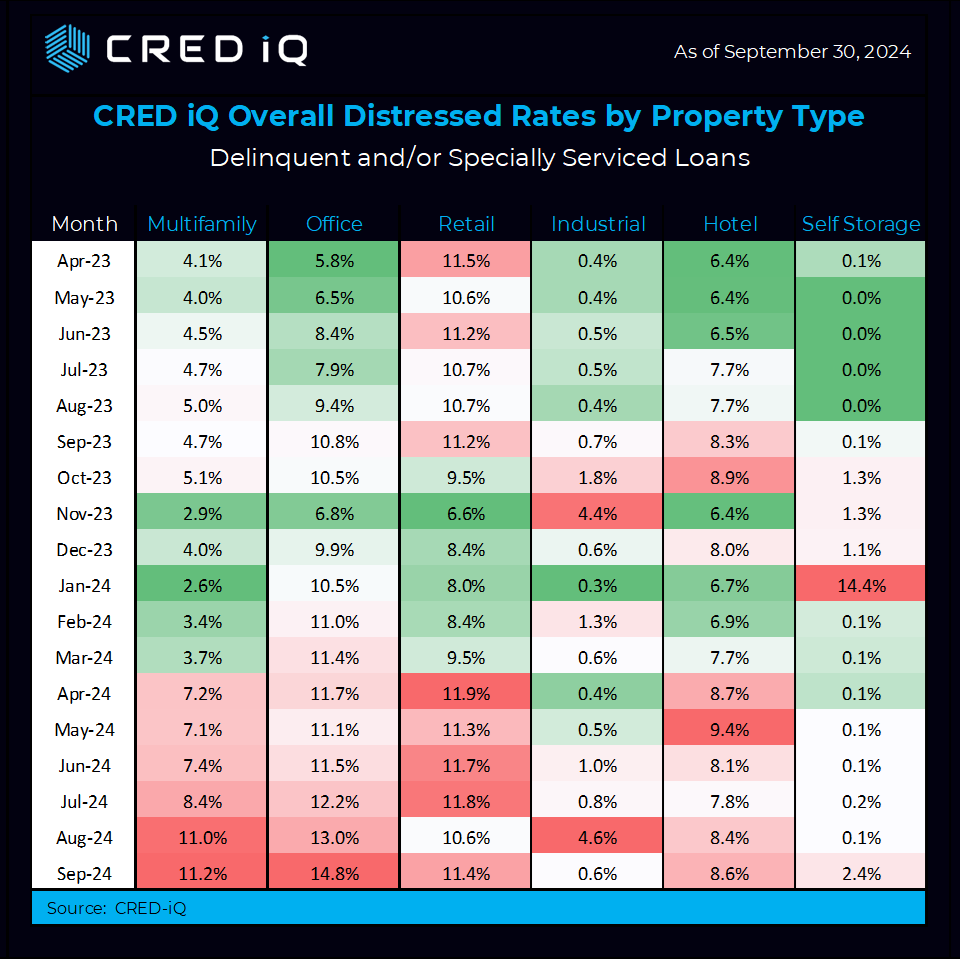

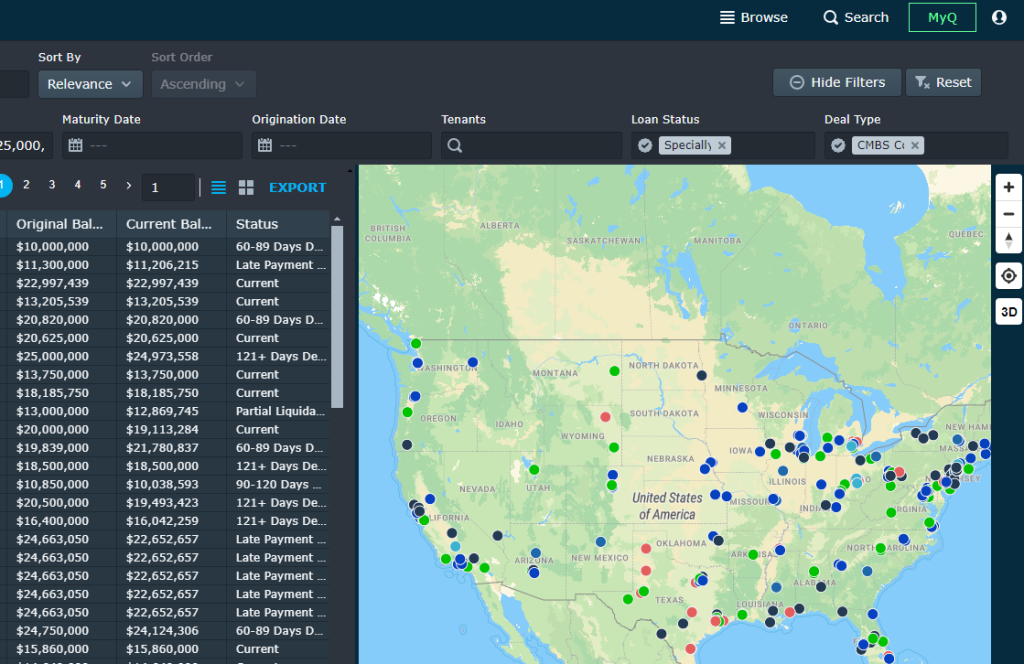

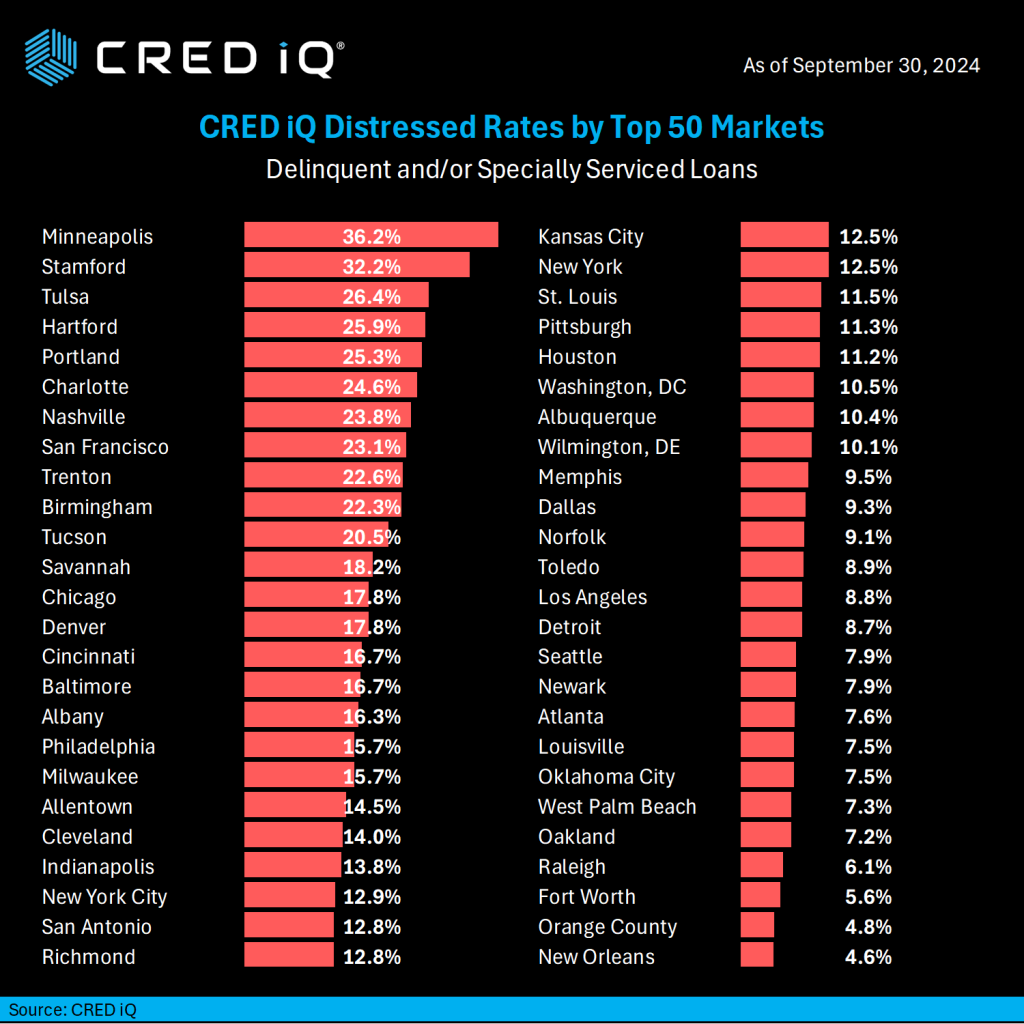

CRED iQ’s research team explored distress trends across the country in our latest geographic study. Our analysis is built upon current balances of all of the loans which CRED iQ tracks within each market; and then calculated the proportion of loans that are distressed. We then compared these results with our previous report from August 29th to reveal near-term trends.

