The commercial real estate collateralized loan obligation (CRE CLO) market offers lenders flexibility and investors exposure to diversified real estate debt. As interest rates elevated the sector experienced notable shifts in loan performance. But are those trends now reversing? Let’s dig into the numbers.

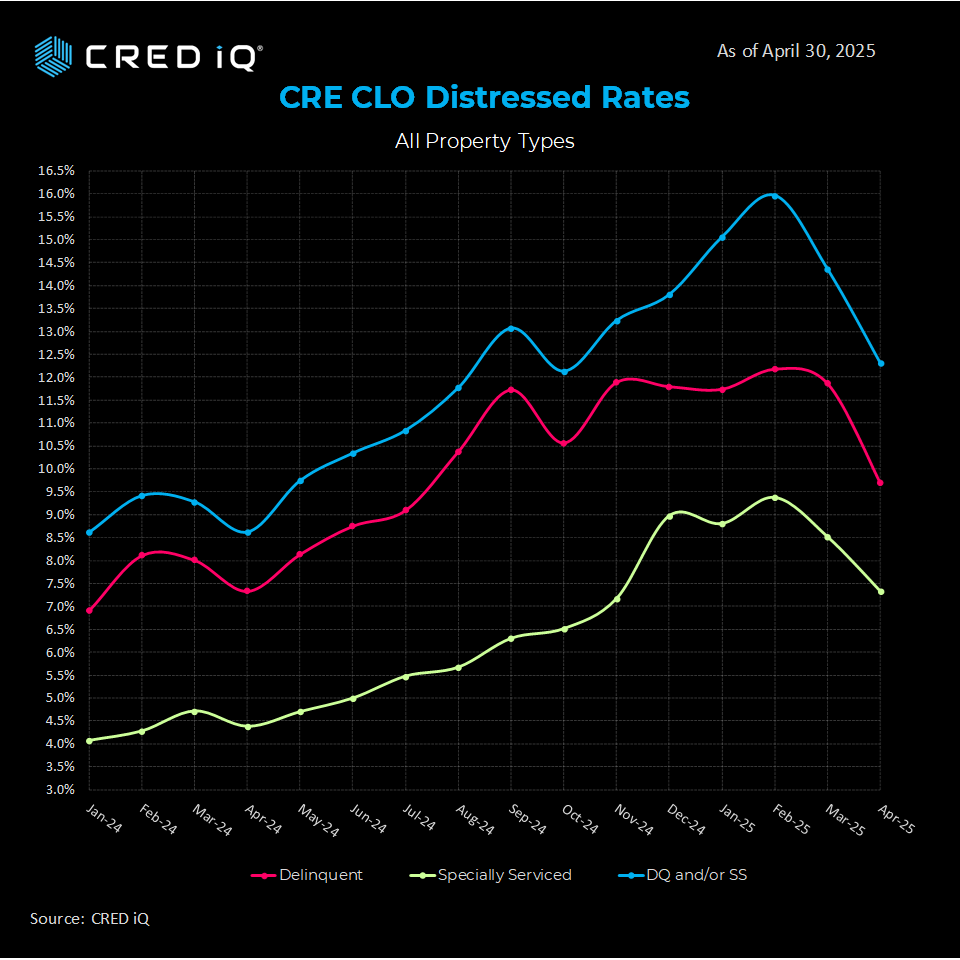

CRED iQ’s latest report on the April results reveal some encouraging trends. Our overall distress rate notched a 410-basis point decline, the largest such favorable move in over a year. The CRE CLO distress rate now stands at 10.3%.

Similarly, the underlying metrics saw meaningful declines as well. Our delinquency rate dropped 220 basis points to 9.7% and special servicing shaved 110 BPS landing at 7.4%

Is CRE CLO Getting Hot?

Our research team widened the aperture a bit to examine the velocity of the CRE CLO sector over the past year. Here are some metrics from our study:

- Total year-to-date CRE CLO issuance totals $11.4 billion, which includes Invesco’s first CLO deal that totaled $1.2 billion

- Also notable TPG’s $1.1 billion managed CRE CLO deal, of which $962 million was rated investment grade.

As a comparison, during the first four months in 2024, CRE CLO volume only totaled $2.2 billion, meaning CRE CLO issuance velocities have increased 400% when compared to last year. Indeed, it could be argued that CRE CLO is already hot!

Payment Status

While these improvements are encouraging, the broader picture reveals ongoing challenges. 63.1% of CRE CLO loans have surpassed their maturity date (down from 69.5% last month). 36.6% are classified as “performing matured –down from 37.3%. This suggests that many borrowers are exercising extension options or negotiating month-to-month arrangements to avoid default.

Current Loans: 16.8% of loans were current (up from 15% in last month’s print).

Non-Performing Matured Loans: Represent 36.6% of CRE CLO loans (up from 32.2% last month)

Delinquent Loans (Pre-Maturity): Account for 15.7% of CRE CLO Loans (a jump up from 13.1% last month).

These figures reflect a market grappling with the aftermath of loans originated in 2021, when cap rates were compressed, valuations were elevated, and interest rates were historically low. Many of these loans, structured with floating rates and three-year terms, are now hitting maturity walls in a dramatically different economic environment.

Case Study: Haven at Bellaire

A real-world example illustrates the pressures facing CRE CLO borrowers. The $46.3 million Haven at Bellaire loan, backed by a 384-unit multifamily property in the Houston market, highlights maturity-related challenges. Set to mature in April 2025, the loan included two, one-year extension options at origination. The loan was added to the servicer’s watchlist in November 2024 due to pending loan maturity and transitioned to performing mature status in April 2025.

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.