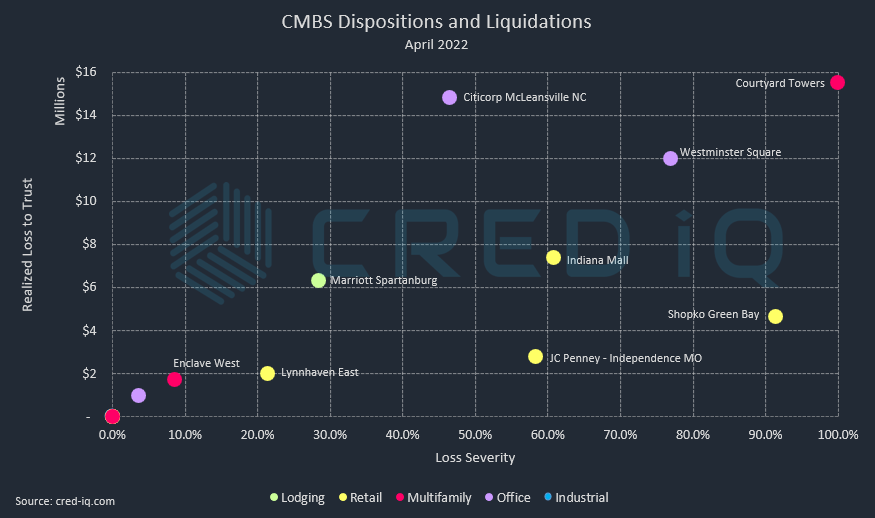

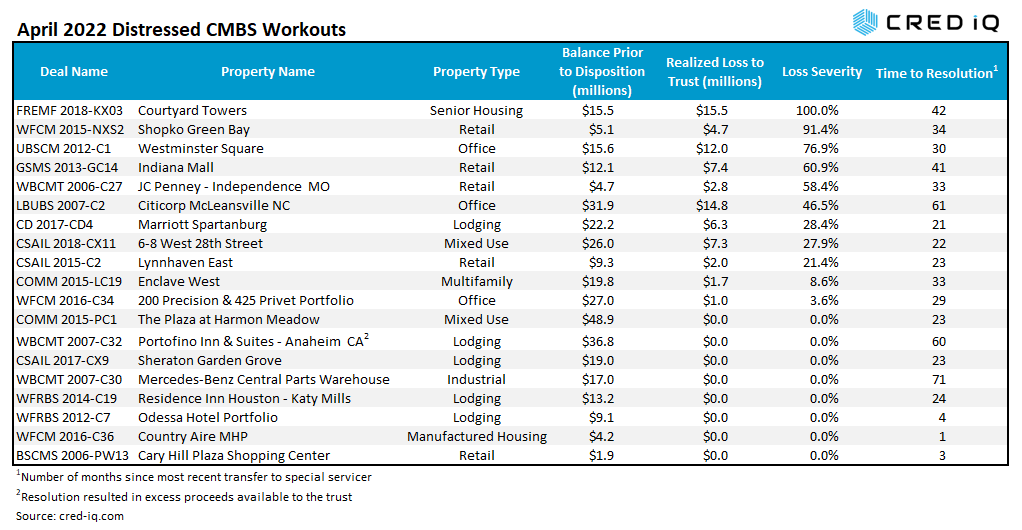

CMBS conduit transactions incurred approximately $60 million in realized losses during April 2022 through the workout of distressed assets. Additionally, a $15.5 mortgage securitized in a Freddie K-Deal securitization, Courtyard Towers, was liquidated with a loss severity of 100%. CRED iQ identified 19 workouts classified as dispositions, liquidation, or discounted payoffs in April 2022. Of those 19 workouts, there were eight distressed assets that were resolved without a loss. One resolution – Portofino Inn & Suites – Anaheim CA — resulted in excess proceeds available to the trust after the REO asset was sold. The sales price for the asset, which was reportedly north of $62 million, was significantly greater than its total exposure, equal to the unpaid balance, servicer advances, and liquidation expenses. Loss severities for the month of April ranged from 4% to 100%, based on outstanding balances at disposition. Total realized losses in April represented a decline compared to March’s realized loss totals of approximately $84.4 million.

Courtyard Towers represents the largest loss, by total amount and severity, among all distressed workouts this month. For historical context, the loan, which was securitized in the FREMF 2018-KX03 transaction, incurred the largest individual loss for any Freddie K-Deal securitization to date. Prior to the workout of Courtyard Towers, there had been 13 resolutions of loans that resulted in realized losses to Freddie K-Deal securitizations. Courtyard Towers is a 175-unit assisted living facility located in Mesa, AZ. The property had been with the special servicer since October 2018. Several prior sale agreements fell out of contract and the property was ultimately sold for $4.85 million, which was significantly below the loan’s $15.5 million outstanding balance at disposition. After liquidation expenses and amounts due to the servicer, the result was a full loss for the loan.

The largest distressed loan, by balance at disposition, to be resolved was the $48.9 million Plaza At Harmon Meadow loan. The loan had transferred to special servicing in April 2020 due to maturity default. After nearly two years in special servicing, the loan was resolved without incurring a loss.

Excluding defeased loans, there was approximately $6.1 billion in securitized debt that was paid off or worked out in April, which was significantly higher than $3.3 billion in March 2022. In April, 10% of the loan resolutions were categorized as dispositions, liquidations, or discounted payoffs, which was in line with the prior month. An additional 13% of the loans paid off with prepayment penalties.

By property type, mixed-use had the highest total of outstanding debt paid off in April. The high volume of mixed-use payoffs was driven by the retirement of a $1.4 billion mortgage secured by Ala Moana — a mixed-use complex in Honolulu, HI comprising a super-regional mall and two office towers.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform designed to unlock investment, financing, and leasing opportunities. CRED iQ provides real-time property, loan, tenant, ownership, and valuation data for over $2.0 trillion of commercial real estate.