CRED iQ continued and expanded its CRE CLO analysis this week. Our research team explored aggravated data by issuer to uncover opportunities and risks within this hot sector.

We wanted to understand the % breakdown of delinquency/distress within these major CRE CLO issuers’ portfolios, and then measure the scale of those portfolios and their associated rankings within the group. Some core measures of our study include:

- Current Deal Balance Outstanding

- Total Delinquent Loan Balance

- Overall Delinquency Percentage

MF1 earned the top spot in Current Deal Balance Outstanding. Arbor topped the category of Total Delinquent Loan Balance ($782 million), while ranking in second on Current Deal Balance Outstanding ($8.1 billion). In total, 9.6% of Arbors loans are delinquent which earns Arbor the #4 position in this category.

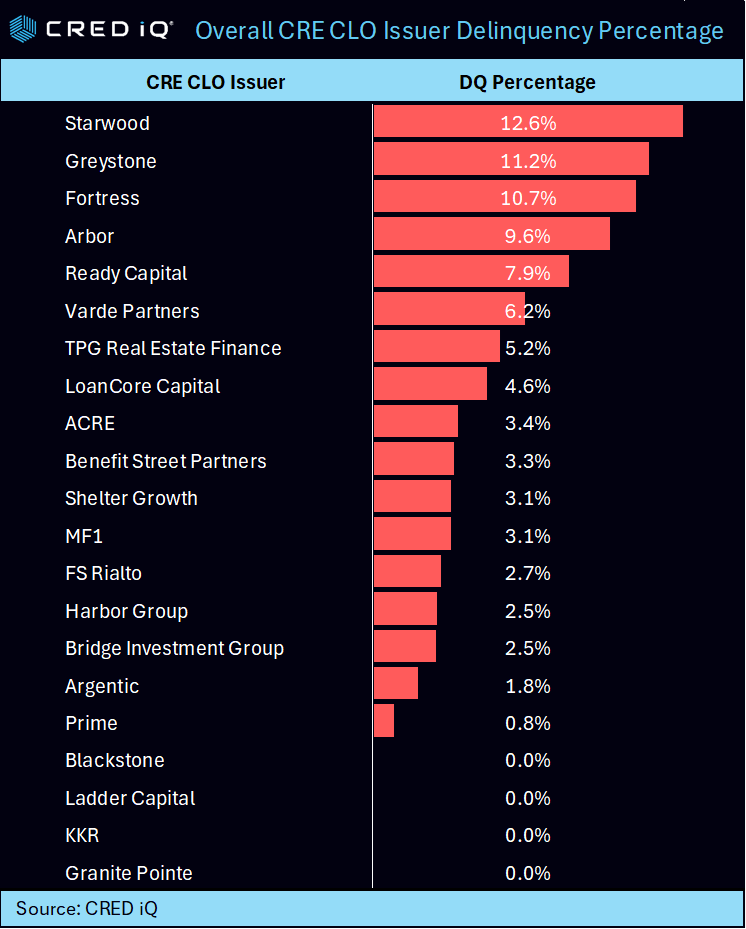

Leading the rankings by delinquent percentage is Starwood, with a whopping 12.6% of their portfolio delinquent. Greystone and Fortress were not far behind with 11.2% and 10.7% respectively. Starwood ranks third in Total Delinquent Loan balance and ranks #10 for current deal balance outstanding.

Top key findings include:

- MF1, Arbor, FS Rialto, Ready Capital, and Benefit Street have the highest amount of CRE CLO loans outstanding.

- Out of the 21 largest CRE CLO issuers, MF1 & Ready Capital have the highest count of active deals issued with 8 each.

- Comparing deal sizes, MF1 has the highest amount with approximately $11.1 billion across 8 deals and FS Rialto has approximately $5.5 billion across their 7 deals.

- Performance-wise, TPG Real Estate Finance and FS Rialto have the lowest amount of delinquent loans when comparing the Top 10 issuers by outstanding deal balance.

- Measuring delinquent percentages of the largest 21 issuers, Starwood, Greywood, Arbor, Ready Capital, and Varde Partners have some of the highest percentages.

- Comparing Delinquent Loans by loan balance, Arbor, Ready Capital, and Starwood have the most. The least amount of delinquent loans stem from deals issued by Blackstone, Prime Finance, Argentic, Bridge Investment Group, and FS Rialto.

Here is the full list of Top 21 CRE CLO issuers:

Active Deals by Balance by Issuer:

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities.

The platform also offers a highly efficient valuation engine which can be leveraged across all property types and geographies. Our data platform is powered by over $2.0 trillion in transactions and data covering CRE, CMBS, CRE CLO, Single Asset Single Borrower (SASB), and all of GSE / Agency.