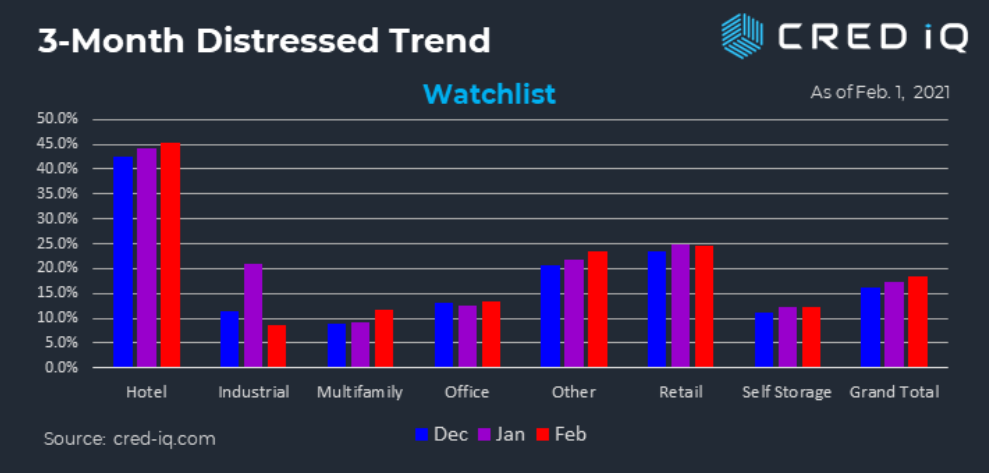

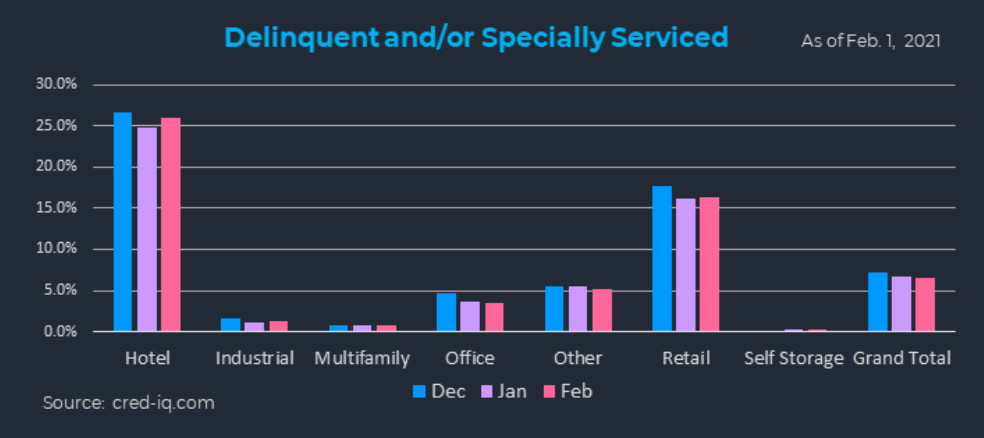

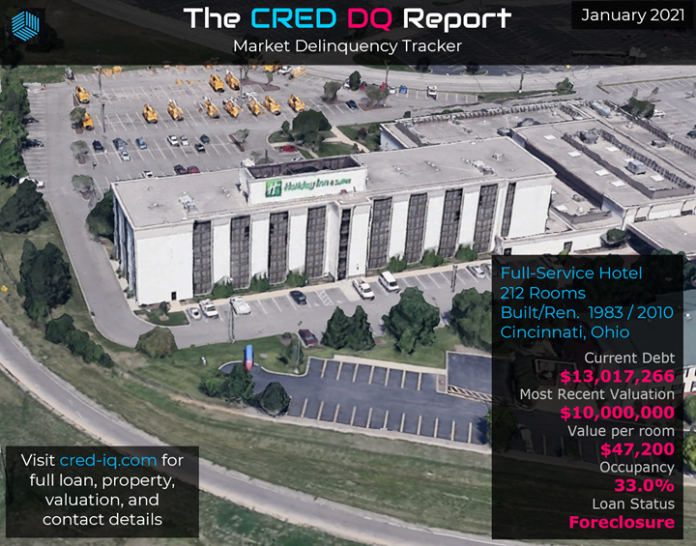

The overall delinquency rate continued its decline for the tenth consecutive reporting period following its rapid ascent from April to June 2020. While the commercial real estate sector may have largely avoided a sustained period of distress resulting from the pandemic, defaults on CRE mortgages remain somewhat elevated across the United States, driven primarily by the retail and lodging sectors. With ongoing COVID 19 vaccination efforts, we expect default rates to continue to level off with more immediate and significant improvements in the hotel sector throughout the remainder of the year.

