In our first WAR Report for 2022, CRED iQ examines the impact of commercial real estate values following a December 21, 2021 announcement by Rite Aid disclosing the closure of 63 stores, some of which have already been shuttered. The announcement follows a similar initiative by CVS Health, which CRED iQ detailed in its December 14, 2021 WAR Report. Rite Aid has already identified store locations that will be closed and began its initiative in November 2021; although, the firm has not disclosed specific locations. The store closure initiative was driven by a need to improve profitability for the company and, as such, unproductive stores in less desirable locations are at risk of being shuttered.

Rite Aid closures are not a new development for commercial real estate investors. The retailer has exited several markets in past years and notably sold approximately 2,000 stores to Walgreens in 2017. Many of the acquired stores were redundant (located within 1 mile) with Walgreens’ incumbent operations and were subsequently closed. In many cases, Walgreens honored Rite Aid’s lease terms to maintain control of the space and limit competition; but examples of subleases came in the form of an agreement with Dollar Tree, O’Reilly Auto Parts, or local wine and spirits shops.

CRED iQ leveraged its platform to identify properties leased to Rite Aid, including single-tenant net lease properties and multi-tenant retail properties. CRED iQ identified 185 properties securing $1.7 billion in outstanding mortgage debt with Rite Aid as tenant. About half of the 185 properties are single tenant or net lease properties. Classifying properties by lease expiration date, CRED iQ was further able to isolate properties with Rite Aid lease expirations over the next 3 years as shown in the table below:

| Lease Expiration Year | # of Properties | Aggregate Outstanding Balance ($000’s) |

| 2021 or Earlier | 3 | $1,227 |

| 2022 | 2 | $2,937 |

| 2023 | 5 | $9,214 |

| 2024 | 7 | $12,155 |

For a copy of the comprehensive list of all CMBS properties with Rite Aid as a tenant — including nearly 100 single tenant locations, please reach out to Shane Beeson (shane@cred-iq.com) or click the link below.

The list includes:

[1] all commercial mortgage exposure to Rite Aid

[2] a complete list of all Rite Aid locations in the US (more than 2,400) and

[3] a list of former Rite Aid locations. Following the 2017 Walgreens acquisition of nearly 2,000 Rite Aid stores, many rent rolls have not been updated to reflect new tenant names. As such, data reported for many properties still indicate Rite Aid is a tenant, whereas the location has since been converted to a Walgreens. A few of these examples were highlighted below and show timely examples of the aftermath of a net lease retail closure.

This week’s WAR Report focuses specifically on singlet tenant properties. Single tenant properties lease to Rite Aid generally trade at higher capitalization rates than their CVS or Walgreens counterparts. Location within a region of commerce is also a key factor and many Rite Aids had inferior locations compared to competing pharmacies. This was magnified in the 2017 acquisition by Walgreens that resulted in several Rite Aid closures. Featured properties below include single tenant retail locations with near-term lease expirations or former Rite Aid locations that secure loans in special servicing.

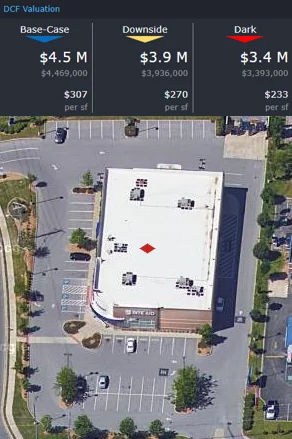

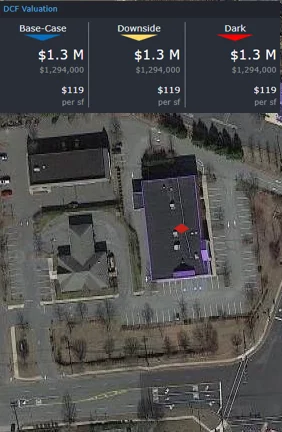

CRED iQ valuations factor in a base-case (expected lease renewal at in-place rent), a downside (lease renewal at 50% reduction in rent), and dark scenarios (100% vacant). Select valuations are provided for the properties below. For full access to the valuation reports including all 3 valuation scenarios as well as full CMBS loan reporting, with detailed financials, updated tenant information, and borrower contact information, sign up for a free trial here.

