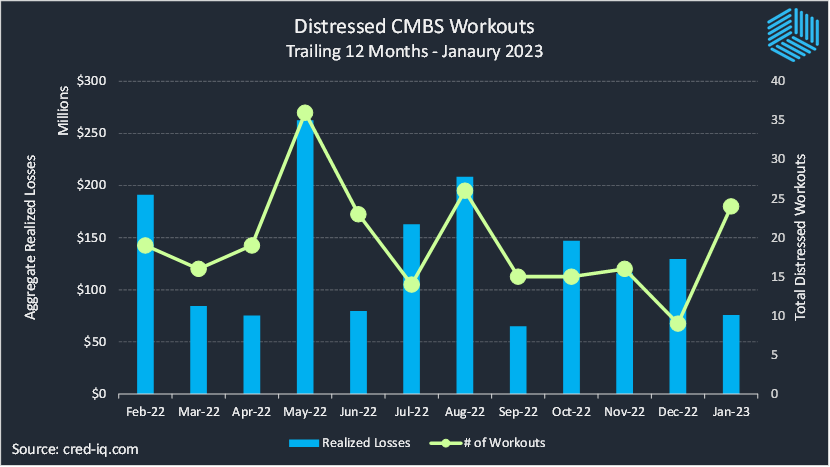

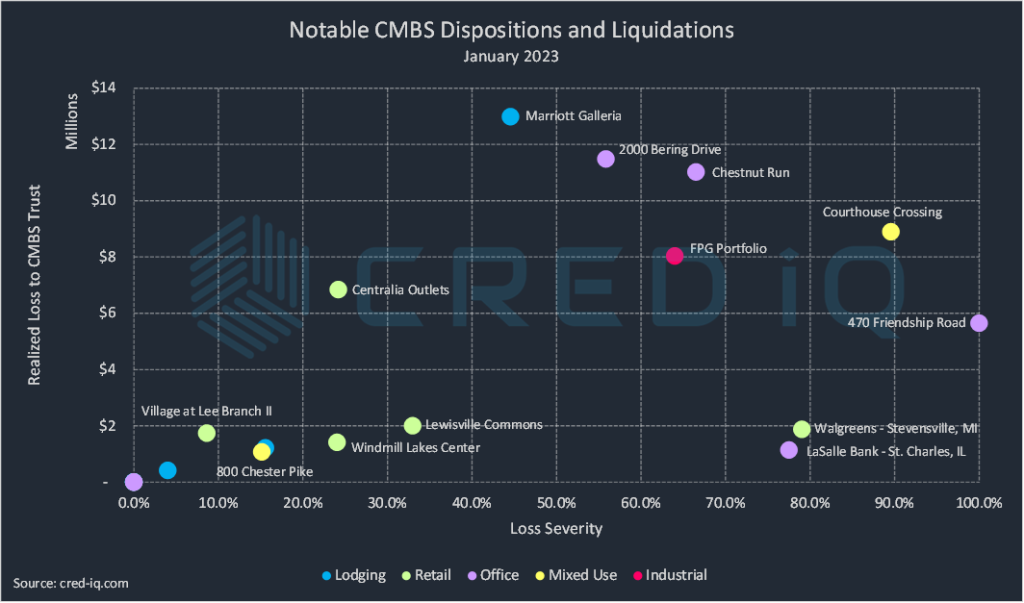

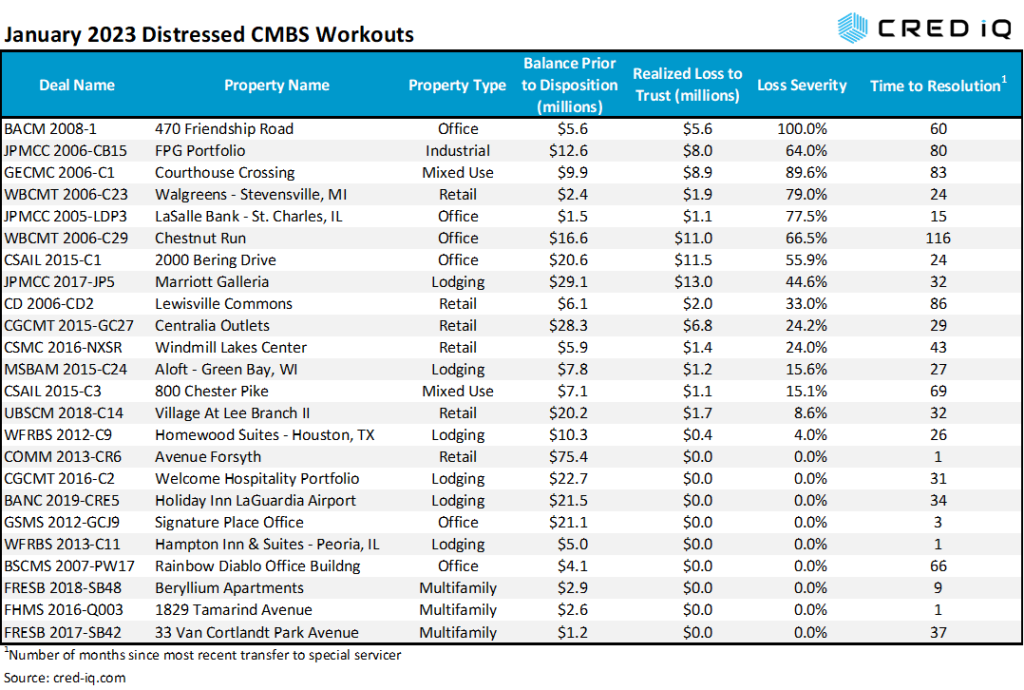

CMBS transactions incurred approximately $76 million in realized losses during January 2023 via the workout of distressed assets. CRED iQ identified 24 workouts classified as dispositions, liquidations, or discounted payoffs in January 2023. Of the 24 workouts, nine were resolved without a loss. Of the 15 workouts resulting in losses, severities for the month of January ranged from 4% to 100%, based on outstanding balances at disposition. Aggregate realized losses in January 2023 were approximately 42% lower than December 2022 despite nearly three times as many distressed workouts. The number of distressed workouts was the third-highest over the past year while aggregate realized losses ranked as one of the three-lowest totals over the same period. On a monthly basis, realized losses for CMBS transactions averaged approximately $133.1 million during the trailing 12 months.

By property type, workouts were evenly concentrated in lodging, office, and retail, each accounting for six distressed resolutions. The six office workouts had the highest total of aggregate realized losses ($29.3 million), which accounted for 39% of total losses for the month. The largest individual realized loss from CRED iQ’s observations was from Marriott Galleria, a 301-key full-service hotel located in Houston, TX. The property had been REO since June 2021 and was sold via auction in August 2022 for approximately $28 million, equal to $93,000 per key. The sale price was significantly higher than the property’s July 2022 appraised value of $18.4 million, equal to $61,000 per key. The asset had outstanding debt of $29.1 million, which incurred a $13 million loss upon liquidation this month accounting for expenses, equal to a 45% severity.

