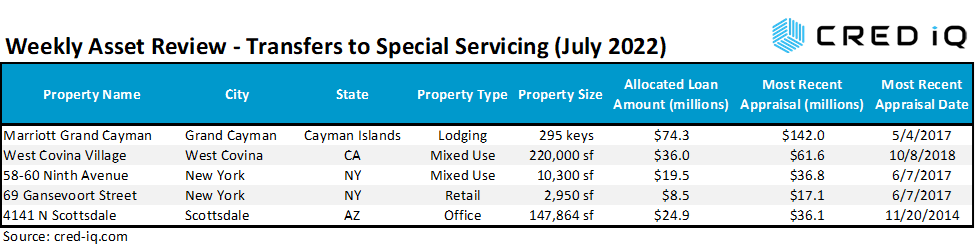

CRED iQ’s special servicing rate for CMBS conduit and SASB transactions declined to 4.47% in July 2022, compared to 4.64% in June 2022. Despite the month-over-month decline, loans totaling nearly $200 million transferred to the special servicer during the July reporting period.

In this week’s Weekly Asset Review (WAR Report), CRED iQ highlights five distressed properties that have transferred to special servicing in June and July 2022. Featured properties include a lodging property located in the Cayman Islands, a mixed-use property outside of Los Angeles, CA, and a pair of ground floor retail spaces in Manhattan, NY.

CRED iQ valuations factor in a base-case (most likely), a downside (significant loss of tenants), and dark scenarios (100% vacant). For access to the valuation reports as well as full CMBS loan reporting, including detailed financials, updated tenant information, and borrower contact information, sign up for a free trial here.

Marriott Grand Cayman

295 keys, Full-Service Hotel, Grand Cayman, KY [View Details]

This $74.3 million loan transferred to the special servicer after a maturity default on July 1, 2022. The loan is secured by a 295-key full-service waterfront resort located on Seven Mile Beach in Grand Cayman. The property was severely impacted by disruptions in international travel starting in early 2020 and the ensuing slow recovery of the tourism industry in the Cayman Islands. However, the loan remained current, without modification or forbearance, throughout COVID-related disruptions. Average occupancy at the resort was reported as 5% during 2021. Corresponding to minimal occupancy, the property had an operating deficit greater than $5 million during 2021. In the last year of stabilization the property generated net cash flow of approximately $13.6 million. Rising interest rates coupled with the absence of stabilized hotel operations likely contributed to the maturity default. Mitigating concern, the collateral property is located in a market with a strategic location and high barriers to entry. For a valuation report and loan-level details, click here.

| Property Name | Marriott Grand Cayman |

| Address | 389 West Bay Road Grand Cayman, KY1-1202 |

| Outstanding Balance | $74,270,353 |

| Interest Rate | 5.45% |

| Maturity Date | 7/6/2022 |

| Most Recent Appraisal | $142,000,000 ($481,356/key) |

| Most Recent Appraisal Date | 5/4/2017 |

West Covina Village

220,000 sf, Mixed-Use (Retail/Office), West Covina, CA [View Details]

This $36 million loan transferred to special servicing on July 8, 2022 due to delinquency. The loan initially became delinquent in June and remained over four months delinquent as of July. The loan is secured by a 220,000-sf retail and office property located in West Covina, CA, approximately 20 miles east of Los Angeles. The retail portion of the property is grocery-anchored by Stater Bros. Markets, which occupies 16% of the property’s NRA. The office portion of the property is occupied by UEI College, which is a for-profit vocational school that occupies 16% of the property’s GLA.

LA Fitness was the third-largest tenant at the property but vacated in late-2021. Prior to its closure, LA Fitness operated the space as Esporta Fitness, which was the gym’s answer to low price offerings from Planet Fitness. The tenant occupied 13% of the property’s GLA but paid significantly higher rent than other tenants, accounting for approximately 24% of the property’s base rent. A November 2021 lease termination allowed LA Fitness to vacate ahead of its scheduled lease expiration in November 2026. The departure of the tenant left the property approximately 80% occupied. For a valuation report and loan-level details, click here.