Rite Aid – Murfreesboro, TN

14,564 sf, Single-Tenant Retail, Murfreesboro, TN [View Details]

This specially serviced property in Murfreesboro, TN is physically vacant but is leased to Walgreens through September 2028. The property has an allocated loan amount of $3.1 million and is part of a 5-building net lease portfolio that secures a $10.1 million mortgage. Rite Aid was the initial tenant at loan origination, but the lease was assumed by Walgreens as part of its 2017 acquisition. Walgreens subsequently closed the store due to its proximity to a superior store location less than a half mile away. The superior Walgreens location is positioned at a nearby signalized intersection, which has more frequent cross traffic and is closer to an interchange with Interstate 24. The portfolio loan transferred to special servicing on June 21, 2021 due to non-compliance with a cash management trigger, likely related to the vacant building. Walgreens has made the vacant building available for sublease; however, use restrictions generally preclude other pharmacy operations. For the full valuation report and loan-level details, click here.

| Property Name | Rite Aid – Murfreesboro |

| Address | 2528 Old Fort Parkway Murfreesboro, TN 37128 |

| Allocated Loan Amount | $3,110,315 |

| Interest Rate | 4.71% |

| Maturity Date | 7/6/2027 |

| Tenant | Lease Expiration | Walgreens | 9/30/2028 |

| Most Recent Appraisal | $5,100,000 ($350/sf) |

| Most Recent Appraisal Date | 4/27/2017 |

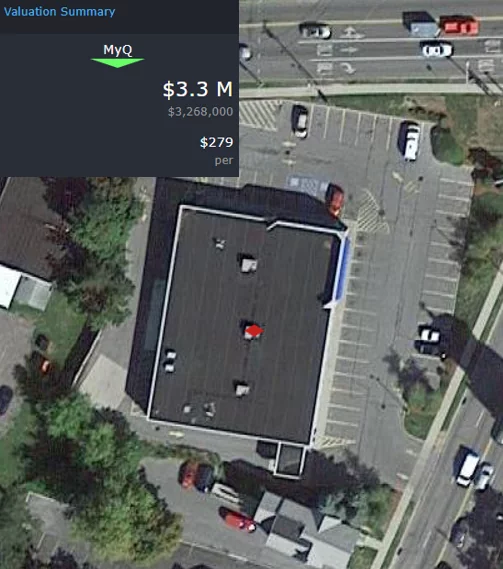

Rite Aid – Watertown, NY

11,699 sf, Single-Tenant Retail, Watertown, NY [View Details]

This REO property, which has outstanding debt of $2 million, was formerly occupied by Rite Aid pursuant to a lease that expired in September 2018. Rite Aid’s operations at the store were acquired by Walgreens in 2017, similar to the Murfreesboro location above. Walgreens favored another location less than a mile away and did not renew the 315 Arsenal Street lease at expiration. The 11,699-sf freestanding retail property then became economically and physically vacant. The building has been with the special servicer, LNR Partners, since 2016 and title to the property was acquired in May 2019. In May 2021, a lease was signed with O’Reilly Auto Parts, which is expected to open in early 2022. The property will likely be marketed for sale once the new tenant is operational. For the full valuation report and loan-level details, click here.

| Property Name | Rite Aid – Watertown |

| Address | 315 Arsenal Street Watertown, NY 13601 |

| Allocated Loan Amount | $1,954,356 |

| Interest Rate | 6.12% |

| Maturity Date | 9/1/2016 |

| Tenant | Lease Expiration | O’Reilly Auto Parts | NAV |

| Most Recent Appraisal | $1,430,000 ($122/sf) |

| Most Recent Appraisal Date | 7/29/2020 |

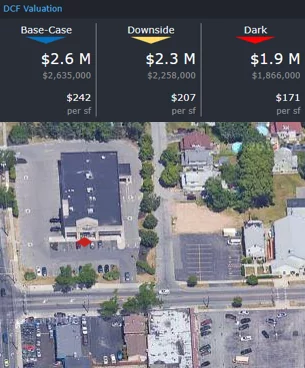

Rite Aid – Rochester, NY

10,908 sf, Single-Tenant Retail, Irondequoit, NY [View Details]