The largest workout by outstanding debt balance was a $75.4 million mortgage secured by The Collection at Forsyth, a 523,535-SF lifestyle center located 30 miles north of Atlanta, GA. The loan transferred to special servicing in early-December 2022 just prior to maturity default. The loan collateral was sold shortly thereafter to CTO Realty Growth Inc. for $96 million ($183/SF), allowing for sale proceeds to retire the outstanding mortgage without incurring a loss. This was a relatively encouraging resolution as the loan was able to be worked out swiftly and without a loss.

Excluding defeased loans, there was approximately $5.7 billion in securitized debt among CMBS conduit, Single-Borrower Large-Loan, and Freddie Mac securitizations that was paid off or liquidated in January 2023, which was approximately an 18% decrease compared to $7 billion in December 2022. In January, 7% of the loan resolutions were categorized as dispositions, liquidations, or discounted payoffs. The percentage of distressed workouts was only 2% in the prior month. Approximately 28% of the loans were paid off with prepayment penalties, which was less than 36% as of the prior month.

Excluding Freddie Mac securitizations, retail had the highest total of outstanding debt payoff in January with approximately 34% of the total by balance. Multifamily and office were the property types with the next highest outstanding debt payoff with 23% and 16% of the total, respectively. Among the largest individual payoffs was a $237.4 million mortgage secured by the Green Acres Mall, a 1.8 million-SF regional mall owned by Macerich and located on Long Island, NY.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform designed to unlock investment, financing, and leasing opportunities. CRED iQ provides real-time property, loan, tenant, ownership, and valuation data for over $2.0 trillion of commercial real estate.