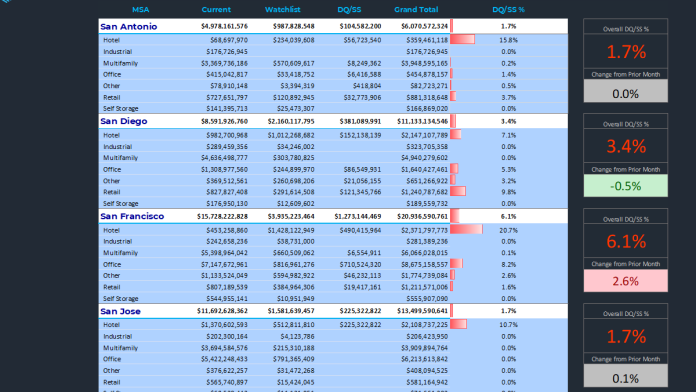

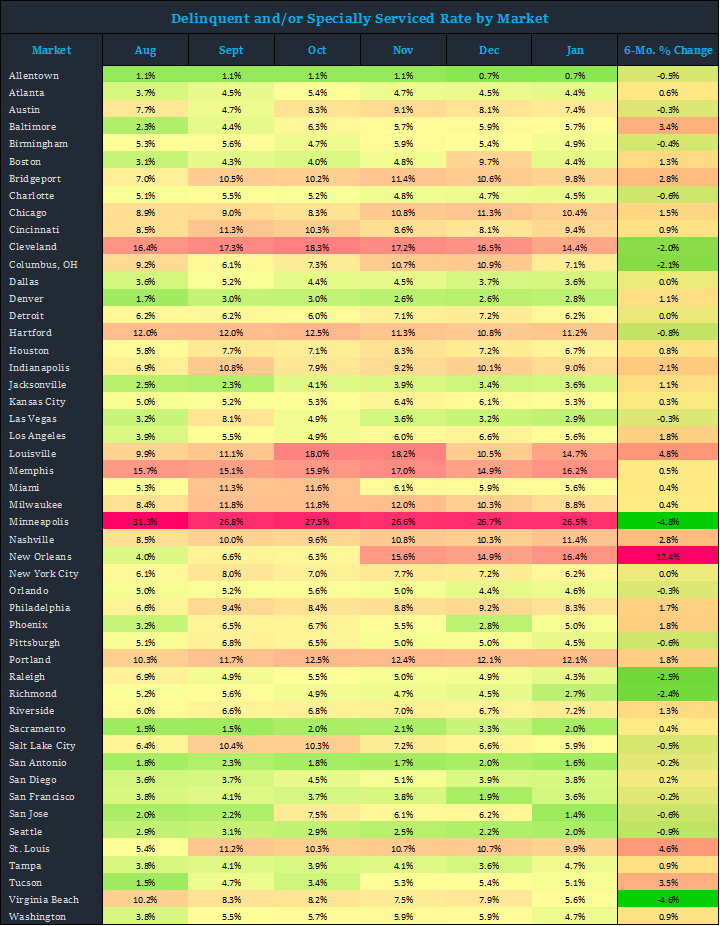

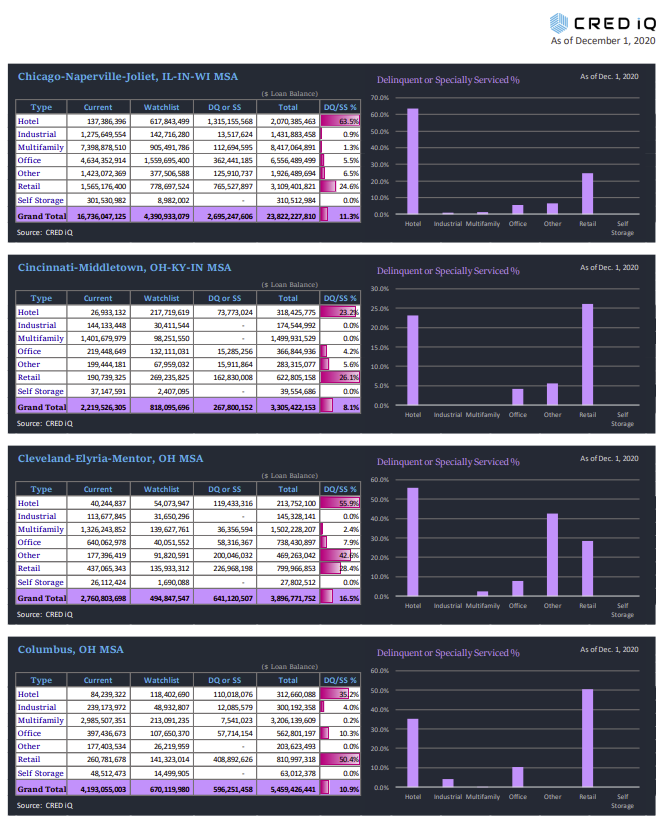

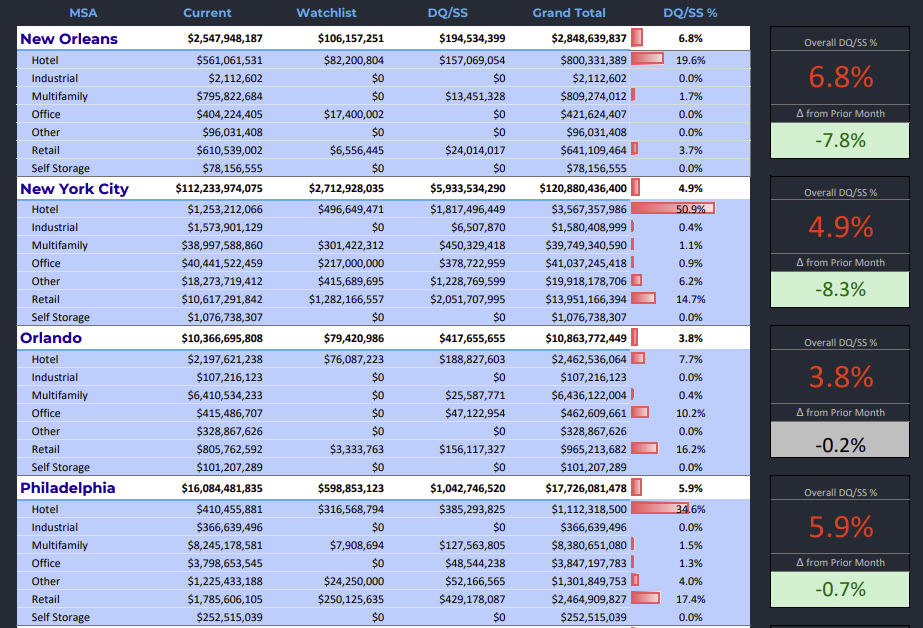

CRED iQ monitors market performance for nearly 400 MSAs across the United States. Below is a summary of the default rates for the 50 largest metros segmented by property type. For these 50 MSAs, the highest delinquency was in Minneapolis, followed by Louisville and Cleveland. Louisville saw the largest month-over-month increase in delinquency. Allentown, Pennsylvania reported the lowest default rate among the 50 MSAs. The most significant month-over-month decline in delinquency was in New York City.