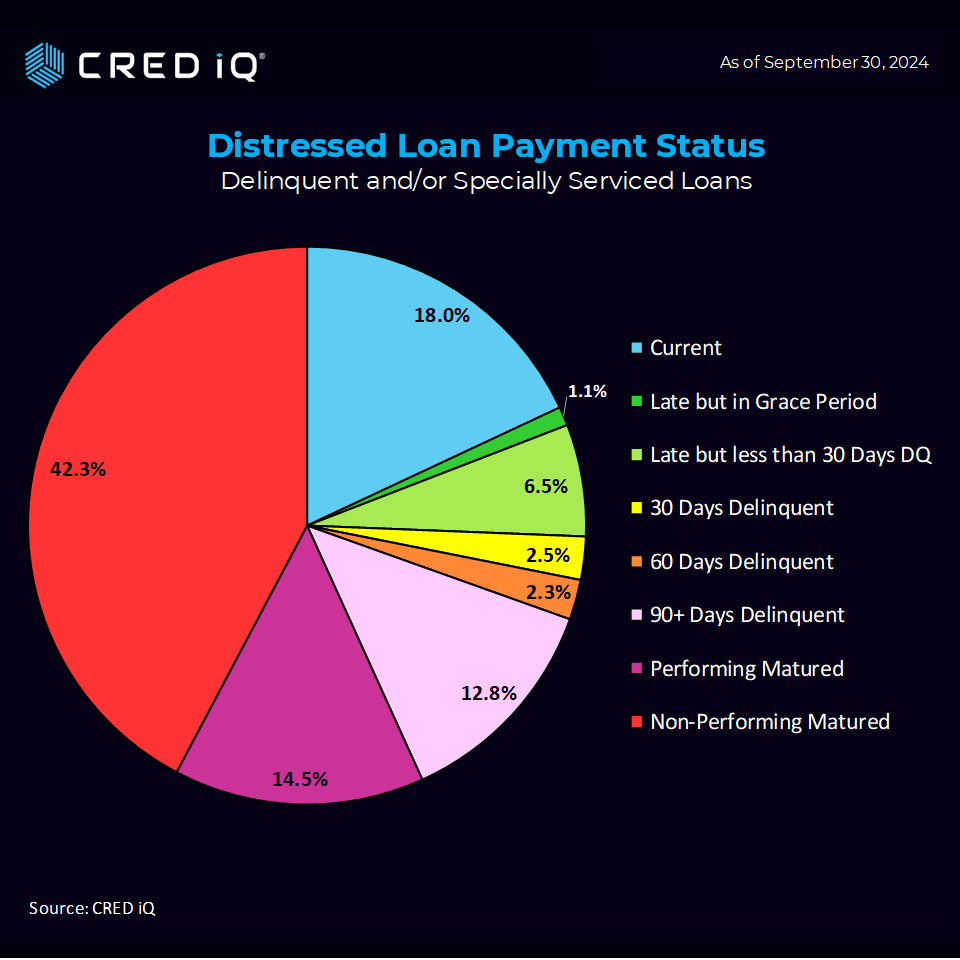

Our report yields the CRED iQ Distress Rate (which combines Delinquent and/or Specially Serviced loans) for the top 50 MSAs with the highest amount of distress of the largest 65 CRE markets.

Minneapolis now leads the top MSAs with 36.2% of their loans in distress. The former number two market soared to the number one spot after logging a stunning increase of 1,260 basis point increase from August. Stamford (32.2%) landed in 2nd place and saw the largest increase in our study from the August print of just 7.7%. A significant factor in Stamford’s increase was the default of an office portfolio. See the Loan Highlight section for details.

