In the ever-evolving landscape of commercial real estate (CRE) collateralized loan obligations (CLOs), monitoring delinquency (DQ), special servicing (SS), and overall distress rates remains crucial for investors and lenders. Data from CRED iQ, a leading provider of CRE analytics, reveals notable trends through August 2025, highlighting a market grappling with economic headwinds like rising interest rates and sector-specific challenges in office and retail properties.

As of August 2025, the DQ rate for CRE CLOs stood at 10.65%, up from 9.22% in July, marking a 143 basis point (bps) increase month-over-month (MoM). This uptick reflects growing payment struggles, with 30-day delinquencies comprising a significant portion of distressed loans at 14.43% of the distressed allocated loan amount (ALA). Similarly, the SS rate climbed to 8.15% from 6.90%, a 125 bps rise, indicating more loans requiring specialized workout strategies. The combined distress rate (DQ and/or SS) reached 13.32%, up 153 bps MoM, underscoring broader portfolio stress.

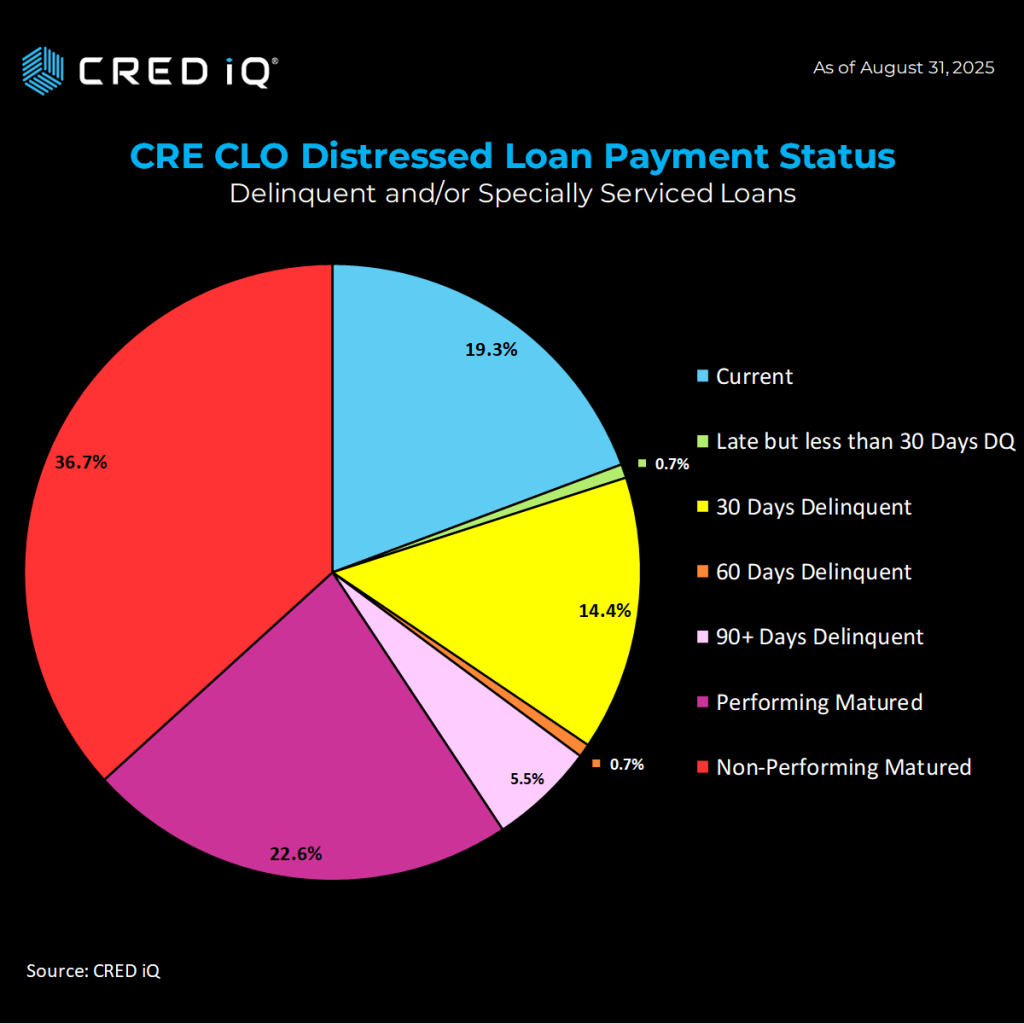

Looking at recent trends, the past few months show volatility but an upward trajectory overall. July 2025 saw DQ rise 82 bps from June’s 8.40%, while SS edged up 23 bps. June, however, bucked the trend with a 264 bps drop in DQ from May’s 11.04%, suggesting temporary relief possibly from seasonal factors or restructurings. Year-over-year, comparing August 2025 to August 2024 (10.37% DQ, 5.67% SS, 11.77% distress), rates have escalated, with DQ up over 28 bps and SS surging 149 bps. This acceleration aligns with maturing loans—over 59% of distressed ALA in August fell under matured categories, split between performing (22.56%) and non-performing (36.74%)—pointing to refinance difficulties in a high-rate environment.

Deeper into the data, payment status breakdowns reveal persistent issues. In August, 90+ day delinquencies accounted for 5.54% of distressed loans, while non-performing matured loans dominated at 36.74%. Earlier months like March 2025 peaked at 11.86% DQ, driven by similar maturity walls. These trends signal caution for CRE CLO stakeholders. With office vacancies lingering and multifamily pressures from oversupply, distress could intensify if rates remain elevated. However, opportunities exist in workouts and value-add strategies. Investors should prioritize granular analysis via platforms like CRED iQ to navigate this cycle effectively.

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.