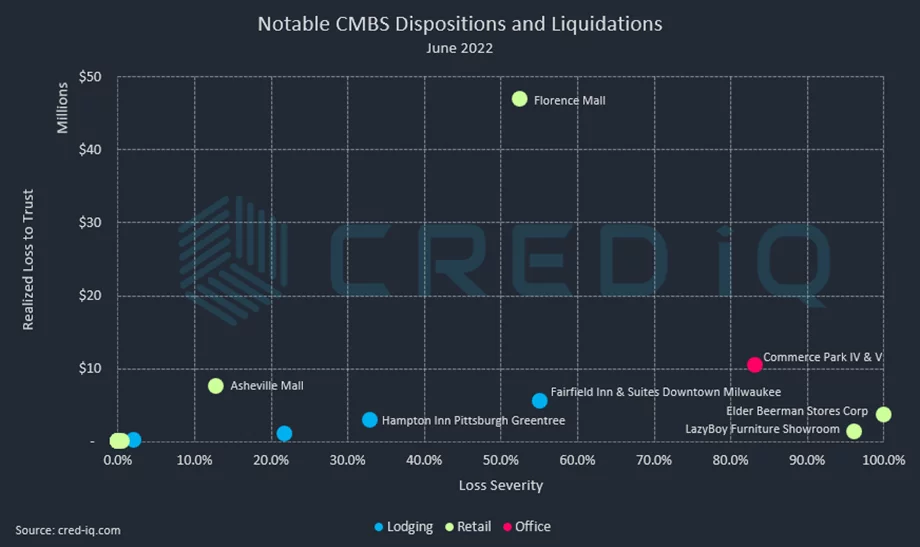

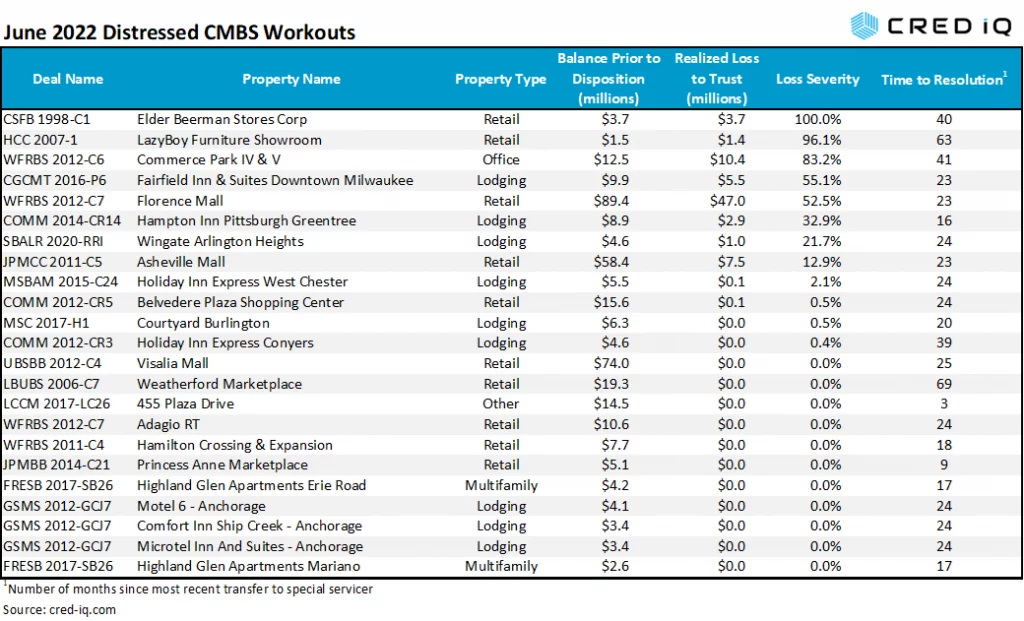

CMBS conduit and SBLL transactions incurred approximately $80 million in realized losses during June 2022 through the workout of distressed assets. CRED iQ identified 21 workouts classified as dispositions, liquidations, or discounted payoffs in June 2022. Additionally, there were two distressed loans securitized in Freddie K transactions that needed workouts, though neither workout resulted in a principal loss to either trust. Of those 23 total workouts, there were 11 distressed assets that were resolved without a loss. Of the 12 workouts resulting in losses, severities for the month of June ranged from less than 1% to 100%, based on outstanding balances at disposition. In total, realized losses in June were significantly lower than May; although, May realized loss totals were the outlier on the high end through year-to-date 2022. March and April 2022 realized loss totals averaged approximately $80 million, in line with this month’s total.

Retail and lodging properties accounted for 83% of the total number of distressed CMBS workouts this month. There were 10 retail workouts and nine lodging workouts. Approximately 75% of realized losses in June were associated with retail properties.

The liquidation of Florence Mall represented the largest loss, by dollar amount, among all distressed workouts this month. The property was formerly owned by Brookfield Property Partners but the firm agreed to a deed-in-lieu of foreclosure in January 2021 after the loan transferred to special servicing in July 2020. After a nearly two-year workout, the loan was resolved with a 52.5% loss severity, resulting in $47 million in principal losses to CMBS certificate holders.

There was only one distressed workout of an office property in June, but the disposition was notable. Commerce Park IV and V consisted of two REO office buildings located in suburban Cleveland, OH. The properties had been in special servicing since January 2019 due to declines in occupancy. Occupancy issues did not improve in subsequent years and the buildings became REO in March 2021. Outstanding debt for the properties totaled approximately $12.5 million at disposition and Commerce Park IV and V were liquidated with a $10.4 million principal loss to CMBS certificate holders, equal to an 83% severity.

Excluding defeased loans, there was approximately $7.8 billion in securitized debt that was paid off or liquidated in June, which was higher than $5.2 billion in May 2022. In June, 5% of the loan resolutions were categorized as dispositions, liquidations, or discounted payoffs, which was significantly lower than the prior month. An additional 10% of the loans paid off with prepayment penalties.

By property type, lodging had the highest total of outstanding debt pay off in June. The high volume of lodging payoffs was driven by the retirement of a $1.38 billion mortgage secured by the 3,027-key Cosmopolitan of Las Vegas. Blackstone sold the resort and casino in May 2022 for $5.65 billion in a transaction that allows the firm to retain partial ownership and transfers operations to MGM Resorts, among other details.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform designed to unlock investment, financing, and leasing opportunities. CRED iQ provides real-time property, loan, tenant, ownership, and valuation data for over $2.0 trillion of commercial real estate.