CRED iQ tracked over $85 billion in multifamily originations for year-to-date 2022, including loans that were securitized in Fannie Mae, Ginnie Mae, Freddie Mac, and CMBS conduit transactions. As a data, analytics, and valuation partner to the commercial real estate community, CRED iQ helps CRE professionals uncover financing, leasing, and investment opportunities. One of our many solutions is identifying the most active markets for loan originations. The highest volume of loan originations is typically in the multifamily sector for any commercial property type on a yearly basis. According to the Mortgage Bankers Association, multifamily originations were up 24% year-over-year in Q2 2022 and up 18% in Q2 2022 compared to Q1.

Loans from Fannie Mae securitizations accounted for 41% of new originations by aggregate balance. CRED iQ included approximately $35.5 billion in Fannie Mae loan originations through August 2022 in observations. Through the first half of 2022, Fannie Mae issued approximately $34.7 billion in mortgage back securities, comprising of nearly 1,900 loans. The Washington, DC and Phoenix markets have dominated Fannie Mae issuance so far in 2022 with approximately $1.7 billion in multifamily originations for each MSA.

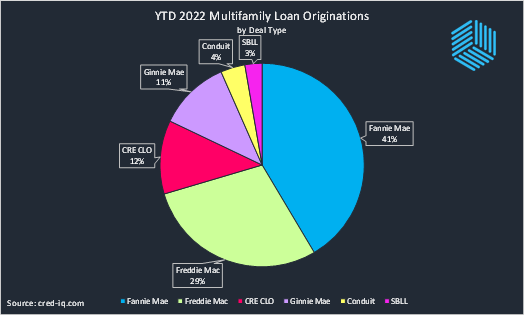

Freddie Mac securitizations accounted for 29% of YTD 2022 multifamily originations within the subset. New multifamily originations that were securitized in CRE CLO (12%), Ginnie Mae (11%), Conduit (4%) and Single Asset Single Borrower (3%) transactions made up the remainder.

Loan origination activity this year has been heavily concentrated in primary markets, which accounted for approximately 56% of total multifamily originations through YTD 2022. Loans secured by multifamily collateral in secondary markets made up 26% of new origination volume while loans secured by properties in tertiary markets made of 18%. Altogether, the 10 most active markets for 2022 multifamily originations accounted for 37% of total volume.

In total, the New York-Northern New Jersey MSA was the most active market with $4.7 billion in originations, accounting for 5.5% of aggregate loan origination volume. The Dallas-Fort Worth MSA was the second most active market with $3.9 billion in multifamily originations, accounting for 4.6% of the total. Phoenix (4.3%), Houston (4.0%) and Washington, DC (3.7%) rounded out the five most active multifamily markets for loan originations in 2022.

Notable secondary markets with the highest levels of origination activity included Columbus, OH (1.5% of total aggregate volume), Las Vegas (1.4%), Indianapolis (1.3%), Tampa (1.2%), and San Antonio (1.2%). Each of these secondary markets tallied over $1 billion in multifamily originations in 2022, between Fannie Mae, Ginnie Mae, Freddie Mac, and private-label CMBS securitizations. Comparing YTD 2022 origination activity to 2021, we find some common markets as leaders in volume. For example, San Antonio led all secondary markets in origination volume during 2021 and ranks fifth through August 2022. Conversely, Oklahoma City has the second highest volume of multifamily originations, among secondary markets, in 2021 but has failed to surpass the top 30 secondary markets so far in 2022.

For those interested in building lending pipelines into tertiary markets, the Ogden, UT, Dayton, OH, and Durham, NC markets were among the most active. CRED iQ tracked over $380 million in 2022 multifamily originations for each of these markets.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. Our data platform is powered by over $2.0 trillion of CMBS, CRE CLO, SBLL, Ginnie Mae, FHA/HUD, and Freddie Mac loan and property data.