This week, CRED iQ reviewed real-time valuations for several assets that secure non-performing matured loans. Maturity defaults often can be a result of distress but may also be a mismatch in the timing of a refinancing effort or sale closing. Most of this week’s assets are attributed to prior distress and had transferred to special servicing before the loan’s maturity balloon was due. Non-performing matured loans are opportunities for distressed investors to step in and infuse capital in situations where traditional solutions may not be an option. This week’s batch of non-performing matured loans includes a prime redevelopment opportunity in White Plains, NY as well as 2 distressed hospitality portfolios.

The CRED iQ valuations factor in a base-case (Most Likely), a downside (significant loss of tenants), and dark scenarios (100% vacant). Base-Case valuations are provided for the properties below. For full access to the valuation reports including the Downside and Dark scenarios as well as full CMBS loan reporting, with detailed financials, updated tenant information, and borrower contact information, sign up for a free trial here.

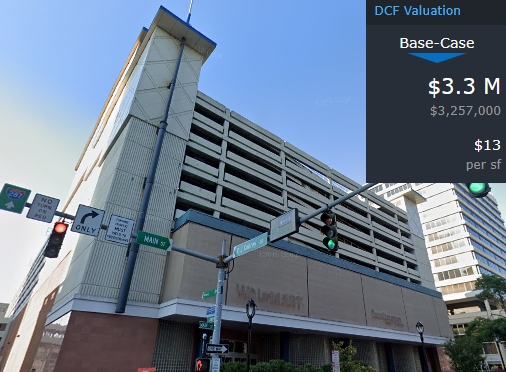

Shoppes on Main

257,360 sf, Storefront Retail, White Plains, NY 10601

This $31.5 million loan was scheduled to mature on October 6, 2021 but has been in special servicing since January 2020. CWCapital, as special servicer, arranged a note sale in September and the non-performing loan was reportedly sold for approximately $3.3 million. The loan is secured by a leasehold interest in 10-story building located in the CBD of White Plains, NY that features 257,360 sf of retail space with garage parking on the top 6 floors. The property was formerly leased to Walmart and Burlington Coat Factory but is now vacant. Walmart closed its store in 2018, citing poor financial performance and incompatibility with its Supercenter store strategy. Burlington vacated at lease expiration in 2019 and moved its store location across the street to City Center, a better-positioned mixed-use development that features a performing arts center, a Target, and a ShopRite.

As previously discussed, part of the loan’s distress is attributed to the property’s ground lease, which required annual payments of $100,000. Ground rent for the property was significantly reduced from $216,000 per year starting in 2016. There has not been any indication of redevelopment plans from the loan’s sponsor, Ivy Realty, but the property’s CBD location has sparked much interest and speculation. The improvements were last appraised for $10.8 million ($42/sf) in September 2020. The market ultimately decided that the note secured by the improvements was worth much less. For the full valuation report and loan-level details, click here.

| Property Name | Shoppes on Main |

| Address | 275 Main Street White Plains, NY 10601 |

| Outstanding Balance | $31,521,518 |

| Interest Rate | 7.25% |

| Maturity Date | 10/6/2021 |

| Most Recent Appraisal | $10,800,000 ($42/sf) |

| Most Recent Appraisal Date | 9/7/2020 |

| CRED iQ Base-Case Value | $3,257,000 ($13/sf) |

Hospitality Specialists Portfolio – Pool 2

257 Keys, Limited-Service Hotels, Moline, IL & Stevenson, MI

This $17.3 million loan was scheduled to mature on October 6, 2021 but transferred to special servicing about 7 months earlier in February 2021. The loan is secured by 3 hotel properties that were severely impacted by the pandemic. A forbearance agreement was signed in June 2020 but the temporary relief did not provide a permanent solution to the properties’ distressed operations. The loan had been delinquent for the 8 months leading up to its maturity date. Rialto Capital Advisors, as special servicer, indicated it is preparing for a deed-in-lieu of foreclosure agreement. The loan’s sponsor is Hospitality Specialists, Inc.

