This week, the CRED iQ team will be in attendance at CREFC’s Conference in Miami. Feel free to drop us a line if you want to talk the latest in commercial real estate analytics or simply browse some vacant retail storefronts along Lincoln Road.

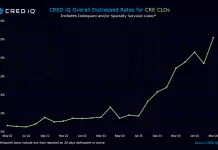

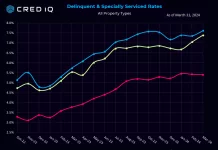

In this week’s WAR Report, CRED iQ calculated real-time valuations for 5 distressed properties that have transferred to special servicing within the past 2 months. Among these is a Times Square retail property and 2 office properties with evidence of tenants vacating in favor of higher quality alternatives. The 2 highlighted office properties contributed to recent increases in CRED iQ’s office sector delinquency rate, which saw its second consecutive increase to 2.74%. Click the link below for a list of all office properties.

CRED iQ valuations factor in a base-case (most likely), a downside (significant loss of tenants), and dark scenarios (100% vacant). For full access to the valuation reports as well as full CMBS loan reporting, including detailed financials, updated tenant information, and borrower contact information, sign up for a free trial here.

1551 Broadway

25,600 sf, Retail and LED Signage, Times Square, NY [View Details]

This $180 million loan transferred to special servicing on November 15, 2021 shortly after a 60-day forbearance expired. The loan was originally scheduled to mature in July 2021, but the borrowing entity, a co-ownership between Wharton Properties (90%) and SL Green (10%), was unable to secure fund to take out the debt. The 60-day forbearance was granted at loan maturity to allow additional time for refinancing. Potentially complicating matters is a $103.8 million mezzanine loan that was funded in 2017.

The loan is secured by a 3-story, 25,600-sf retail building located in Times Square. Included as collateral is 14,500 sf of LED signage that spans an additional 4 stories on top of the building. The property is entirely leased by American Eagle Outfitters pursuant to a lease that expires in February 2024. The retail store was temporarily closed during the pandemic and media reports have indicated the possibility of American Eagle vacating at lease expiration. Reports of the space being marketed to prospective tenants started emerging in early 2020. The property is one of the best positioned within Times Square. The average daily pedestrian count along Broadway, between W 46th Street and W 47th Street, was 175,153 during December 2021, which was slightly higher than 2019 pre-pandemic levels and more than 140% higher than 2020 levels.

American Eagle paid annualized total base rent of $21.3 million in 2021. Prior to loan origination, a little over 50% of total base rent was attributed to the LED signage. For the full valuation report and loan-level details, click here.

| Property Name | 1551 Broadway |

| Address | 1551 Broadway New York, NY 10036 |

| Outstanding Balance | $180,000,000 |

| Interest Rate | 5.10% |

| Maturity Date | 7/6/2021 |

| Most Recent Appraisal | $360,000,000 ($14,063/sf) |

| Most Recent Appraisal Date | 6/1/2021 |

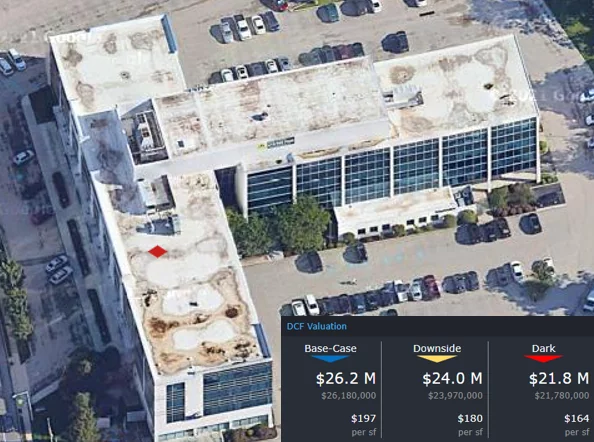

One Presidential

133,115 sf, Office, Bala Cynwyd, PA [View Details]

This $29.3 million loan transferred to special servicing on November 16, 2021 due to the lease expiration of the collateral property’s largest tenant, Hamilton Lane. The loan is secured by a 4-story, 113,115-sf office building in Bala Cynwyd, PA, approximately 5 miles northwest of Center City Philadelphia. Hamilton Lane occupied 52,045 sf and accounted for 39% of the building’s GLA. The former tenant vacated One Presidential in favor of Seven Towers Bridge, a new headquarters in Conshohocken, PA. Hamilton Lane leased space at two other office properties in Bala Cynwyd and cited a need to consolidate its employees into one location; although, a flight to quality appeared to also play a factor. Seven Tower Bridge is a newly constructed development with superior amenities than One Presidential. In addition to One Presidential losing its largest tenant, Novak Francella LLC, accounting for 11% of the GLA, vacated at lease expiration in July 2021.

