $500M–$2B+ range.

CRE CLO

The standout story of 2025: CRE CLO volume has surged more than 2.5× from the entire 2024 total. Floating-rate, transitional loans are back in demand as interest rates stabilize, and investors chase higher yields in a lower-rate environment.

Conduit

Traditional multi-borrower conduit deals are the only segment trailing 2024’s pace. Through October, volume sits at $26.6B versus $32.9B for all of last year. Heightened caution around office exposure and multifamily supply concerns have slowed the conduit pipeline, though agency-backed multifamily deals continue to provide a floor.

The Big Picture

The shift is clear: capital is rotating decisively into SBLL and especially CRE CLO structures. Investors and lenders are favoring larger, more concentrated executions and floating-rate product over diversified fixed-rate conduit pools — at least for now.

CRED iQ CRE Market Snapshot

Rates have eased significantly YoY: 10-Year Treasury 4.08% (-20 bps), 1M Term SOFR 3.98% (-68 bps), Fed Funds 3.75-4.00% (-100 bps). Inflation continues to cool (CPI 3.0%, Core PCE 2.9%).

Agency CMBS (Fannie/Freddie/Ginnie) jumped 35% to $122.5B, led by multifamily.

Cap rates held flat nationally at 6.3% (office 7.1%, multifamily 5.6%). CRE debt outstanding reached $6.2T (2Q25), with banks at 49%, agency 17%, life companies 12%, CMBS 11%.

2025 maturities total $957B (banks $452B, CMBS/CRE CLO $231B), with $4.8T looming through 2027+. Lending share in 1H25 shows CMBS rebounding to 21% (from 11% in 2023), while agency slipped to 20%.

Bottom line: Lower rates and strong CRE CLO/SASB activity are driving a clear issuance rebound heading into year-end.

CRED iQ tracks every loan in these transactions with daily surveillance, distress flags, and valuation updates. Log into the platform for full deal documents, servicer commentary, and property-level performance on the $127B+ issued YTD.

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.

THE DATA, INFORMATION AND/OR RELATED MATERAL (“DELIVERABLES”) IS BEING OFFERED AS-IS/WHERE-AS CONDITION. CRED-IQ MAKES NO REPRESENTATION OR WARRANTY AS TO QUALITY OR ACCURACY OF SUCH DELIVERABLES BEING PURCHASED, WHETHER EXPRESS OR IMPLIED, EITHER IN FACT OR BY OPERATION OF LAW, STATUTE, OR OTHERWISE, AND CRED-IQ SPECIFICALLY DISCLAIMS ANY AND ALL IMPLIED OR STATUTORY WARRANTIES INCLUDING WARRANTIES OF MERCHANTABILITY AND OF FITNESS FOR A PARTICULAR PURPOSE, TECHNICAL PERFORMANCE, AND NON-INFRINGEMENT. WITHOUT LIMITING THE FOREGOING, YOU AS CUSTOMER ACKNOWLEDGE THAT YOU HAVE NOT AND ARE NOT RELYING UPON ANY IMPLIED WARRANTY OF MERCHANTABILITY OR OF FITNESS FOR A PARTICULAR PURPOSE OR OTHERWISE, OR UPON ANY REPRESENTATION OR WARRANTY WHATSOEVER AS TO THE DELIVERABLES IN ANY REGARDS WHATSOEVER, AND ACKNOWLEDGE THAT CRED-IQ MAKES NO, AND HEREBY DISCLAIMS ANY, REPRESENTATION, WARRANTY OR GUARANTEE THAT THE PURCHASE, USE OR COMMERCIALIZATION OF ANY DELIVERABLES WILL BE USEFUL TO YOU OR FREE FROM INTERFERENCE. BY ACCEPTANCE OF THE DELIVERABLES, YOU HEREBY RELEASE CRED-IQ AND ITS AFFILIATES AND AGENTS FROM ALL CLAIMS, DAMAGES AND LIABILITY ARISING HEREUNDER.