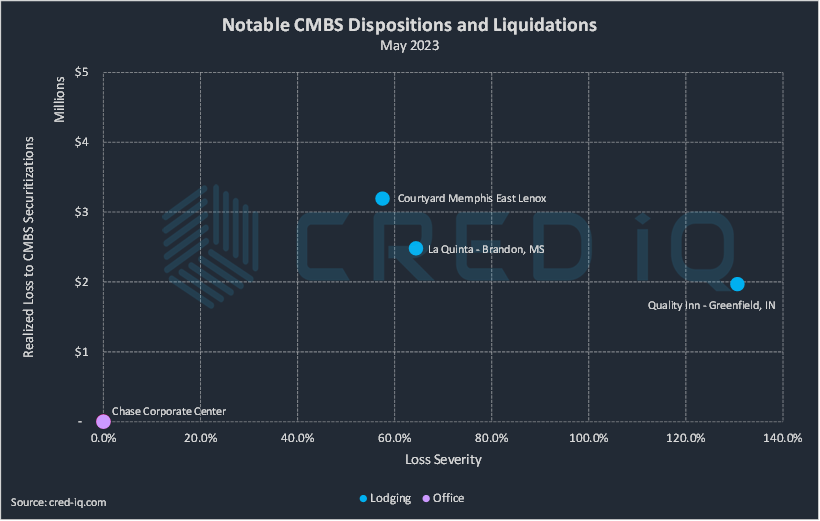

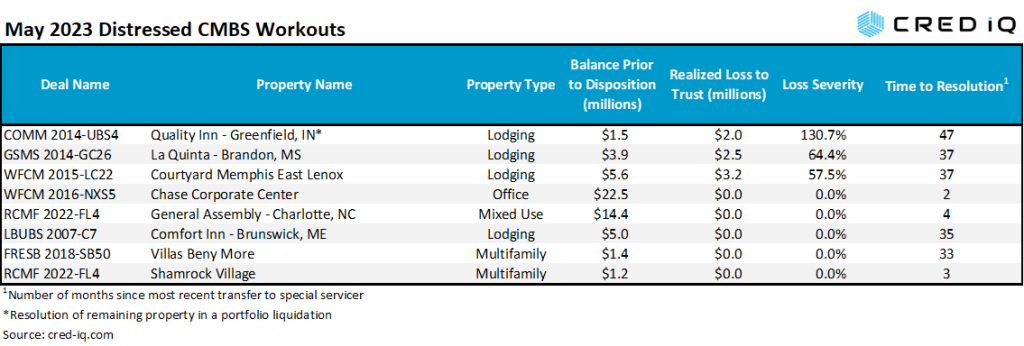

CMBS transactions incurred approximately $8 million in realized losses during May 2023 via the workouts of distressed assets. CRED iQ identified eight workouts classified as dispositions, liquidations, or discounted payoffs in May 2023. Of the eight workouts, five were resolved without a principal loss. Of the three workouts resulting in losses, severities for the month of May ranged from 57.5% to 131%, based on outstanding balances at disposition. Aggregate realized losses in May 2023 were a fraction of the total from April due to a lower volume of workouts and a smaller average outstanding loan balance at disposition. The aggregate realized loss total of $7.6 million was also significantly lower than the average aggregate monthly CMBS loss total for the trailing 12 months, which was equal to approximately $125.5 million.

By property type, lodging properties accounted for half of the eight distressed resolutions in May 2023. Three of the four lodging workouts incurred realized losses. All realized losses in May were sourced to workouts involving hotels. Each lodging workout took approximately three years to be resolved from initial transfers to special servicing. Resolution timing for these hotels aligned with adverse financial impacts from the onset of the pandemic in 2020 and the subsequent inability of hotel operations to recover in the proceeding years.

The largest individual realized loss was associated with a loan secured by the Courtyard by Marriott Memphis East Lenox, a 96-key limited-service hotel located 15 miles outside of downtown Memphis, TN. The loan had an outstanding balance of $5.6 million prior to disposition and the distressed workout resulted in a realized loss of $3.2 million, equal to a 57.5% severity.

The largest individual loss severity was associated with the Quality Inn & Suites – Greenfield, IN, a 177-key limited-service hotel. The hotel was part of a two-property portfolio that secured a mortgage with an origination amount of $9.5 million. The loan transferred to special servicing in July 2019 and one of the hotels, flagged as a Holiday Inn Express, was sold through receivership in March 2022. Proceeds from the sale were applied to the loan’s outstanding balance. The loan, with only the Quality Inn hotel as collateral, was resolved with a $2.0 million loss against a $1.5 million outstanding balance prior to disposition, equal to a 131% severity.

The largest workout by outstanding balance was a $22.5 million mortgage secured by Chase Corporate Center, a 211,257-SF multi-building office property located in Birmingham, AL. The loan defaulted at is February 2023 maturity date and subsequently transferred to the special servicer. While the loan was in special servicing, the borrower was able to negotiate a purchase and sale agreement that resulted in a payoff of the loan without a principal loss. This two-month resolution was the quickest of all of May’s workouts.

Excluding defeased loans, there was approximately $3.4 billion in securitized debt among CMBS conduit, and Single-Borrower Large-Loan securitizations that was paid off or liquidated in May 2023, which was in line with April’s totals. In May, 2% of the loan resolutions were categorized as dispositions, liquidations, or discounted payoffs. The percentage of distressed workouts was markedly lower in the prior month. Loan prepayment remained relatively low in volume in May 2023 — approximately 8% of the loans were paid off with prepayment penalties, which was in line with prior months.

Retail had the highest total of outstanding debt payoff by property type in May with approximately 28% of the total by balance. Multifamily and lodging had the next highest percentages of outstanding debt payoff with 20% of the total for each property type. The $173.3 million payoff of the 483,569-SF Legacy Place power center in Dedham, MA and the $160 million refinancing for 541,527 SF of the Cumberland Mall in Atlanta, GA were among the largest mortgages to pay off in May 2023.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities.

The platform also offers a highly efficient valuation engine which can be leveraged across all property types and geographies. Our data platform is powered by over $2.0 trillion in transactions and data covering CRE, CMBS, CRE CLO, Single Asset Single Borrower (SASB), and all of GSE / Agency.