At CRED iQ, our mission is to provide commercial real estate (CRE) professionals with the data and insights needed to navigate an ever-evolving market. This week, our research team took a deep dive into loan delinquency trends, expanding our lens from the Great Financial Crisis (GFC) to the present day. By focusing on FDIC-insured commercial banking and savings institutions, which includes community banks, we’ve uncovered critical patterns in CRE loan performance, offering a clearer perspective on today’s marketplace.

A Broader Perspective on CRE Loan Delinquencies

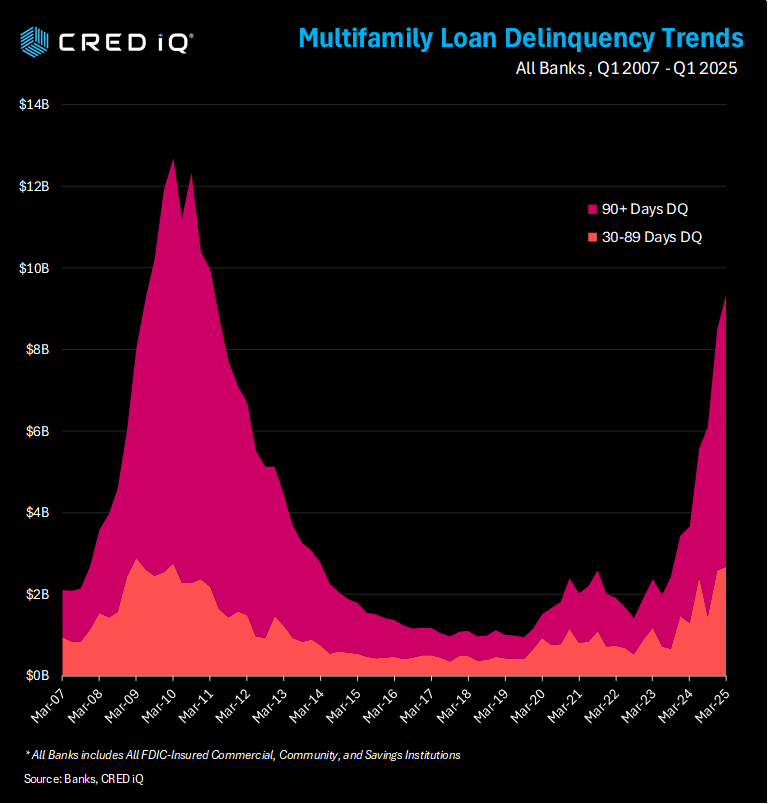

Our analysis spans from March 2007 to March 2025, shifting focus from securitized and agency markets to FDIC-insured institutions. We examined two key segments: Multifamily properties and Core CRE, which includes office, retail, hotel, industrial, self-storage, and other property types. This approach builds on our earlier research, providing a comprehensive view of delinquency trends and their implications for the CRE industry.

Key Findings from Q1 2025

Our analysis revealed several notable trends in loan performance:

- Core CRE Lending Growth Slows: The long-term average annual growth rate for Core CRE lending balances is 4.55%. However, Q1 2025 saw an annualized growth rate of just 1.22%, the lowest since 2012, signaling a cautious lending environment.

- Core CRE Delinquencies Rise: Total delinquencies across Core property types reached $31.4 billion in Q1 2025, equating to a 1.70% overall delinquency rate. Of this, $25.1 billion are loans 90+ days delinquent, while $6.3 billion are 30–89 days delinquent.

- Net Losses Decline for Core CRE: Net losses in the Core sector totaled $3.9 billion in Q1 2025, down from $5.9 billion in the prior quarter, suggesting some stabilization.

- Multifamily Losses Hit a Peak: Multifamily properties reported net losses of $767 million in Q1 2025, the highest quarterly total since 2012, highlighting growing challenges in this sector.

Five-Year Comparison: March 2020 to March 2025

To contextualize recent trends, we compared delinquency metrics from March 2020 to March 2025:

- Multifamily Delinquencies Surge: Delinquent loan balances in the Multifamily sector grew from $1.5 billion (0.3% delinquency rate) in 2020 to $9.4 billion (1.5%) in 2025. Loans 90+ days delinquent increased dramatically, from $0.56 billion to $6.71 billion.

- Core CRE Delinquencies Double: Delinquent loan balances in the Core segment rose from $15.4 billion (1.0%) in 2020 to $31.4 billion (1.7%) in 2025, with 90+ day delinquencies climbing from $9.7 billion to $25.1 billion.

These shifts underscore the increasing pressures on CRE loan performance, particularly in the Multifamily sector, where rising delinquencies and losses signal heightened risk.

Why These Insights Matter

For CRE professionals—lenders, investors, brokers, and property managers—understanding delinquency trends is critical for managing risk and identifying opportunities. CRED iQ’s granular data and advanced analytics empower clients to:

- Monitor Portfolio Health: Track loan performance and delinquency metrics in real time to proactively address potential issues.

- Assess Market Risks: Identify vulnerabilities in specific property types or regions to inform lending and investment strategies.

- Optimize Decision-Making: Leverage historical and current data to forecast trends and make informed decisions in a competitive market.

CRED iQ: Your Partner in CRE Intelligence

At CRED iQ, we go beyond data aggregation to deliver actionable insights tailored to your needs. Our platform provides comprehensive, real-time data on loan performance, property financials, and market trends, all validated for accuracy and accessible through an intuitive interface. Whether you’re navigating rising delinquencies or seeking growth opportunities, CRED iQ equips you with the tools to stay ahead.

Explore the Data with CRED iQ

Ready to dive deeper into CRE market trends? Visit CRED iQ to explore our platform and discover how our data-driven insights can transform your approach to commercial real estate.

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.

THE DATA, INFORMATION AND/OR RELATED MATERAL (“DELIVERABLES”) IS BEING OFFERED AS-IS/WHERE-AS CONDITION. CRED-IQ MAKES NO REPRESENTATION OR WARRANTY AS TO QUALITY OR ACCURACY OF SUCH DELIVERABLES BEING PURCHASED, WHETHER EXPRESS OR IMPLIED, EITHER IN FACT OR BY OPERATION OF LAW, STATUTE, OR OTHERWISE, AND CRED-IQ SPECIFICALLY DISCLAIMS ANY AND ALL IMPLIED OR STATUTORY WARRANTIES INCLUDING WARRANTIES OF MERCHANTABILITY AND OF FITNESS FOR A PARTICULAR PURPOSE, TECHNICAL PERFORMANCE, AND NON-INFRINGEMENT. WITHOUT LIMITING THE FOREGOING, YOU AS CUSTOMER ACKNOWLEDGE THAT YOU HAVE NOT AND ARE NOT RELYING UPON ANY IMPLIED WARRANTY OF MERCHANTABILITY OR OF FITNESS FOR A PARTICULAR PURPOSE OR OTHERWISE, OR UPON ANY REPRESENTATION OR WARRANTY WHATSOEVER AS TO THE DELIVERABLES IN ANY REGARDS WHATSOEVER, AND ACKNOWLEDGE THAT CRED-IQ MAKES NO, AND HEREBY DISCLAIMS ANY, REPRESENTATION, WARRANTY OR GUARANTEE THAT THE PURCHASE, USE OR COMMERCIALIZATION OF ANY DELIVERABLES WILL BE USEFUL TO YOU OR FREE FROM INTERFERENCE. BY ACCEPTANCE OF THE DELIVERABLES, YOU HEREBY RELEASE CRED-IQ AND ITS AFFILIATES AND AGENTS FROM ALL CLAIMS, DAMAGES AND LIABILITY ARISING HEREUNDER.