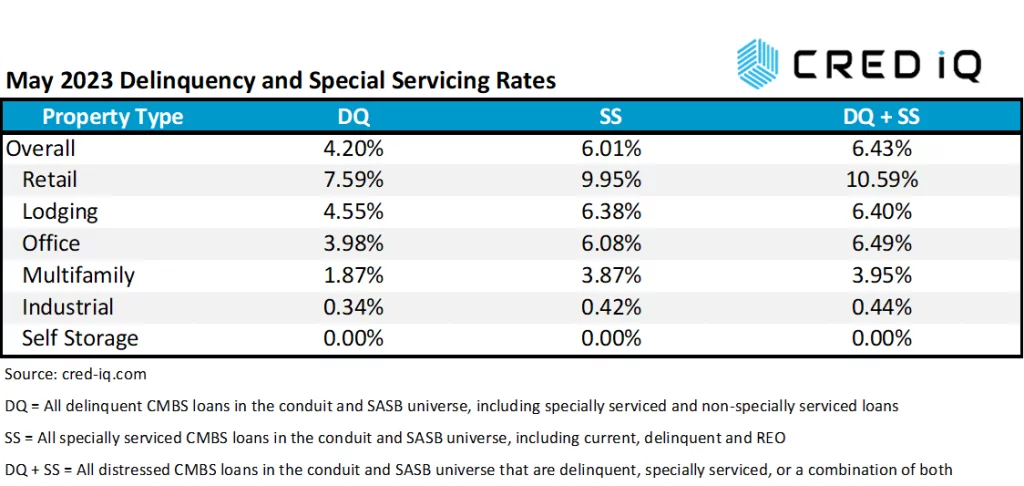

SS = All specially serviced CMBS loans in the conduit and SASB universe, including current, delinquent and REO

DQ + SS = All distressed CMBS loans in the conduit and SASB universe that are delinquent, specially serviced, or a combination of both

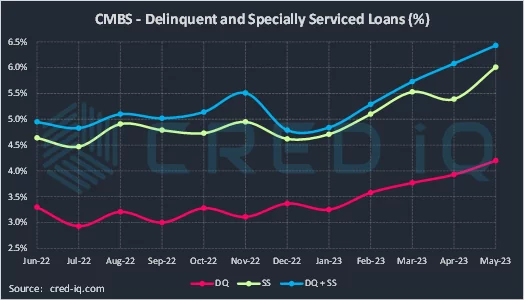

The CRED iQ delinquency rate for CMBS for the month of May 2023 increased for the fourth consecutive month to 4.20%. The delinquency rate was 28 basis points higher than the prior month’s rate of 3.93%, equal to a 7% increase. Furthermore, the CRED iQ delinquency rate has risen by approximately 29% since the start of 2023 as a result of headwinds facing the commercial real estate industry. Main drivers include increased distress in the office sector and a tighter refinancing environment for loans coming due at maturity. The delinquency rate is equal to the percentage of all delinquent specially serviced loans and delinquent non-specially serviced loans, for CRED iQ’s sample universe of $600+ billion in CMBS conduit and single asset single-borrower (SASB) loans. CRED iQ’s special servicing rate, equal to the percentage of CMBS loans that are with the special servicer (delinquent and non-delinquent), increased month-over-month to 6.01%, from 5.39%. After a slight decline in April, the special servicing rate continued its upward trendline started in December 2022 when the rate equaled 4.62%. Aggregating the two indicators of distress – delinquency rate and special servicing rate – into an overall distressed rate (DQ + SS%) equals 6.43% of CMBS loans that are specially serviced, delinquent, or a combination of both. Last month’s distressed rate was equal to 6.08%, which was 35 basis points lower that the May 2023 distressed rate. The month-over-month increase in the overall distressed rate mirrors increases in the delinquency and special servicing rates. Distressed rates generally track slightly higher than special servicing rates as most delinquent loans are also with the special servicer.

SS = All specially serviced CMBS loans in the conduit and SASB universe, including current, delinquent and REO

DQ + SS = All distressed CMBS loans in the conduit and SASB universe that are delinquent, specially serviced, or a combination of both

May 2023 data revealed additional turmoil for the office sector for which the property-level delinquency rate rose to 3.98%, compared to 3.81% in April. One of the largest loans to be reported delinquent was a $783 million senior fixed-rate mortgage secured by 375 Park Avenue, a 38-story, 830,928-SF office tower located in Midtown Manhattan. The loan failed to pay off at its scheduled May 2023 maturity date and subsequently transferred to special servicing to execute a modification, which extended the loan’s maturity date one year, among other terms. Financing for the property included an additional $217 million in mezzanine debt that was also extended. A near-term delinquency cure is likely given the closing of the modification; however, the maturity default exemplifies the choppy waters facing impending office debt maturities.

Perhaps more concerning was the 30-day delinquency of a $275 million mortgage secured by EY Plaza, a 920,308-SF office tower in downtown Los Angeles. The loan transferred to special servicing in April 2023 due to the missed payment. Similar to 375 Park, EY Plaza has mezzanine financing ($30 million). However, a primary difference from a credit perspective is that EY Plaza is encumbered by floating-rate debt, which highlights issues with debt service coverage more so than refinance risk.

