New York City and Office Dominate 1st Half 2024 Valuation Declines

As we pass the halfway point in 2024, CRED iQ analyzed properties that were re-appraised this year and in 2023. Our research team wanted to expose trending and any associated insights of what lies ahead in the second half. Each of these properties were either delinquent or with the special servicer and received updated appraisals in 2023 or 2024.

In total, the average decline in value compared to the original valuation at issuance was -43%, an increase of 140 basis points over our Q4 2023 print.

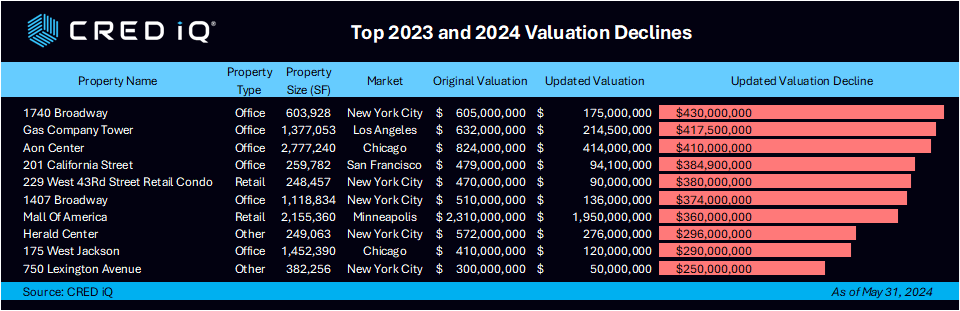

Our analysis looked at 2024 year-to-date performance and then created rankings for both 2023 and 2024 combined. The combined view offers an important dimension as many key properties in 2024 were last appraised in 2023.

Sector Perspectives

- The top three largest overall declines, not surprisingly, were in the Office sector which also saw the largest single property valuation decline. Within our sample, 2024 declines averaged a 53%

- The retail sector was not far behind, notching an average valuation decline of 52%, along with the fourth largest single asset reduction across all property types

- The hotel sector saw an average of 40% valuation reduction

- Comparing our Q4 2023 report with this analysis, the average multifamily valuation decline remained mostly flat at 35%. Meanwhile, industrial improved from 32% declines to 10% in this current print.

Individual Property Performance

Looking across the top 10 declining assets for both 2023 and 2024, 6 are office properties, 2 are in the retail sector and 2 are classified as “other”. Half of the top 10 are located in New York City, 2 in California (one each in Los Angeles and San Francisco), and the Midwest was represented by 2 properties in Chicago and 1 in Minneapolis.

With a touch of irony, we take note that the same address digits for the #1 overall asset decliner 1740 Broadway, appear with newcomer 1407 Broadway which came in at #6 in the combined analysis.

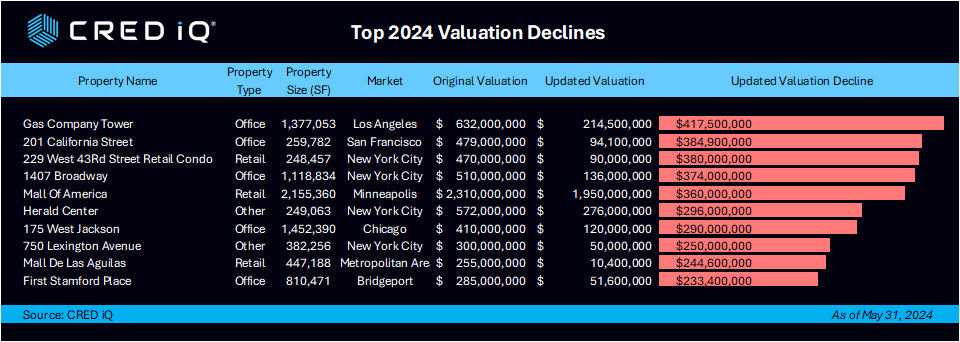

We see a number of familiar names on the top ten list for properties appraised in 2024 including the number one entry the Gas Company Tower—an office property in Los Angeles and 229 West 43rd Street which comes in at #3. Just like the combined list, 5 of the top 10 properties are in the office sector, followed by 3 in retail and 2 in the other category.

About CRED iQ

CRED iQ is an official market data provider for the Commercial Real Estate and financial industries. Powered by over $2.3 trillion in loan and transaction data that includes all property types and geographies.

CRE professionals leverage CRED iQ for a wide spectrum of use cases such as uncovering acquisition & lending opportunities, market analysis, underwriting, and risk management.