Properties and mortgage notes securing nearly $600 million in outstanding CMBS debt were auctioned from January 2023 through mid-June 2023, based on CRED iQ’s observations of impending losses for investors. Sales through an auction can take a couple months to close; however, sale transactions can be delayed or even fail to close after a due diligence process. Additional complications include relatively tighter lending for the commercial real estate market compared to the prior year; although, many of the distressed auction sales can attract all-cash acquisition bids. Of the approximate 70 auctions observed thus far in the first half of 2023, only nine sales auctioned assets with CMBS debt totaling $40 million were closed as of the June 2023 reporting period.

CRED iQ monitored over 70 individual CMBS property and note sales through their respective auction processes during the first half of 2023 and were able to identify definitive final bids for approximately 57 of those properties. Of the 57 auctions with definitive bids, 25 involved distressed sales facilitated by a special servicer. Of the 25 specially serviced assets, there were 16 REO properties with titles that transferred to respective CMBS trusts prior to auction events. Special servicers are tasked with liquidating these properties, sometimes after a period of stabilization, for maximum proceeds on behalf of CMBS certificate holders.

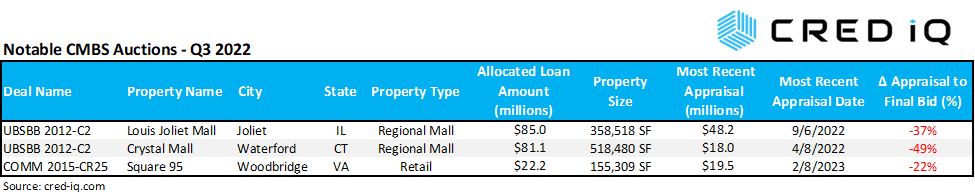

Of the 16 REO properties that were auctioned, the average holding period between title acquisition and auction date was approximately 1.5 years. The shortest holding period was slightly over seven months, and the longest holding period was just under five years. The most protracted sale was a March 2023 auction of Square 95, a 155,309-SF big-box retail outparcel of the Potomac Mills Mall in Woodbridge, VA. The special servicer acquired title on behalf of the CMBS trust in June 2018. The high bid was approximately $15.2 million, equal to $98/SF, which was approximately 22% less than the property’s most recently reported appraisal value of $19.5 million. The property was sold to the municipality of Prince William County, which is also a tenant that was previously signed by the special servicer to backfill more than half of the property’s vacant space. Outstanding debt on the property was approximately $22 million.

By securitization vintage, auctions since the start of 2023 were most prevalent among 2017 vintage deals. Approximately 43% of observed auctions were from 2017 securitizations, many from a 138-property lodging portfolio that used the auction process to unencumber individual hotels from a single large-loan securitization. For this reason, hotels were the most common property type for CMBS auctions with more than 50 attempted sales between January 2023 and mid-June 2023. Retail properties also comprised a high quantity of auctions with eight attempted sales. By market, the auctioned assets were dispersed geographically. Houston and Chicago were notable MSAs with exposure to multiple auctions of CMBS properties.

CRED iQ observed insights into pricing discovery for properties that resulted from assets’ final bids. Of the auction results confirmed during the first half of 2023, there were 25 CMBS properties that reported appraisal dates as of 2021 or later. Excluding assets with pre-2021 appraisals, approximately 32% of the auctioned assets were observed to have received final bids that were higher than most recent appraisals.

When properties traded at a discount to the most recent appraisals, the average difference was approximately -33%. One of the most severe discounts from appraisal to final bid, equal to -49%, was the Crystal Mall in Waterford, CT. The 518,480-SF property had been REO since October 2022 and was sold for $9.25 million, equal to $18/SF. The final bid was approximately half of the property’s most recently reported appraisal value of $18 million and 94% lower than the mall’s appraisal from April 2012 when its $95 million mortgage was originated. The mall had approximately $81 million of outstanding debt as of June 2023.

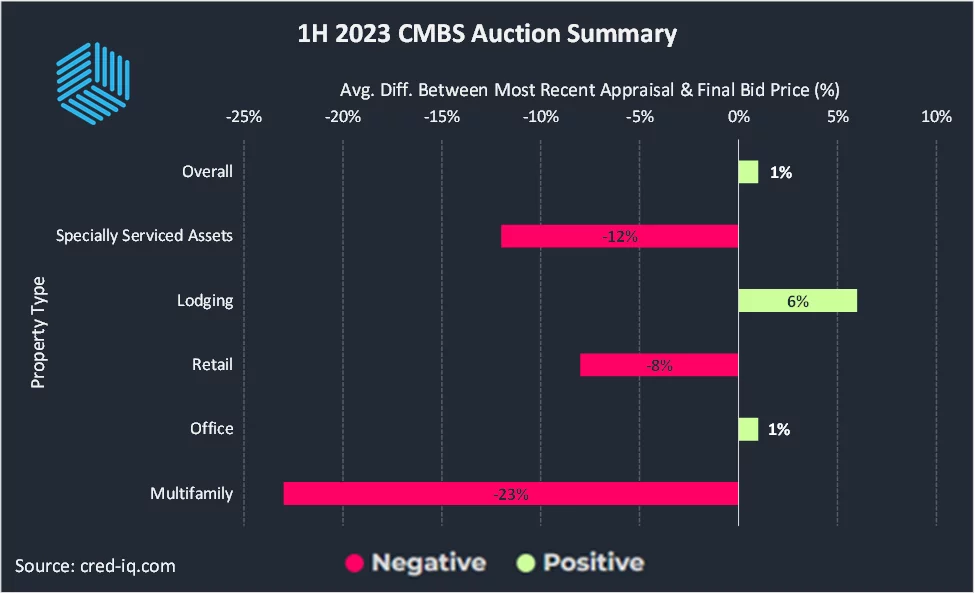

In summary, the average difference between final bid prices and most recent appraisals was approximately +1%. Isolating for specially serviced assets resulted in an average difference of -12%. Lodging properties exhibited a +6% average variance between recent appraisals and final auction bids while retail properties fared worse with an -8% average difference between most recent appraisals and final bids. Multifamily properties had a -23% difference, but most of the properties had small outstanding debt balances, less than $2 million. Office properties had a +1% average variance between most recent appraisals and final bids.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities.

The platform also offers a highly efficient valuation engine which can be leveraged across all property types and geographies. Our data platform is powered by over $2.0 trillion in transactions and data covering CRE, CMBS, CRE CLO, Single Asset Single Borrower (SASB), and all of GSE / Agency.