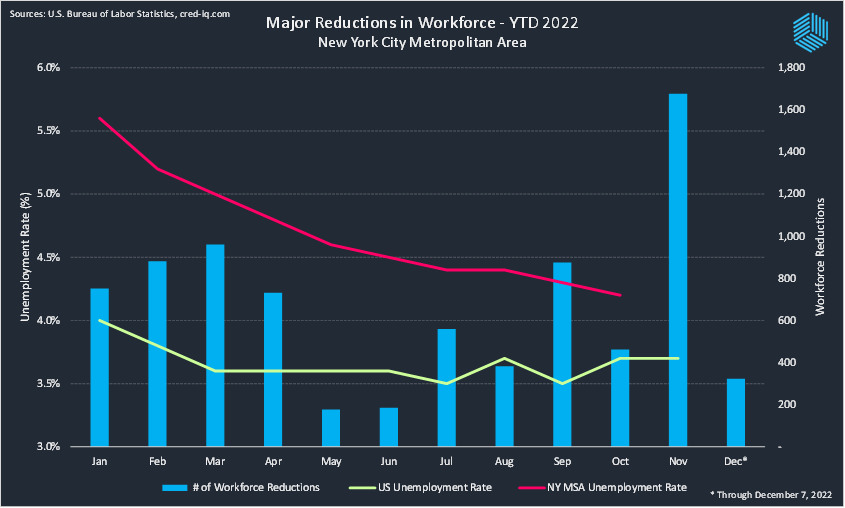

CRED iQ tracked major workforce reductions for the New York City metropolitan area through year-to-date 2022. A major workforce reduction is defined as a closing or layoff event that impacts 25 or more employees from a business that has more than 50 full-time employees. CRED iQ identified approximately 130 of these events, which have impacted nearly 8,000 employees from January 2022 through the first week of December 2022.

Most notable from our observations is a significant surge in workforce reductions in November 2022, when more than 1,600 employees were affected. On average, about 700 employees were impacted by workforce reductions per month. As such, the month of November exhibited activity that was more than two times greater than the monthly average. Overall, the number of employees impacted by workforce reductions is significantly higher when accounting for business with less than 50 full-time employees and events affecting less than 25 employees.

Large reductions in workforce are often sources of headline risk with the likes of Amazon, Facebook, Twitter, and Snap all making similar announcements in 2022 regarding a reduced workforce. However, the impacts of these events may not be evident through high-level labor statistics. The US unemployment rate, often considered a lagging indicator, has declined from 4% in January 2022 to 3.7% as of November 2022. On a more granular level, the unemployment rate for the New York City MSA has declined 25% from January 2022 (5.6%) through October (4.2%). With a large workforce reduction in September 2022 and the surge of reduction events in November 2022, it remains to be seen if the activity is enough to soften the unemployment rate for New York City MSA over time. Often, separation or closing dates are delayed by a few months and permanent reductions take time to bake into high-level statistics.

A more immediate impact may be seen in the commercial real estate industry. In theory, a reduction in workforce by a company can be followed by a reduction in the need for commercial space. CRED iQ identified notable CMBS properties that have been impacted, including 225 Park Avenue. Facebook occupied 266,460 sf of space at 225 Park Avenue, equal to 39% of NRA at the property, but the firm terminated its lease agreement in October 2022, five years prior to lease expiration in October 2027. The property secures a $235 million mortgage that matures in June 2027.

Another notable workforce event was Warner Media’s shuttering of its CNN+ platform in April 2022. CNN+ operated as a segment of Turner Broadcasting under the Warner Media umbrella with operations based out of 30 Hudson Yards. Warner Media occupies the entirety of the 1.4 million-sf office condo with a lease that expires in June 2034. The CNN+ business segment took up at least one of Time Warner’s 26 floors of space as well as additional studio space.

Most common among property uses that were impacted by workforce reductions were hotels and restaurants. Some hotels were permanently closed while other lodging properties lost contracts to provide temporary housing for COVID quarantines during the year. One hotel in CMBS that was impacted was the Mr. C Seaport Hotel. The 66-key hotel secures a $30.9 million mortgage that transferred to special servicing in August 2022. Reports indicate that the borrower is working to sell the hotel to another party. As year-end 2022 comes to a close, a close eye on the possibility of tenants downsizing can foreshadow implications for associated commercial real estate properties.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform designed to unlock investment, financing, and leasing opportunities. CRED iQ provides real-time property, loan, tenant, ownership, and valuation data for over $2.0 trillion of commercial real estate.