The loan is secured by fee interests in a Residence Inn hotel located in Moline, IL and a Hampton Inn hotel located in Stevensville, MI. The loan is also secured by a leasehold interest in a Hampton Inn located in Moline, IL. The ground lease for the property expires in 2035 but has 30 years in additional extension options. Despite the borrower citing COVID-19 as the primary reason for delinquency and poor performance, the loan had a pre-pandemic below-breakeven DSCR for the year ended 2019. The portfolio was appraised for $22.65 million in August 2021, equal to $88,132/key, which represented a 41% decline from the appraisal at origination. For the full valuation report and loan-level details, click here.

| Property Name | Size (Keys) | Address | Allocated Loan Amount | CRED iQ Base-Case Value |

| Residence Inn Moline | 84 | 4600 53rd Street Moline, IL 61625 | $6,684,179 | $8,129,000 ($96,779/key) |

| Hampton Inn & Suites Moline | 98 | 2450 69th Avenue Moline, IL 61265 | $6,365,885 | $9,302,000 ($94,922/key) |

| Hampton Inn Stevensville | 75 | 5050 Red Arrow Highway Stevensville, MI 49127 | $4,274,237 | $1,845,000 ($24,607/key) |

Hospitality Specialists Portfolio – Pool 1

285 Keys, Limited-Service Hotels, Michigan

This $16.5 million loan, which shares Hospitality Specialists, Inc. as a sponsor, was also scheduled to mature on October 6, 2021. The loan transferred to special servicing simultaneously with Pool 2, mentioned above; however, commentary for the Pool 1 loan exhibits a slightly more positive syntax than Pool 2 by stating that negotiations for forbearance are in progress. A forbearance agreement for the loan was previously documented in June 2020. Unlike Pool 2, the Pool 1 loan is current in payment.

The loan is secured by fee interests in 3 limited-service hotels located in western Michigan. Two of the properties are located in Grand Rapids, MI. The hotels operate under 3 different flags: SpringHill Suites, Hampton Inn, and Residence Inn. The extent of operational disruption caused by COVID-19 is evident with the transfer to special servicing, although, the degree of distress is not clear since financial statements have not been reported since 2019. For the full valuation report and loan-level details, click here.

| Property Name | Size (Keys) | Address | Allocated Loan Amount | CRED iQ Base-Case Value |

| SpringHill Suites Grand Rapids | 109 | 5250 28th Street SE Grand Rapids, MI 49512 | $6,423,758 | $10,980,000 ($100,696/key) |

| Hampton Inn & Suites Grand Rapids | 98 | 5200 28th Street SE Grand Rapids, MI 49512 | $5,555,683 | $9,985,000 ($101,885/key) |

| Residence Inn Holland | 78 | 631 Southpoint Ridge Road Holland, MI 49423 | $4,557,395 | $10,520,000 ($134,810/key) |

147-149 Grand Street

8,409 sf, Mixed-Use (Retail/Multifamily), New York, NY 10013

This $12.0 million loan was previously featured in the July 14, 2021 WAR Report shortly after it transferred to special servicing. The loan has passed its scheduled maturity date of October 6, 2021 and continues to be non-performing. Since our last update, the borrower submitted a maturity extension proposal that was rejected. The borrower followed with a proposal for a discounted payoff. Midland Loan Services, as special servicer, may wait until 2022 to pursue foreclosure, absent any foreclosure moratorium. For the latest updates on this loan as well as a full valuation report and loan-level details, click here.

