CRED iQ examined major lease expirations for CMBS office collateral for the near-term, 18-month horizon, as well as the next 10 years. Downsizing and non-renewal by office tenants is a contributing factor to headwinds facing the office sector, which has been plagued by employee-employer workplace dynamics and tenants’ need to shed space, reduce real estate costs, and right-size physical footprints during a period of economic uncertainty.

A high-level view of lease expirations provides a general sense, or foreboding in some instances, of the mechanics that the office sector needs to work through as the property type falls out of favor with lenders, investors, and other commercial real estate industry constituents. Lease expiration analysis also serves as a tool to evaluate when and where the next pockets of elevated office distress will materialize.

Office collateral has been a primary contributor to incremental distress in commercial real estate throughout 2023. CRED iQ’s distressed rate for CMBS office loans, which includes delinquent loans and specially serviced loans secured by office collateral, was 5.8% as of April 2023 and has increased for six consecutive months. Furthermore, the distressed rate for office collateral has more than doubled compared to 12 months prior and is at its highest level since CRED iQ started tracking such data in early 2020.

CRED iQ examined over 21,000 major leases for CMBS office and mixed-use collateral properties. For this exercise, major leases were defined as one of the five-largest leases by percentage of net rentable area (NRA) for a particular property. Additionally, office collateral securing CMBS does not represent the entire office market, but rather serves as proxy to identify challenges facing the larger universe of office properties.

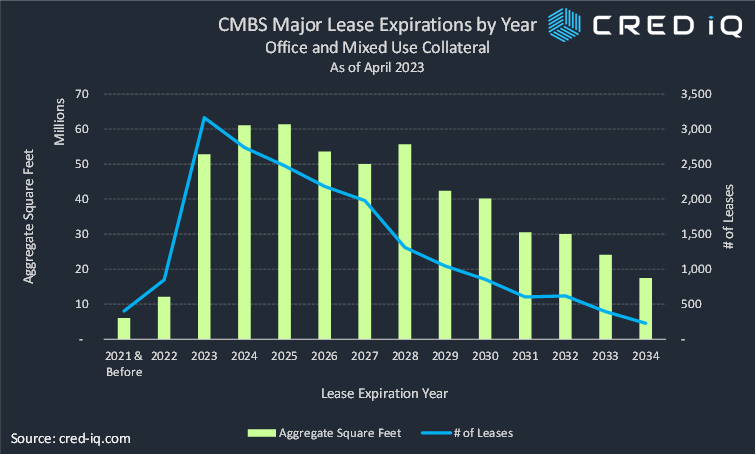

Takeaways from our observations include over 500 million SF of NRA and 17,000+ leases scheduled to expire over the next 10 years for office properties secured by CMBS loans. There is nearly 53 million SF of space that has already expired in 2023 or is scheduled to expire during the remainder of 2023. Scheduled lease rollover is at its highest in 2024 and 2025 — each year will individually have more than 60 million SF rolling. The aggregate number of leases with expiration dates in 2024 and 2025 was more than 5,000. Scheduled lease expirations subsequently taper off in 2026 (53 million SF) and 2027 (50 million SF) before surging to 55 million SF in 2028. As a caveat to these figures, the underlying data by its nature is historical, imperfect, and may not reflect recent extensions that tenants may have signed.

Lease expiration figures were further parsed by geographic location to provide a granular view by MSA. A detailed view of lease expirations by individual office market helps identify which markets’ vacancy rates are at risk of being stressed. The data was parsed to isolate the second half of 2023 and the full year 2024. In both time frames, the New York MSA had the highest amount of space and the highest number of leases scheduled to expire. In total, the New York MSA had more than 14 million SF of leases scheduled to expire in the next 18 months — 4 million SF is scheduled to expire in the second half of 2023 and 10 million SF is scheduled to expire in 2024. In the second half of 2023, notable MSAs with elevated lease rollover included Washington, DC and Philadelphia with both markets ranking in the Top 5 for that category. The Washington, DC and Philadelphia markets both have distressed rates for office properties in excess of 10%. Looking forward to 2024, focus shifts to the Chicago and Atlanta MSAs. Chicago has 3 million SF of space expiring in 2023 with a most recent distressed rate of 19.5% for office collateral. Atlanta has 2.1 million SF of leases scheduled to expire in 2024 with a 20% distressed rate for office as of April 2023.

To be fair, many tenants will renew or even expand footprints in certain office buildings. However, rising vacancy rates — in excess of 20% and even stretching to 30% in certain markets — indicate a high level of risk that many tenants will downsize or fail to renew altogether. Lease expirations can have several possible outcomes for office landlords. From a positive perspective, a renewal or new direct lease may allow rents to reset higher if market conditions are favorable. However, high vacancies and downward pressures on rental rates may lead to reductions in cash flow and subsequent distressed scenarios.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities.

The platform also offers a highly efficient valuation engine which can be leveraged across all property types and geographies. Our data platform is powered by over $2.0 trillion in transactions and data covering CRE, CMBS, CRE CLO, Single Asset Single Borrower (SASB), and all of GSE / Agency.