The multifamily sector continues to be a dynamic space for investors, with evolving trends shaping opportunities across major U.S. markets. Using exclusive data from CRED iQ, our research team analyzed recent commercial mortgage-backed securities (CMBS), Freddie Mac and Fannie Mae loan issuances since January 2024 to identify the top multifamily markets driving near-term momentum. By examining key metrics from recent loans —unit counts, property counts, loan balances, and year built—we’ve uncovered the most active and promising markets for multifamily investment.

Key Findings from CRED iQ’s Analysis

Our team evaluated multiple data points to create a comprehensive weighted score ranking of multifamily markets. Here’s what stood out:

- Dallas-Fort Worth MSA Leads in Scale: Dallas tops the charts with an impressive 103,983 units financed since January 2024, far surpassing New York’s 67,833 units. Dallas also ranks third in property count (440 properties) and shows significant new supply, with 5,722 units built in 2020 alone.

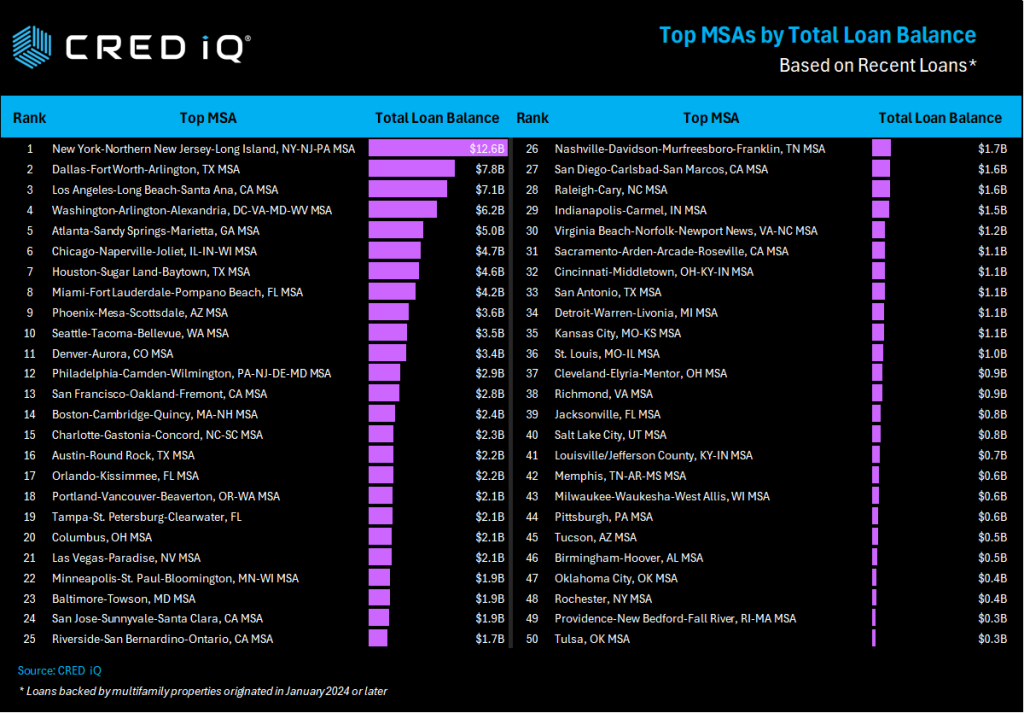

- New York MSA Dominates Loan Volume: The New York MSA, encompassing northern New Jersey and Long Island, leads in loan balances with $12.6 billion in multifamily loans originated since January 2024. It also ranks first in property count (765 properties) and new units built since 2022.

- Los Angeles Holds Strong: Los Angeles, including Long Beach and Santa Ana, secures third place in our weighted rankings, bolstered by 503 properties with new loans, making it a key player in the multifamily space.

- Emerging Trends in New Construction: Dallas and Houston stand out for units built in 2020 (5,722 and 3,038, respectively). However, for newer units built in 2022 and 2023, Miami emerges as a strong contender, ranking third in this category.

Weighted Score Rankings: The Top Multifamily Markets

After analyzing unit counts, property counts, loan balances, and construction trends, CRED iQ’s weighted score rankings reveal the following top MSAs for multifamily investment:

- New York MSA – Leading in loan volume, property count, and new units built since 2022, New York remains a powerhouse for multifamily investment.

- Dallas-Fort Worth MSA – With unmatched unit volume and strong new construction activity, Dallas is a close second.

- Los Angeles MSA – A consistent performer across metrics, Los Angeles secures third place.

- Three-Way Tie: Atlanta, Chicago, Houston – Atlanta (including Sandy Springs and Marietta), Chicago (including Naperville and Joliet), and Houston (including Sugar Land and Baytown) share fourth place, each showing robust multifamily activity.

- Washington, D.C. MSA – Including Arlington and Alexandria, D.C. rounds out the top seven, driven by steady demand and investment.

What This Means for Investors

The multifamily market is thriving in these top MSAs, with Dallas and New York leading the pack due to their scale, loan activity, and new construction. Markets like Los Angeles, Atlanta, Chicago, Houston, and Washington, D.C., also present compelling opportunities, particularly for investors seeking diversified portfolios. Miami’s rise in newer construction signals its growing appeal for those targeting emerging supply.

CRED iQ’s data underscores the resilience and potential of the multifamily sector in 2025. As market dynamics evolve, these top-ranked MSAs are well-positioned to deliver strong returns for savvy investors.

Source: CRED iQ, based on CMBS and Fannie Mae multifamily loan issuances from January 2024 onward.