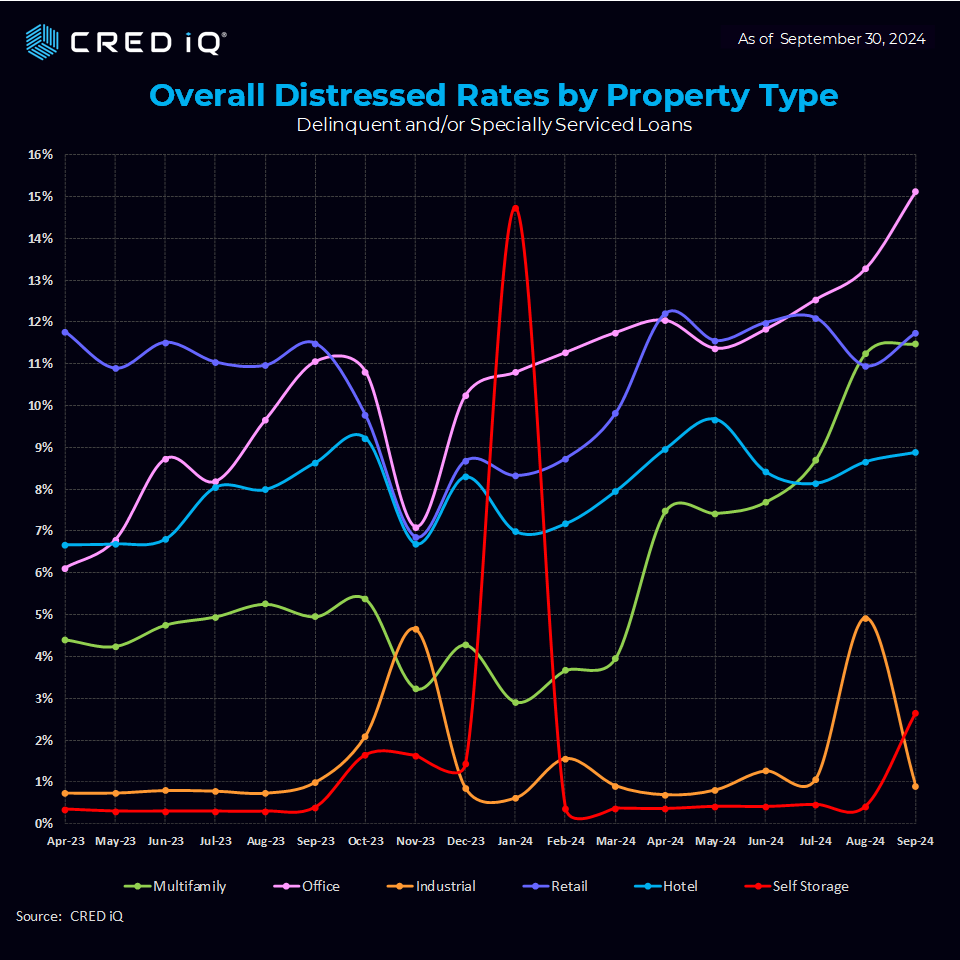

Tulsa (26.4%), Hartford (25.9%) and Portland (25.3%) round out the top 5. Former number one Charlotte came in at number 6 with a 24.6% distress rate compared to 24.8% in August. Adding some perspective, the overall distress rate for all loans across every market was 9.1% as of our October 3rd report.