| Property Name | West Covina Village |

| Address | 301-477 North Azusa Avenue West Covina, CA 91791 |

| Outstanding Balance | $36,000,000 |

| Interest Rate | 5.44% |

| Maturity Date | 12/6/2028 |

| Most Recent Appraisal | $61,600,000 ($280/sf) |

| Most Recent Appraisal Date | 10/8/2018 |

58-60 Ninth Avenue and 69 Gansevoort Street

13,250 sf, Mixed-Use (Retail/Multifamily), New York NY [View Details]

These two properties located in the Meatpacking District of Manhattan, NY transferred to special servicing on July 1, 2022 due to imminent monetary default. The properties secure a $28 million mortgage that is scheduled to mature on August 6, 2022, indicating an impending maturity default likely also contributed to the loan’s transfer to the special servicer.

The property at 58-60 Ninth Avenue is a four-story building with 10,300-sf with 6,800 sf of retail space and three multifamily units. The retail space was formerly occupied by Free People pursuant to a lease that was scheduled to expire in January 2027. However, the retailer stopped paying rent in early 2020 and the loan sponsor, Delshah Capital, terminated the lease after missed rent payments. For a valuation report and loan-level details, click here.

| Property Name | 58-60 Ninth Avenue |

| Address | 58-60 Ninth Avenue New York, NY 10011 |

| Allocated Loan Amount | $19,500,000 |

| Interest Rate | 4.25% |

| Maturity Date | 8/6/2022 |

| Most Recent Appraisal | $36,800,000 ($3,573/sf) |

| Most Recent Appraisal Date | 6/7/2017 |

The property at 69 Gansevoort Street is a single-tenant 2,950-sf retail space that was formerly occupied by Madewell. The tenant rejected its lease through bankruptcy proceeds and vacated in August 2020. Similar to the Free People lease, Madewell’s lease was scheduled to expire in January 2027. A long-term replacement tenant does not appear to have been found. For a valuation report and loan-level details, click here.

| Property Name | 69 Gansevoort Street |

| Address | 69 Gansevoort Street New York, NY 10014 |

| Allocated Loan Amount | $8,500,000 |

| Interest Rate | 4.25% |

| Maturity Date | 8/6/2022 |

| Most Recent Appraisal | $17,100,000 ($5,797/sf) |

| Most Recent Appraisal Date | 6/7/2017 |

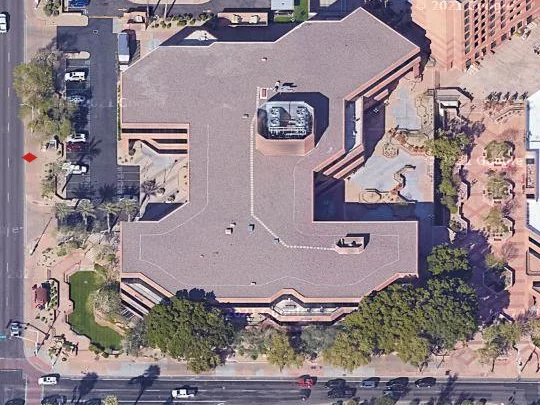

4141 N Scottsdale

147,864 sf, Office, Scottsdale, AZ [View Details]

CRED iQ last highlighted this property in a November 2021 Weekly Asset Review report, detailing the anticipated departure of the property’s largest tenant, Aetna. The tenant, which used the space for its Coventry Health Care operations, vacated at lease expiration in December 2021. Aetna accounted for 73% of the property’s NRA. The property secures a $24.9 million mortgage that is scheduled to mature in February 2025. The loan transferred to special servicing on June 21, 2022 due to delinquency. Comments from the special servicer stated that the borrower is under contract to sell the property and is in the process of defeasing the loan. For a valuation report and loan-level details, click here.

| Property Name | 4141 N Scottsdale |

| Address | 4141 N Scottsdale Road Scottsdale, AZ 85251 |

| Outstanding Balance | $24,903,900 |

| Interest Rate | 4.11% |

| Maturity Date | 2/6/2025 |

| Most Recent Appraisal | $36,100,000 ($244/sf) |

| Most Recent Appraisal Date | 11/20/2014 |

For full access to our loan database and valuation platform, sign up for a free trial below:

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. Our data platform is powered by over $2.0 trillion of CMBS, CRE CLO, SBLL, Ginnie Mae, FHA/HUD, and Freddie Mac loan and property data.