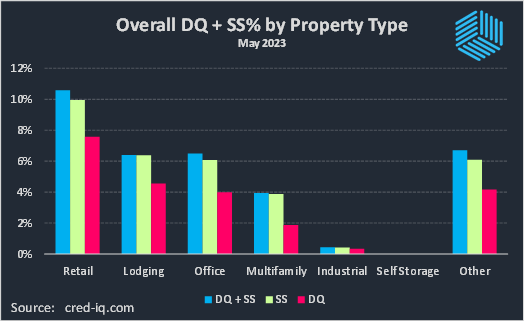

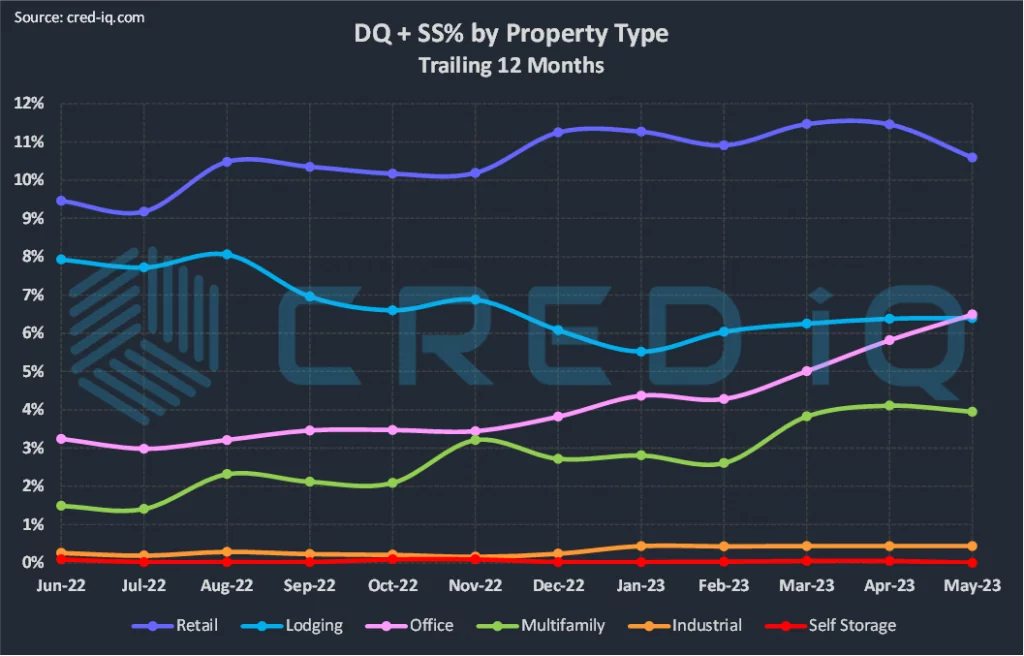

The delinquency rate for office properties has been the most volatile among property types. The lodging delinquency rate (4.55%) exhibited a modest month-over-month increase but is down year-over-year. The retail delinquency rate (7.59%) is higher than April’s rate but has exhibited signals of plateauing with recent workouts of loans secured by regional malls. The multifamily delinquency rate (1.87%) has exhibited year-over-year increases but remains relatively lower than other major property types. Industrial (0.34%) and self-storage (0.00%) continue to outperform from a delinquency perspective.

Pivoting to special servicing rates by property type, office loans exhibited the most activity. The special servicing rate for loans secured by office properties increased to 6.08%, compared to 5.57% as of April 2023. With its rate now above 6%, the office special servicing rate is nearly double its level from 12 months ago. This month’s surge in specially serviced office loans was driven by the transfer of a $1.3 billion loan secured by a 146-property office portfolio owned by Workspace Property Trust. The floating-rate loan transferred to special servicing in April 2023 ahead of its upcoming July 2023 maturity date. The loan has an extension option remaining but obtaining an interest rate cap may be cost prohibitive.

Aside from the office sector, the special servicing rate for retail loans declined to 9.95%, compared to 11.04% as of April 2023. The special servicing rate for lodging came in at 6.38%, a modest increase compared to April 2023. Multifamily (3.87%) exhibited a decrease in its special servicing rate and the special servicing rate for industrial properties (0.42%) was relatively flat compared to the prior month. There was no self-storage specially serviced inventory.

CRED iQ’s CMBS distressed rate (DQ + SS%) by property type accounts for loans that qualify for either delinquent or special servicing subsets. This month, the overall distressed rate for CMBS increased to 6.43%. The increase was 34 basis points higher than April’s distressed rate (6.08%), equal to a 5.7% increase. CRED iQ observed a relative surge in the overall distressed rate over the past four months as the distressed rate pushes to its highest level since early-2022.

For additional information about two of this month’s largest loans that transferred to special servicing, click View Details below:

| [View Details] | [View Details] | |

| Loan | 375 Park Avenue | EY Plaza |

| Balance | $783 million | $275 million |

| Special Servicer Transfer Date | 4/13/2023 | 4/11/2023 |

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities.

The platform also offers a highly efficient valuation engine which can be leveraged across all property types and geographies. Our data platform is powered by over $2.0 trillion in transactions and data covering CRE, CMBS, CRE CLO, Single Asset Single Borrower (SASB), and all of GSE / Agency.