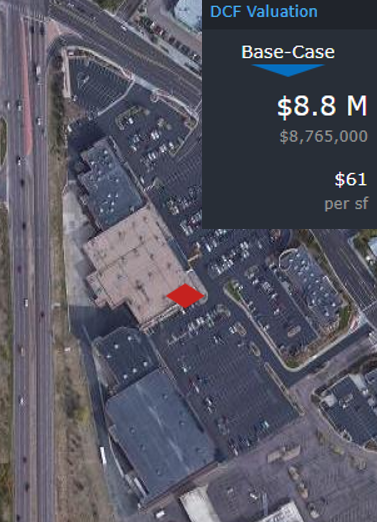

Broadmoor Towne Center

143,797 sf, Retail, Colorado Springs, CO 80906

This $10.4 million loan transferred to special servicing on September 23, 2021 due to delinquency and imminent maturity default. Loan maturity was scheduled for October 6, 2021 and the loan is now non-performing. Servicer commentary indicated the borrower was having difficulty securing refinancing, likely due to uncertain tenancy at the Colorado Springs retail center. The retail strip lost its 2 largest tenants since loan origination. Gordman’s formerly occupied 49,995 sf, equal to 35% of the GLA, until it vacated in 2020 after its parent company, Stage Stores, filed for bankruptcy. Office Depot formerly occupied 15,000 sf, equal to 10% of the GLA, but vacated in 2016. Furniture store Rush Market is on a month-to-month lease and occupies the former Gordman’s space while the former Office Depot space remains vacant. The property, which is adjacent to a former Sears department store that has been redeveloped into a Magnum Shooting Center, also operates under a ground lease. The most recent ground rent payment was $224,000 but the terms will reset upon a 10-year renewal in January 2023. CRED iQ’s estimated occupancy for the property is 52%, assuming that Rush Mark is a temporary tenant. For the full valuation report and loan-level details, click here.

| Property Name | Broadmoor Towne Center |

| Address | 1802-1918 Southgate Road Colorado Springs, CO 80906 |

| Outstanding Balance | $10,359,780 |

| Interest Rate | 4.51% |

| Maturity Date | 10/6/2021 |

| Most Recent Appraisal | $25,200,000 ($175/sf) |

| Most Recent Appraisal Date | 8/6/2014 |

| CRED iQ Base-Case Value | $8,765,000 ($61/sf) |

(Former) BI-LO Portfolio

276,852 sf, Retail Shopping Centers, South Carolina

This $8.5 million loan failed to pay off at its October 6, 2021 maturity date but the borrower was granted a maturity extension to December 1, 2021. The loan is secured by 4 retail centers located in South Carolina. The borrower is in the process of selling 2 of the properties. The remaining 2 properties are expected to be refinanced, according to servicer commentary. Despite the extension, the loan was flagged as a non-performing matured loan by the servicer.

All 4 of the properties were formerly anchored by a BI-LO grocery store, which is a subsidiary of Southeastern Grocers. Southeastern Grocers dissolved its BI-LO brand of supermarkets in 2020 and many locations were sold to other grocers or retailers. Food Lion took over at two of the properties in Cayce, SC and Chesnee, SC. Big Lots now occupies the former BI-LO location at Collins Corner Shopping Center in Greer, SC and the BI-LO location at the Gaffney Shopping center remains dark. BI-LO’s leases at each of the properties appear to still be in place, according to the servicer. The properties have performed well in aggregate, which is evidenced by NCF that has increased by approximately 38% since loan origination. For the full valuation report and loan-level details, click here.

| Property Name | Size (square feet) | Address | Allocated Loan Amount | CRED iQ Base-Case Value |

| Collins Corner Shopping Center | 70,538 | 715 E Wade Hampton Boulevard Greer, SC 29650 | $3,070,180 | $5,224,000 ($74/sf) |

| Edenwood Shopping Center | 98,467 | 2451 Charleston Highway Cayce, SC 29033 | $2,951,115 | $4,669,000 ($47/sf) |

| Gaffney Shopping Center | 45,048 | 1013 W Floyd Baker Boulevard Gaffney, SC 29341 | $1,241,679 | $1,062,000 ($24/sf) |

| Chesnee Shopping Center | 62,799 | 712 South Alabama Avenue Chesnee, SC 29323 | $1,241,679 | $2,086,000 ($33/sf) |

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. For full access to our loan database and valuation platform, sign up for a free trial below: