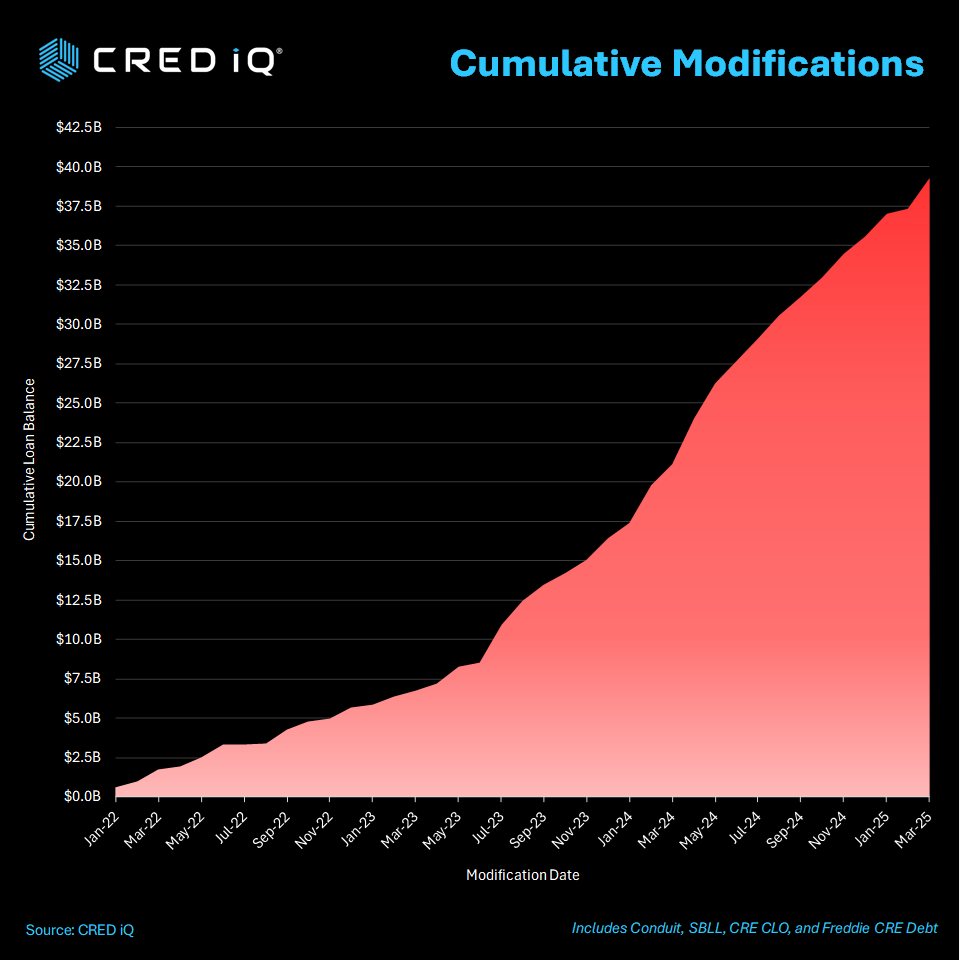

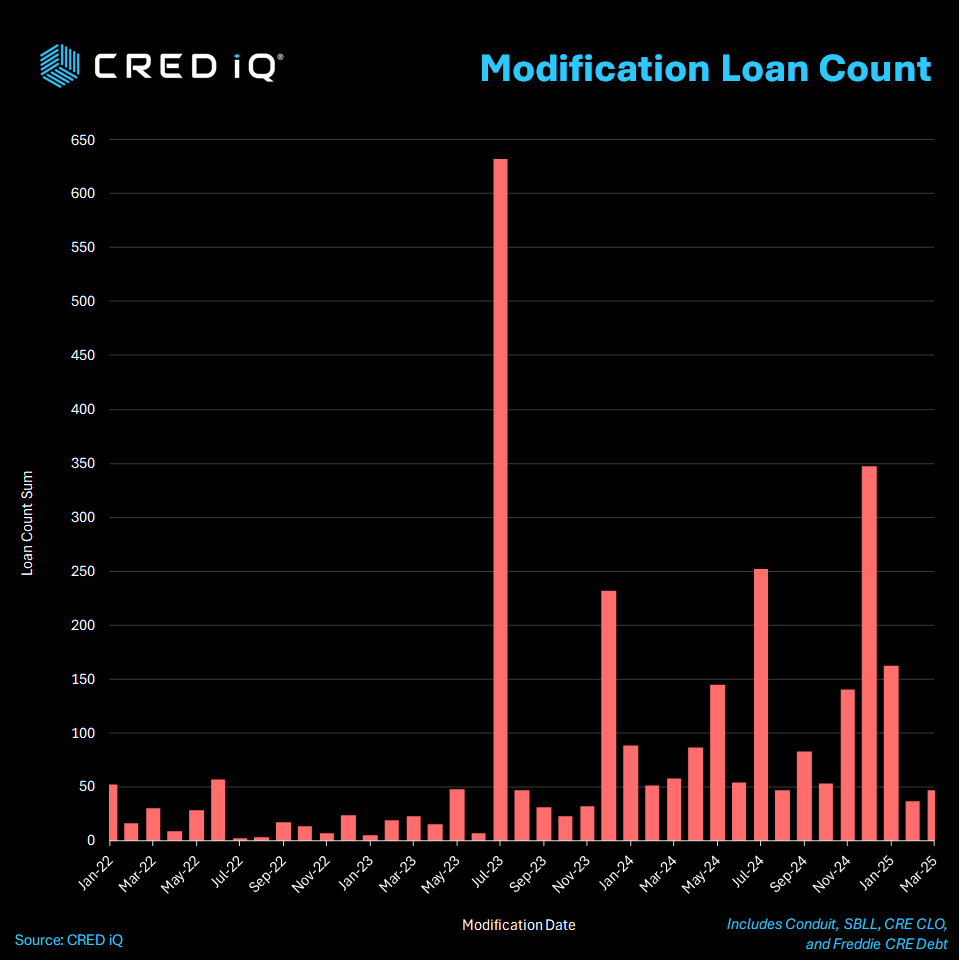

The commercial mortgage-backed securities (CMBS) market is showing signs of stabilization, with the overall distress rate declining for the third consecutive month, according to CRED iQ’s latest analysis. However, modest increases in delinquency and special servicing rates, coupled with a shift toward non-performing loans past maturity, warrant close attention from commercial real estate (CRE) professionals. Below, we unpack the trends shaping the CMBS landscape and their implications for investors, lenders, and property owners.

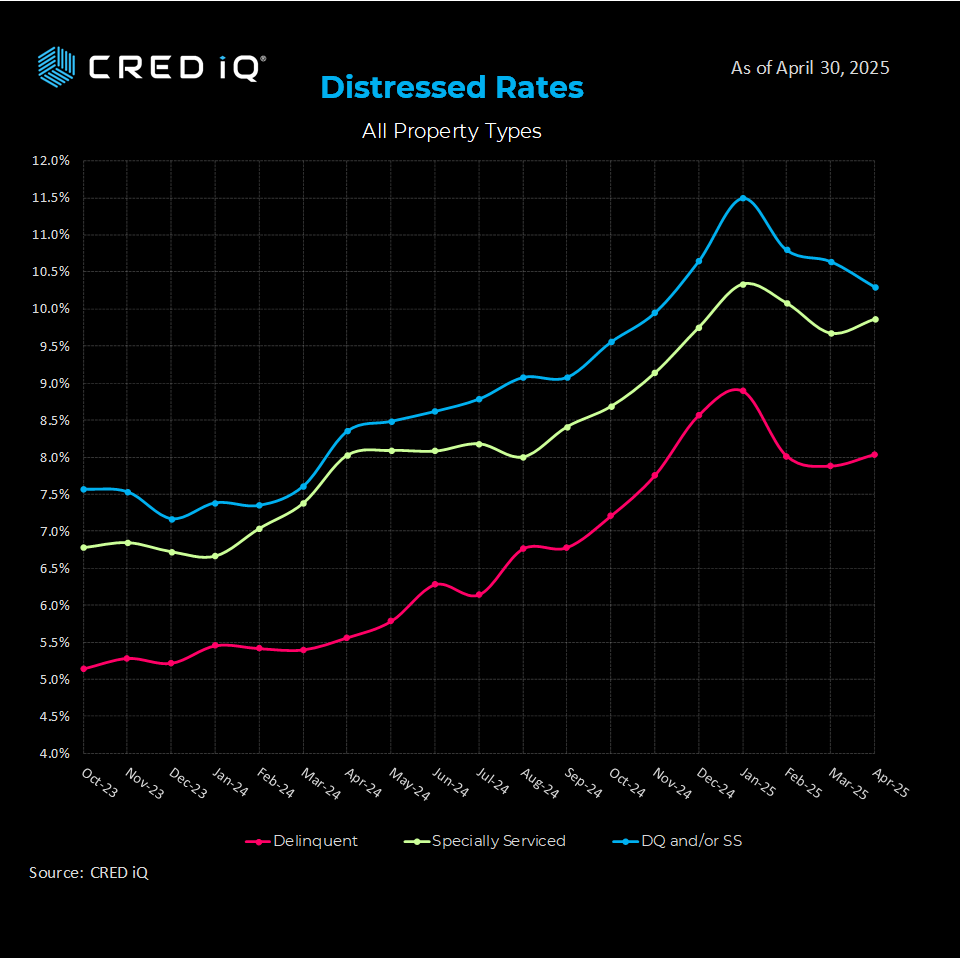

Distress Rate Trends: A Cautious Optimism

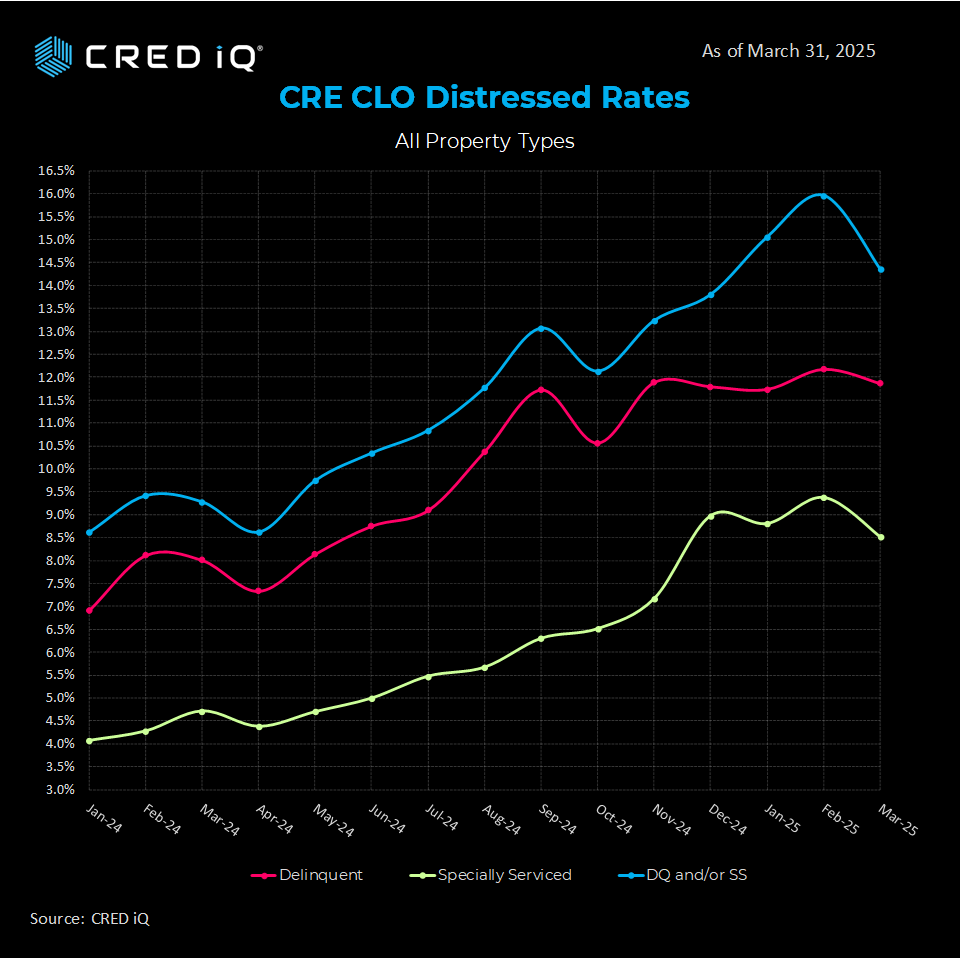

CRED iQ’s distress rate, a composite metric capturing loans 30+ days delinquent (or worse) and those in special servicing, fell by 30 basis points to 10.3% in the latest reporting period. This marks the third straight month of declines, signaling potential relief in the CRE sector after a period of heightened volatility. Despite this positive trend, the delinquency rate ticked up slightly from 7.9% to 8.0%, while the special servicing rate increased by 20 basis points to 9.9%. These upticks highlight the need for vigilance as underlying pressures persist.

Payment Status Breakdown: A Closer Look

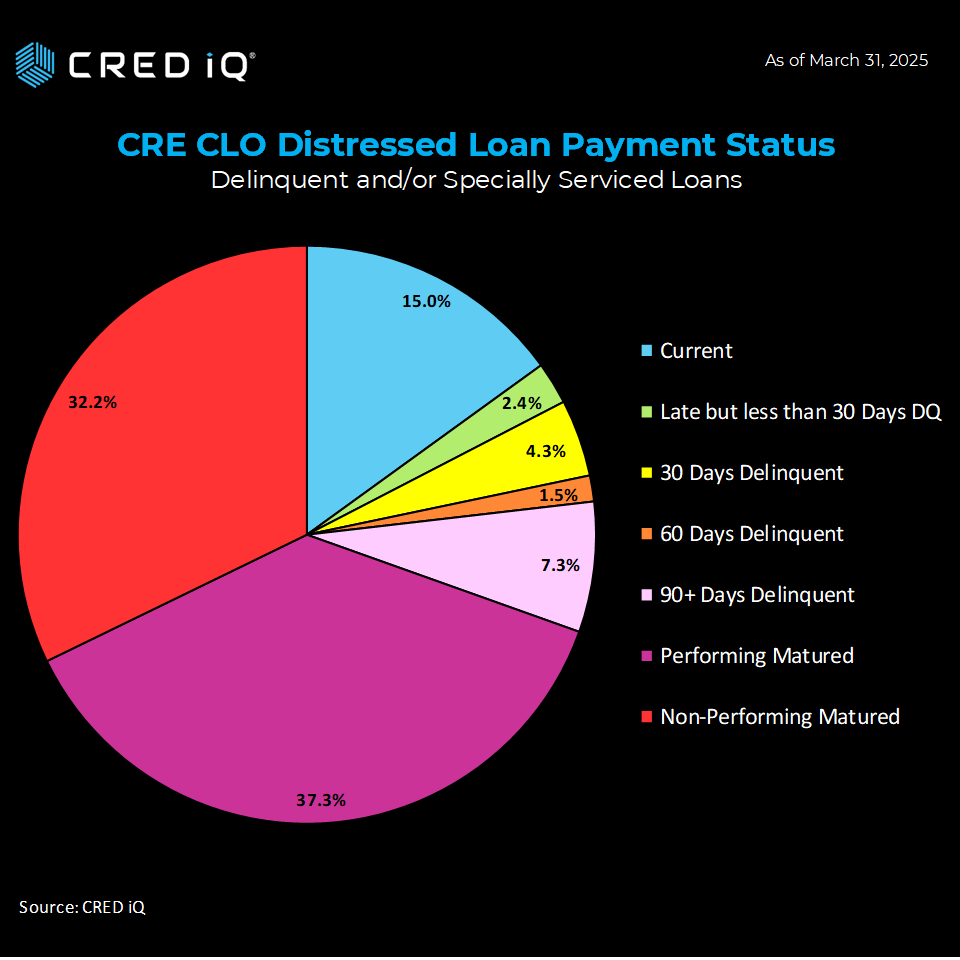

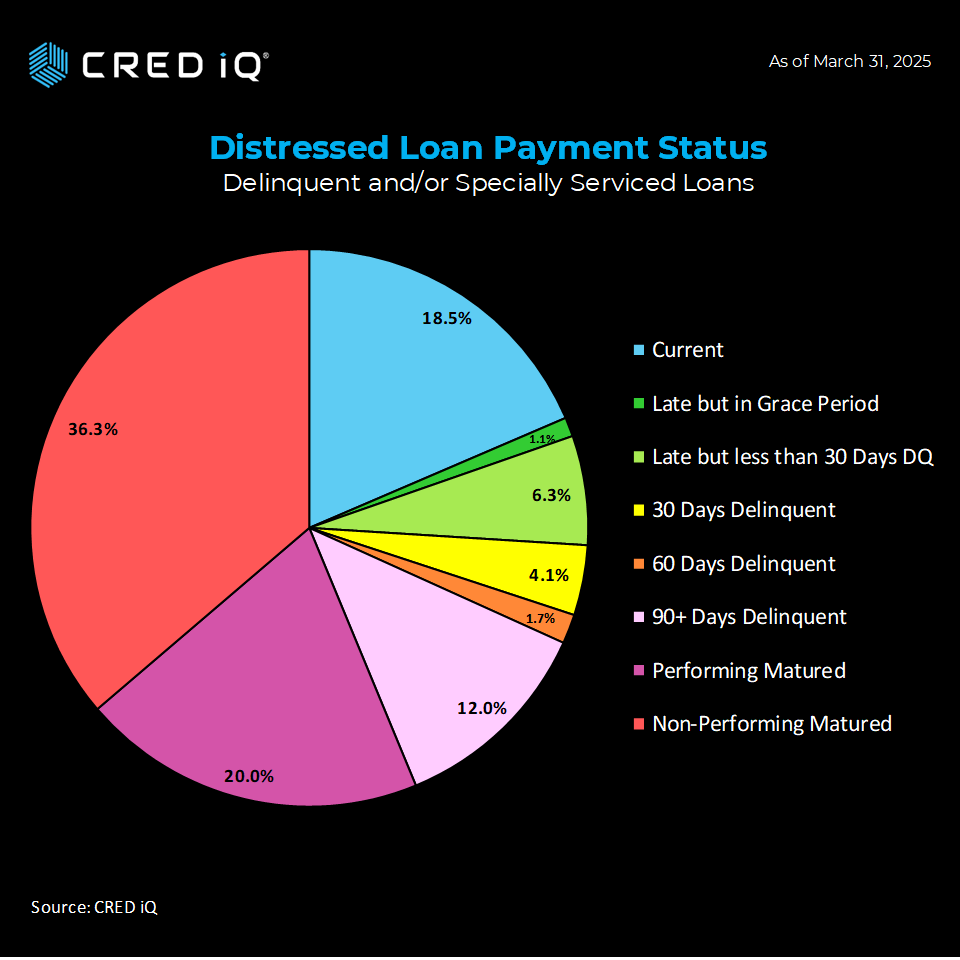

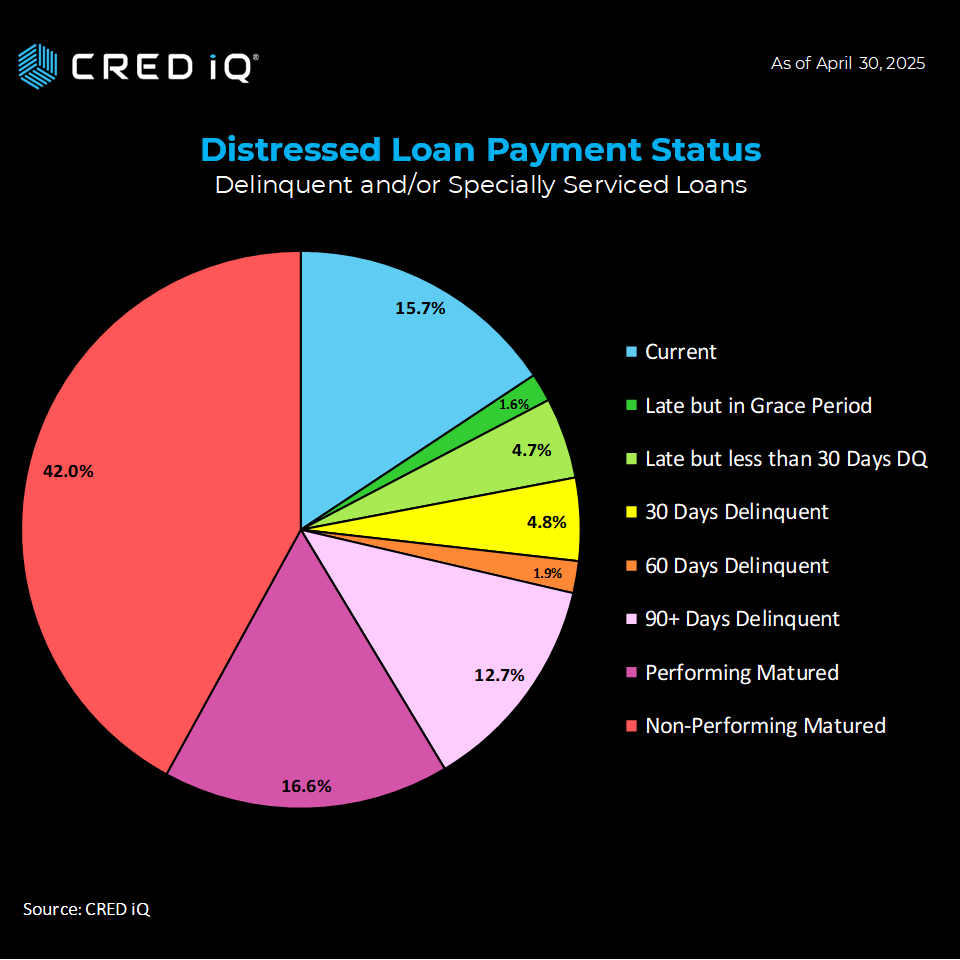

Analyzing the payment status of approximately $52.9 billion in distressed CMBS loans reveals critical shifts:

- Current Loans: $8.3 billion (15.7%) remain current, down from $10.3 billion in the prior month, reflecting a reduction in performing loans.

- Delinquent Loans: $13.6 billion (25.7%) are delinquent, including those within grace periods, holding steady month-over-month.

- Matured Loans: $31.0 billion (58.6%) have passed their maturity date. Of these, 16.6% are performing (down from 20.0%), while 42.0% are non-performing (up from 36.3%), indicating a notable swing toward non-performance.

This shift in matured loans underscores the challenges borrowers face in refinancing or resolving loans in a high-interest-rate environment, a trend that could impact CMBS portfolio performance if it persists.