LNR, as special servicer, will discuss potential workouts with the borrower, Keystone Property Group. Foreclosure or receivership are possibilities given low occupancy at the collateral and uncertain leasing opportunities for such a large space. Altogether, Hamilton Lane left 3 large vacancies in the Bala Cynwyd submarket. CRED iQ estimates occupancy at the property to be approximately 31%.

One potential complication for workout is a $3.6 million subordinate mortgage that was originated by The Bancorp Bank. The payment waterfall for the senior and subordinate components of the mortgage was structured as pro-rata, but the transfer to special servicing shifted the waterfall to a sequential pay structure. For the full valuation report and loan-level details, click here.

| Property Name | One Presidential |

| Address | 1 Presidential Boulevard Bala Cynwyd, PA 19004 |

| Outstanding Balance | $29,278,714 |

| Interest Rate | 5.08% |

| Maturity Date | 7/5/2026 |

| Most Recent Appraisal | $50,300,000 ($378/sf) |

| Most Recent Appraisal Date | 4/6/2017 |

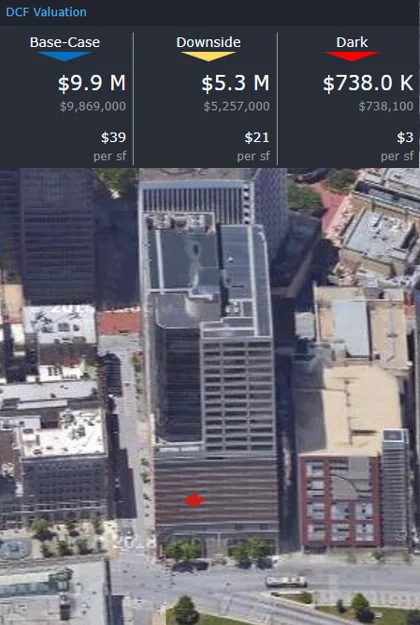

201 North Charles

251,347 sf, Office, Baltimore, MD [View Details]

This $11.8 million loan transferred to special servicing on November 12, 2021 due to imminent monetary default. The loan is secured by leasehold interest in a 28-story office tower in the Baltimore, MD CBD. The property’s largest tenant, law firm Silverman Thompson, is vacating at lease expiration in February 2022 in favor of 400 East Pratt Street, which overlooks the Inner Harbor. Silverman Thompson’s lease accounted for 10% of the property’s GLA. The second-largest tenant at the property, Alperstein & Diener, accounts for 4% of the GLA and has a lease expiration in April 2022.

The property’s two ground leases will be considerations for workout negotiations. The property’s main ground lease expires in 2112. A second ground lease covers parking access to the building and expires in 2033. Annual ground rent was last reported to be approximately $375,000.

Occupancy at 201 North Charles has steadily declined for 3 consecutive years from 80% in 2019 to 70% in 2021 as the CBD has fallen out of favor with office tenants. Many high-profile tenants, including T. Rowe Price, have moved or are planning moves to nearby Harbor Point — again continuing with the theme of flight to quality mentioned with One Presidential. CRED iQ’s estimated occupancy for the property is 60%. For the full valuation report and loan-level details, click here.