By property type, the hotel and retail sectors remain the largest contributors to the delinquency percentages for the majority of these statistical areas. Loans backed by self-storage, multifamily, and industrial facilities posted the lowest delinquency rates for most of these markets.

About CRED iQ

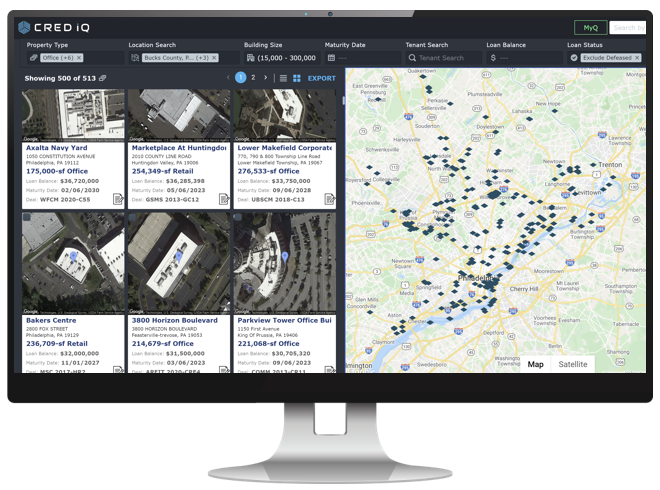

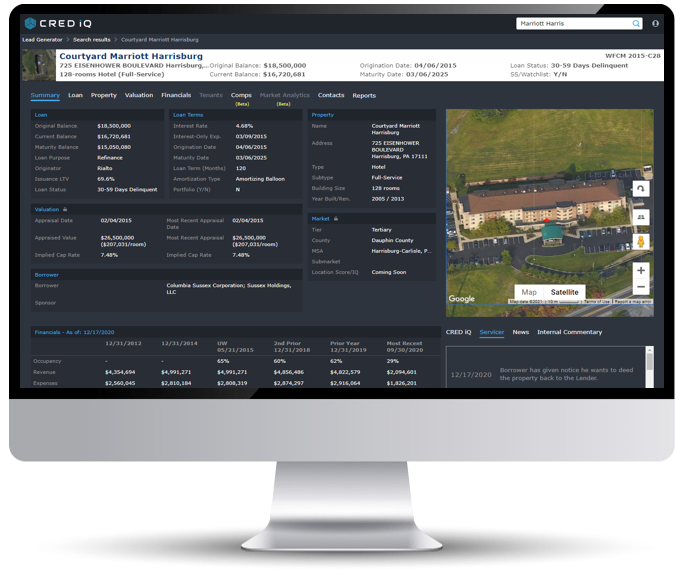

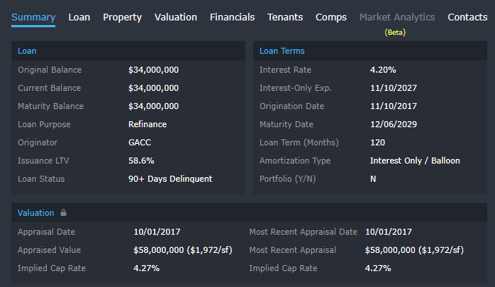

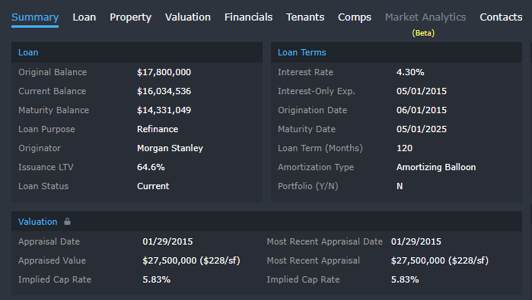

CRED iQ is a commercial real estate data, analytics, and valuation platform designed to unlock investment, financing, and leasing opportunities. CRED iQ provides real-time property, loan, tenant, ownership, and valuation data for over $910 billion of commercial real estate..

CRED iQ tracks loan-level performance for the entire CMBS, CRE CLO, SBLL, and Agency universes.