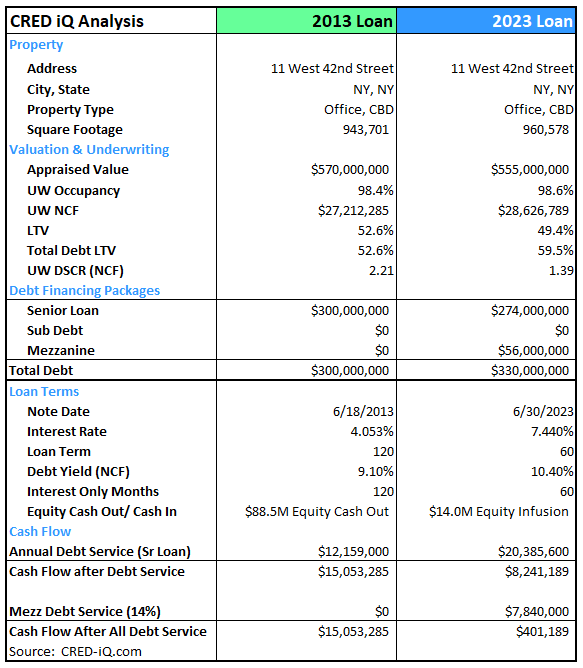

Understanding current interest rates, DSCRs, LTVs, Debt Yields and valuation has never been more important during this tightening period. CRED iQ analyzed recent loans issued this year and compared them to loans from a decade earlier. Our analysis took a deep dive into the underwriting of the same asset for two different loans during two different commercial real estate cycles. One was in 2013 that was fresh out of the great financial crisis of 2008/2009 and the most recent loan was issued in June 2023.

Property

The 11 West 42nd Street Property is a 33-story CBD office building containing approximately 943,701 SF of gross rentable area. and located within the Grand Central submarket of New York City. The property was constructed in 1927 and renovated in 1978 and then later on in 2018. The borrower of both of the loans analyzed is Tishman Speyer and Silverstein Properties.

2013 Loan

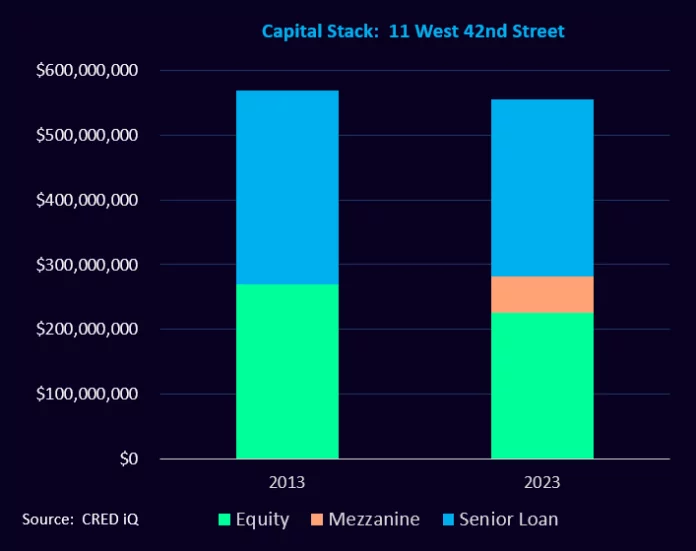

On June 13, 2013, Goldman Sachs originated a $300 million senior loan on this asset. Appraised for $570 million ($604/SF) at the time of loan origination, the loan was leveraged at an all-in 52.6% LTV since there was no other subordinate debt or mezzanine financing. This appraised value suggested an implied cap rate of 4.77%. At the time of loan origination, Tishman & Silverstein enjoyed an $88.5 million cash out with this refinancing.

Terms of the loan included a 4.053% interest rate and a 10-year loan term that was full-term interest only. Annual debt service equated to $12.2 million. Based on the underwritten net cash flow of $27.2 million (as of 2013) and an underwritten occupancy of 98.4%, the DSCR on the loan equaled 2.21x.

2023 Loan

Fast-forward ten years of interest-only payments and annual free cash flows after debt service of approximately $15.0 million, it was time for a new loan. This time around, Tishman & Silverstein were able to secure a much smaller loan, with a much higher interest rate. Let’s dive into the numbers.

The new loan was originated in June 2023 by several originators (Bank of America, UBS, and LMF Commercial) and totaled $274.0 million on the senior note. In addition to the $274 million senior loan, Bank of America provided the borrower with $56 million in mezzanine financing. The total debt package for this new loan totals $330 million compared to the 2013 loan of only $300 million. The appraised value this time around was $555 million ($577/SF) – the new collateral square footage was 960,578 square feet. LTVs were 49.4% on the senior loan and 59.5% on the total debt. Based on the underwritten net cash flow of $28.6 million, the appraised value’s implied cap rate is 5.16%!

Terms of this loan were drastically different compared to the loan made ten years ago. The loan’s interest rate is 7.44% (339 basis point increase) and is full-term interest only with a maturity date in June 2028 (5-year loan). Underwritten with $28.6 million in net cash flow, the debt yield on this loan was 10.4% compared to the 2013 loan that had a debt yield of 9.10%.

Annual debt service payment is $20.4 million (compared to $12.2 million last time). In order to secure the loan, the borrower was required to infuse $14 million of equity (compared to cashing out $88.5 million the last time). The mezzanine loan’s interest rate carries a 14.0% rate, for an additional annual burden of $7.8 million/year. Total debt service for this debt package totaled $28.2 million, leaving approximately $401,189 of free net cash flow for the borrower per year.

How do interest rates impact commercial real estate if all else stays the same? About $15 million a year of free net cash flow for this borrower.