CRED iQ’s Methodology: A Comprehensive Approach

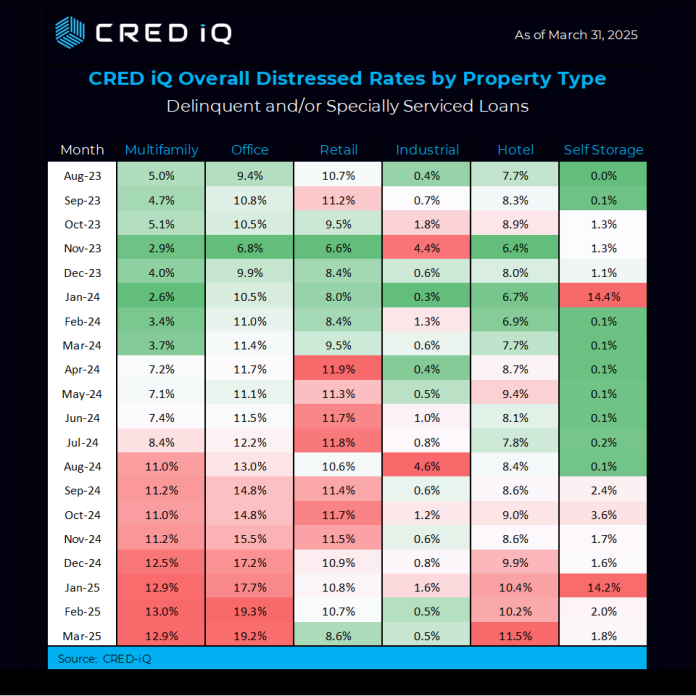

CRED iQ’s distress rate provides a holistic view of CMBS performance by combining delinquency (30+ days past due) and special servicing activity, including both performing and non-performing loans that fail to pay off at maturity. Our analysis focuses on conduit and single-borrower large loan structures, while separately tracking Freddie Mac, Fannie Mae, Ginnie Mae, and CRE CLO metrics. This granular approach ensures CRE professionals have a clear, actionable understanding of market dynamics.

What’s Driving the Trends?

The consecutive decline in the distress rate is a promising sign for the CRE sector, potentially reflecting improved borrower performance or successful loan resolutions. However, the uptick in delinquency and special servicing rates suggests ongoing challenges, particularly for properties facing maturity defaults. The increase in non-performing matured loans highlights the impact of tighter financing conditions and elevated interest rates, which continue to strain borrowers’ ability to refinance.

Looking Ahead: Implications for CRE Stakeholders

For CRE professionals, these trends carry several implications:

- Investment Strategy: The declining distress rate may present opportunities for investors to acquire performing assets at favorable terms, but caution is advised given the rise in non-performing loans.

- Risk Management: Lenders and servicers should closely monitor matured loans, as the shift toward non-performance could elevate default risks.

- Portfolio Optimization: Property owners should prioritize proactive engagement with servicers to address potential maturity challenges and explore workout options.

CRED iQ remains committed to delivering timely, data-driven insights to help stakeholders navigate this evolving landscape. Our team is actively monitoring delinquency, special servicing, and maturity trends to provide clarity on the forces shaping the CMBS market.

Stay Informed with CRED iQ

As the CRE sector continues to adapt to macroeconomic shifts, CRED iQ’s comprehensive analytics offer a critical resource for decision-makers. For a deeper dive into our data or to discuss how these trends impact your portfolio, contact our team today. Stay tuned for our next update, where we’ll continue to track the metrics driving the CMBS market.

For more information, visit CRED iQ or reach out to our research team.

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.

THE DATA, INFORMATION AND/OR RELATED MATERAL (“DELIVERABLES”) IS BEING OFFERED AS-IS/WHERE-AS CONDITION. CRED-IQ MAKES NO REPRESENTATION OR WARRANTY AS TO QUALITY OR ACCURACY OF SUCH DELIVERABLES BEING PURCHASED, WHETHER EXPRESS OR IMPLIED, EITHER IN FACT OR BY OPERATION OF LAW, STATUTE, OR OTHERWISE, AND CRED-IQ SPECIFICALLY DISCLAIMS ANY AND ALL IMPLIED OR STATUTORY WARRANTIES INCLUDING WARRANTIES OF MERCHANTABILITY AND OF FITNESS FOR A PARTICULAR PURPOSE, TECHNICAL PERFORMANCE, AND NON-INFRINGEMENT. WITHOUT LIMITING THE FOREGOING, YOU AS CUSTOMER ACKNOWLEDGE THAT YOU HAVE NOT AND ARE NOT RELYING UPON ANY IMPLIED WARRANTY OF MERCHANTABILITY OR OF FITNESS FOR A PARTICULAR PURPOSE OR OTHERWISE, OR UPON ANY REPRESENTATION OR WARRANTY WHATSOEVER AS TO THE DELIVERABLES IN ANY REGARDS WHATSOEVER, AND ACKNOWLEDGE THAT CRED-IQ MAKES NO, AND HEREBY DISCLAIMS ANY, REPRESENTATION, WARRANTY OR GUARANTEE THAT THE PURCHASE, USE OR COMMERCIALIZATION OF ANY DELIVERABLES WILL BE USEFUL TO YOU OR FREE FROM INTERFERENCE. BY ACCEPTANCE OF THE DELIVERABLES, YOU HEREBY RELEASE CRED-IQ AND ITS AFFILIATES AND AGENTS FROM ALL CLAIMS, DAMAGES AND LIABILITY ARISING HEREUNDER.