This freestanding retail building leased to Rite Aid through August 2022. The property has an allocated loan amount of $1.5 million and is part of a 2-building net lease portfolio that secures a $3.2 million mortgage. Scheduled loan maturity is a little more than a year after Rite Aid’s lease expiration at the 1714 Norton Street location. The property is located in the town of Irondequoit, which is approximately 3 miles north of the Rochester, NY CBD. This particular Rite Aid location is about a mile away from Rochester General Hospital and faces intense pharmacy competition in the surrounding region. There are 3 Walgreens and 1 CVS within 2 miles of the property. The nearest Rite Aid is about 1.5 miles away, located more proximate to the Rochester CBD. For the full valuation report and loan-level details, click here.

| Property Name | Rite Aid – Rochester |

| Address | 1714 Norton Street Irondequoit, NY 14609 |

| Allocated Loan Amount | $1,495,631 |

| Interest Rate | 5.50% |

| Maturity Date | 9/6/2023 |

| Tenant | Lease Expiration | Rite Aid | 8/22/2022 |

| Most Recent Appraisal | $3,500,000 ($321/sf) |

| Most Recent Appraisal Date | 4/24/2013 |

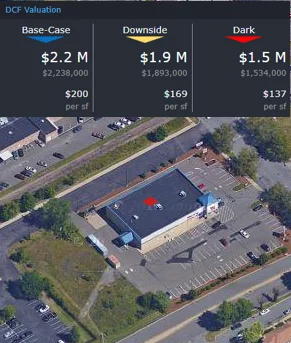

Rite Aid – Wilkes-Barre, PA

11,180 sf, Single-Tenant Retail, Wilkes-Barre, PA [View Details]

This freestanding Rite Aid in Wilkes-Barre secures a $1.4 million loan and is located approximately 20 miles southwest of Scranton, PA. Rite Aid’s lease expires in March 2022, which is a significant concern. A second Rite Aid Pharmacy is located less than a half mile away and the competitive Rite Aid is located more central to the urban center, within the Public Square retail corridor of Wilkes-Barre. However, the 155 East Northampton Street location has drive-through amenities that are not available at the Public Square location. Loan maturity is scheduled for June 1, 2025. For the full valuation report and loan-level details, click here.

| Property Name | Rite Aid – Wilkes-Barre |

| Address | 155 East Northampton Street Wilkes-Barre, PA 18701 |

| Outstanding Balance | $1,429,864 |

| Interest Rate | 4.49% |

| Maturity Date | 6/1/2025 |

| Tenant | Lease Expiration | Rite Aid | 3/31/2022 |

| Most Recent Appraisal | $2,650,000 ($237/sf) |

| Most Recent Appraisal Date | 4/24/2015 |

Rite Aid – Flemington, NJ

10,908 sf, Single-Tenant Retail, Flemington, NJ [View Details]

This physically vacant building in Flemington, NJ secures a $1.4 million loan and was formerly occupied by Rite Aid until the store was acquired by Walgreens in 2017. Walgreens assumed the lease, which is scheduled to expire in October 2023. Walgreens operates a pharmacy located directly across the street and shuttered operations at the 78 Church Street location in July 2018. The property is now dark and the lease likely will not be renewed. The loan transferred to special servicing in November 2018, shortly after the Walgreens operations closed; however, updated commentary indicates the loan may return to the master servicer in the near term. Loan maturity is scheduled for October 2023. For the full valuation report and loan-level details, click here.

| Property Name | Rite Aid – Flemington |

| Address | 78 Church Street Flemington, NJ 08822 |

| Outstanding Balance | $1,402,498 |

| Interest Rate | 5.34% |

| Maturity Date | 10/1/2023 |

| Tenant | Lease Expiration | Walgreens | 10/27/2023 |

| Most Recent Appraisal | $4,350,000 ($399/sf) |

| Most Recent Appraisal Date | 5/27/2013 |

For full access to our loan database and valuation platform, sign up for a free trial below:

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. Our data platform is powered by over $2.0 trillion of CMBS, CRE CLO, SBLL, Ginnie Mae, FHA/HUD, and Freddie Mac loan and property data.