| Property Name | 201 North Charles |

| Address | 201 North Charles Street Baltimore, MD 21201 |

| Outstanding Balance | $11,790,628 |

| Interest Rate | 5.53% |

| Maturity Date | 9/6/2023 |

| Most Recent Appraisal | $19,200,000 ($76/sf) |

| Most Recent Appraisal Date | 6/4/2013 |

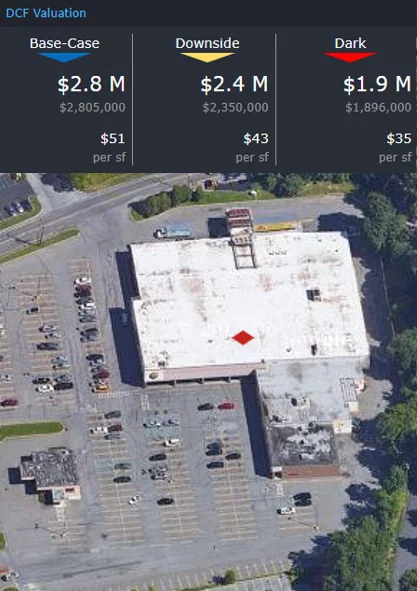

88 North Plank Road

54,876 sf, Retail, Newburgh, NY [View Details]

This $4.5 million loan transferred to special servicing on December 3, 2021 following the loss of the collateral property’s anchor tenant, ShopRite. The loan is secured by a 54,876-sf neighborhood center in Newburgh, NY, approximately 70 miles north of Manhattan along the Hudson River. ShopRite terminated its lease at the property and vacated in September 2021. The tenant occupied 41,676 sf, accounting for 76% of the GLA, pursuant to a lease that was scheduled to expire in June 2025. However, ShopRite had a termination option at any time as long as six months’ notice was provided. Replacement with another grocery tenant may be plausible, but servicer commentary for the loan indicates significant levels of deferred maintenance. The property’s second-largest tenant is Family Dollar with a lease that expires in 2037 and accounts for 15% of the GLA. Assuming the absence of any co-tenancy clauses tied to ShopRite’s lease termination, CRED iQ’s estimated occupancy is equal to 24%. For the full valuation report and loan-level details, click here.

| Property Name | 88 North Plank Road |

| Address | 88 North Plank Road Newburgh, NY 12550 |

| Outstanding Balance | $4,534,428 |

| Interest Rate | 4.67% |

| Maturity Date | 8/6/2024 |

| Most Recent Appraisal | $8,000,000 ($146/sf) |

| Most Recent Appraisal Date | 5/2/2014 |

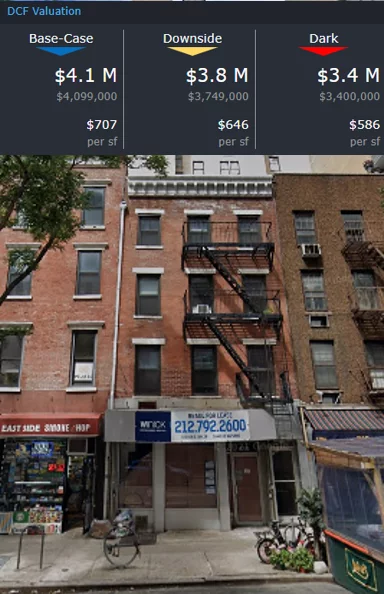

1392 Third Avenue

5,800 sf, Mixed Use (Retail/Multifamily), Manhattan, NY [View Details]

This $3.0 million loan transferred to special servicing on November 26, 2021. The loan is secured by a 4-story, 5,800-sf mixed-use property located in the Upper East Side of Manhattan, NY. The building contains 6 multifamily units and a ground-floor retail unit. The retail unit was previously occupied by TD Ameritrade pursuant to a lease that expired in March 2021, but the tenant went dark as early as July 2020. Additionally, the borrower has been unresponsive with providing the servicer updated financials for the property. The latest set of financials available were from 2018. For the full valuation report and loan-level details, click here.

| Property Name | 1392 Third Ave |

| Address | 1392 Third Avenue New York, NY 10075 |

| Outstanding Balance | $3,037,420 |

| Interest Rate | 4.22% |

| Maturity Date | 5/1/2023 |

| Most Recent Appraisal | $5,500,000 ($948/sf) |

| Most Recent Appraisal Date | 3/6/2013 |

For full access to our loan database and valuation platform, sign up for a free trial below:

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. Our data platform is powered by over $2.0 trillion of CMBS, CRE CLO, SBLL, Ginnie Mae, FHA/HUD, and Freddie Mac loan and property data.