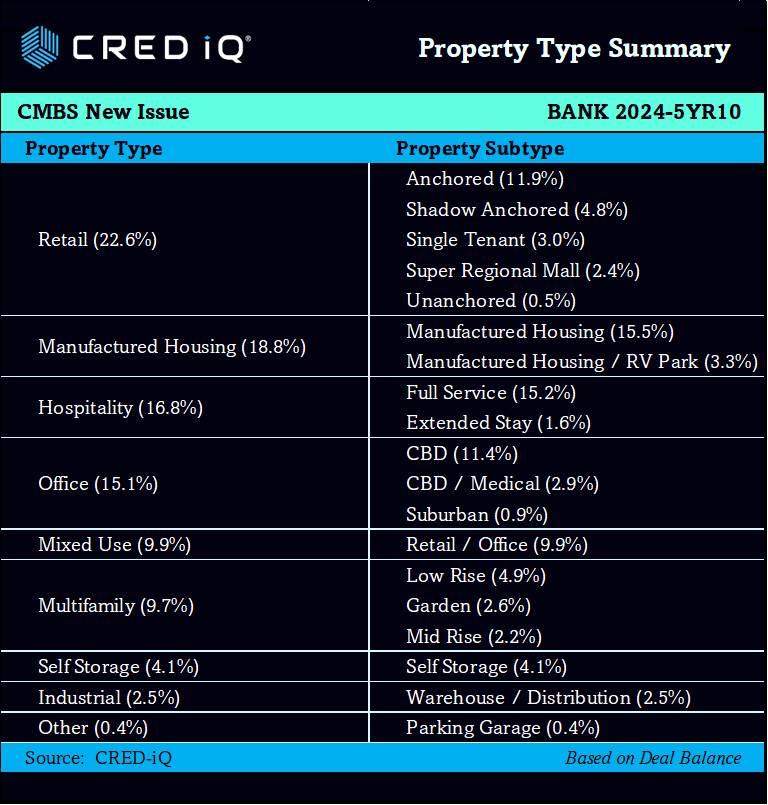

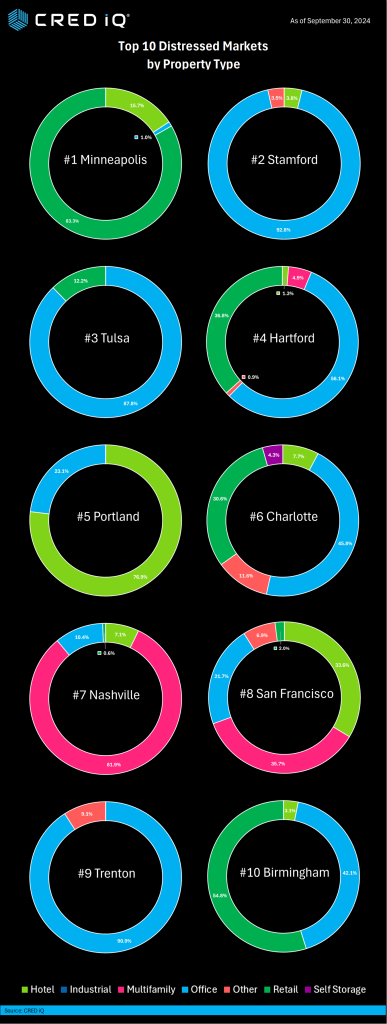

Looking deeper at MSAs experiencing the most distress, the office segment is a major factor in Stamford (93% of distressed loans are from the office segment), Trenton (91%), and Tulsa (88%).

Minneapolis (83%) and Birmingham (55%) see more than half of the markets’ distress emanating from the retail segment. Hotel drives the most distress in Portland (77%), while Nashville distress primarily stems from multifamily (81.9%).

Loan Highlight

The 982,483 SF Stamford Plaza Portfolio backs a $246.6M loan that defaulted at its August 2024 maturity. Consequently, the loan transferred to the special servicer in August 2024.

The portfolio consists of four adjacent office towers in downtown Stamford. Most recently, the portfolio was 71% occupied and performing with a below breakeven DSCR of 0.69. The collateral was valued at $427.2 million at underwriting in June 2014.

Early Warning Signals

CRED iQ’s early signals of upcoming distress include loans that have been added to the servicer’s watchlist for credit-related issues. Issues include weak financial performance, low occupancy, high tenant rollover, upcoming maturity risk among other reasons to be flagged as possible troubles.

About CRED iQ

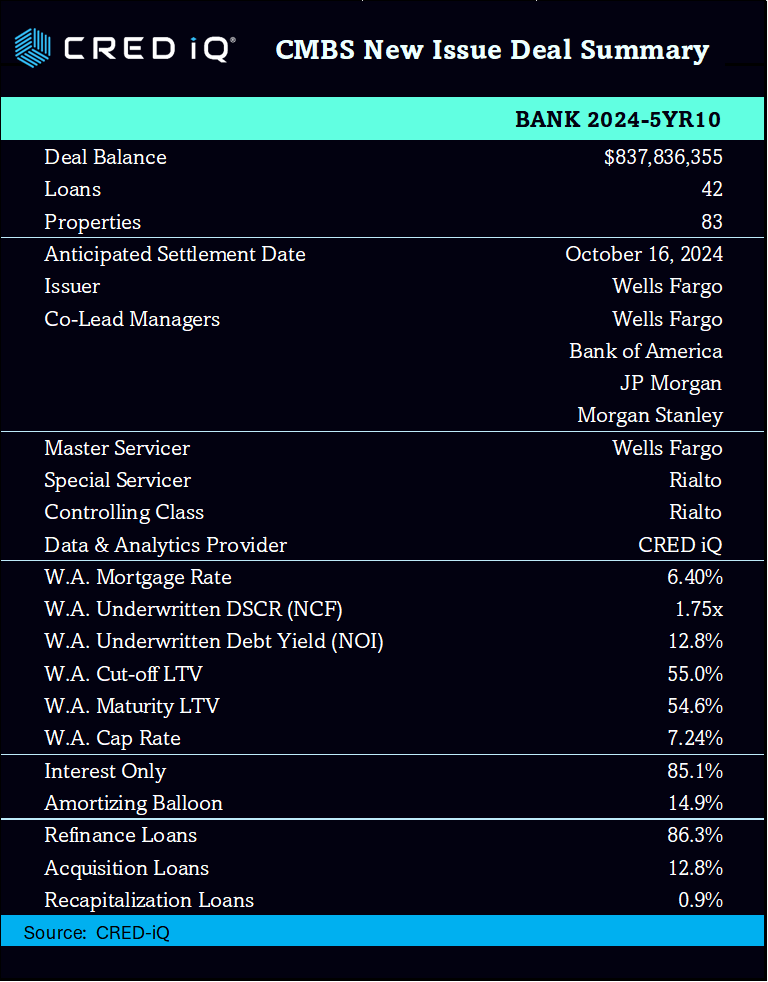

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.